Market Overview

The Israel Military Unmanned Ground Vehicle (UGV) market is valued at USD ~ billion based on a five-year historical analysis. The market is driven by increasing demand for unmanned systems in military operations, reducing risks to human soldiers, and improving operational efficiency. Furthermore, technological advancements in AI, machine learning, and autonomous navigation systems are accelerating the market’s growth. The demand for autonomous military vehicles in surveillance, reconnaissance, and combat support roles has further fueled market expansion.

Israel dominates the Military UGV market due to its strong defense capabilities, cutting-edge technology, and government support for innovation in unmanned systems. The country has been a leader in developing autonomous systems for military use, supported by robust defense research and development infrastructure. Israel’s defense industry has attracted significant investments from both the government and private sectors, contributing to the development of advanced UGVs. Additionally, its strategic geographical location in the Middle East has made it a key player in defense technologies.

Market Segmentation

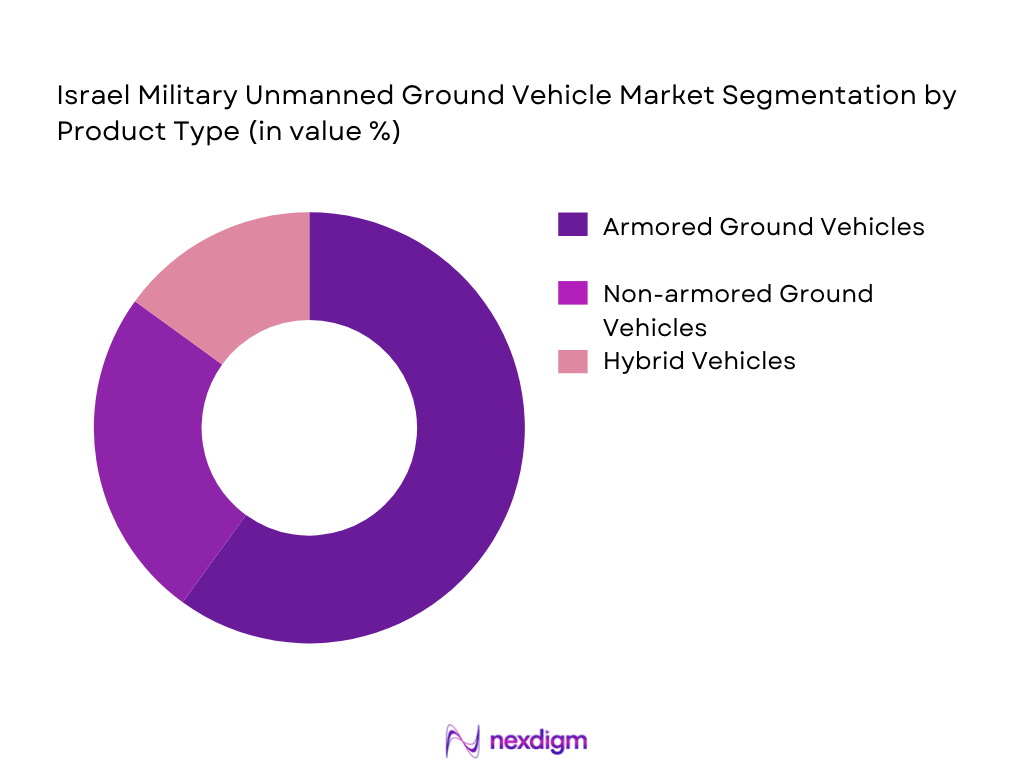

By Product Type

The Israel Military UGV market is segmented into armored ground vehicles, non-armored ground vehicles, and hybrid vehicles. Armored ground vehicles have the dominant market share due to their crucial role in high-risk operations. These vehicles are preferred for military reconnaissance and combat support due to their ability to withstand harsh conditions and provide protection to onboard systems. The need for robust, heavily armored systems in military applications further drives the dominance of this segment.

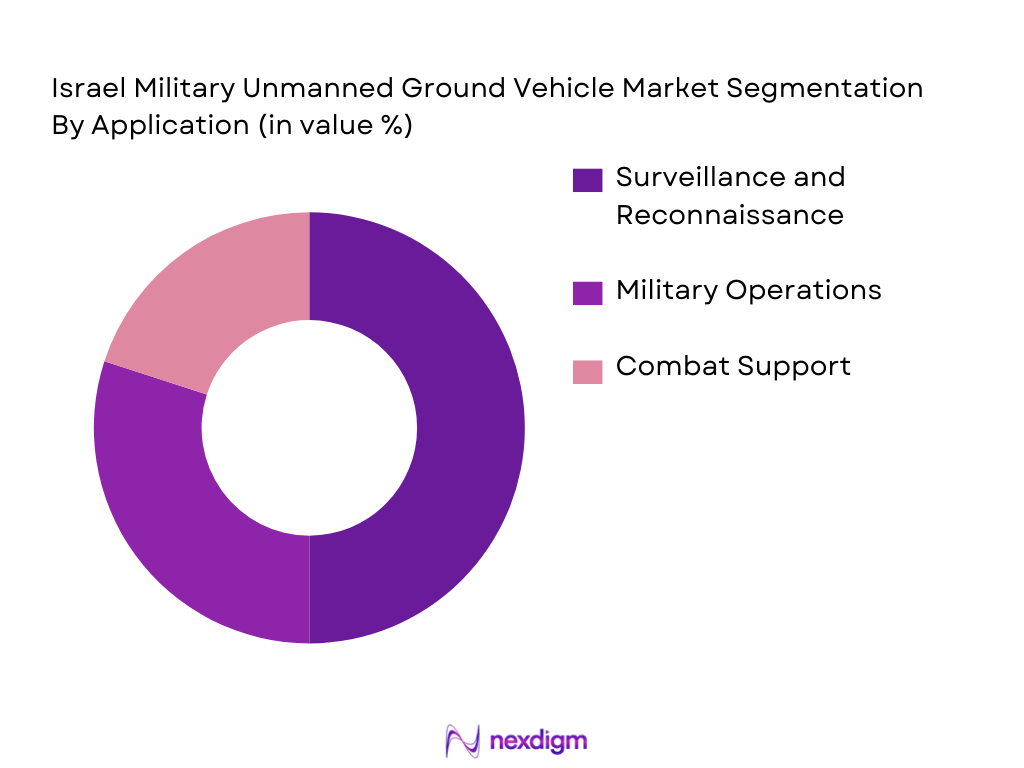

By Application

The Israel Military UGV market is segmented by application into military operations, surveillance and reconnaissance, and combat support. Surveillance and reconnaissance vehicles hold the highest market share, driven by Israel’s emphasis on border security and intelligence gathering. The need for real-time surveillance in hostile environments has led to the widespread adoption of UGVs in these applications. Additionally, advancements in sensors and autonomous capabilities are enhancing the effectiveness of these systems.

Competitive Landscape

The Israel Military UGV market is dominated by a few major players, including local manufacturers such as Elbit Systems and Rafael Advanced Defense Systems, alongside international giants like Northrop Grumman and BAE Systems. These companies have extensive R&D capabilities and a strong foothold in the defense sector. The consolidation in the market is a result of their significant technological advancements and partnerships with government agencies to develop cutting-edge unmanned systems.

| Company | Establishment Year | Headquarters | Revenue (USD) | Key Product Types | Market Share | Key Competitive Advantage |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1950 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

Israel Military Unmanned Ground Vehicle Market Analysis

Growth Drivers

Increasing Military Modernization

The increasing pace of military modernization in Israel is one of the primary growth drivers for the Military Unmanned Ground Vehicle (UGV) market. The Israeli Defense Forces (IDF) are constantly investing in advanced technologies to maintain their operational edge. This includes the integration of unmanned systems to enhance tactical and strategic capabilities. The emphasis on unmanned vehicles for critical missions such as reconnaissance, border security, and combat support is becoming crucial in modernizing the military. The reduction in risk to human soldiers and the ability to operate in hostile and hazardous environments make UGVs an essential component of military modernization. With government policies encouraging innovation and funding for R&D, Israel remains at the forefront of adopting unmanned systems to address national defense needs, further fueling the demand for military UGVs.

Need for Surveillance and Reconnaissance Capabilities

The growing need for enhanced surveillance and reconnaissance capabilities is a key factor driving the growth of the Military UGV market in Israel. Due to the complex geopolitical situation in the Middle East, Israel places a strong emphasis on monitoring its borders and conducting intelligence gathering operations. UGVs equipped with advanced sensors and autonomous navigation systems provide the ability to operate in dangerous and often inaccessible areas. These vehicles can capture real-time intelligence without exposing personnel to significant risks. As the demand for security increases, particularly in regions with high political instability, UGVs equipped for surveillance and reconnaissance will continue to play a vital role in Israel’s defense strategy.

Market Challenges

High Production and Maintenance Costs

Despite their numerous advantages, one of the major challenges in the Israel Military UGV market is the high production and maintenance costs associated with these systems. Developing UGVs with advanced technologies, such as autonomous driving, machine learning, and AI integration, requires substantial investment in research, development, and testing. These high initial costs, along with the complexity of maintenance and the need for highly skilled personnel, limit the widespread adoption of UGVs, particularly for smaller defense contractors or countries with more constrained budgets. Furthermore, the long lifecycle of these vehicles demands ongoing maintenance and support, increasing operational costs for defense agencies.

Integration with Existing Military Systems

Another significant challenge is the integration of UGVs with existing military systems. Many defense organizations, including the Israeli military, rely on a complex array of legacy systems, and integrating new unmanned vehicles into these frameworks presents both technical and operational difficulties. Ensuring that UGVs can seamlessly communicate and operate alongside manned systems and other unmanned assets is a complex task. The risk of interoperability issues can hinder the effective deployment of UGVs in real-world scenarios. Additionally, military personnel must be adequately trained to operate and maintain these advanced systems, which adds an extra layer of complexity to integration.

Opportunities

Technological Advancements in Autonomous Vehicles

One of the most exciting opportunities for growth in the Israel Military UGV market is the continued technological advancements in autonomous vehicles. Autonomous driving technology is rapidly improving, driven by innovations in artificial intelligence, machine learning, and sensor technology. These advancements enhance the capabilities of military UGVs, making them more reliable, efficient, and effective in a variety of operational settings. The ability of UGVs to operate autonomously in hostile and complex environments, such as urban warfare zones or border regions, positions them as critical assets for future military operations. As AI technology continues to evolve, the potential for fully autonomous UGVs in military applications will expand, unlocking new market opportunities.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations represent a significant opportunity for growth in the Israel Military UGV market. Israel’s defense sector has a long history of collaborating with global technology companies and other nations to enhance its military capabilities. Collaborations between Israeli defense firms and international players can lead to the development of next-generation UGVs with cutting-edge features. These partnerships can help reduce costs, accelerate technological development, and provide access to new markets. Additionally, international defense contracts and agreements can expand the use of Israeli-made UGVs in military forces around the world. By leveraging its expertise in unmanned systems and forging alliances with global stakeholders, Israel can secure its position as a leading supplier of military UGVs in the global defense market.

Future Outlook

Over the next 5 years, the Israel Military UGV market is expected to experience substantial growth driven by continuous advancements in autonomous systems, increased demand for unmanned operations in military settings, and strategic defense initiatives. The adoption of unmanned ground vehicles for surveillance, reconnaissance, and combat support roles will remain a significant driver, as these systems offer improved operational efficiency and minimized risk to human soldiers. Moreover, Israel’s robust defense innovation policies and military expenditure are expected to contribute to a favorable market environment for UGV development.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Northrop Grumman

- BAE Systems

- General Robotics

- G-Nius Robotics

- Urban Aeronautics

- ODF Optronics

- Roboteam

- Marom Dolphin

- UGV Innovations

- Officina Stellare

- Accenture

- Thales Group

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Israel Ministry of Defense, Israel Defense Forces)

- Defense Contractors

- Military Equipment Suppliers

- Technology Providers (AI, Robotics)

- Aerospace & Defense Manufacturers

- Strategic Defense Planning Agencies

- Law Enforcement Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Israel Military UGV Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Israel Military UGV Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple military UGV manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Israel Military UGV market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analyst

- Growth Drivers

Increasing Military Modernization

Need for Surveillance and Reconnaissance Capabilities

Demand for Reduced Operational Risks - Market Challenges

High Production and Maintenance Costs

Integration with Existing Military Systems - Opportunities

Technological Advancements in Autonomous Vehicles

Strategic Partnerships and Collaborations - Trends

Growing Adoption of Artificial Intelligence

Integration of UAV and UGV Systems - Government Regulation

Safety Standards for Autonomous Vehicles

Export Control and Compliance - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competition Ecosystem

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Product Type (In Value %)

Armored Ground Vehicles

Non-armored Ground Vehicles

Hybrid Vehicles - By Application (In Value %)

Military Operations

Surveillance and Reconnaissance

Combat Support - By End User (In Value %)

Defense Forces

Government Agencies

Private Contractors - By Region (In Value %)

Central Israel

Northern Israel

Southern Israel

Western Israel - By Technology (In Value %)

Autonomous Systems

Remote Control Systems

AI-Integrated Vehicles

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by UGV Type Segment - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by UGV Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Players in the Israel Military UGV Market

- Detailed Profiles of Major Companies

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries (IAI)

General Robotics

G-Nius Robotics

Urban Aeronautics

ODF Optronics

Roboteam

Marom Dolphin

UGV Innovations

Officina Stellare

Accenture

Thales Group

BAE Systems

Northrop Grumman

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035