Market Overview

The Israel Mortar Ammunition Market is experiencing substantial growth, primarily driven by the continuous defense modernization programs and military expansion in Israel. As of recent reports, the market size stands at USD ~, bolstered by increasing demand for high-tech mortar systems for both military and defense applications. Growth is largely influenced by technological advancements in ammunition and military spending, coupled with Israel’s strategic investments in defense innovation and security. Furthermore, geopolitical tensions in the region have fueled demand for more advanced weaponry systems, ensuring the continuous expansion of the market.

Israel holds the dominant position in the global mortar ammunition market, largely due to its strong defense industry and technological advancements. Major cities like Tel Aviv and Haifa are central hubs for the defense sector, with local companies such as Elbit Systems and Rafael Advanced Defense Systems playing key roles. Israel’s strategic location in the Middle East further amplifies its dominance, as the country is one of the largest defense exporters globally. Additionally, the country’s close defense relationships with nations like the United States and India contribute to its leading market position, especially in military-grade ammunition production and innovation.

Market Segmentation

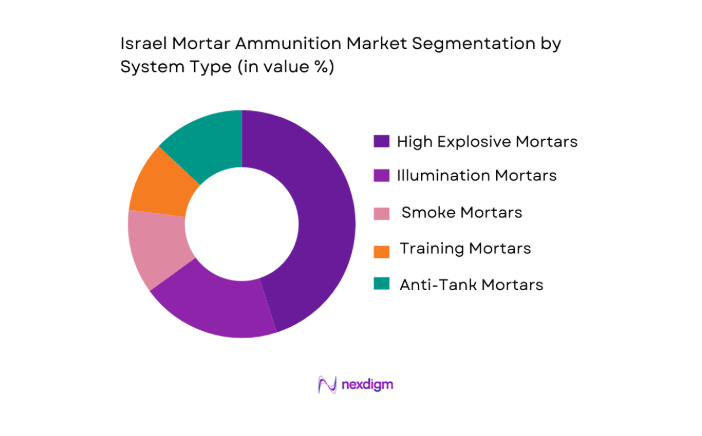

By System Type

The Israel Mortar Ammunition Market is segmented into various system types including high explosive mortars, illumination mortars, smoke mortars, training mortars, and anti-tank mortars. Among these, high explosive mortars currently dominate the market due to their widespread application in combat situations. These mortars are crucial for both offensive and defensive operations, making them the go-to choice for military forces. Their ability to deliver devastating firepower in various combat scenarios has ensured their leading position. Major defense contractors in Israel, such as IMI Systems and Soltam Systems, continue to innovate in this category, strengthening its market share.

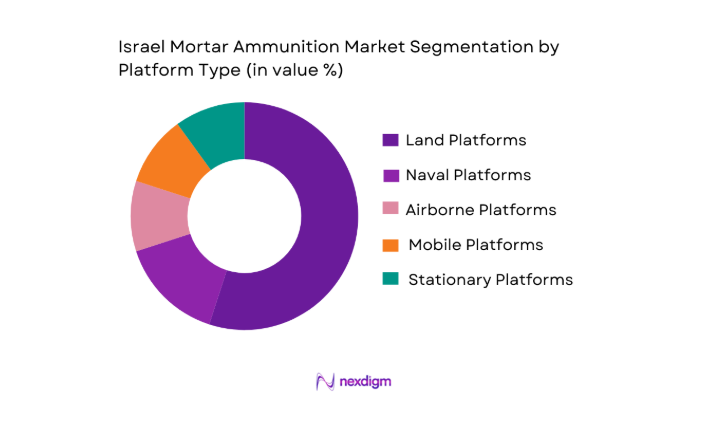

By Platform Type

The platform type segmentation in the Israel Mortar Ammunition Market includes land, naval, airborne, mobile, and stationary platforms. Land platforms dominate this segment as they form the backbone of Israel’s ground-based defense strategy. Mortar systems used in land-based platforms are integral to both offensive and defensive operations in military ground forces. The continued enhancement of these systems with precision-guided capabilities further drives their dominance. Additionally, Israel’s well-established military infrastructure supports the widespread deployment of mortars across land-based platforms, ensuring their leading market share.

Competitive Landscape

The Israel Mortar Ammunition Market is dominated by several key players, including both local manufacturers and global defense companies. Companies such as Elbit Systems and Rafael Advanced Defense Systems continue to innovate and maintain dominance in the market due to their extensive experience in designing advanced ammunition systems. The consolidation of local and international brands in Israel’s defense sector ensures a competitive landscape driven by both technological innovation and the increasing demand for military-grade ammunition systems.

| Company Name | Establishment Year | Headquarters | Market Segment Focus | Innovation Focus | Global Reach | Product Range |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat Hasharon, Israel | ~ | ~ | ~ | ~ |

| Soltam Systems | 1950 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

Israel Mortar Ammunition Market Dynamics

Growth Drivers

Increasing Military Expenditure in Israel

Israel has consistently increased its defense budget to ensure the readiness of its armed forces and maintain military superiority in the region. According to the World Bank, Israel’s defense expenditure was approximately USD ~ in 2022. This reflects the country’s continued prioritization of its security needs due to geopolitical tensions in the Middle East, particularly with neighboring nations. The government’s sustained focus on defense spending ensures the growth of the defense sector, including mortar ammunition, as Israel continues to invest heavily in advanced military technology. This expenditure supports a wide range of defense systems, including mortars, ensuring an ongoing demand for advanced ammunition systems.

Rising Demand for Advanced Mortar Systems

The demand for advanced mortar systems in Israel has surged due to the evolving military strategies and the increasing need for precision-guided weaponry. In recent years, Israel’s military has focused on enhancing its capabilities, particularly for close combat situations and urban warfare. The IDF (Israel Defense Forces) has increasingly adopted advanced mortar systems, driven by technological advancements in targeting and accuracy. By 2024, the Israeli military has integrated state-of-the-art precision-guided mortar systems into its artillery units, supported by the nation’s investment in defense technology, which is set to expand as Israel focuses on modernizing its armed forces.

Market Challenges

High Production Costs

The production of advanced mortar systems in Israel is hindered by the high costs of research, development, and manufacturing. As Israel’s defense sector is highly reliant on cutting-edge technology, the production of precision-guided mortar systems requires significant investment in specialized components and materials. For example, components such as guidance systems, sensors, and automated targeting systems involve high production costs due to their complexity and reliance on high-grade materials. According to the International Monetary Fund (IMF), Israel’s defense expenditure per capita reached USD ~ in 2024, reflecting the increased costs associated with maintaining and upgrading its military technologies. These costs are expected to challenge manufacturers in providing cost-effective solutions while maintaining high standards of innovation.

Regulatory Constraints on Military Exports

Israel faces significant regulatory constraints when it comes to exporting military products, including mortar systems. The Israeli government maintains strict control over defense exports due to national security concerns and international diplomatic considerations. In 2024, Israel’s Ministry of Defense imposed several restrictions on the sale of advanced weapons systems to specific countries in the Middle East, especially due to international arms control agreements and regional tensions. These regulatory constraints impact the ability of Israeli defense companies to access new markets, limiting the potential growth of their mortar ammunition sales abroad. This limitation could slow down the expansion of Israeli-made mortars in international markets.

Market Opportunities

Emerging Military Markets in the Middle East

The Middle East remains a vital region for the expansion of the Israel Mortar Ammunition Market. Many countries in the region, including Saudi Arabia and the UAE, are significantly increasing their defense budgets due to rising security concerns and geopolitical instability. The Middle East’s defense spending exceeded USD ~ in 2024, according to the World Bank. As these nations focus on modernizing their military capabilities, including adopting advanced mortar systems, they represent a growing market for Israel’s mortar ammunition. With Israel’s advanced technology and close military ties with these nations, it is well-positioned to tap into this expanding market and increase its defense exports.

Upgrading Legacy Mortar Systems

Many countries in the Middle East and beyond are focusing on upgrading their legacy mortar systems to more advanced, precision-guided versions. This presents a significant opportunity for Israel’s mortar ammunition market, as Israel has been a leader in the development of modern mortar technologies. In 2024, the IDF (Israel Defense Forces) is undertaking a significant project to replace its older mortar systems with newer, more efficient models, including autonomous mortars with improved targeting systems. As these advanced systems continue to demonstrate their value, Israel is positioned to capitalize on the growing trend of upgrading older mortar systems in both regional and international markets.

Future Outlook

Over the next decade, the Israel Mortar Ammunition Market is expected to exhibit strong growth driven by continued technological advancements and the expansion of defense budgets in Israel. With a focus on enhancing the capabilities of existing mortar systems, including precision-guided and automated features, the market is likely to see a rise in demand for these systems. Furthermore, the evolving geopolitical landscape in the Middle East will continue to spur investments in defense technology, particularly in the domain of mortar ammunition.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- IMI Systems

- Soltam Systems

- Israel Aerospace Industries

- BAE Systems

- Northrop Grumman

- Lockheed Martin

- Thales Group

- General Dynamics Ordnance and Tactical Systems

- Raytheon Technologies

- Saab Group

- Leonardo DRS

- L3 Technologies

- Rheinmetall

Key Target Audience

- Government and Regulatory Bodies

- Defense Contractors

- Military & Defense Agencies

- Investments and Venture Capitalist Firms

- Private Security & Defense Companies

- International Buyers of Mortar Ammunition

- Defense Research & Development Institutions

- Armed Forces Procurement Divisions

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the critical variables influencing the Israel Mortar Ammunition Market. Through desk research and secondary sources, key factors such as government defense spending, technological advancements in mortars, and market penetration by global defense companies are assessed.

Step 2: Market Analysis and Construction

In this phase, historical data concerning the market’s growth, regional demand for mortar systems, and production statistics are analyzed. The analysis includes examining data on government defense contracts and procurement strategies in Israel and abroad.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are verified through expert consultations with defense industry professionals, including representatives from major Israeli manufacturers and military agencies. These interviews help validate market trends and data.

Step 4: Research Synthesis and Final Output

The final research phase integrates insights gathered from consultations and secondary data sources. The objective is to deliver a comprehensive and accurate analysis of market dynamics, ensuring that the final report reflects the true state of the Israel Mortar Ammunition Market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Military Expenditure in Israel

Rising Demand for Advanced Mortar Systems

Technological Advancements in Mortar Ammunition - Market Challenges

High Production Costs

Regulatory Constraints on Military Exports

Dependency on International Defense Relations - Market Opportunities

Emerging Military Markets in the Middle East

Upgrading Legacy Mortar Systems

Growth of Autonomous Mortar Platforms - Trends

Shift Toward Precision-Guided Mortars

Integration of Mortars with Networked Systems

Increasing Use of Mortars for Urban Warfare

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

High Explosive Mortars

Illumination Mortars

Smoke Mortars

Training Mortars - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Mobile Platforms - By Fitment Type (In Value%)

Portable Mortars

Vehicle-mounted Mortars

Towed Mortars

Self-Propelled Mortars - By End User Segment (In Value%)

Military & Defense

Paramilitary Forces

Border Security Agencies

Civil Protection Agencies

Research & Development Institutions - By Procurement Channel (In Value%)

Direct Procurement

Defense Contractors

Government Contracts

Third-Party Distributors

- Market Share Analysis

- Cross Comparison Parameters (Cost of Production, Export Potential, Technological Advancements, End-User Adoption, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Military Industries

Soltam Systems

Elson Industrial Solutions

IMI Systems

Israel Aerospace Industries

Tadiran Electronic Systems

General Dynamics Ordnance and Tactical Systems

BAE Systems

Northrop Grumman

Leonardo DRS

Lockheed Martin

Thales Group

Saab Group

Raytheon Technologies

- Military Forces Require High-Efficiency Ammunition

- Paramilitary Forces Adopting Mortars for Border Surveillance

- Research Institutes Innovating in Mortar Technology

- Civil Protection Agencies Leveraging Mortars for Disaster Relief

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035