Market Overview

The Israel missile propulsion system market is driven by increasing defense budgets globally USD ~, technological advancements in propulsion systems, and rising geopolitical tensions. Based on a recent historical assessment, the market is expected to reach a significant size, with investments directed toward missile systems development, particularly in propulsion technologies. The growing demand for enhanced missile accuracy and long-range capabilities, as well as defense modernization efforts, significantly contributes to the market’s expansion. The global demand for more sophisticated propulsion systems further accelerates innovation, with a notable focus on solid, liquid, and hybrid propulsion methods.

Israel remains a dominant player in the missile propulsion system market due to its advanced defense capabilities and substantial investment in military technology. The country’s strategic position in the Middle East, coupled with its strong defense industry and collaboration with international defense contractors, bolsters its leadership. Israel’s defense initiatives, particularly in missile development, have made it a leader in missile propulsion technologies. This dominance is fueled by its high-tech infrastructure, skilled workforce, and significant government funding dedicated to defense advancements, positioning the country as a key market player in the region.

Market Segmentation

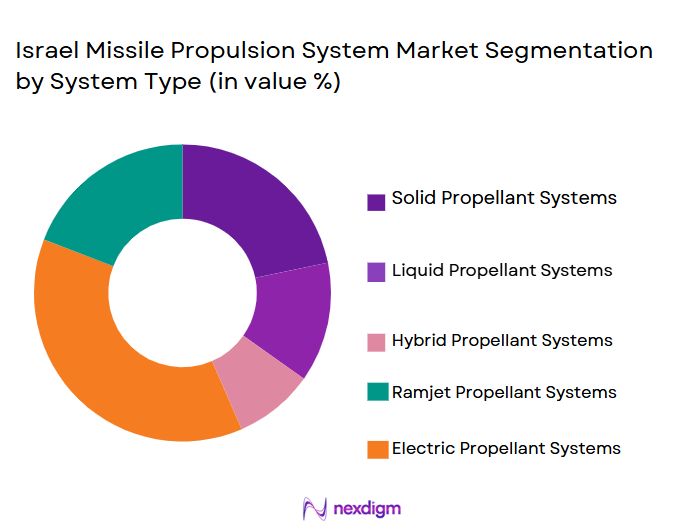

By System Type

Israel missile propulsion system market is segmented by product type into solid propellant systems, liquid propellant systems, hybrid propellant systems, ramjet propulsion systems, and electric propulsion systems. Recently, solid propellant systems have a dominant market share due to their long-standing use in military missile applications, offering high efficiency, reliability, and better handling capabilities. These systems are widely used in ballistic missiles, space exploration systems, and defense applications, contributing to their popularity. Additionally, technological advancements in solid propellant design and manufacturing processes have further solidified its dominance. With a proven track record in military and aerospace sectors, solid propellant systems continue to cater to defense needs and remain the preferred option for various propulsion system applications.

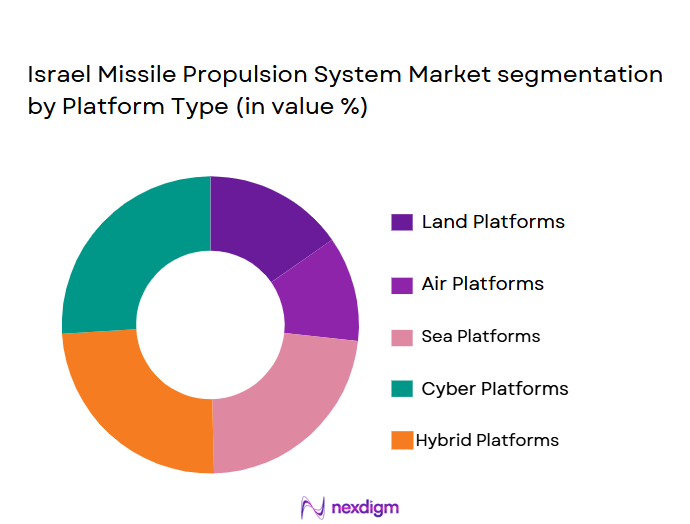

By Platform Type

Israel missile propulsion system market is segmented by platform type into land-based platforms, air-based platforms, sea-based platforms, submarine-launched systems, and space-based platforms. Air-based platforms have a dominant market share due to the extensive use of missile propulsion systems in fighter jets and other aerial military applications. Israel’s advanced air defense systems and air superiority technologies, such as the Iron Dome, boost the demand for air-based missile systems. The growing need for high-speed and long-range missiles for air-to-air and air-to-ground operations, along with continuous advancements in missile guidance and propulsion, supports the increased adoption of air-based platforms for missile propulsion systems.

Competitive Landscape

The competitive landscape of the Israel missile propulsion system market is shaped by several global and regional players. Consolidation in the industry has been driven by partnerships between defense contractors and governments. Major players dominate the market, leveraging advanced propulsion technologies and manufacturing capabilities. Israel’s military and defense sector is highly consolidated, with a few key players influencing the market, offering innovation and high-performance solutions. Technological advancements and collaborations further strengthen these players’ positions in the market, with increasing demand for more advanced missile propulsion systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Propulsion Type Focus |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

Israel missile propulsion system Market Analysis

Growth Drivers

Increasing Defense Budgets

The growing geopolitical tensions across the globe, particularly in the Middle East, have led to an increase in defense budgets. Israel, as a key player in the region, has continually bolstered its military expenditures, especially in missile defense technologies. This investment has led to the development of cutting-edge propulsion systems capable of supporting more advanced missile technologies, including high-speed and precision-guided missiles. The market’s growth is driven by the need for these advanced systems, further supported by Israel’s focus on technological innovation in missile defense systems. The rise in defense spending has directly fueled the demand for missile propulsion systems as governments seek to strengthen their military capabilities, ensuring they are prepared for both conventional and unconventional warfare. Along with national security needs, international defense partnerships have bolstered the demand for advanced missile propulsion systems. This trend of defense spending is expected to continue, with increased investments in missile technologies shaping the market’s future.

Technological Advancements in Missile Propulsion Systems

The continuous evolution of missile propulsion systems has been a key growth driver in Israel. Innovations in solid and hybrid propellant technologies, along with the integration of high-efficiency materials, have led to better performance and reduced operational costs. Israel’s missile development programs are a testament to the country’s commitment to remaining at the forefront of missile defense technologies. As new materials and technologies emerge, propulsion systems become more efficient, leading to longer-range capabilities and higher accuracy. These advancements have made missile propulsion systems more cost-effective, which in turn drives adoption in both military and aerospace sectors. With ongoing advancements, including electric propulsion and sustainable fuels, Israel continues to enhance its missile capabilities, ensuring the nation remains a global leader in defense systems and missile propulsion technologies.

Market Challenges

High Development and Maintenance Costs

The high cost of developing and maintaining advanced missile propulsion systems poses a significant challenge for market growth. These systems require considerable investments in research and development, coupled with the need for continuous upgrades to stay competitive. Israel, as a leader in missile defense, faces challenges in ensuring that its missile propulsion systems remain at the cutting edge while balancing budget constraints. The advanced technologies involved, including solid and hybrid propellants, demand substantial capital investment from both public and private sectors. Additionally, the maintenance costs for these systems, including high-performance materials and specialized manufacturing techniques, can be significant, adding another layer of complexity to the market. Despite technological advancements that aim to reduce costs, these systems still represent a significant financial burden, limiting the potential for broader market adoption.

Regulatory and Certification Barriers

Regulatory frameworks governing the production, testing, and deployment of missile propulsion systems are stringent, creating barriers for companies looking to enter the market. Certification requirements for new missile systems often involve extensive testing, approvals, and compliance with international arms control agreements. These regulatory hurdles can delay the development and deployment of new technologies, preventing companies from quickly capitalizing on innovations in missile propulsion systems. Furthermore, Israel’s strict defense regulations, while ensuring security and compliance with international norms, add complexity to the procurement process. Companies must navigate a complex landscape of national and international laws to bring their propulsion systems to market, which can hinder innovation and growth in the sector.

Opportunities

Integration of AI and Automation in Propulsion Systems

One of the most promising opportunities for the missile propulsion system market is the integration of artificial intelligence (AI) and automation into missile systems. AI offers the potential to improve missile accuracy, efficiency, and propulsion system performance. Through machine learning algorithms, AI can optimize propulsion systems for speed, range, and power, enhancing overall missile capabilities. This shift toward automation not only increases system efficiency but also lowers operational costs, making it a compelling opportunity for defense contractors and government agencies. Israel, with its leading role in AI and defense technologies, stands to benefit significantly from this opportunity, with the integration of AI in missile propulsion systems expected to drive growth and innovation in the market.

Expansion of International Defense Collaborations

Israel’s position as a global leader in missile defense systems positions it well for further international collaborations. Countries seeking to enhance their defense capabilities are increasingly turning to Israel for advanced missile propulsion solutions. Through international partnerships, Israel can expand its reach, offering its expertise and technology to global defense agencies. These collaborations can take the form of joint development projects, technology transfers, or defense sales agreements, providing Israel with access to new markets and growing the demand for its missile propulsion systems. As countries around the world invest in advanced missile technologies, these partnerships will be crucial for continued market growth.

Future Outlook

The Israel missile propulsion system market is expected to experience sustained growth in the next five years, driven by advancements in technology, strategic defense initiatives, and increased defense spending. As defense needs evolve, demand for more efficient, long-range, and high-speed propulsion systems will continue to rise. Israel’s strong position in the missile defense sector, bolstered by continued government investments and global defense partnerships, ensures that the market will remain robust. The focus on sustainable, cost-effective propulsion systems, along with innovations in AI and automation, will play a key role in shaping the future of the missile propulsion market.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Lockheed Martin

- Northrop Grumman

- Thales Group

- MBDA

- BAE Systems

- L3Harris Technologies

- Raytheon Technologies

- Honeywell Aerospace

- General Dynamics

- Textron Systems

- Saab

- Leonardo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace agencies

- National defense ministries

- Private defense firms

- Military procurement offices

- Research and development units

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables such as propulsion system types, technological advancements, and regulatory factors.

Step 2: Market Analysis and Construction

Next, the market is analyzed by studying historical trends, industry reports, and available market data to construct a clear market framework.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through consultations with industry experts, engineers, and defense contractors to ensure the accuracy of findings.

Step 4: Research Synthesis and Final Output

Finally, the research data is synthesized, and a comprehensive report is generated, covering all aspects of the market, including future trends and projections.

- Executive Summary

- Israel Missile Propulsion System Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets globally

Advancements in missile technology and propulsion

Rising geopolitical tensions and defense needs - Market Challenges

High development and maintenance costs

Technological complexity of advanced propulsion systems

Regulatory and certification hurdles - Market Opportunities

Growth in demand for precision-guided missiles

Partnerships with international defense contractors

Technological advancements in hybrid and electric propulsion systems - Trends

Shift towards environmentally friendly propulsion technologies

Integration of AI and machine learning in propulsion systems

Adoption of lightweight and more efficient materials

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Solid Propellant Systems

Liquid Propellant Systems

Hybrid Propellant Systems

Ramjet Propulsion Systems

Electric Propulsion Systems - By Platform Type (In Value%)

Land-Based Platforms

Air-Based Platforms

Sea-Based Platforms

Submarine-Launched Systems

Space-Based Platforms - By Fitment Type (In Value%)

Military Missile Systems

Space Exploration Systems

Research and Development Platforms

Test and Training Systems

Commercial Space Systems - By EndUser Segment (In Value%)

Defense Forces

Aerospace Agencies

Defense Contractors

Government and Regulatory Bodies

Private Aerospace Companies - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Contractors

Private Sector Procurement

International Defense Deals

Government Bids and Tenders

- Market Share Analysis

- Cross Comparison Parameters

(Technology Innovation, Cost Efficiency, Operational Reliability, Strategic Alliances, Market Presence) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rafael Advanced Defense Systems

Israel Aerospace Industries (IAI)

Elbit Systems

IAI MLM Division

Raytheon Technologies

Lockheed Martin

Northrop Grumman

Thales Group

MBDA

General Dynamics

BAE Systems

L3Harris Technologies

Honeywell Aerospace

Honeywell International

Rockwell Collins

- Government defense agencies requiring advanced systems

- Private sector companies developing aerospace technologies

- International defense bodies collaborating on missile defense systems

- Aerospace firms expanding into propulsion system integration

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035