Market Overview

The Israel Multi Launch Rocket Systems market has experienced significant growth, driven by Israel’s strategic defense needs and technological innovations. The market is primarily influenced by continuous investments in defense and security systems by the Israeli government, in addition to expanding defense collaborations with international partners. With defense budgets in Israel growing steadily, the market size has expanded significantly, reaching USD ~ in 2025. This is backed by the ongoing demand for advanced defense technologies, particularly in the military and security sectors. The market is driven by the increasing need for long-range weaponry and rapid response systems in the face of regional geopolitical tensions.

Israel remains the primary hub for the Multi Launch Rocket Systems market, as it is home to the leading manufacturers and technological innovators in defense systems. The dominance of Israel is attributed to its strong military infrastructure, high defense spending, and continuous research and development. The country’s central role in regional security, particularly in the Middle East, contributes to its market leadership. Additionally, strategic alliances with key defense stakeholders globally, including the U.S. and NATO allies, further solidify Israel’s position as a dominant player in this sector.

Market Segmentation

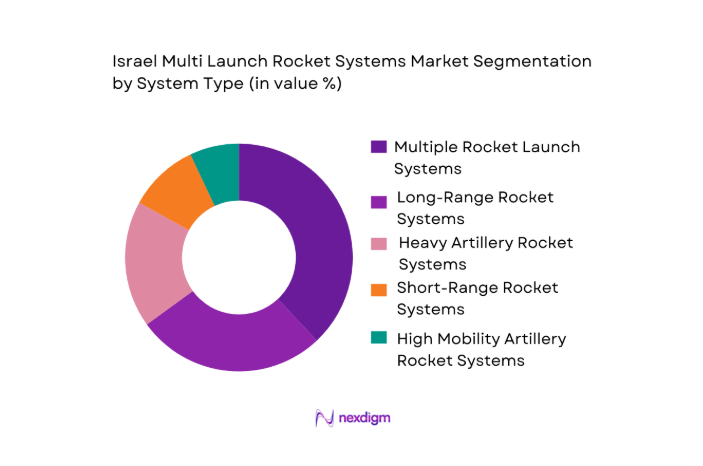

By System Type

The Israel Multi Launch Rocket Systems market is segmented by system type, which includes multiple rocket launch systems, long-range rocket systems, heavy artillery rocket systems, short-range rocket systems, and high mobility artillery rocket systems. Among these, the multiple rocket launch systems dominate the market due to their versatile deployment capabilities and operational efficiency. The high demand for these systems can be attributed to their flexibility in launching a large number of rockets in a short period, making them ideal for both defensive and offensive military operations. The technological advancements in these systems, such as enhanced targeting and guidance systems, continue to drive their dominance in the market.

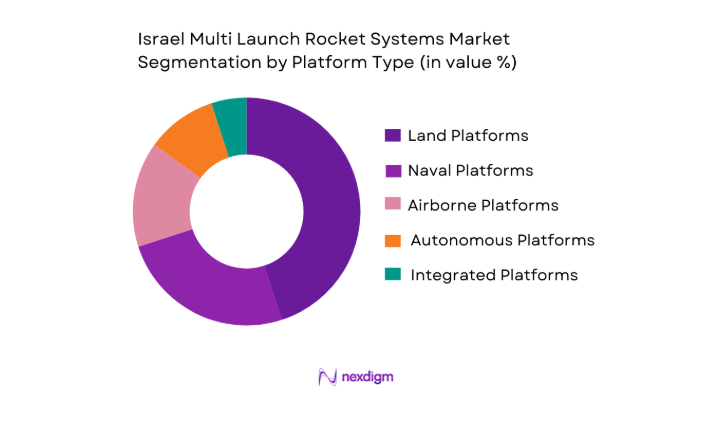

By Platform Type

The market is also segmented by platform type, which includes land-based platforms, naval platforms, airborne platforms, autonomous platforms, and integrated platforms. Among these, land-based platforms dominate the market due to the high adoption rate for their versatility and ability to deliver high-volume firepower in diverse combat scenarios. Land-based rocket systems provide quick mobility and integration with existing defense infrastructure, making them a preferred choice for most defense forces, including the Israeli military. The advancement of mobile platforms and integration with advanced targeting systems further drives the dominance of this segment.

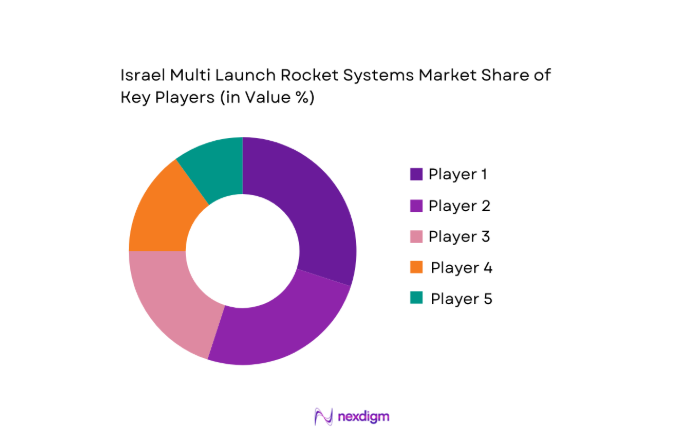

Competitive Landscape

The Israel Multi Launch Rocket Systems market is dominated by a few key players, including local manufacturers and global defense giants. These companies play a significant role in shaping the market through continuous innovation, strategic partnerships, and government contracts. The key players in this market include defense firms like Elbit Systems, Rafael Advanced Defense Systems, and Israel Aerospace Industries, which are renowned for their advanced technology solutions and robust military capabilities. These companies dominate through their strong research and development programs, vast production capabilities, and the ability to cater to both local and international defense needs.

| Company Name | Establishment Year | Headquarters | Market Position | Defense Contracts | Innovation & Technology | Global Presence | Revenue in Defense |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat Hasharon, Israel | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

Israel Multi Launch Rocket Systems Market Analysis

Growth Drivers

Increase in Military Expenditure

Global military spending has seen a steady increase, with the defense budget of Israel rising significantly over recent years. In 2024, Israel’s defense spending amounted to approximately USD ~, a consistent upward trend from previous years. According to data from the World Bank, global military expenditure as a whole reached USD ~ in 2024. This growth is largely driven by nations increasing their defense budgets in response to geopolitical instability and security concerns. As a result, Israel’s defense sector, including Multi Launch Rocket Systems, is seeing continued investment, ensuring technological advancements and system upgrades in line with rising military needs. This increase in defense spending reflects the country’s ongoing commitment to enhancing its defense infrastructure and boosting market demand for advanced weaponry, including multi-launch rocket systems.

Rising Geopolitical Tensions in the Region

The Middle East remains one of the most geopolitically volatile regions in the world, with increasing instability spurring higher demand for advanced defense systems. In 2023, military conflicts in the region, particularly between Israel and neighboring countries, have intensified. According to the International Monetary Fund (IMF), the Middle East’s security dynamics are heavily influenced by territorial disputes, such as the ongoing tension between Israel and Palestine. In response to these escalating tensions, Israel continues to invest heavily in defense systems, with a focus on long-range missile systems and multi-launch rocket technologies. The rising threat of missile attacks and regional conflicts is one of the main drivers of Israel’s focus on enhancing its multi-launch rocket systems, ensuring readiness and precision in defense strategies. This geopolitical unrest guarantees a long-term market need for these technologies.

Market Challenges

High Initial Procurement and Maintenance Costs

The cost of acquiring and maintaining advanced multi-launch rocket systems is a significant barrier for many countries and military organizations. For Israel, a leader in defense technology, procurement costs for rocket systems and their associated infrastructure can reach billions of dollars. According to a report by the Israeli Ministry of Defense, the Iron Dome system, while effective, has an estimated initial procurement cost of USD ~ per battery, with additional maintenance and operational costs. This high cost structure can deter some smaller nations from investing in these systems. Additionally, maintenance requirements for complex rocket systems are ongoing and expensive, requiring sophisticated parts and skilled personnel, which further drives up the long-term costs associated with these systems. These financial constraints present a significant challenge in ensuring widespread adoption and limiting the market’s growth potential, especially in emerging economies.

Regulatory and Compliance Hurdles

The multi-launch rocket system market is heavily regulated by international arms control agreements and national defense policies. In particular, the export of such defense systems is tightly controlled under various government frameworks, such as the U.S. International Traffic in Arms Regulations (ITAR) and the Wassenaar Arrangement. These regulations impose strict guidelines on the distribution of advanced defense technologies, limiting market access for manufacturers and creating challenges in the global expansion of rocket systems. As of 2023, Israel’s Ministry of Defense reports that export licenses for advanced rocket systems are often delayed due to complex compliance checks and the need for approval from international regulatory bodies. This results in delays in fulfilling defense contracts and impedes the potential for rapid growth in international markets, particularly in regions like Africa and Southeast Asia.

Market Opportunities

Emerging Defense Needs in Middle Eastern Countries

The Middle East continues to be a critical region for defense spending and the demand for advanced military systems. In countries like Saudi Arabia and the UAE, defense budgets have been rising consistently, reflecting the growing need for advanced defense technologies in the region. According to the World Bank, the Middle East’s defense spending reached USD ~ in 2024, with countries like Saudi Arabia and the UAE significantly increasing their defense budgets to respond to regional instability. These emerging defense needs are driving the demand for multi-launch rocket systems and other high-tech weaponry, positioning Israel as a key supplier to these nations. As tensions in the region escalate, the market for advanced rocket systems in the Middle East is set to expand, creating numerous opportunities for Israel’s defense manufacturers.

Growing Demand for Advanced Weaponry Systems

Increased threats from regional and international adversaries have led to a growing global demand for advanced military systems, including multi-launch rocket systems. With countries prioritizing modernizing their defense infrastructure, the demand for sophisticated weaponry is higher than ever. As military forces seek to enhance their capabilities against missile threats, the Israel Multi Launch Rocket Systems market stands to benefit. The global rise in defense spending, which reached approximately USD ~ in 2024 (as reported by the International Monetary Fund), indicates that nations are increasingly investing in upgrading their military technology. This presents a significant opportunity for manufacturers of multi-launch rocket systems, as defense agencies look for more effective ways to protect their territories and assets.

Future Outlook

Over the next decade, the Israel Multi Launch Rocket Systems market is expected to show steady growth, driven by advancements in rocket technology and increasing geopolitical instability in the Middle East. The demand for advanced and versatile weapon systems will continue to grow as defense forces seek to enhance their operational capabilities. Additionally, the development of autonomous systems and integration with artificial intelligence will be key drivers of innovation in this market. As Israel strengthens its defense collaborations with global allies and expands its technological capabilities, the market will continue to thrive.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- IMI Systems

- Lockheed Martin

- Boeing

- Raytheon Technologies

- General Dynamics

- BAE Systems

- MBDA

- Northrop Grumman

- Thales Group

- Saab AB

- Kongsberg Gruppen

- L3 Technologies

Key Target Audience

- Military Forces

- Defense Contractors

- Government Agencies

- Investments and Venture Capitalist Firms

- Regulatory Bodies

- Security Organizations

- Private Sector Defense Sector Companies

- Arms Export Agencies

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology involves identifying the critical variables that shape the Israel Multi Launch Rocket Systems market. This includes evaluating the market’s core drivers, such as technological advancements and defense spending. Extensive secondary research is performed using reliable databases and industry reports to identify the key factors influencing the market’s growth.

Step 2: Market Analysis and Construction

Historical market data is compiled and analyzed, focusing on past trends in system deployments, technological advancements, and defense budgets. This step also includes the construction of future market projections using the data from manufacturers, governments, and military agencies. Additionally, revenue generation across various segments is examined for its impact on market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

A combination of qualitative and quantitative research methods will be used, including in-depth interviews with defense experts, military officials, and defense contractors. These insights help validate the hypotheses and ensure that the market projections align with actual industry behavior. Expert opinions on technological developments and procurement trends are integrated into the findings.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data collected from the primary and secondary research. Detailed discussions are held with leading defense manufacturers to validate the final research findings. This ensures a comprehensive, accurate, and fully validated analysis of the Israel Multi Launch Rocket Systems market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in military expenditure

Rising geopolitical tensions in the region

Technological advancements in rocket system efficiency - Market Challenges

High initial procurement and maintenance costs

Regulatory and compliance hurdles

Security and privacy concerns in defense technology - Market Opportunities

Emerging defense needs in Middle Eastern countries

Growing demand for advanced weaponry systems

Expansion of cross-border defense cooperation - Trends

Integration of AI and automation in rocket systems

Adoption of lightweight materials in system design

Shift towards modular, adaptable systems - Government regulations

- SWOT analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Multiple rocket launch systems

Long-range rocket systems

Heavy artillery rocket systems

Short-range rocket systems

High mobility artillery rocket systems - By Platform Type (In Value%)

Land-based platforms

Naval platforms

Airborne platforms

Autonomous platforms

Integrated platforms - By Fitment Type (In Value%)

OEM fitment

Aftermarket fitment

Modular fitment

Integrated fitment

Custom fitment - By EndUser Segment (In Value%)

Military forces

Defense contractors

Government agencies

Security organizations

Private defense sector - By Procurement Channel (In Value%)

Direct procurement

Indirect procurement

Third-party procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, Fitment Type, End User Segment)

- SWOT Analysis

- Pricing analysis of major players

- Key Players

Lockheed Martin

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

IMI Systems

Thales Group

MBDA

Raytheon

Kongsberg Gruppen

Saab AB

Northrop Grumman

Boeing

General Dynamics

BAE Systems

Tactical Missiles Corporation

L3 Technologies

- Increasing demand from military forces for advanced rocket systems

- Shift towards multi-platform rocket deployment for versatility

- Emergence of private sector involvement in defense manufacturing

- Growing government interest in self-sufficiency for defense systems

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035