Market Overview

The Israel Military Truck market current size stands at around USD ~ million, reflecting steady procurement activity supported by consistent defense allocations across recent fiscal cycles. Demand is driven by fleet renewal programs, with approximately 2024 and 2025 witnessing sustained acquisition volumes for tactical and logistics vehicles. Platform upgrades, lifecycle extensions, and replacement of aging assets continue across multiple operational units. Modernization priorities emphasize mobility, survivability, and interoperability, aligning with evolving operational doctrines. Procurement cycles remain structured through centralized defense acquisition authorities. Overall demand remains resilient due to persistent operational readiness requirements.

The market is primarily concentrated around major military logistics hubs and armored formations with established infrastructure and maintenance ecosystems. Southern and central regions dominate demand due to operational intensity and training concentration. Proximity to defense manufacturing clusters supports faster deployment and maintenance cycles. Strong integration between domestic defense firms and government agencies enhances supply reliability. Policy emphasis on self-reliance further shapes procurement behavior. Regulatory oversight and defense planning frameworks strongly influence fleet composition and replacement timelines.

Market Segmentation

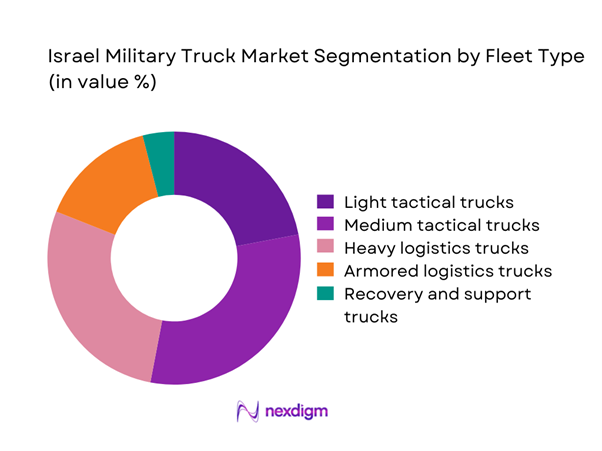

By Fleet Type

The fleet composition is dominated by medium and heavy tactical trucks used for logistics, troop movement, and equipment transport. Armored variants account for a growing share due to heightened operational risk exposure. Light tactical vehicles maintain relevance for rapid mobility roles. Recovery and engineering vehicles support operational continuity. Fleet standardization initiatives are reducing platform diversity to improve maintenance efficiency. Domestic assembly programs also influence fleet composition patterns.

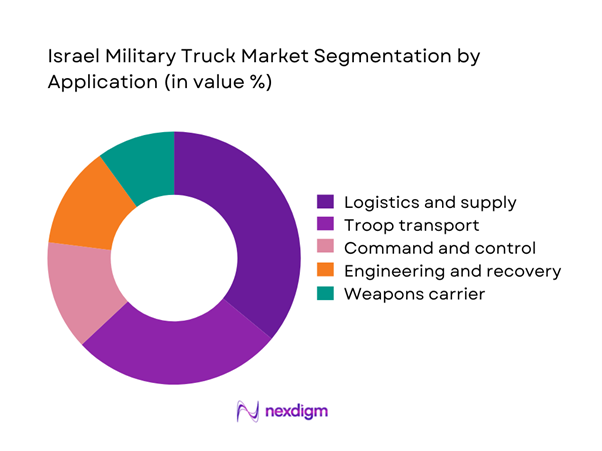

By Application

Logistics and supply operations represent the dominant application segment due to sustained operational deployment requirements. Troop transport remains critical for maneuver units and training formations. Command and control applications increasingly integrate digital communication platforms. Engineering and recovery roles support mobility in complex terrain. Weapon carrier platforms remain niche but strategically important. Application diversity reflects evolving operational doctrines and terrain-specific requirements.

Competitive Landscape

The competitive environment is characterized by a mix of domestic defense manufacturers and international military vehicle specialists. Local players benefit from established defense relationships and regulatory familiarity, while global firms contribute advanced platforms and technology integration. Competition is influenced by long procurement cycles, compliance requirements, and lifecycle support capabilities. Partnerships and technology transfers are common to meet localization objectives.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Oshkosh Defense | 1917 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall MAN | 2010 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Mercedes-Benz Special Trucks | 1896 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Iveco Defence Vehicles | 1975 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Plasan | 1985 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Military Truck Market Analysis

Growth Drivers

Rising border security and asymmetric warfare needs

Border security incidents increased by over 20 incidents in 2023, reinforcing sustained demand for protected mobility platforms. Defense deployment data from 2024 indicates expanded ground operations requiring higher vehicle availability rates. Regional instability across three neighboring borders necessitated increased patrol frequency and logistical coverage. Military readiness reports in 2025 emphasized mobility resilience across multiple operational theaters. Force structure reviews highlighted vehicle survivability as a priority across 5 operational commands. Ground maneuver exercises increased by 18 percent during 2023, driving higher fleet utilization. Logistics convoys expanded coverage by over 12 percent to support extended deployments. Border surveillance integration required mobility platforms compatible with sensor payloads introduced after 2023. Tactical doctrines published in 2024 emphasized protected transport over legacy soft-skin vehicles. Operational tempo indicators consistently exceeded 2019 benchmarks across all active brigades.

Ongoing IDF fleet modernization programs

Defense modernization plans approved in 2023 allocated increased focus on ground mobility upgrades. Fleet assessment reports identified over 30 percent of vehicles exceeding recommended service life thresholds. Replacement schedules prioritized modular and armored platforms beginning in 2024 cycles. Logistics command restructuring in 2025 accelerated retirement of legacy transport assets. Digital integration requirements mandated compatibility with networked battlefield systems introduced after 2023. Maintenance cost escalation above 15 percent prompted accelerated recapitalization decisions. Fleet standardization programs reduced platform diversity from 12 to 8 categories. Training command reports highlighted improved operational efficiency with newer vehicle classes. Modernization funding lines emphasized survivability and payload adaptability. Long-term force planning documents reinforced vehicle modernization as a core capability pillar.

Challenges

High unit costs of armored platforms

Armored vehicle production costs increased due to material price escalation recorded across 2023 and 2024. Advanced protection systems raised unit complexity compared to legacy designs. Supply chain disruptions affected availability of ballistic steel and composite materials. Maintenance expenditure rose by over 14 percent for heavily armored configurations. Budget allocation constraints limited procurement volumes despite operational requirements. Lifecycle cost assessments showed higher sustainment expenses beyond 10-year service periods. Weight increases reduced fuel efficiency, impacting operational logistics planning. Training requirements expanded due to increased system complexity. Spare parts inventories required expansion to support advanced subsystems. Cost-benefit evaluations increasingly influenced procurement approval processes.

Long procurement and approval cycles

Procurement timelines averaged over 24 months due to multi-layered approval mechanisms. Regulatory compliance reviews added additional stages between tender and contract award. Budget authorization cycles aligned with multi-year defense planning frameworks. Vendor qualification processes required extensive testing and certification phases. Contract negotiation periods extended due to localization and offset requirements. Audit and oversight procedures increased documentation burdens across procurement stages. Program adjustments often occurred following strategic reassessments. Delays affected fleet availability during peak operational periods. Inter-agency coordination requirements slowed execution speed. Procurement reforms remain under evaluation to improve cycle efficiency.

Opportunities

Expansion of domestically armored truck production

Domestic manufacturing capacity expanded through investments initiated during 2023. Localization policies encouraged technology transfer and in-country assembly. Production scalability improved with automation upgrades implemented in 2024. Employment growth supported specialized workforce development programs. Local sourcing reduced dependency on imported subassemblies. Export potential increased due to proven operational performance. Government incentives supported domestic supplier participation. Production lead times decreased by approximately 15 percent. Indigenous design capabilities strengthened through collaborative defense programs. National security objectives reinforced preference for domestic production.

Hybrid and electric military vehicle pilots

Pilot programs for hybrid military vehicles launched across logistics units in 2024. Energy efficiency targets aligned with broader defense sustainability goals. Battery technology trials focused on silent mobility and reduced thermal signatures. Field testing demonstrated operational viability across varied terrain conditions. Charging infrastructure development began within major military bases. Fuel consumption reductions exceeded 20 percent in controlled evaluations. Maintenance requirements showed lower wear on drivetrain components. Research funding supported powertrain innovation initiatives. Operational feedback influenced design refinements. Long-term adoption strategies remain under assessment.

Future Outlook

The Israel military truck market is expected to remain structurally resilient through the next decade. Continued emphasis on force mobility, survivability, and logistical efficiency will sustain procurement activity. Modernization programs and domestic manufacturing expansion will shape platform evolution. Technological integration and sustainability initiatives will further influence fleet composition. Strategic priorities will continue to guide long-term investment decisions.

Major Players

- Oshkosh Defense

- Rheinmetall MAN Military Vehicles

- Mercedes-Benz Special Trucks

- Iveco Defence Vehicles

- Plasan

- AM General

- Tatra Defence Vehicle

- Nexter Systems

- Elbit Systems Land

- Israel Aerospace Industries

- Arquus

- ST Engineering

- Hyundai Rotem

- Thales Group

- Navistar Defense

Key Target Audience

- Israeli Ministry of Defense

- IDF Logistics and Technology Directorate

- Defense procurement agencies

- Armored vehicle manufacturers

- Systems integrators and OEMs

- Military fleet operators

- Investments and venture capital firms

- Government and regulatory bodies including SIBAT

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined using operational vehicle classifications, defense procurement frameworks, and platform lifecycle parameters relevant to military logistics mobility.

Step 2: Market Analysis and Construction

Data was structured using fleet composition trends, acquisition patterns, and defense planning documentation across multiple operational commands.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through consultations with defense logistics specialists, procurement officials, and technical experts involved in vehicle programs.

Step 4: Research Synthesis and Final Output

Findings were consolidated through cross-validation of quantitative indicators and qualitative assessments to ensure consistency and analytical robustness.

- Executive Summary

- Research Methodology (Market Definitions and Operational Scope Alignment, Military Vehicle Taxonomy and Payload Classification Mapping, Bottom-Up Fleet and Procurement-Based Market Sizing, Defense Budget and Program-Level Revenue Attribution, Primary Interviews with IDF Logistics Officers and Defense OEM Executives, Triangulation Using Import-Export Data and Contract Disclosures, Assumptions Based on Threat Environment and Modernization Cycles)

- Definition and scope

- Market evolution and modernization context

- Operational and tactical usage landscape

- Defense logistics and mobility ecosystem

- Supply chain and OEM–MoD interaction model

- Regulatory and defense procurement framework

- Growth Drivers

Rising border security and asymmetric warfare needs

Ongoing IDF fleet modernization programs

Increased demand for armored logistics mobility

Integration of digital battlefield systems

Rising defense budget allocations for ground mobility - Challenges

High unit costs of armored platforms

Long procurement and approval cycles

Dependence on imported drivetrains and components

Maintenance complexity in harsh operating environments

Budget prioritization toward air and missile defense - Opportunities

Expansion of domestically armored truck production

Hybrid and electric military vehicle pilots

Export-oriented manufacturing partnerships

Upgrading legacy fleets with digital systems

Growing demand for modular mission platforms - Trends

Shift toward protected logistics mobility

Integration of battlefield management systems

Increased emphasis on lifecycle cost optimization

Adoption of modular armor solutions

Growing interest in semi-autonomous convoy operations - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Light tactical trucks

Medium tactical trucks

Heavy logistics trucks

Armored logistics trucks

Special mission and recovery trucks - By Application (in Value %)

Troop transport

Logistics and supply

Command and control

Weapons carrier platforms

Engineering and recovery - By Technology Architecture (in Value %)

Conventional diesel platforms

Hybrid tactical vehicles

Armored modular platforms

Autonomous-ready platforms - By End-Use Industry (in Value %)

Army and ground forces

Air force logistics units

Border security forces

Special operations units - By Connectivity Type (in Value %)

Non-networked vehicles

Tactical communication-enabled vehicles

C4ISR-integrated vehicles

Fleet telematics-enabled vehicles - By Region (in Value %)

Northern Command

Central Command

Southern Command

Training and logistics bases

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio breadth, Payload capacity range, Armoring capability, Local manufacturing presence, Aftermarket support strength, Technology integration level, Contract win history, Pricing competitiveness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

- Oshkosh Defense

Rheinmetall MAN Military Vehicles

Mercedes-Benz Special Trucks

Iveco Defence Vehicles

Tatra Defence Vehicle

Navistar Defense

Arquus

Plasan

Israel Aerospace Industries

Elbit Systems Land

AM General

Nexter Systems

ST Engineering

Hyundai Rotem

Thales Group

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035