Market Overview

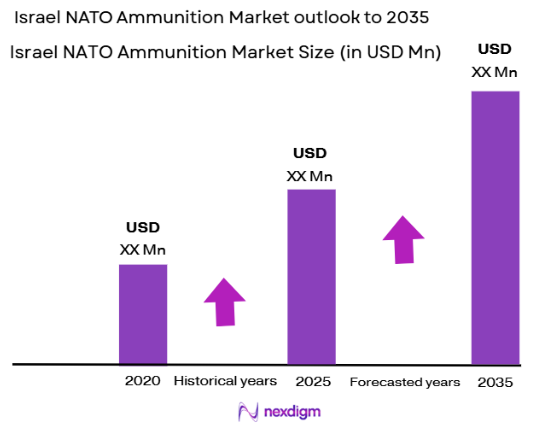

The Israel NATO Ammunition market size is valued at approximately USD ~billion in 2024, with continuous growth driven by increasing defense spending and the evolving geopolitical landscape. This growth is largely supported by Israel’s position as a significant military player in the Middle East, focusing on innovation and advanced defense technologies. Moreover, NATO’s growing defense cooperation with Israel is contributing to the demand for advanced ammunition and defense equipment. The market’s expansion is underpinned by significant investments in military infrastructure and cutting-edge ammunition technologies.

The dominant players in the Israel NATO Ammunition market include Israel, the United States, and various European NATO countries. Israel, as a leading defense technology innovator, contributes significantly to the demand for advanced ammunition systems, especially with the integration of cutting-edge weaponry and defense solutions. The U.S. also plays a central role due to its ongoing partnerships with NATO, bolstering demand for highly advanced ammunition systems. European nations are seeing an increase in demand for NATO standard ammunition due to heightened defense spending and the strengthening of NATO’s collective defense initiatives.

Market Segmentation

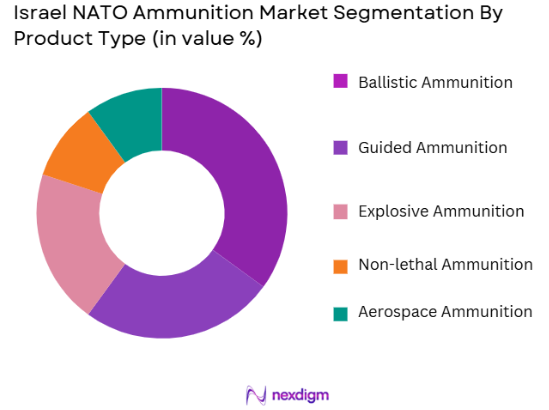

By Product Type:

The Israel NATO Ammunition market is segmented by product type into ballistic ammunition, guided ammunition, explosive ammunition, non-lethal ammunition, and aerospace ammunition. Ballistic ammunition currently holds the dominant market share within this segment due to its long-standing presence and versatility in a wide range of military applications. Ballistic ammunition is frequently used in a variety of NATO operations and Israel’s military, contributing to its market leadership. With continual improvements in design and accuracy, ballistic ammunition remains the preferred choice in combat, providing effective performance in various conditions.

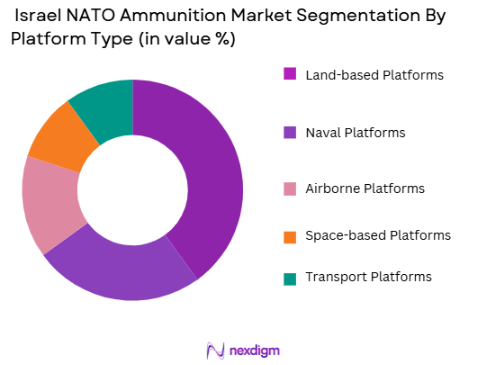

By Platform Type:

The market is segmented by platform type into land-based platforms, naval platforms, airborne platforms, space-based platforms, and transport platforms. Land-based platforms dominate the market share, primarily due to their extensive use in defense systems and military operations. These platforms require a wide variety of ammunition, including ballistic and explosive types, for operations ranging from ground defense to tactical warfare. The versatility and adaptability of land-based platforms in various military settings make them the primary driver of market demand in this segment.

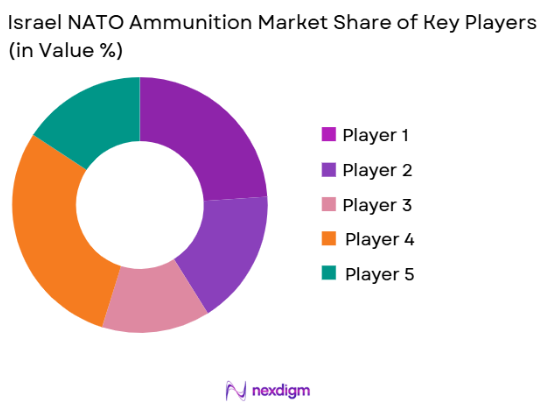

Competitive Landscape

The Israel NATO Ammunition market is characterized by the dominance of several major defense companies that manufacture and supply ammunition for Israel and NATO nations. These companies are critical to supplying high-tech, reliable ammunition systems that meet NATO standards. A few major players include Israel Military Industries (IMI), Elbit Systems, and Rafael Advanced Defense Systems, alongside global giants like Lockheed Martin and BAE Systems. These players benefit from long-term contracts with military forces and NATO collaborations, reinforcing their market position.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Innovation Leadership | Global Reach | Technology Integration |

| Israel Military Industries | 1933 | Lod, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

Israel NATO Ammunition Market Analysis

Growth Drivers

Rising Geopolitical Tensions

The growing geopolitical instability in the Middle East, particularly Israel’s proximity to conflict zones and its ongoing security concerns, drives an increasing demand for advanced ammunition solutions. The expansion of NATO’s military presence in the region, coupled with the rising defense budgets across member countries, has significantly contributed to the demand for high-tech, precision ammunition systems. Israel’s role as a strategic partner to NATO forces further enhances its defense capabilities, and the need for advanced, reliable, and scalable ammunition is expected to continue rising. As threats from state and non-state actors intensify, ammunition systems designed for long-range precision, high velocity, and multi-role functionalities are likely to gain traction. This geopolitical landscape is a primary growth driver for Israel’s ammunition market as it seeks to strengthen its military capabilities and support NATO operations globally.

Technological Advancements in Ammunition Systems

Israel is at the forefront of defense technology, with constant innovations in ammunition systems, including smart, guided, and non-lethal ammunition. These advancements have allowed Israel to maintain a technological edge, particularly with systems that offer enhanced accuracy, reduced collateral damage, and improved operational efficiency. NATO’s growing interest in these high-performance ammunition systems, which offer greater precision and operational versatility, further fuels demand. Furthermore, emerging trends such as the development of multi-role and modular ammunition systems are gaining popularity in the Israel NATO Ammunition market. These systems enable the military to adapt to rapidly changing warfare scenarios, making them a crucial growth driver for the market in the coming years.

Market Challenges

Regulatory and Certification Hurdles

One of the main challenges for the Israel NATO Ammunition market is the complex and stringent regulatory environment governing the export and use of military-grade ammunition. NATO member countries, as well as Israel, are subject to a range of regulations and certification processes that control the production and distribution of ammunition. These regulations, often influenced by political factors, international treaties, and security concerns, can delay the deployment of new technologies and complicate cross-border transactions. Additionally, compliance with NATO’s standardization agreements can lead to high costs and extended timelines for product development, creating significant barriers for companies looking to maintain market competitiveness.

Supply Chain and Production Costs

A significant challenge facing the Israel NATO Ammunition market is the complexity and vulnerability of the supply chain. Israel’s ammunition production relies on specialized materials and components, which may be sourced from various global suppliers. Disruptions in the supply chain—whether due to geopolitical tensions, trade restrictions, or logistical challenges—can result in delays and increased production costs. The high cost of raw materials used in ammunition production, combined with rising energy prices and labor costs, has led to inflationary pressures in the market. Such challenges impact manufacturers’ ability to meet increasing demand, making the supply chain a critical factor in the market’s ability to scale effectively.

Opportunities

Emerging Non-Lethal Ammunition Demand

An emerging opportunity in the Israel NATO Ammunition market is the growing demand for non-lethal ammunition, especially for peacekeeping and crowd control operations. NATO forces are increasingly turning to non-lethal weapons as part of their broader strategy to minimize casualties in conflict zones. Israel, with its advanced capabilities in defense technology, has the opportunity to capitalize on this shift by developing specialized non-lethal ammunition systems. These systems are particularly attractive for missions in urban warfare, peacekeeping, and riot control, where minimizing civilian casualties is a priority. As global demand for such solutions grows, the Israeli defense sector is well-positioned to lead the way in creating innovative, highly effective non-lethal ammunition for NATO operations.

Growing Defense Budgets and NATO Partnerships

Another key opportunity lies in the increasing defense budgets of NATO countries and the strategic partnerships between Israel and NATO forces. As NATO countries continue to strengthen their military capabilities in response to rising global threats, particularly in Eastern Europe and the Middle East, there is a heightened demand for advanced ammunition solutions. Israel’s continued collaboration with NATO forces provides significant opportunities to secure contracts for supplying state-of-the-art ammunition, particularly in the realms of guided munitions, long-range artillery shells, and missile defense systems. Additionally, as Israel’s defense industry integrates more advanced technologies, such as artificial intelligence and machine learning into ammunition systems, it positions itself as a leader in next-generation warfare technologies, further cementing its role as a key supplier to NATO forces.

Future Outlook

The Israel NATO Ammunition market is projected to experience steady growth over the next decade, driven by the continuous modernization of defense infrastructure and the rising need for advanced weaponry in response to global security threats. The forecasted compound annual growth rate (CAGR) for the market during the 2026-2035 period is expected to be around ~%, driven by increased defense budgets and technological advancements in ammunition production. Israel’s position as a leading defense innovator and its strategic partnerships with NATO countries will remain key factors contributing to sustained growth in this sector.

Major Players

- Israel Military Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Lockheed Martin

- BAE Systems

- General Dynamics

- Northrop Grumman

- Thales Group

- Leonardo DRS

- Raytheon Technologies

- Saab Group

- Rheinmetall AG

- FN Herstal

- Denel SOC Ltd

- Ruag Group

Key Target Audience

- Defense Ministries

- Military Contractors and Defense Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Armed Forces

- Security Agencies and Defense Authorities

- International Defense Alliances

- Manufacturers of Advanced Ammunition Technologies

Research Methodology

Step 1: Identification of Key Variables

The first step involves the identification of critical variables that influence the Israel NATO Ammunition market. This process includes extensive desk research, analysis of defense policies, and market dynamics. The goal is to capture a comprehensive view of the market and understand the factors influencing its growth.

Step 2: Market Analysis and Construction

This phase involves compiling historical data on ammunition production, sales, and usage by NATO forces and Israel. The focus is on understanding the supply chain, market penetration, and distribution networks across various sectors within the defense industry.

Step 3: Hypothesis Validation and Expert Consultation

Experts in defense manufacturing and NATO operations are consulted to validate assumptions and market hypotheses. These consultations, through structured interviews, provide valuable insights into trends, technological developments, and the strategic direction of the ammunition market.

Step 4: Research Synthesis and Final Output

This final step synthesizes the gathered data and expert insights into a cohesive market model. The aim is to provide a detailed analysis of the market dynamics, forecasted growth, and competitive landscape. Verification through interactions with key stakeholders ensures the final analysis is accurate and actionable.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

Market Definition and Scope

Value Chain & Stakeholder Ecosystem

Regulatory / Certification Landscape

Sector Dynamics Affecting Demand

Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising geopolitical tensions in the Middle East

Expansion of NATO operations

Technological advancements in ammunition systems - Market Challenges

Regulatory hurdles in NATO member countries

Supply chain disruptions affecting military procurement

Rising competition from emerging ammunition manufacturers - Trends

Shift towards multi-role and modular ammunition systems

Increasing focus on sustainability in ammunition manufacturing

Rise of digitalization in ammunition management systems

- Market Opportunities

Increase in defense budgets by NATO countries

Development of smart ammunition technologies

Growing demand for non-lethal ammunition for peacekeeping operations - Government regulations

Compliance with NATO standardization agreements

Export control regulations on military goods

Environmental regulations for ammunition disposal and recycling - SWOT analysis

Strength: Strong partnerships with NATO and defense agencies

Weakness: Dependence on government contracts

Opportunities: Expansion into emerging markets

Threats: Increased competition from non-traditional defense companies - Porters 5 forces

High bargaining power of suppliers due to limited ammunition producers

Moderate threat of substitutes with growing demand for non-lethal alternatives

Intense rivalry among existing market players

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ballistic Ammunition

Guided Ammunition

Explosive Ammunition

Non-lethal Ammunition

Aerospace Ammunition - By Platform Type (In Value%)

Land-based Platforms

Naval Platforms

Airborne Platforms

Space-based Platforms

Transport Platforms - By Fitment Type (In Value%)

Direct Fitment

Retrofit

Modular Fitment

Multi-role Fitment

Custom Fitment - By EndUser Segment (In Value%)

Military & Defense

Homeland Security

Private Security

International NATO Collaborations

Emergency Services - By Procurement Channel (In Value%)

Direct Procurement from Government

Private Sector Procurement

Contract-based Procurement

Government Auctions

Third-party Distributors

- Market Share Analysis

- CrossComparison Parameters(Market Share, Growth Rate, Technological Advancement, Distribution Networks, Pricing Strategies)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Military Industries

Elbit Systems

Rafael Advanced Defense Systems

Tadiran Electronic Systems

Israel Aerospace Industries

Boeing

Lockheed Martin

General Dynamics

BAE Systems

Raytheon Technologies

Northrop Grumman

Thales Group

Leonardo DRS

BAE Land Systems

Dynamit Nobel Defence

- Increasing demand from international NATO collaborations

- Strong military presence driving ammunition purchases

- Homeland security needs for advanced ammunition types

- Emerging private security companies requiring specialized products

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035