Market Overview

The market for Israel’s missile and missile defense systems is substantial, with a growing demand driven by the increasing regional security threats and Israel’s strategic positioning in the Middle East. Based on a recent historical assessment, the market size in USD ~ for 2024 is expected to reach billions, supported by Israel’s consistent military innovation, robust defense strategies, and continued investments in cutting-edge technologies. The country’s military expenditure remains among the highest globally, positioning it as a major player in the global defense market. The development of advanced missile systems, such as Iron Dome and David’s Sling, continues to drive the market forward, while the country maintains a leading role in missile defense technology.

Israel has long been at the forefront of missile defense technologies, supported by its strong military and defense industry. The country’s dominance is reinforced by its active defense strategies, technological innovation, and strategic collaborations with international defense contractors. Cities like Tel Aviv and Haifa play critical roles in the development and integration of missile defense systems, benefiting from Israel’s substantial investments in the defense sector. This technological advantage, paired with a robust defense network, ensures that Israel maintains a strong presence in the missile defense market globally.

Market Segmentation

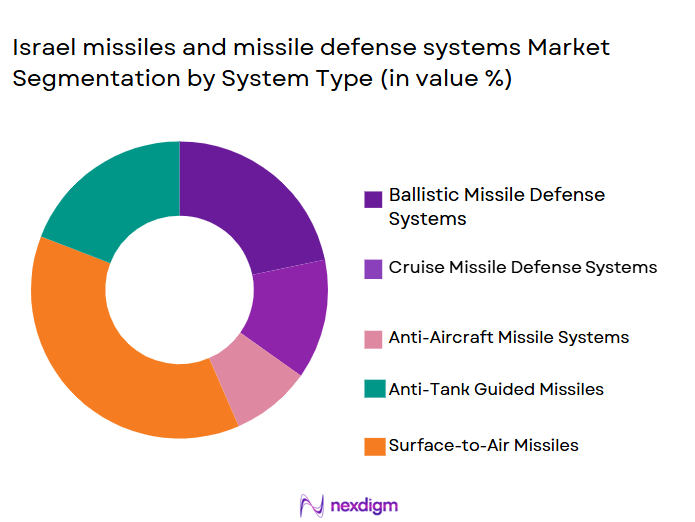

By System Type

Israel missile defense market is segmented by product type into ballistic missile defense systems, cruise missile defense systems, anti-aircraft missile systems, anti-tank guided missiles, and surface-to-air missiles. Recently, ballistic missile defense systems have dominated the market share due to their advanced interception capabilities, particularly with systems like the Iron Dome. These systems have a proven track record in defending against short-range threats, which significantly boosts their demand. Israel’s expertise in designing and deploying these systems, combined with its regional security needs, positions ballistic missile defense as the leading product segment in the market.

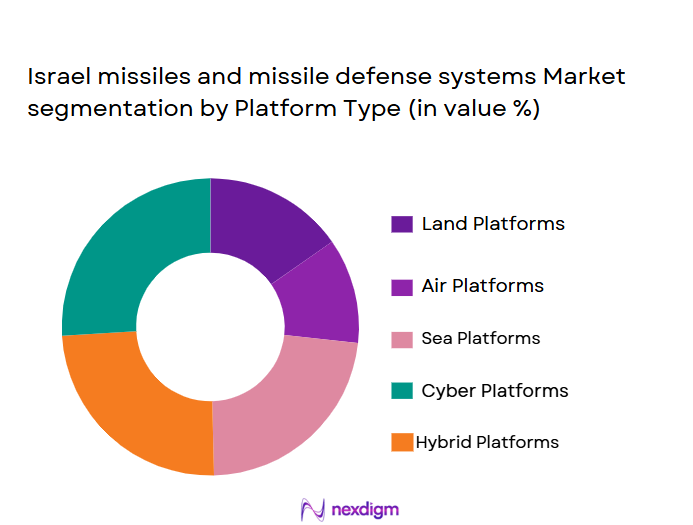

By Platform Type

The Israel missile defense market is segmented by platform type into land-based systems, sea-based systems, airborne systems, space-based systems, and integrated ground systems. The land-based systems have the dominant market share, primarily driven by the extensive deployment of systems like Iron Dome on the ground for short-range missile defense. Their adaptability, cost-effectiveness, and proven success in various defense scenarios make them the preferred option for most defense forces globally. These systems play a crucial role in Israel’s defense infrastructure, contributing to their significant market share in missile defense systems.

Competitive Landscape

The competitive landscape of the Israel missile defense market is dominated by several key players, including both domestic and international firms. These players are involved in constant technological innovations and strategic collaborations to maintain or grow their market share. The market exhibits some level of consolidation, with major players holding significant shares in the development and production of missile defense systems. Israel’s missile defense capabilities are widely respected, and the industry’s competitive nature ensures continuous advancements in missile interception technologies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (2024) | Defense Collaboration |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

Israel missiles and missile defense systems Market Analysis

Growth Drivers

Increasing Regional Security Threats

Increasing geopolitical tensions in the Middle East and surrounding regions are driving demand for missile defense systems. Israel, as a country at the forefront of these threats, prioritizes defense technologies, particularly missile defense systems, to protect its borders and allies. With ongoing threats from regional adversaries, the need for advanced missile defense technologies like Iron Dome and Arrow is crucial. The continued escalation of threats, coupled with the advancements in missile technology, creates a sustained demand for robust defense systems. Israel’s defense expenditure supports further innovations and research, ensuring that these systems remain state-of-the-art in countering evolving missile threats. The growing focus on securing critical infrastructures, military assets, and civilian populations further fuels the demand for missile defense solutions. This persistent focus on security and defense underlines the increasing growth of the market for missile defense systems.

Technological Advancements in Missile Defense

Technological innovation plays a significant role in driving growth in the Israel missile defense market. Israel has led the development of systems such as the Iron Dome and the David’s Sling, which have proven highly effective against short-range and medium-range threats. With advancements in radar technology, interception mechanisms, and battle management systems, missile defense systems have become more efficient and precise. The ongoing research and development into hypersonic missile defense, automated interception, and integration with broader defense infrastructures provide a continuous stream of growth. Technological advancements not only enhance the effectiveness of these systems but also expand their application, ensuring long-term market demand. Furthermore, Israel’s collaborations with international defense contractors help push the boundaries of missile defense technologies, creating a more competitive market.

Market Challenges

High Cost of Advanced Missile Defense Systems

The primary challenge facing the Israel missile defense market is the high cost associated with developing and deploying advanced systems. The development of cutting-edge technologies, such as missile interception mechanisms, radar systems, and integrated defense platforms, requires substantial investment in research and development. Additionally, the cost of maintaining and upgrading these systems to keep pace with evolving threats adds to the financial burden. For many countries, the high costs associated with acquiring and deploying these defense systems can limit their access to such technologies, restricting market expansion. While Israel’s government prioritizes defense spending, the high cost of these systems poses a significant challenge to the broader market, especially for countries with limited defense budgets.

Regulatory Compliance and Export Restrictions

Regulatory barriers and export restrictions are major challenges in the global missile defense market. While Israel has developed some of the most advanced missile defense systems in the world, the export of these technologies is highly regulated. International arms control agreements and political tensions may limit the export opportunities for Israel’s missile defense solutions, despite high global demand. The restrictions placed on the transfer of sensitive defense technologies, particularly missile defense systems, hinder market growth in certain regions. Moreover, the political dynamics surrounding defense contracts, including the reliance on strategic alliances and agreements, can delay or prevent the adoption of Israeli systems in specific markets.

Opportunities

Technological Integration with Artificial Intelligence

The integration of artificial intelligence (AI) into missile defense systems presents a significant opportunity for growth. AI-powered systems offer enhanced decision-making capabilities, faster reaction times, and improved targeting accuracy, making them highly valuable in modern defense scenarios. The ability to integrate AI into existing missile defense technologies, such as the Iron Dome or Arrow systems, allows for smarter, automated systems capable of defending against complex, multi-layered threats. As AI continues to advance, the demand for its integration into missile defense systems will increase, providing a new avenue for market expansion and innovation. Israel’s focus on technology integration ensures that it remains a leader in the missile defense industry, paving the way for further opportunities.

Expansion in Emerging Markets

As emerging markets seek to strengthen their defense capabilities, there is a growing opportunity for Israeli missile defense systems. Countries in regions like Asia, Africa, and Latin America are increasingly focused on upgrading their defense infrastructures to counter rising security threats. Israel’s missile defense technologies, such as Iron Dome and David’s Sling, are seen as effective solutions to counter short-range and medium-range missile threats. The increasing military budgets of emerging economies, combined with the demand for advanced defense technologies, present a lucrative opportunity for Israeli defense companies. Strategic partnerships and government contracts in these regions could lead to significant market growth for Israel’s missile defense systems.

Future Outlook

Over the next five years, the Israel missile defense market is expected to experience robust growth, driven by continued geopolitical instability and technological advancements. Demand for advanced missile defense systems will remain strong, supported by growing regional threats and Israel’s commitment to defense innovation. The integration of cutting-edge technologies, such as AI and hypersonic defense systems, will further enhance the capabilities of existing platforms. Additionally, regulatory support and expanding defense budgets in emerging markets will create new opportunities for Israeli missile defense technologies, ensuring sustained market growth. The market’s future is marked by ongoing technological evolution and a global demand for secure, effective defense solutions.

Major Players

• Rafael Advanced Defense Systems

• Israel Aerospace Industries

• Lockheed Martin

• Raytheon Technologies

• Boeing

• Northrop Grumman

• Thales Group

• General Dynamics

• L3Harris Technologies

• BAE Systems

• Saab Group

• Leonardo

• Honeywell Aerospace

• Harris Corporations

Key Target Audience

• Government and regulatory bodies

• Ministry of Defense (Israel)

• Israeli Defense Forces

• Ministry of Interior (Israel)

• National Security Agencies

• International military buyers

• Private defense contractors

Research Methodology

Step 1: Identification of Key Variables

Key variables affecting the missile defense market, such as technological advancements, geopolitical factors, and military expenditure, are identified and defined to form the basis for research.

Step 2: Market Analysis and Construction

In-depth analysis of market trends, drivers, challenges, and opportunities is conducted, with a focus on historical data and emerging patterns in the global defense market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations, including interviews with industry leaders and defense contractors, to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

The collected data is synthesized into a comprehensive market report, offering clear insights and projections for the Israel missile defense systems market.

- Executive Summary

- Israel missiles and missile defense systems Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in regional security threats

Advancements in missile defense technology

Escalating defense budgets in the Middle East - Market Challenges

High cost of advanced missile defense systems

Export restrictions and compliance challenges

Technological integration issues with legacy systems - Market Opportunities

Rising demand for advanced defense systems in emerging markets

Technological innovations in missile interception and countermeasures

Increased government investments in defense modernization programs - Trends

Integration of Artificial Intelligence in missile defense

Growing focus on hypersonic missile defense technologies

Collaboration between Israel and global defense contractors for system upgrades

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ballistic Missile Defense Systems

Cruise Missile Defense Systems

Anti-Aircraft Missile Systems

Anti-Tank Guided Missiles

Surface-to-Air Missiles - By Platform Type (In Value%)

Land-based Systems

Sea-based Systems

Airborne Systems

Space-based Systems

Integrated Ground Systems - By Fitment Type (In Value%)

Retrofit Systems

New System Installations

Custom Fit Systems

Modular Fit Systems

Mobile Fit Systems - By EndUser Segment (In Value%)

Israeli Defense Forces

Foreign Military Customers

National Security Agencies

Private Military Contractors

Government and Regulatory Bodies - By Procurement Channel (In Value%)

Direct Government Procurement

Third-party Procurement Agencies

Private Sector Procurement

International Partnerships

Joint Ventures with Defense Manufacturers

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, System Cost, Technological Edge, Product Innovation, Geographic Reach) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries (IAI)

Lockheed Martin

Raytheon Technologies

Boeing

Northrop Grumman

Thales Group

General Dynamics

L3Harris Technologies

BAE Systems

Saab Group

Leonardo

ThyssenKrupp

Harris Corporation

- Governments seeking missile defense capabilities

- Private defense contractors integrating missile defense into systems

- Regional allies procuring defense systems for strategic deterrence

- International collaborations for technology exchange and system upgrades

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035