Market Overview

The Israel Military Truck Market is valued at approximately USD ~ billion, driven by the country’s robust defense industry, strategic geopolitical positioning, and increasing defense spending. Israel’s military truck market is influenced by the demand for advanced military logistics solutions, essential for troop mobility and equipment transport in various terrains. With rising military budgets and continued investments in defense infrastructure, demand for specialized military trucks, including tactical vehicles, is expected to increase.

Israel’s military truck market is dominated by domestic players, along with some international defense firms. The country’s defense industry is one of the most advanced globally, fueled by innovations in military technology and a focus on enhancing operational capabilities. Israel’s military trucks are in high demand, especially within its defense and military sectors, largely due to the local military’s emphasis on mobility, ruggedness, and advanced capabilities. Additionally, Israel’s strategic location and strong export relationships amplify its dominance in the market.

Market Segmentation

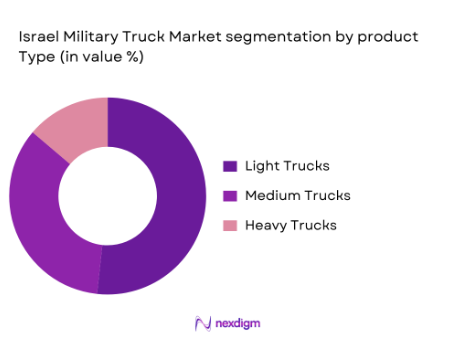

By Product Type

The Israel Military Truck Market is segmented by product type into light trucks, medium trucks, and heavy trucks. The light trucks segment is dominant, primarily due to their versatility, ease of use, and wide application across various military operations. These trucks are highly sought after for quick mobilization, troop movement, and logistics. They are well-suited for the Israeli military’s focus on mobility, particularly in challenging terrains, making them a preferred choice for military operations. Their ability to carry essential payloads while maintaining operational speed and flexibility gives them an edge in the military truck market.

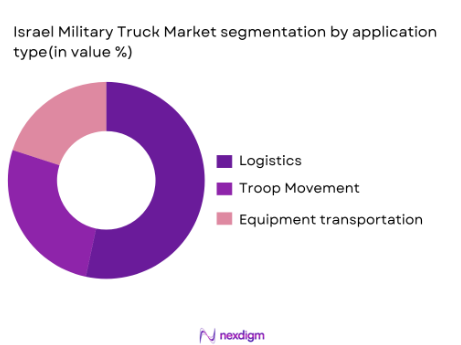

By Application

The market is also segmented by application, including logistics, troop movement, and equipment transportation. The logistics segment holds a dominant share, driven by Israel’s strategic need to ensure efficient movement of supplies, ammunition, and military vehicles. The increasing complexity of military operations, including rapid deployment and maintaining supply chains under high-stress conditions, has significantly boosted demand for logistics trucks. These trucks are essential for providing critical logistical support during military operations, both within Israel and for export purposes.

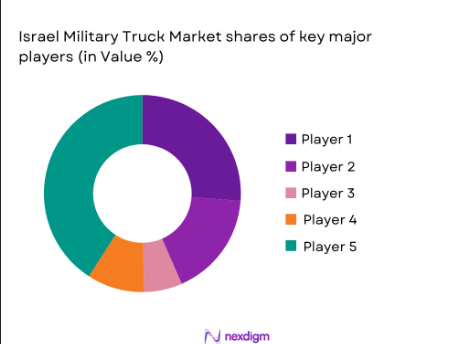

Competitive Landscape

The Israel Military Truck Market is highly competitive, with several domestic and international players dominating the space. The market is led by companies like General Dynamics, Israel Military Industries (IMI), and local defense firms such as the Israel Defense Forces (IDF) suppliers. These players benefit from strong government contracts, robust R&D efforts, and specialized manufacturing capabilities. The market’s consolidation around a few major firms ensures significant influence from established players, fostering innovation and market growth.

| Company | Establishment Year | Headquarters | Defense Expertise | Logistics Capabilities | Export Orientation | R&D Intensity |

| General Dynamics | 1899 | USA | – | – | – | – |

| Israel Military Industries (IMI) | 1933 | Israel | – | – | – | – |

| Caterpillar | 1925 | USA | – | – | – | – |

| Oshkosh Defense | 1917 | USA | – | – | – | – |

| Rheinmetall | 1889 | Germany | – | – | – | – |

Israel Military Truck Market Analysis

Growth Drivers

Increased military spending and defense modernization initiatives

Israel’s defense budget has seen a steady increase in recent years, with the Israeli government allocating approximately USD 24.3 billion to defense spending in 2023. This increase in funding supports Israel’s military modernization programs, including the upgrade of logistics and transportation capabilities, which directly impacts the demand for military trucks. The expansion of defense initiatives is further driven by the strategic need to strengthen Israel’s defense infrastructure amidst growing regional security challenges. The government’s consistent focus on advancing the military’s mobility and operational readiness is a key driver of the demand for specialized military trucks.

Expansion of regional operational capabilities and alliances

Israel’s strategic alliances and defense collaborations, particularly with the United States and NATO, significantly influence its military infrastructure development, including military truck procurement. The Israeli military’s operational scope, particularly in cross-border operations, requires highly reliable and robust logistics support. Israel has increasingly focused on enhancing its operational capabilities through partnerships that emphasize defense technology and vehicle modernization. This expansion enhances Israel’s ability to engage in regional operations, particularly in volatile environments, thereby driving demand for more advanced and specialized military trucks.

Market Challenges

Regulatory barriers to foreign equipment procurement

One of the key challenges in Israel’s military truck market is the regulatory framework governing foreign equipment procurement. Israel has stringent defense procurement regulations that restrict the import of military vehicles and equipment unless they meet specific defense standards. These regulations are driven by national security concerns and the desire to maintain domestic production capabilities. The complexity and time-consuming nature of these procurement processes can delay the integration of new technology into the military’s fleet, limiting the ability to rapidly modernize logistics and transport systems with foreign-made trucks.

Integration of advanced mission systems into trucks

The increasing complexity of military missions requires trucks to be equipped with advanced mission systems, including communication networks, navigation systems, and weapon integration capabilities. However, the integration of these systems presents significant challenges, especially for older vehicle models that were not initially designed with such advanced technology in mind. Moreover, the cost of retrofitting older military trucks with these systems is high, and there is a constant need for technological upgrades to meet evolving mission requirements. The complexity of ensuring compatibility between various systems can create operational bottlenecks.

Market Opportunities

Localization of truck production and service capabilities

The Israeli government has consistently pushed for local production of defense equipment as part of its defense industrial base strategy. There is a marked shift towards enhancing local capabilities in military truck manufacturing and maintenance. As of 2023, Israel has been fostering partnerships between defense manufacturers like Israel Military Industries (IMI) and local truck producers to develop military vehicles tailored to Israel’s specific needs. Local production ensures better supply chain control and faster service response times, strengthening Israel’s defense capabilities. Additionally, the growth of the local defense sector allows for higher levels of technological innovation and integration in the military vehicle market.

Technological advancements in hybrid and electric military trucks

The demand for hybrid and electric military trucks is on the rise due to the Israeli military’s push for more environmentally sustainable solutions. In 2023, the Israeli Ministry of Defense launched an initiative to develop and integrate hybrid and electric vehicles into its military fleet, aiming to reduce fuel dependence and carbon emissions. Israel’s investment in electric vehicle technology is supported by government-backed initiatives, such as the “Green Defense Initiative,” which promotes energy efficiency in defense operations. The Israeli military’s early adoption of cutting-edge hybrid and electric technologies positions it at the forefront of sustainable military logistics solutions.

Future Outlook

Israel’s focus on defense modernization, particularly in the areas of military vehicles and logistics systems, is expected to drive the growth of its military truck market in the coming years. With advancements in autonomous vehicle technology, Israel is investing in autonomous military trucks for increased efficiency and reduced human error. Additionally, Israel’s defense forces are emphasizing the development of multi-purpose, adaptable trucks capable of integrating various mission systems, ensuring that the fleet remains versatile for future operational needs. These efforts are expected to further enhance the operational readiness and effectiveness of Israel’s defense logistics.

15 Major Players

- General Dynamics

- Israel Military Industries (IMI)

- Caterpillar

- Oshkosh Defense

- Rheinmetall

- Navistar Defense

- Tata Motors Defense

- Volvo Defense

- Mercedes-Benz Defense

- MAN Truck & Bus

- DAF Trucks

- Iveco Defence Vehicles

- Scania

- BAE Systems

- Lockheed Martin

Key Target Audience

- Government and regulatory bodies

- Military contractors and defense system integrators

- Defense procurement agencies

- Military logistics providers

- Armament and equipment manufacturers

- Investments and venture capitalist firms

- Military vehicle maintenance companies

- Defense export companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the primary factors influencing the Israel Military Truck Market. This includes analyzing economic, political, and military conditions that impact defense budgets and procurement trends. A combination of secondary data and industry-specific databases will be utilized to define key market variables.

Step 2: Market Analysis and Construction

This phase compiles historical data, analyzing the growth of Israel’s defense sector and its effect on military truck demand. We will evaluate product development, regional military requirements, and the supply chain’s role in shaping the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions will be validated through interviews with industry experts from defense contractors, military logistics experts, and procurement officers. These consultations will help refine data accuracy and provide insights into future trends.

Step 4: Research Synthesis and Final Output

The final stage involves consolidating all research findings and reviewing them with military manufacturers to ensure the reliability of market analysis. This will help refine sales predictions and understand shifting market dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased military spending and defense modernization initiatives

Expansion of regional operational capabilities and alliances

Rising demand for advanced logistics and mobility solutions - Market Challenges

Regulatory barriers to foreign equipment procurement

Integration of advanced mission systems into trucks

High costs and long procurement timelines for heavy-duty trucks - Market Opportunities

Localization of truck production and service capabilities

Technological advancements in hybrid and electric military trucks

Emerging demand for specialized trucks for peacekeeping and humanitarian missions - Trends

Shift towards multi-role and adaptable truck platforms

Integration of advanced avionics and defensive systems

Growing collaboration in joint multinational defense operations

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Tactical Trucks

Logistics Trucks

Armored Trucks

Recovery Vehicles

Command and Control Trucks - By Platform Type (In Value%)

Wheeled Trucks

Tracked Trucks

Multi-Purpose Platforms

Off-Road Trucks

Heavy Duty Trucks - By Fitment Type (In Value%)

New Platform Procurement

Retrofit and Modernization

Upgraded Platforms

Standard Systems

Mission-Specific Systems - By End User Segment (In Value%)

Israel Defense Forces

Foreign Military Sales

International Partnerships

Aerospace Manufacturers

Civilian Support Units - By Procurement Channel (In Value%)

Direct Government Procurement

OEM Partnerships

International Defense Alliances

Local Manufacturing Channels

Third-Party Integration

- Market Share Analysis

- Cross Comparison Parameters (Platform Performance, Military Budget Allocation, Technology Integration, Regional Partnerships, Manufacturing Capacity)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Israel Military Industries

Elbit Systems

Mercedes-Benz

MAN Trucks

Navistar Defense

General Dynamics

Sisu Defense

Rheinmetall

Oshkosh Corporation

Tatra Trucks

Iveco Defence Vehicles

Scania AB

Volvo Group

Boeing Defense

KMW

- Israel Defense Forces demand for tactical and logistics mobility

- International military export demand

- Collaboration with NATO and other defense organizations

- Private contractors and civil service vehicles in military applications

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035