Market Overview

The Israel Mine Warfare market is expected to see significant growth, driven by advancements in military technology and the increasing need for enhanced mine-clearing capabilities in various conflict zones. Based on a recent historical assessment, the market size is valued at approximately USD ~ billion, with continued investment from both government and defense contractors. This growth is fueled by the integration of autonomous systems, precision technologies, and state-of-the-art detection equipment. The military’s priority to neutralize landmines, unexploded ordnance, and other remnants of war remains a crucial driver for this market.

In Israel, the demand for mine warfare solutions is concentrated in areas with historical and ongoing military conflicts, such as the border regions with Lebanon and Palestine. The country has invested heavily in advanced technologies, including robotic mine-clearance vehicles and unmanned systems, to ensure efficient and safe operations. The proximity to volatile regions and the strategic need for mine clearance in areas of military engagement has positioned Israel as a leader in this market. The dominance of this region can be attributed to the government’s commitment to defense spending and the necessity of cutting-edge mine-clearing technologies.

Market Segmentation

By System Type

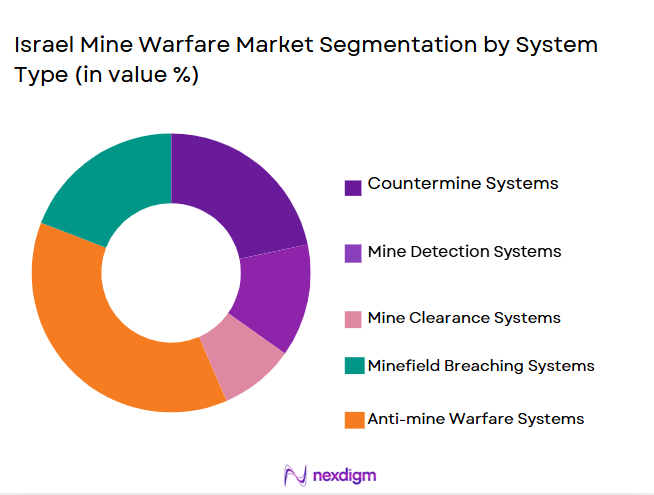

Israel Mine Warfare market is segmented by product type into countermine systems, mine detection systems, mine clearance systems, minefield breaching systems, and anti-mine warfare systems. Recently, mine detection systems have held a dominant market share due to the increasing demand for precise, efficient, and non-invasive detection technologies. The growth of these systems is largely driven by the adoption of advanced sensing technologies, such as ground-penetrating radar (GPR) and metal detectors, which significantly enhance the accuracy and speed of mine detection. Additionally, the focus on automation and integration with autonomous platforms has boosted the demand for mine detection systems, especially in conflict zones.

By Platform Type

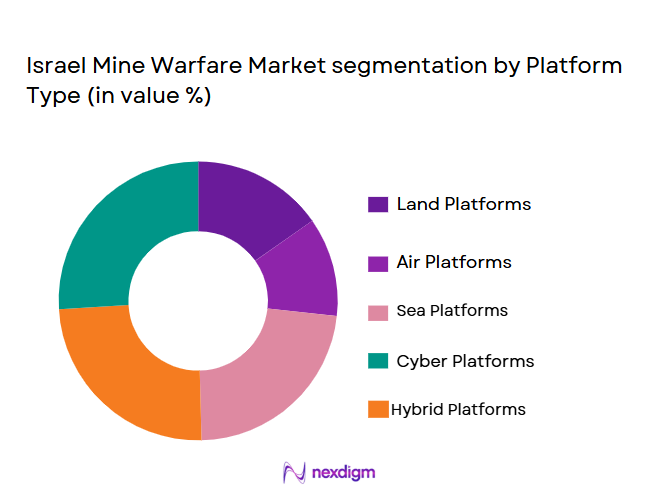

Israel Mine Warfare market is also segmented by platform type into land-based platforms, naval platforms, aerial platforms, autonomous platforms, and remote-controlled platforms. Recently, autonomous platforms have dominated the market share due to their advanced capabilities in detecting and clearing mines without putting human personnel in harm’s way. The growing interest in unmanned systems for military applications, along with the enhanced mobility and precision provided by these platforms, has made them a preferred choice for many defense contractors and government agencies. The integration of artificial intelligence (AI) and machine learning for autonomous decision-making further strengthens the appeal of these platforms.

Competitive Landscape

The Israel Mine Warfare market is highly competitive, with several large and medium players dominating the landscape. Major defense contractors continue to invest in research and development (R&D) to advance technologies for mine detection, clearance, and prevention. This competitive environment has led to consolidations and strategic partnerships aimed at enhancing technological offerings and expanding global reach. Players are also focusing on the integration of AI, robotics, and unmanned systems to gain a competitive edge.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Innovation Focus |

| Rafael Advanced Defense | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat Hasharon | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

Israel mine warfare Market Analysis

Growth Drivers

Increasing Military Spending

Increasing military spending in Israel has been one of the primary drivers of the mine warfare market. Israel’s defense budget has steadily risen in recent years, driven by national security concerns and the need to modernize defense systems. This includes a significant investment in technology, particularly in the fields of mine detection and clearance systems. With conflicts and tensions in surrounding regions, the Israeli military has prioritized upgrading its mine warfare capabilities. In addition to traditional threats, Israel faces the growing challenge of asymmetric warfare, where mines and explosive devices are frequently used by adversaries. The country’s focus on maintaining its military superiority has resulted in substantial investments in defense technologies, including mine-clearing robots, unmanned aerial vehicles (UAVs), and advanced detection systems, further boosting the mine warfare market.

Technological Advancements in Autonomous Systems

Another key driver of the Israel Mine Warfare market is the growing demand for autonomous systems. As military operations become more complex, the need for automated solutions that can operate efficiently in hazardous environments, like minefields, has increased. Autonomous systems offer the dual benefit of minimizing human risk while improving operational efficiency. Israel has been at the forefront of developing such systems, integrating AI and machine learning to enhance the decision-making process in mine detection and clearance. These systems are increasingly being deployed in military operations across various conflict zones, driving the market growth as governments and defense contractors look to adopt these advanced solutions. The innovation and efficiency provided by autonomous systems are making them a preferred choice for military forces.

Market Challenges

High Cost of Advanced Systems

The high cost associated with the development and deployment of advanced mine warfare technologies is one of the primary challenges facing the market. The integration of cutting-edge technologies such as autonomous systems, AI, and precision mine detection equipment significantly increases the cost of these solutions. For many defense contractors and governments, these high upfront costs can be a significant barrier to widespread adoption. Additionally, maintenance, training, and logistical support costs further add to the financial burden. As the market for mine warfare solutions continues to evolve, finding cost-effective solutions without compromising on performance remains a key challenge. Governments, particularly in smaller or developing nations, may face difficulties in securing the necessary funding for such advanced systems, limiting market expansion.

Regulatory and Certification Barriers

Regulatory and certification barriers present another challenge for the Israel Mine Warfare market. The military defense sector is highly regulated, with strict standards governing the design, manufacture, and deployment of mine warfare technologies. Ensuring compliance with these regulations, as well as acquiring the necessary certifications, can be a lengthy and complex process. This not only delays product deployment but also increases costs for manufacturers. Moreover, different countries have varying regulations, which can make it difficult for companies to offer solutions in international markets. Navigating the complex regulatory landscape is essential for companies seeking to expand their reach and operate in global markets.

Opportunities

Global Demand for Demining Operations

A significant opportunity for the Israel Mine Warfare market lies in the increasing global demand for demining operations. Many regions, particularly in Africa and the Middle East, still face significant challenges related to landmines and unexploded ordnance. International organizations, as well as national governments, are investing heavily in demining operations to clear affected areas and ensure the safety of civilians. Israel’s expertise in mine clearance and its technological advancements make it well-positioned to provide solutions for these global challenges. Expanding partnerships with international organizations and offering advanced mine warfare solutions can drive market growth, especially as humanitarian aid organizations prioritize safe, mine-free zones for resettlement and development.

Integration of Robotics and AI in Mine Warfare

Another opportunity for growth in the Israel Mine Warfare market lies in the integration of robotics and AI. As the demand for autonomous systems grows, there is an increasing opportunity for companies to develop and market robotic mine-clearing vehicles, drones, and other unmanned systems. These technologies offer enhanced precision, safety, and efficiency in mine detection and clearance operations, reducing human risk and operational costs. Furthermore, the use of AI in these systems allows for the creation of intelligent, self-learning platforms capable of adapting to complex and changing minefield environments. As defense contractors continue to invest in these technologies, the market for AI-driven mine warfare solutions is expected to expand rapidly.

Future Outlook

The Israel Mine Warfare market is expected to continue evolving with advancements in technology and increasing demand for efficient, automated mine detection and clearance solutions. The integration of AI, robotics, and autonomous platforms will drive growth, with technological developments making mine clearance faster, safer, and more cost-effective. Governments, particularly in conflict-prone regions, will continue to prioritize investments in mine warfare technologies to ensure the safety of their military personnel and civilians. Regulatory support, along with increased international collaborations, will create further opportunities for market expansion.

Major Players

- Rafael Advanced Defense Systems

- Elbit Systems

- IMI Systems

- Lockheed Martin

- General Dynamics

- Northrop Grumman

- BAE Systems

- Thales Group

- Leonardo

- L3 Harris Technologies

- Kongsberg Gruppen

- Rheinmetall

- Saab

- IAI

- Raytheon Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Non-governmental organizations (NGOs)

- International defense organizations

- Aerospace and defense sector suppliers

- Security agencies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key market drivers, constraints, trends, and technological innovations that impact the Israel Mine Warfare market.

Step 2: Market Analysis and Construction

In this phase, detailed data is collected to segment the market based on factors such as product type, platform type, and geographical region.

Step 3: Hypothesis Validation and Expert Consultation

The collected data is validated through consultations with industry experts and stakeholders to ensure accuracy and consistency in the market predictions.

Step 4: Research Synthesis and Final Output

The final market analysis report is synthesized, providing a comprehensive overview of the Israel Mine Warfare market with accurate forecasts and actionable insights.

- Executive Summary

- Israel Mine Warfare Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing military spending in Israel

Ongoing territorial conflicts necessitating advanced mine warfare solutions

Technological advancements in autonomous mine detection and clearance systems - Market Challenges

High cost of advanced mine warfare technologies

Limited availability of specialized personnel for mine clearance

Complex regulatory and certification processes - Market Opportunities

Emerging demand for autonomous mine-clearing robots

Collaborations with international defense organizations

Growth in global demand for demining operations in conflict zones - Trends

Integration of artificial intelligence in mine detection systems

Development of hybrid platforms combining multiple warfare capabilities

Focus on enhancing safety standards for demining operations

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Countermine Systems

Mine Detection Systems

Mine Clearance Systems

Minefield Breaching Systems

Anti-mine Warfare Systems - By Platform Type (In Value%)

Land-Based Platforms

Naval Platforms

Aerial Platforms

Autonomous Platforms

Remote-Controlled Platforms - By Fitment Type (In Value%)

Integrated Systems

Modular Systems

Standalone Systems

Retrofit Systems

Original Equipment Systems - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Sector

International Organizations - By Procurement Channel (In Value%)

Direct Procurement

Tender-Based Procurement

Contract-Based Procurement

Government Agencies Procurement

Commercial Procurement

- Market Share Analysis

- Cross Comparison Parameters

(System Complexity, Platform Compatibility, Cost Efficiency, Technology Integration, Procurement Model) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rafael Advanced Defense Systems

Elbit Systems

IMI Systems

IAI

Lockheed Martin

Thales

General Dynamics

Northrop Grumman

BAE Systems

Raytheon Technologies

Leonardo

Kongsberg Gruppen

Saab

L3 Harris Technologies

Rheinmetall

- Government defense agencies driving demand for mine-clearing systems

- Private sector developing innovative mine clearance technologies

- International organizations seeking demining solutions for humanitarian efforts

- Military forces investing in advanced mine detection and clearance systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035