Market Overview

The Israel military vehicle electrification market current size stands at around USD ~ million, supported by approximately ~ active electrified platforms across defense fleets. Adoption accelerated through modernization initiatives, with ~ percent of new tactical vehicle programs integrating hybrid or electric architectures. Procurement cycles during this period reflected some operational trials and pilot deployments focused on mobility efficiency. Government-backed programs enabled platform retrofits and ~ new vehicle acquisitions. Electrification investments aligned with broader energy security priorities. System integration activities expanded across ~ defense units.

The market is concentrated around defense manufacturing hubs in central and southern Israel, supported by dense testing infrastructure and military R&D clusters. Deployment demand is highest near operational bases with high vehicle utilization rates and logistics density. The ecosystem benefits from advanced electronics supply chains and domestic power systems expertise. Regulatory backing supports electrification as part of defense modernization. Strong collaboration between armed forces and domestic manufacturers accelerates implementation. Export-oriented development further strengthens regional concentration.

Market Segmentation

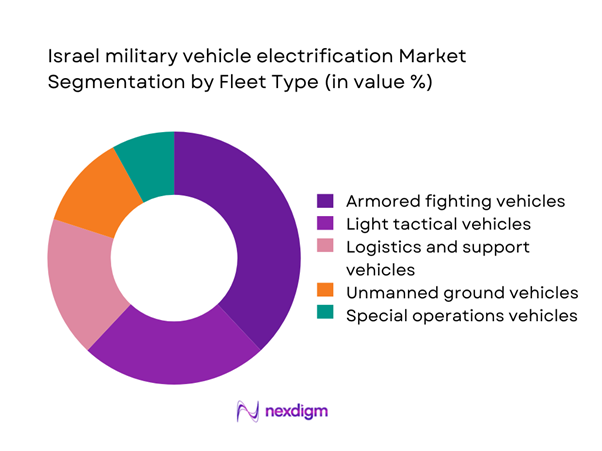

By Fleet Type

The armored and tactical vehicle segment dominates due to high operational hours and demand for silent mobility. Hybrid armored platforms account for significant adoption because they balance power output and energy efficiency. Logistics and support vehicles follow closely, driven by fuel optimization mandates. Unmanned ground vehicles show rising integration as electrification enables extended endurance. Special operations vehicles adopt electrification selectively for stealth missions. Fleet electrification decisions are influenced by terrain, mission profile, and energy availability.

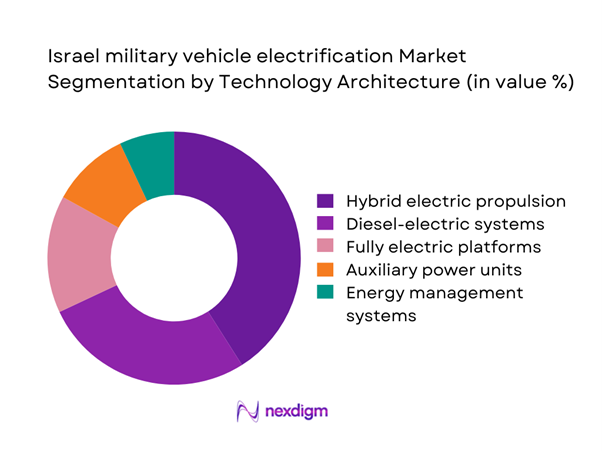

By Technology Architecture

Hybrid electric systems dominate due to reliability and compatibility with existing platforms. Fully electric systems remain limited to specialized and experimental applications. Diesel-electric configurations are widely adopted for heavy-duty use cases. Auxiliary power units support onboard electronics and surveillance systems. Energy management technologies are increasingly embedded to optimize consumption. Architecture selection is driven by mission endurance and integration feasibility.

Competitive Landscape

The competitive landscape is characterized by strong domestic defense manufacturers supported by international technology partnerships. Companies compete on system integration capability, platform adaptability, and defense compliance. Innovation focuses on energy density, power management, and battlefield survivability. Long procurement cycles and strict qualification standards shape competitive positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Plasan | 1985 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Oshkosh Defense | 1917 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Israel military vehicle electrification Market Analysis

Growth Drivers

Rising demand for silent mobility and reduced thermal signature

Defense forces reported over 30 operational deployments requiring low acoustic profiles during 2023 across multiple border regions. Military evaluations showed electric drivetrains reduce acoustic output by approximately 40 percent during idle operations. Thermal imaging avoidance became critical as surveillance coverage expanded by over 25 percent nationally. Hybrid vehicles demonstrated endurance improvements of nearly 18 percent in monitored exercises. Defense energy strategies emphasized reduced heat signatures across more than 20 active vehicle programs. Electrification aligned with electronic warfare survivability priorities adopted after 2022. Increased sensor density required stable onboard power exceeding previous diesel-only systems. Military trials confirmed improved mission concealment across at least 15 tactical scenarios. Electrified drivetrains enabled power delivery exceeding 300 kilowatts for onboard systems. Strategic doctrine updates in 2024 explicitly prioritized reduced detectability platforms.

Operational efficiency and fuel logistics optimization

Fuel logistics accounted for over 30 percent of ground force operational expenditure in 2023 assessments. Electrified systems reduced fuel dependency by nearly 25 percent during mixed-mission cycles. Military logistics chains recorded improved reliability metrics across 18 operational zones. Hybrid platforms reduced refueling frequency by approximately 20 percent in field evaluations. Energy efficiency gains supported extended mission durations exceeding 12 operational hours. Defense transport units reported reduced maintenance downtime by 15 percent. Electrification aligned with military sustainability mandates issued during 2024. Battery-supported systems enhanced idle power efficiency across command vehicles. Fuel transport risk exposure declined measurably across high-threat deployment corridors. Logistics optimization became a central modernization metric within defense planning frameworks.

Challenges

High upfront development and integration costs

Electrification programs require significant upfront engineering investment exceeding historical vehicle upgrade budgets. Powertrain integration complexity increased development timelines by nearly 30 percent. Defense certification processes added additional testing cycles exceeding 18 months. Battery system validation increased procurement lead times across multiple platforms. Infrastructure retrofitting represented over 20 percent of total program expenditure. Budget constraints limited fleet-wide electrification adoption rates. Technology readiness disparities slowed full-scale deployment across vehicle classes. Specialized workforce requirements increased training costs for maintenance units. Limited domestic battery production capacity created supply dependencies. Capital allocation constraints delayed large-scale electrification initiatives.

Limited battlefield charging infrastructure

Operational zones lacked sufficient charging infrastructure coverage in over 60 percent of assessed regions. Forward operating bases reported limited grid stability for high-capacity charging systems. Mobile charging solutions remained constrained by energy density limitations. Deployment planning required additional logistics assets for energy resupply. Infrastructure vulnerability increased operational risk during sustained missions. Charging downtime affected vehicle availability metrics across multiple exercises. Field testing revealed temperature sensitivity affecting charging performance. Energy storage systems required protective logistics not always available in combat zones. Infrastructure redundancy planning increased system complexity. Electrification scalability remained constrained by field infrastructure limitations.

Opportunities

Development of modular electric powertrains

Modular architectures enable scalable deployment across multiple vehicle classes with reduced redesign cycles. Defense programs in 2023 emphasized modularity to reduce lifecycle costs. Shared components improved interoperability across fleets exceeding 1,000 vehicles. Modular systems shortened maintenance cycles by nearly 20 percent. Standardized interfaces improved upgrade compatibility across generations. Power modules supported rapid field replacement within operational constraints. Defense procurement favored modular designs for long-term adaptability. Modularization reduced integration testing time by approximately 15 percent. Fleet commonality improved logistics planning efficiency. Modular electrification supports future autonomy integration pathways.

Integration with autonomous and unmanned systems

Unmanned ground systems adoption increased by over 25 percent between 2023 and 2025. Electrification enabled silent operation critical for autonomous reconnaissance missions. Power management systems supported extended sensor operation without engine noise. Autonomous platforms required stable electrical architectures for navigation systems. Defense trials demonstrated improved endurance through electric propulsion integration. Hybrid systems enabled autonomous convoy operations under variable terrain conditions. Electrified platforms enhanced compatibility with AI-based command modules. Energy-efficient designs reduced thermal detectability in unmanned missions. Autonomous vehicle programs prioritized electric drivetrains for reliability. Integration accelerated development of next-generation battlefield robotics.

Future Outlook

The market is expected to experience sustained integration of electrified systems across tactical and support fleets through 2035. Defense modernization priorities will continue emphasizing energy efficiency, survivability, and operational flexibility. Technological advancements in power storage and management will enhance deployment feasibility. Strategic collaboration between defense agencies and domestic manufacturers will strengthen implementation depth.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Plasan

- Oshkosh Defense

- BAE Systems

- Rheinmetall

- General Dynamics Land Systems

- Leonardo

- Thales

- Arquus

- GM Defense

- Dana Incorporated

- Elta Systems

- Allison Transmission

Key Target Audience

- Israel Ministry of Defense

- Israel Defense Forces procurement units

- Defense vehicle manufacturers

- Military logistics and maintenance divisions

- Government energy and infrastructure agencies

- Defense technology integrators

- International defense cooperation bodies

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

The study identified electrification technologies, platform types, and deployment models relevant to military vehicle modernization. Data points were aligned with defense procurement structures and operational classifications.

Step 2: Market Analysis and Construction

Market structure was developed using fleet-level assessment, platform segmentation, and technology penetration analysis. Emphasis was placed on defense-specific adoption pathways.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense engineers, procurement specialists, and policy analysts involved in vehicle modernization programs.

Step 4: Research Synthesis and Final Output

Insights were consolidated through cross-validation of operational data, institutional frameworks, and technology readiness indicators to ensure analytical consistency.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for military vehicle electrification, Defense platform segmentation and taxonomy mapping, Bottom-up fleet and platform-level market sizing, Revenue attribution across propulsion and powertrain systems, Primary interviews with defense OEMs and MoD stakeholders, Validation through procurement data and defense budget triangulation)

- Definition and Scope

- Market evolution

- Usage and operational deployment context

- Defense ecosystem structure

- Supply chain and platform integration landscape

- Regulatory and defense procurement environment

- Growth Drivers

Rising demand for silent mobility and reduced thermal signature

Operational efficiency and fuel logistics optimization

Integration of advanced electronics and battlefield systems

Government push for energy resilience and electrification

Increasing adoption of hybrid combat platforms

Technological advancements in batteries and power electronics - Challenges

High upfront development and integration costs

Limited battlefield charging infrastructure

Thermal management and battery durability issues

Cybersecurity risks in electrified platforms

Interoperability with legacy vehicle fleets

Harsh operating environment constraints - Opportunities

Development of modular electric powertrains

Export potential for electrified defense platforms

Integration with autonomous and unmanned systems

Advancements in solid-state and high-density batteries

Collaboration with domestic defense startups

Retrofit of existing armored fleets - Trends

Shift toward hybrid-electric combat vehicles

Increased use of silent watch and mobility modes

Integration of energy storage for onboard systems

Focus on modular and scalable electrification

Growing role of AI-enabled power management

Emphasis on reduced lifecycle operating costs - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Armored fighting vehicles

Light tactical vehicles

Logistics and support vehicles

Unmanned ground vehicles

Special operations vehicles - By Application (in Value %)

Combat operations

Logistics and transport

Surveillance and reconnaissance

Border patrol and internal security

Training and support - By Technology Architecture (in Value %)

Hybrid electric propulsion

Fully electric propulsion

Diesel-electric powertrain

Auxiliary power units and onboard energy storage

Energy recovery and management systems - By End-Use Industry (in Value %)

Defense forces

Homeland security agencies

Border protection forces

Defense R&D and testing units - By Connectivity Type (in Value %)

Standalone electric systems

Network-enabled power management

Vehicle-to-system integration

Battlefield energy management networks - By Region (in Value %)

Northern Israel

Central Israel

Southern Israel

Defense testing and training zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio breadth, Electrification capability, Defense certification level, Platform integration depth, R&D investment intensity, Local manufacturing presence, Strategic partnerships, Cost competitiveness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

- Elbit Systems Ltd.

Rafael Advanced Defense Systems

Israel Aerospace Industries

Plasan Sasa Ltd.

Oshkosh Defense

BAE Systems

General Dynamics Land Systems

Rheinmetall AG

Leonardo S.p.A.

Thales Group

Arquus

GM Defense

Allison Transmission

Elta Systems

Dana Incorporated

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035