Market Overview

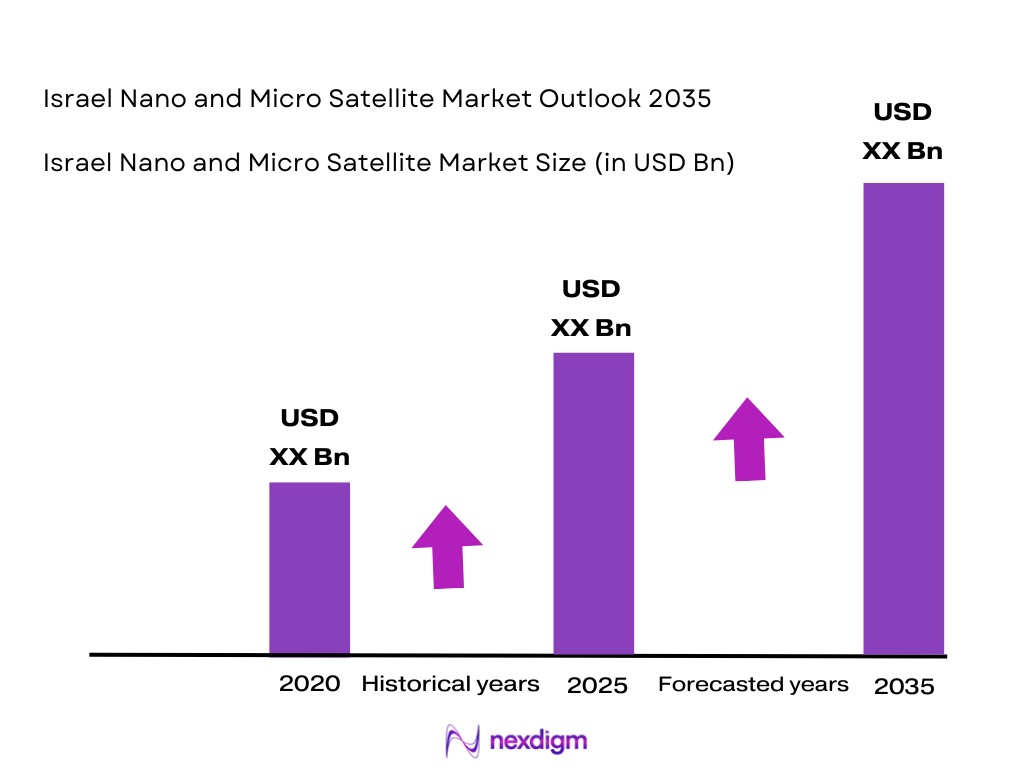

The Israel Nano & Micro Satellite Market has seen significant growth, driven by advancements in miniaturization technologies and increasing demand from both governmental and commercial sectors. In 2025, the market size was valued at approximately USD ~ million. The growth of this market is primarily attributed to the country’s well-established space technology infrastructure, driven by Israel’s innovation in satellite systems and a strong ecosystem of governmental support, such as that from the Israel Space Agency. The country’s increasing involvement in small satellite constellations and its defense and communication technologies continue to propel this market forward.

The dominant cities in the Israel Nano & Micro Satellite Market are Tel Aviv, Herzliya, and Haifa. These cities host Israel’s major aerospace and defense companies, startups, and academic institutions, making them crucial players in the space technology ecosystem. Israel’s proximity to international launch providers and its established relationships with global defense and aerospace industries further contribute to the dominance of these cities. The Israeli government’s investment in space exploration and national security initiatives also plays a central role in the growth of the market in these regions.

Market Segmentation

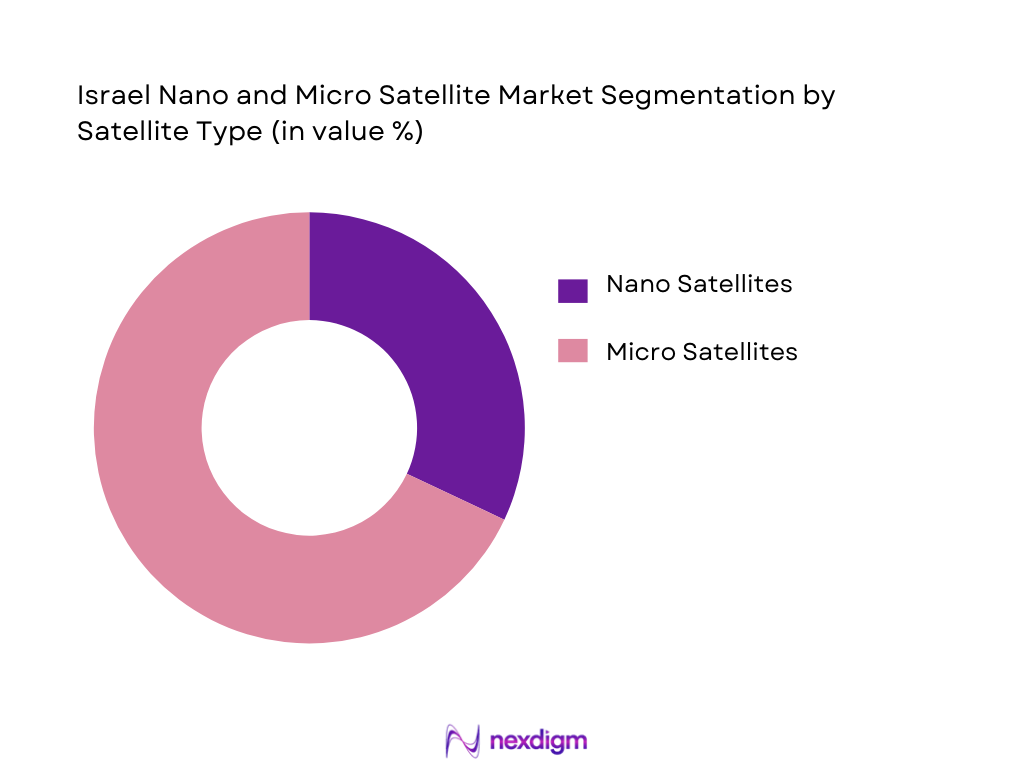

By Satellite Type

The market is segmented into two major categories: nano satellites (weighing less than 10 kg) and micro satellites (weighing between 10 to 100 kg). In 2024, the micro satellite segment accounted for the largest share of the market. This dominance is driven by the increasing demand for higher payload capacity, including communication and earth observation capabilities, which are efficiently handled by micro satellites. Micro satellites offer a balance of affordability, performance, and scalability, which makes them an attractive option for both commercial entities and governmental applications. Nano satellites, though smaller and less expensive, are more commonly used for specific research, educational, and military functions where payload requirements are minimal.

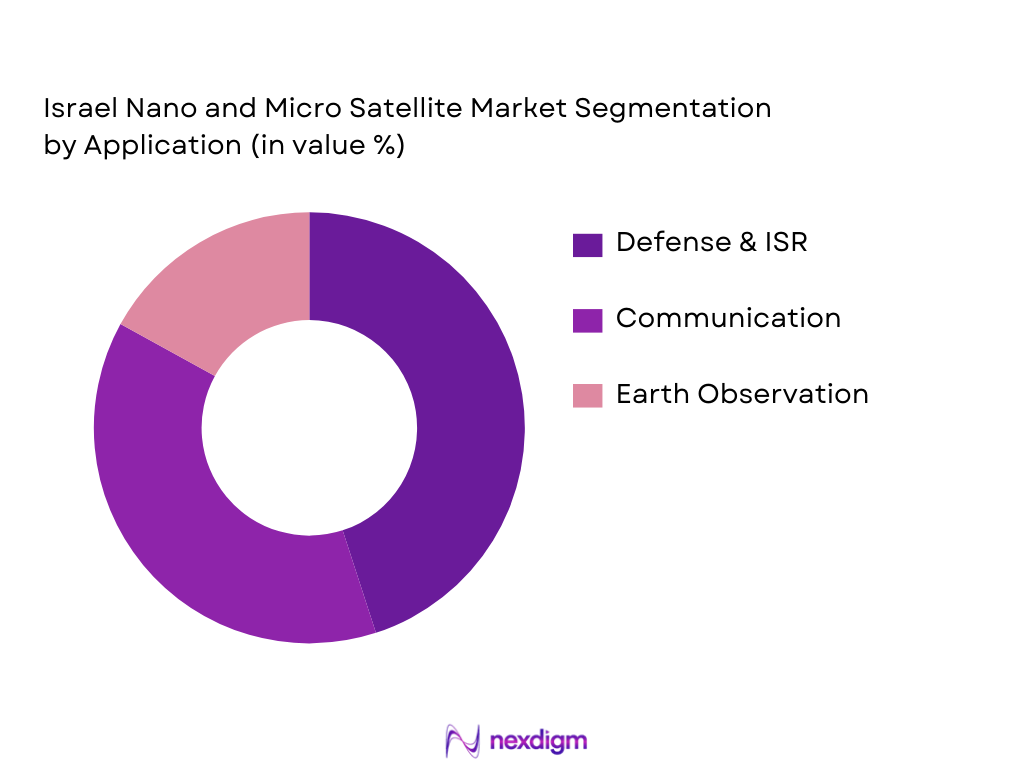

By Application

The Israel Nano & Micro Satellite Market is primarily driven by applications in Earth observation, communications, and defense. Among these, the defense sector holds the dominant share, especially given the dual-use capabilities of many Israeli satellites for both civilian and military applications. The satellite systems play a crucial role in national security for surveillance, intelligence, and reconnaissance missions. Communication satellites are also gaining traction due to Israel’s growing interest in expanding its satellite-based telecommunication networks, including the rise of private satellite constellations. Earth observation satellites are seeing increasing demand for both environmental monitoring and commercial data services.

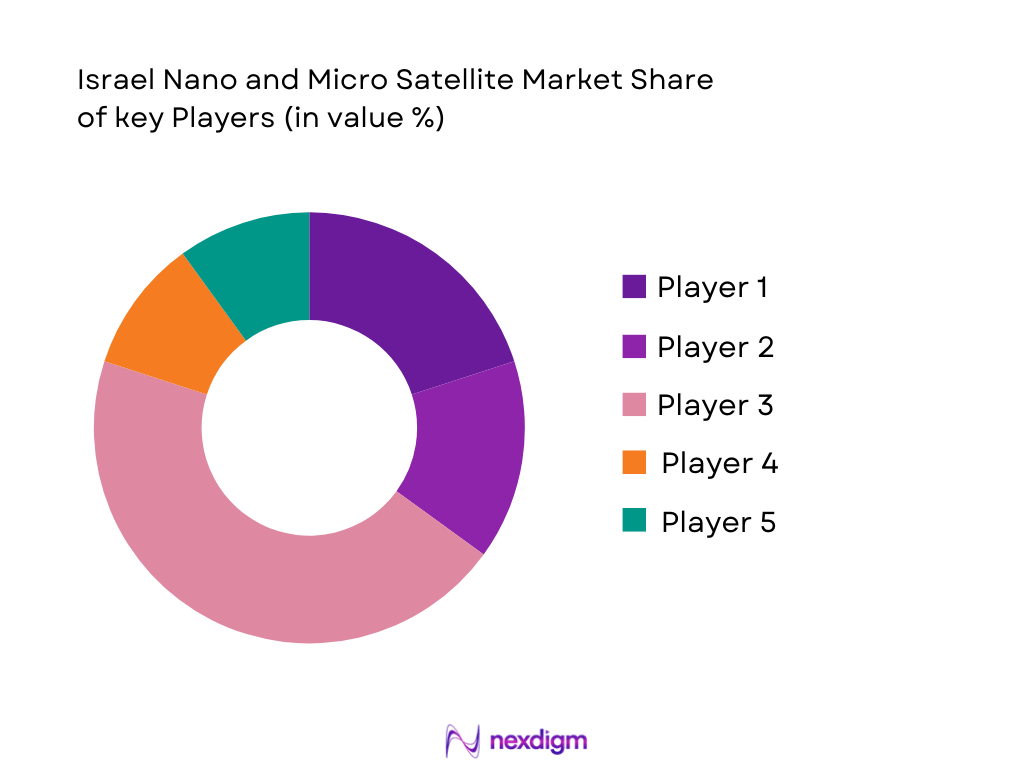

Competitive Landscape

The Israel Nano & Micro Satellite Market is highly competitive, with a strong presence of local defense contractors, startups, and academic institutions. The market is dominated by a few key players, including Israel Aerospace Industries (IAI), Rafael Advanced Defense Systems, and NSLComm. These companies hold a significant portion of the market due to their technological innovations, government contracts, and specialized expertise in small satellite manufacturing and deployment. Additionally, smaller startups and universities contribute to the market by launching new, innovative satellite systems.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technological Capabilities | R&D Investment | Export Capabilities | Government Contracts |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| NSLComm | 2017 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| SpacePharma | 2017 | Herzliya, Israel | ~ | ~ | ~ | ~ | ~ |

| Effective Space | 2015 | Herzliya, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Nano & Micro Satellite Market Analysis

Growth Drivers

Cost‑Efficiency in LEO / surge in Constellations

The increasing cost-efficiency of launching satellites into Low Earth Orbit (LEO) has played a pivotal role in the expansion of the nano and micro satellite market in Israel. Lower launch costs, coupled with the miniaturization of satellite technology, have made it more economically viable for both governmental and commercial entities to deploy large constellations. The surge in satellite constellations, especially for communication, Earth observation, and IoT applications, has significantly boosted the market. The ability to deploy multiple satellites in a single launch enables better coverage and redundancy, which is crucial for applications like global internet coverage and real-time data gathering. Israel’s strong aerospace sector, along with its collaborations with international launch providers, ensures that cost-efficient solutions for LEO satellite deployments are increasingly accessible.

Defense & Dual Use Demand

Israel’s defense and security requirements have led to significant investments in dual-use satellite technologies, which serve both civilian and military purposes. Nano and micro satellites are particularly well-suited for surveillance, reconnaissance, and secure communication functions, all vital for Israel’s defense sector. These small-scale satellites are cost-effective while still offering robust performance for intelligence gathering, border monitoring, and national security applications. The growing demand for small, agile satellites with dual-use capabilities has been a key driver, enhancing Israel’s position as a leader in satellite-based defense technologies.

Restraints & Challenges

Extended Defense Procurement Cycles

The procurement of military lighting systems in Saudi Arabia is governed by rigorous and multi-layered processes. Projects must undergo detailed technical assessments, security vetting, compliance reviews, and financial approvals before contract award. Lighting systems are often bundled into larger infrastructure or platform modernization programs, further extending decision timelines. These prolonged cycles can span multiple planning and budgeting phases, delaying market entry for new technologies and increasing uncertainty for suppliers. Extended procurement timelines also increase working capital requirements, as vendors must invest in bidding, prototyping, and compliance activities long before revenue realization. This environment favors well-capitalized firms and established defense contractors, limiting participation by smaller or emerging players.

Stringent MIL-STD and NVG Certification Requirements

Military lighting systems must comply with stringent standards covering durability, ingress protection, shock resistance, and electromagnetic compatibility. In tactical and aviation applications, compatibility with night-vision devices is mandatory, requiring precise spectral control and advanced optical engineering. Achieving these certifications demands specialized testing facilities, skilled engineering teams, and repeated validation cycles. Certification costs and long development timelines increase the total cost of ownership for suppliers and slow product innovation. For buyers, these strict requirements limit the pool of qualified vendors, reducing competitive pressure and slowing technology refresh cycles.

Opportunities

Local Manufacturing and Offset Programs

Defense offset and localization programs present significant long-term opportunities for market participants. Companies that invest in local manufacturing or assembly facilities can meet offset requirements while gaining preferential access to government contracts. Local operations enable faster delivery, improved maintenance response, and stronger alignment with national industrial objectives. Over time, these capabilities position Saudi Arabia as a regional production and export hub for military lighting systems, particularly for neighboring defense markets.

Smart and Connected Military Lighting Systems

The transition toward smart and secure military bases is creating strong demand for connected lighting systems. These solutions integrate with surveillance, perimeter security, and command platforms to provide adaptive illumination based on operational needs. Smart lighting improves energy efficiency, enhances threat detection, and supports predictive maintenance. As defense infrastructure becomes more digitized, lighting systems evolve into intelligent assets, offering suppliers opportunities in software integration, data analytics, and long-term service contracts.

Future Outlook

Over the next several years, the Israel Nano & Micro Satellite Market is expected to show considerable growth, driven by continued advancements in satellite miniaturization, the expansion of satellite constellations, and increasing demand for both commercial and defense applications. Israel’s prominent role in space innovation, particularly through its defense sector, will continue to propel the market, with the government investing heavily in space technologies. Additionally, commercial opportunities in satellite communications, IoT applications, and earth observation will further drive the market, as both global and domestic players seek to develop and deploy small satellites for a wide range of applications.

The rising demand for affordable, high-performance satellites from private companies, particularly startups and telecommunications operators, will lead to a growing market for micro satellites. With Israel’s growing presence in international space partnerships, these trends are expected to accelerate the growth trajectory for the next decade.

Major Players

- Israel Aerospace Industries (IAI)

- Rafael Advanced Defense Systems

- NSLComm

- SpacePharma

- Effective Space

- Gilat Satellite Networks

- MDA (MacDonald, Dettwiler and Associates)

- Orbital Sciences Corporation

- Tyvak International

- Surrey Satellite Technology Ltd

- GomSpace

- Airbus Defence and Space

- SpaceX

- Planet Labs

- Rocket Lab

Key Target Audience

- Government Agencies: Israel Space Agency (ISA), Ministry of Defense (MOD)

- Defense Contractors and Agencies: Rafael Advanced Defense Systems, Israel Aerospace Industries (IAI)

- Commercial Satellite Operators

- Satellite and Launch Service Providers

- Venture Capitalists and Investment Firms

- International Space Agencies and Regulatory Bodies

- Satellite Data Service Providers

- Telecom Operators and Satellite Internet Service Providers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables that affect the Israel Nano & Micro Satellite Market. This includes collecting data from government sources, industry reports, and interviews with market experts. These variables help define the scope of market research and assist in pinpointing areas that influence market growth.

Step 2: Market Analysis and Construction

This phase includes the aggregation and analysis of historical data concerning the market’s growth, segmentation, and demand drivers. It involves the evaluation of key industries utilizing nano and micro satellites in Israel, including defense, commercial, and academic sectors.

Step 3: Hypothesis Validation and Expert Consultation

To validate the assumptions and data derived, consultations are conducted with industry experts, satellite manufacturers, and government bodies. These discussions offer real-world insights and further refine the research.

Step 4: Research Synthesis and Final Output

The final step integrates all research findings, including expert opinions and industry data, into a cohesive market analysis. This ensures the accuracy of conclusions and projections for the Israel Nano & Micro Satellite Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions (Nano < 10 kg, Micro 10–100 kg, LEO/MEO/LEO Constellations), Data Sources (Primary executive interviews, launch provider logs, academic satellite tracking), Market Sizing Approach (Revenue, Units, Systems Count, Satellite FAB Capacity), Research Limitations and Future Scope)

- Definition and Scope

- Space Tech Evolution in Israel (Startup ecosystem + legacy aerospace)

- Historical Genesis of Nano & Micro Satellites in Israel

- Israel Space Policy & Institutional Framework (Israel Space Agency, INSA roles)

- Satellite Value Chain

- Growth Drivers

Cost‑Efficiency in LEO / surge in Constellations

Defense & Dual Use Demand

Academic & Research Satellite Programs - Restraints & Challenges

Launch Access Constraints

International Regulatory Compliance (Export Control)

Miniaturization Limits & Payload Performance - Emerging Opportunities

Quantum Communication Satellites

AI‑enabled Onboard Data Processing

Satellite‑as‑a‑Service Business Models - Market Trends

Constellation Economics

Software‑Defined Radios & AI/ML Payloads

On‑orbit Servicing & Shared Platforms - Government & Policy Landscape

Space R&D Funding & Incentives

Defense Procurement and Strategic Mandates

Export/Transfer Regulations

International Space Partnerships & Launch Agreements

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Satellite Mass Class (In Value %)

Nano (< 10 kg)

Microsat (10–100 kg)

Sub‑class CubeSat (1U/3U/6U)

Mini‑Class Hybrid Programs - By Application (In Value %)

Earth Observation & Remote Sensing (High‑Res EO Payloads)

Communications & IoT Constellations

Scientific & Academic Missions (University payloads)

Defense & ISR Payloads

Technology Demonstration & Quantum Comm (e.g., TAU‑SAT3) - By Segment Value Chain Component (In Value %)

Satellite Bus & Structure

Payload Instruments (Optical, RF, Comm, IoT)

Onboard Computing & AI/ML Processing

Ground Segment & Telemetry, Tracking & Control (TT&C)

Launch & Deployment Services - By Customer Type (In Value %)

Government (Defense, Civil Research)

Academic & Research Institutions

Commercial (Telecom, Earth Data Services)

Start‑Ups & Venture Projects

- Market Share Estimation (by Revenue, Units)

- Government/Academic vs. Commercial Split

- Cross‑Comparison Parameters (Company Overview (ISRAEL HQ presence), Satellite Segment Served (Nano/Micro), Launch Strategy (In‑House vs. Partnered), IP & Technology Differentiators (Payload, Comm, AI/ML), Production Capacity (Satellites per year), Revenue by Business Unit (Manufacturing, Data Services))

- Company Profiles

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

NSLComm (Nano‑sat Constellation Plans)

Rural Satellite Ventures

SpacePharma / CubeSat partners

Gilat Satellite Networks (Comm Ground + Integration)

Effective Space (Israeli‑linked M&A profile)

Local Academic Teams (Tel Aviv Univ., Ben‑Gurion Univ.)

International Benchmarks: Planet Labs

GomSpace

Surrey Satellite Technology Ltd

Rocket Lab (Launch Synergies)

Tyvak / Terran Orbital

Clyde Space / AAC Space (Subsidiary roles)

SpaceX (Commercial LEO Demand Pulser)

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035