Market Overview

The Israel Military Unmanned Aerial Vehicles market is valued at USD ~ billion, with significant demand driven by increasing investments in defense technology and the growing requirement for intelligence, surveillance, and reconnaissance (ISR) capabilities. This market is largely propelled by Israel’s defense strategies, emphasizing unmanned technologies, and a continued focus on enhancing military precision and efficiency. The demand is also driven by global conflicts and regional security dynamics, particularly around Israel’s border security operations and its collaboration with international defense programs.

Key players in the market are largely based in Israel, where companies like Israel Aerospace Industries (IAI) and Elbit Systems play pivotal roles in research and development. The country’s dominance is attributed to its robust defense industry, global partnerships, and advanced technological capabilities in UAV systems. Additionally, Israel’s long-standing focus on innovation, military collaboration, and strong export ties contribute significantly to its leadership in the unmanned aerial vehicle market.

Market Segmentation

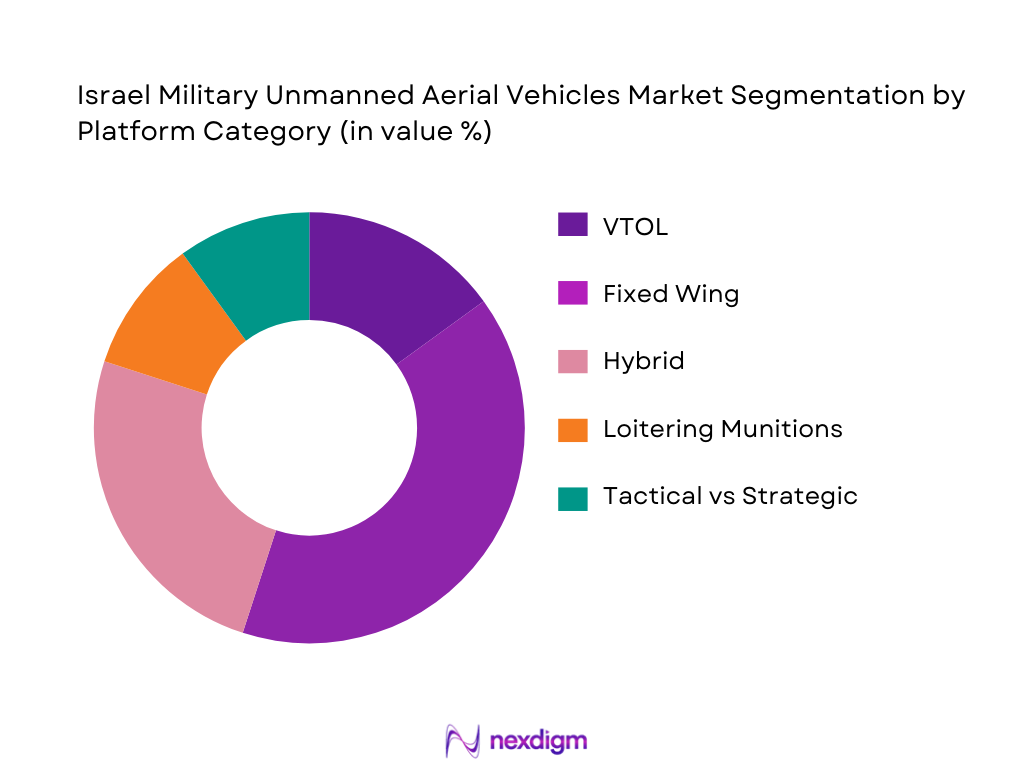

By Platform Category

The Israel Military Unmanned Aerial Vehicles market is segmented by platform categories such as VTOL (vertical takeoff and landing), fixed-wing UAVs, hybrid systems, loitering munitions, and tactical versus strategic UAVs. Fixed-wing UAVs, due to their endurance and long-range capabilities, dominate the market as they are crucial for ISR missions, surveillance, and reconnaissance. VTOL UAVs are gaining popularity for their ability to operate in confined spaces, while hybrid systems are gaining attention for their versatility in different operational scenarios.

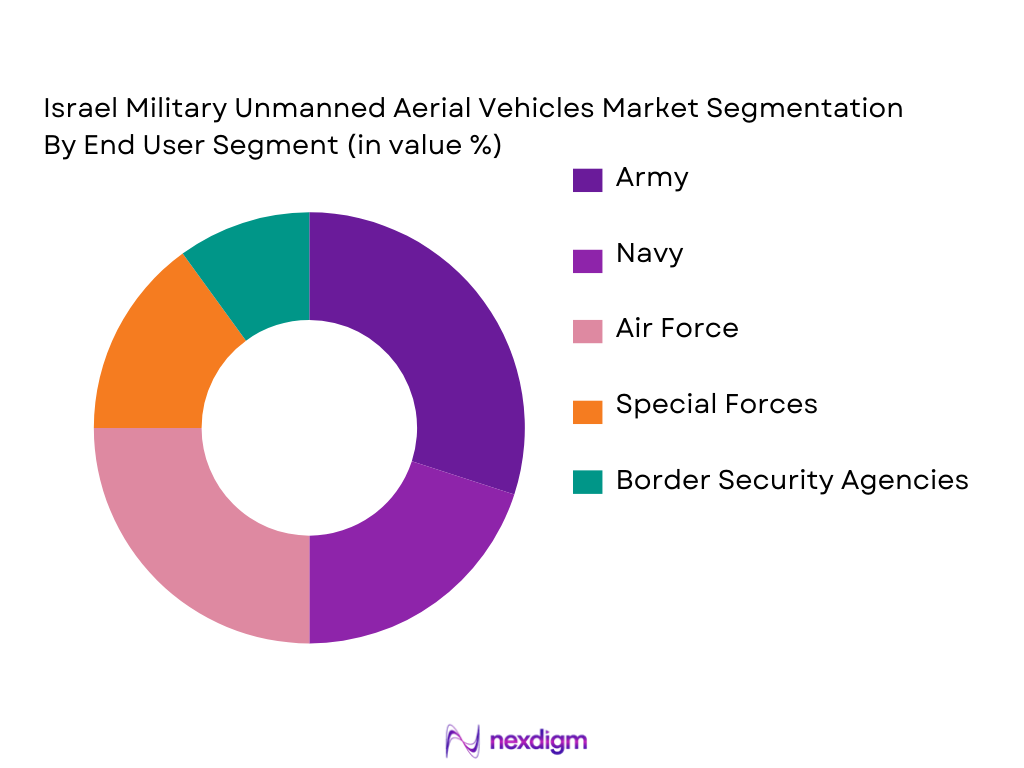

By End User Segment

The end-user segments of the Israel Military UAV market include the Army, Navy, Air Force, Special Forces, and Border Security Agencies. The Army holds a significant market share due to the strategic importance of UAVs for land-based ISR operations. The Air Force also plays a major role, utilizing UAVs for air-to-ground operations, intelligence gathering, and long-range strike capabilities. Border Security Agencies are increasingly deploying UAVs for persistent surveillance along sensitive borders.

Competitive Landscape

The Israel Military Unmanned Aerial Vehicles market is dominated by a few major players such as Israel Aerospace Industries (IAI), Elbit Systems, Rafael Advanced Defense Systems, Aeronautics Ltd, and UVision Air. These companies maintain dominance due to their advanced technological capabilities, government contracts, and strong defense partnerships. Israel’s well-developed defense ecosystem, including high-tech UAV manufacturing and integration, continues to fuel the competitive dynamics of the market.

| Company | Establishment Year | Headquarters | Technology Leadership | Export Orientation | Platform Integration | Production Capacity | Strategic Alliances |

| Israel Aerospace Industries (IAI) | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Ltd | 1997 | Israel | ~ | ~ | ~ | ~ | ~ |

| UVision Air | 2000 | Israel | ~ | ~ | ~ | ~ | ~ |

Israel military Unmanned Aerial Vehicles Market Analysis

Growth Drivers

Shift to Unmanned Operations (Force Multipliers)

The global shift towards unmanned systems has significantly influenced Israel’s military strategy. Unmanned aerial vehicles (UAVs) are seen as force multipliers, providing enhanced surveillance, reconnaissance, and combat capabilities without putting human lives at risk. Israel has been at the forefront of developing and deploying UAVs, with their strategic importance being highlighted in recent conflicts. The use of UAVs for operations such as target acquisition, intelligence gathering, and precision strikes has revolutionized Israel’s military tactics. With the ability to operate in hostile environments and conduct persistent surveillance, UAVs offer an unparalleled advantage in terms of flexibility, cost-effectiveness, and safety. This shift is further propelled by advancements in autonomous systems, increasing Israel’s reliance on unmanned aerial vehicles for its defense needs, especially in border security and counter-terrorism operations.

Increased ISTAR Demand (Persistent Surveillance)

Israel’s demand for ISTAR (Intelligence, Surveillance, Target Acquisition, and Reconnaissance) capabilities has been growing due to the necessity for persistent surveillance in its defense strategies. UAVs are essential for fulfilling these demands, allowing for continuous monitoring of sensitive regions. The ability of UAVs to offer real-time intelligence with minimal operational downtime makes them an attractive solution for the Israeli military, particularly for border patrols, air surveillance, and monitoring enemy movements. The importance of situational awareness in modern warfare has led to an increase in the integration of UAVs with ISTAR systems, ensuring comprehensive intelligence gathering in complex, dynamic environments. Additionally, UAVs can operate in all weather conditions, enhancing Israel’s surveillance capabilities for both day and night missions.

Market Challenges

Export Controls and Regulatory Barriers (ITAR/EAR Equivalents)

A significant challenge for Israel in the UAV market is the strict export controls imposed on military technology. The U.S. International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR) restrict the sale of military-grade UAV systems to other countries. These regulations affect Israel’s ability to expand its UAV sales, as many nations require access to advanced technologies for their defense operations. The Israeli defense industry must navigate these regulatory hurdles, which often involve complex licensing processes. While Israel has established strong defense ties with nations such as India and Germany, global trade in UAVs is often limited by these export restrictions. Overcoming these barriers involves finding ways to collaborate with nations that have less restrictive regulatory environments, while also ensuring compliance with international laws.

Spectrum Management Constraints (Comm Links)

Another challenge in the UAV market is managing spectrum availability for communication links. UAVs require secure and reliable communication channels for remote operation and real-time data transmission. However, the electromagnetic spectrum is a finite resource, and the proliferation of UAVs has led to increased competition for bandwidth, especially in military operations where communication security is paramount. In Israel, where UAVs are extensively used for surveillance and targeted operations, spectrum management becomes critical to avoid interference and ensure the integrity of mission-critical communications. These spectrum constraints could hinder the operational efficiency of UAVs, especially when deployed in large numbers or in densely populated regions where communication frequencies are already heavily utilized.

Opportunities

Sensor Miniaturization (Multi-Modal EO/IR)

The trend of sensor miniaturization is one of the key opportunities driving the Israel military UAV market. The advancement of miniaturized sensors, particularly electro-optical (EO) and infrared (IR) systems, has opened up new possibilities for UAVs. These sensors enable the UAVs to carry out highly precise surveillance, targeting, and reconnaissance missions. Smaller, lighter sensors are critical for enhancing the UAV’s payload capacity and overall mission endurance. Israel’s defense sector is leading the way in the development of multi-modal EO/IR sensors, which combine multiple sensing capabilities such as day/night vision and infrared tracking in a compact form. This technological innovation is expanding the operational potential of UAVs, allowing them to perform complex tasks such as identifying and tracking targets at extended ranges, all while maintaining their stealth and mobility. The integration of these advanced sensors enhances the effectiveness of UAVs in diverse combat and intelligence-gathering scenarios, thus contributing to their widespread adoption.

Swarming Capabilities (Cooperative Engagement)

Swarming capabilities present a significant opportunity for Israel’s UAV market, enabling multiple UAVs to operate in a cooperative, coordinated manner to achieve complex mission objectives. Swarming allows UAVs to work together autonomously or semi-autonomously, enhancing operational flexibility and the ability to overwhelm enemy defenses. This technology is particularly beneficial for Israel’s military strategy, allowing for synchronized attacks, surveillance, and disruption of enemy systems. The development of advanced algorithms and AI-driven control systems enables UAVs to communicate with each other in real time, adapting to changing mission parameters. Swarming capabilities make UAVs more effective in counteracting air defense systems and conducting coordinated strikes, providing Israel with a tactical edge in both defense and offense. This opportunity also extends to asymmetric warfare, where smaller UAV swarms can be used to target larger, more conventional forces.

Future Outlook

Over the next 5-6 years, the Israel Military UAV market is expected to grow significantly, propelled by technological advancements in autonomous UAV systems, increased demand for ISR operations, and ongoing defense modernization initiatives. Continuous innovation in payloads, longer flight endurance, and the integration of AI and machine learning will further drive growth in the market. In addition, strategic defense collaborations and export partnerships are expected to play a key role in expanding Israel’s market share across global defense sectors.

Major Players

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Rafael Advanced Defense Systems

- Aeronautics Ltd

- UVision Air

- Urban Aeronautics

- BlueBird Aero Systems

- Roboteam

- Controp Precision Technologies

- Airobotics

- Percepto

- Elbit Systems (UAV Subsidiary Focus)

- Israel Military Industries UAV Division

- Tadiran Spectralink (UAV Sensors)

- Smart Shooter (Loitering Systems)

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Israel Ministry of Defense, U.S. Department of Defense, European Defense Agency)

- Military Procurement Agencies

- Aerospace and Defense OEMs

- UAV Systems Integrators

- Military Logistics and Maintenance Providers

- UAV Training Institutes

- Military R&D Units

Research Methodology

Step 1: Identification of Key Variables

The first phase focuses on identifying critical drivers of the Israel Military UAV market. Secondary research is conducted, leveraging industry databases and defense procurement reports to map key trends, challenges, and innovations in the UAV market.

Step 2: Market Analysis and Construction

Historical market data is compiled to evaluate the growth trajectory of Israel’s UAV industry. This includes examining adoption rates, technological advancements, and market penetration within defense sectors.

Step 3: Hypothesis Validation and Expert Consultation

A hypothesis will be developed based on initial research, validated through interviews with industry professionals and UAV manufacturers. Insights will be gathered from defense planners, R&D units, and end-users to refine the data.

Step 4: Research Synthesis and Final Output

The final step involves combining all insights from primary and secondary research sources, refining the final market outlook. Expert consultations will help validate projections on growth drivers, challenges, and competitive dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions [operational UAV definitions, military mission classifications], Abbreviations, Market Sizing Approach [unit shipments, installed platform value], Consolidated Research Approach [primary surveys with defence procurement], Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions )

- Definition and Scope

- Overview Genesis

- Technology Evolution and Capability Sets

- Operational Doctrine and Deployment Trends

- Supply Chain and Value Chain Analysis

- Growth Drivers

Shift to Unmanned Operations (Force Multipliers)

Increased ISTAR Demand (Persistent Surveillance)

Budget Allocations (Defense Spending Patterns)

Export Market Expansion (Diplomatic Offsets)

Technology Advances (AI/ML Autonomy)

- Market Challenges

Export Controls and Regulatory Barriers (ITAR/EAR Equivalents)

Spectrum Management Constraints (Comm Links)

Counter‑UAV Threats (Survivability)

Industrial Base Bottlenecks (Component Shortages)

Certification Complexity (Airworthiness)

- Opportunities

Sensor Miniaturization (Multi‑Modal EO/IR)

Swarming Capabilities (Cooperative Engagement)

Long Endurance Platforms (Beyond Line of Sight)

Autonomous Decision Support (AI Guidance)

Aftermarket Services (Training, Logistics)

- Trends

Modular Payload Architectures (Plug‑and‑Play)

C4ISR Network Integration (Data Link Standards)

Low Observable Designs (Signature Reduction)

Hybrid Propulsion Adoption (Range Extension)

Export Partnership Models (Co‑Production)

- Government Regulation

Defense Procurement Policies (Acquisition Frameworks)

Export Licensing Regimes (Compliance)

Airspace Integration Standards (UAS Traffic Management)

Safety and Testing Protocols (Military Testing Ranges)

- SWOT Analysis

Strengths (Technology Leadership)

Weaknesses (Export Limitations)

Opportunities (New Markets)

Threats (Adversary Countermeasures)

- Stake Ecosystem

OEMs

Subsystem Suppliers

Systems Integrators

End Users

Maintenance and Training Providers

- Porter’s Five Forces

Supplier Power (Critical Components)

Buyer Power (Government Buyers)

Competitive Rivalry (Platform Variants)

Threat of Substitutes (Manned Alternatives)

Barrier to Entry (Certification, Technology)

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Platform Category (In Value %)

VTOL (Vertical Take‑Off and Landing Capability)

Fixed Wing (Endurance Profile)

Hybrid (Mission Flexibility)

Loitering Munitions (Strike Profiles)

Tactical vs Strategic (Range/Endurance)

- By End User Segment (In Value %)

Army (Land ISR)

Navy (Maritime ISR)

Air Force (Air Operations)

Special Forces (Covert Missions)

Border Security Agencies (Persistent Surveillance)

- By Mission Application (In Value %)

Intelligence, Surveillance and Reconnaissance (Sensor Payload Types)

Target Acquisition and Tracking (Laser Designation)

Electronic Warfare Support (Signal Intercept Systems)

Strike/Attack (Munition Integration)

Communications Relay (Network Nodes)

- By Propulsion and Power Systems (In Value %)

Electric (Silent Operations)

Piston Engine (Cost Efficiency)

Turbine (High Performance)

Hybrid Systems (Extended Endurance)

Fuel Cell (Emerging Technology)

- By Geography (In Value %)

Domestic Defence Forces (Regional Basing)

Export Markets (Regional Blocs)

Joint Operations Frameworks (Coalitions)

Training Ranges and Testing Sites (Infrastructure)

Maintenance Hubs (Support Facilities)

- Market Share of Major Players on the Basis of Value/Volume

- Cross Comparison Parameters (Company Overview , Product Portfolio Depth , Sensor and Payload Integration Capability , Endurance and Range Performance , Communication and Data Link Systems , Export Licensing and Compliance Footprint [regional permissions], Aftermarket Support Infrastructure , Production Capacity and Scalability , Unit Cost Structures , Strategic Partnerships and Joint Ventures , Autonomous and AI Capability Maturity , Certification and Airworthiness Credentials , Market Reach and Deployment Footprint , R&D Investment Intensity)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Platform Configurations and Mission Sets

- Detailed Profiles of Major Companies

Israel Aerospace Industries (IAI)

Elbit Systems

Rafael Advanced Defense Systems

Aeronautics Ltd

UVision Air

Urban Aeronautics

BlueBird Aero Systems

Roboteam

Controp Precision Technologies

Airobotics

Percepto

Elbit Systems (UAV Subsidiary Focus)

Israel Military Industries UAV Division

Tadiran Spectralink (UAV Sensors)

Smart Shooter (loitering systems)

- Market Demand and Utilization Patterns

- Procurement Planning and Budget Allocations

- Regulatory and Compliance Requirements

- Operational Needs, Gaps, and Pain Points

- Decision‑Making Process and Acquisition Criteria

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035