Market Overview

The Israel military wearables market is valued at approximately USD ~ million, driven by the ongoing modernization of military forces, the integration of advanced technology, and a focus on enhancing soldier safety and efficiency. Key drivers include the increasing demand for wearable technologies that provide real-time data, advanced communication capabilities, and wearable health monitoring devices that improve operational readiness and reduce casualties. These technologies are expected to remain critical as Israel continues its emphasis on military readiness.

Israel, a global leader in defense innovation, dominates the military wearables market due to its robust defense industry, research capabilities, and commitment to technological advancement. The country’s strategic partnerships with global defense leaders, along with its long-standing focus on cybersecurity, positions it as a key player. Israel’s commitment to integrating cutting-edge wearable solutions for soldiers continues to drive its leadership in this sector, strengthening its position in global defense exports.

Market Segmentation

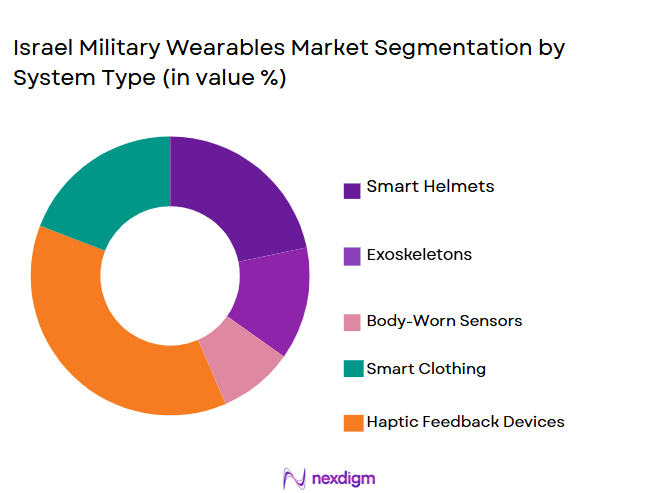

By System Type

The Israel military wearables market is segmented by product type into wearable communication systems, health-monitoring devices, and augmented reality helmets. Health-monitoring devices are currently leading the market segment. The focus on improving soldier performance through monitoring physical metrics such as heart rate, fatigue, and stress levels has made health-related wearables a priority. The increasing adoption of such devices for enhancing the operational capabilities and safety of soldiers contributes to the growing demand in this segment.

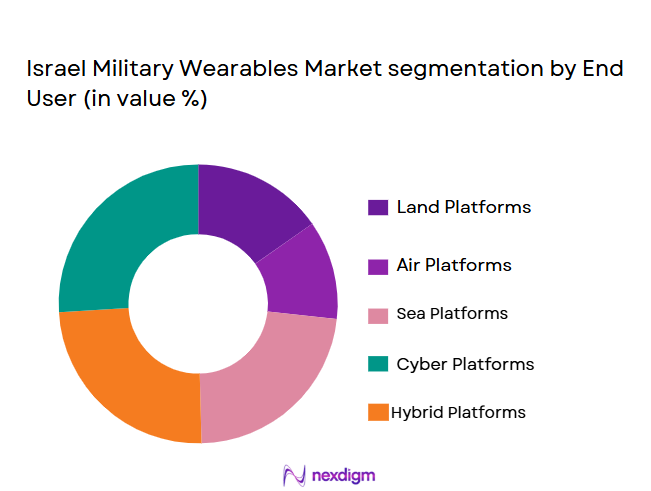

By End-User

The market is also segmented by end-user into military forces, paramilitary organizations, and defense contractors. Military forces dominate the end-user segment, driven by the consistent push towards modernization and enhancing operational efficiency. Military forces’ emphasis on wearable technologies that improve battlefield effectiveness, increase situational awareness, and enhance communication capabilities is key to their dominance in this market.

Competitive Landscape

The Israel military wearables market is competitive, with several prominent players leading the industry. These companies have established themselves through consistent innovation and a strong relationship with defense organizations.

| Company | Establishment Year | Headquarters | Product Portfolio Breadth | NVG / Tactical Certification | Local Defense Offset Status | Integration Capability | After-Sales & Field Support | Installed Project Base |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| IAI ELTA Systems | 1967 | Ashdod, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elta Systems | 1986 | Herzliya, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

Israel military wearables Market Analysis

Growth Drivers

Integration of AI and IoT for real-time data processing

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in military wearables is a key driver of the market. AI enhances decision-making by processing real-time data from various wearable devices, such as sensors and smart clothing, allowing soldiers to receive actionable insights on health, location, and tactical information. IoT enables seamless communication between devices, ensuring that the data gathered from wearables can be accessed by command centers for immediate action. This integration improves situational awareness, boosts operational efficiency, and enhances coordination between troops, making it a critical element in modern military operations.

Rising demand for enhanced soldier safety and performance

There is a growing emphasis on improving soldier safety and performance, driving demand for military wearables. These wearables, including body sensors, smart helmets, and exoskeletons, provide real-time monitoring of soldiers’ health metrics such as heart rate, body temperature, and stress levels. This data helps identify potential health risks before they become serious, improving overall well-being. Wearables also enhance soldier performance by offering real-time feedback on posture, movements, and fatigue levels, which allows for optimized physical readiness during combat or training missions.

Market Challenges

High cost of advanced wearables

One of the major challenges in the military wearables market is the high cost associated with advanced devices. The integration of cutting-edge technologies like AI, IoT, and advanced sensors into wearables often results in high manufacturing costs. Additionally, the specialized nature of these devices, which must withstand harsh environments and meet strict military standards, further raises their price. This can limit the accessibility of these wearables to certain defense organizations, particularly those in developing countries or with budget constraints.

Security and data privacy concerns

Security and data privacy are significant concerns in the adoption of military wearables. These devices collect and transmit sensitive data related to soldiers’ health, movements, and strategic operations. The risk of cyber-attacks or data breaches that could compromise military operations or put soldiers’ lives at risk is a serious issue. Ensuring that the data is encrypted, securely transmitted, and properly protected from unauthorized access is crucial. Additionally, there are concerns over how this data could be misused if it falls into the wrong hands, making robust cybersecurity measures a top priority for wearable manufacturers and defense forces alike.

Opportunities

Increasing defense budgets for R&D in military wearables

As global defense budgets rise, there is an increasing investment in research and development (R&D) for military wearables. Many countries are recognizing the strategic advantage of equipping soldiers with cutting-edge technologies that enhance performance and safety. Increased funding is driving the development of more advanced wearables, ranging from smart uniforms to wearable exoskeletons, aimed at improving soldier endurance and protection. This growing budget allocation presents a significant opportunity for manufacturers to innovate and supply new, more effective wearables for the military sector.

Advancement in augmented reality (AR) for battlefield applications

Augmented reality (AR) technology has immense potential for battlefield applications, and its integration into military wearables is a growing opportunity. AR can provide soldiers with real-time overlays of critical information, such as maps, enemy positions, or mission objectives, directly within their field of vision. This capability enhances situational awareness, reduces cognitive load, and allows for quicker decision-making during high-pressure situations. The development of AR-enabled wearables, such as smart glasses or helmets, is an exciting opportunity to revolutionize how soldiers interact with their environment and gather vital information during missions.

Future Outlook

Over the next decade, the Israel military wearables market is expected to witness substantial growth, driven by technological advancements in sensor technologies, wearables for real-time data transmission, and integration with other military systems. The focus on enhancing the operational efficiency, safety, and health of soldiers in combat scenarios will continue to propel the demand for wearables. Moreover, the rising demand for advanced communication and augmented reality systems in military applications is expected to further drive market growth.

Major Players in the Market

- Thales Group

- L3 Technologies

- Lockheed Martin

- Kongsberg Gruppen

- Raytheon Technologies

- BAE Systems

- Harris Corporation

- Elbit Systems

- Northrop Grumman

- Leonardo

- General Electric

- Navantia

- Rheinmetall Defence

- Honeywell International

- Saab AB

Key Target Audience

- Israeli Ministry of Defense

- Israel Defense Forces (IDF)

- Paramilitary Organizations

- Global Military Forces

- Defense Contractors (Israel and Global)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Israel Defense Export Control Agency)

- Military Equipment Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key variables that influence the Israel military wearables market, including technological trends, defense budgets, and military modernization efforts. Data is gathered from primary and secondary sources, including defense reports, government publications, and industry databases.

Step 2: Market Analysis and Construction

In this phase, we will analyze historical market data and trends, focusing on factors such as market size, growth rate, and key technological developments in the wearable segment. We will also consider market drivers, challenges, and opportunities within the context of Israel’s defense industry.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with defense experts, military personnel, and industry leaders. This will involve structured interviews and expert feedback to refine assumptions and provide insights into market conditions.

Step 4: Research Synthesis and Final Output

The final phase will involve compiling all research and analysis into a comprehensive report. This will include recommendations for stakeholders within the Israel military wearables market, based on a detailed understanding of current trends and future projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Integration of AI and IoT for real-time data processing

Rising demand for enhanced soldier safety and performance

Technological advancements in wearable materials and battery life - Market Challenges

High cost of advanced wearables

Security and data privacy concerns

Limited standardization in wearable technology - Opportunities

Increasing defense budgets for R&D in military wearables

Advancement in augmented reality (AR) for battlefield applications

Expansion of military wearables to allied nations - Trends

Shift towards energy-efficient and sustainable wearables

Development of AI-powered predictive analytics for enhanced soldier performance

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Smart Helmets

Exoskeletons

Body-Worn Sensors

Smart Clothing

Haptic Feedback Devices - By Platform Type (In Value%)

Land Platforms

Air Platforms

Sea Platforms

Cyber Platforms

Hybrid Platforms - By Fitment Type (In Value%)

Personalized Wearables

Modular Wearables

Integrated Wearables

Standalone Wearables

Adaptive Wearables - By EndUser Segment (In Value%)

Army

Navy

Air Force

Special Forces

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Procurement

Private Sector Procurement

Online Procurement

Third-party Vendors

- Market Share Analysis

- Cross Comparison Parameters (Technology integration, Product durability, Cost-efficiency, Security protocols, User acceptance)

- SWOT Analysis of Key Players

- Pricing analysis of major players

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Motorola Solutions

Honeywell

Thales Group

Bae Systems

General Dynamics

Northrop Grumman

BAE Systems

Sierra Nevada Corporation

Rockwell Collins

L3 Technologies

Raytheon Technologies

Vuzix

- Increasing adoption by armed forces for tactical advantage

- Rising demand for wearables for mental health monitoring

- Integration with legacy military equipment

- Focus on ergonomics and user comfort

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035