Market Overview

The Israel NATO C4ISR market is expected to maintain strong growth due to its strategic positioning within the global defense ecosystem. Israel, a key player in defense technology, has been continuously investing in military infrastructure, bolstering the demand for Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) systems. These systems are integral to the operation of military forces, driving their demand in regions like Israel and NATO-member countries. In 2024, the market is valued at approximately USD ~billion, driven by the increasing focus on digital warfare, cybersecurity, and real-time intelligence. Governments and defense organizations are investing heavily to modernize their C4ISR capabilities, particularly in response to evolving geopolitical threats.Israel remains a dominant force in the C4ISR market due to its technological innovation, strong defense industry, and partnerships with NATO countries. Israel’s strategic geographical location and political alliances have allowed it to develop and integrate advanced C4ISR systems for military operations. Additionally, the United States and European NATO countries play significant roles in the market. The U.S., being Israel’s top defense partner, leads in the adoption of C4ISR systems, particularly with advanced platforms and technologies. Other key NATO countries such as the United Kingdom and France continue to modernize their defense infrastructure, thereby contributing to the growing demand for cutting-edge C4ISR solutions.

Market Segmentation

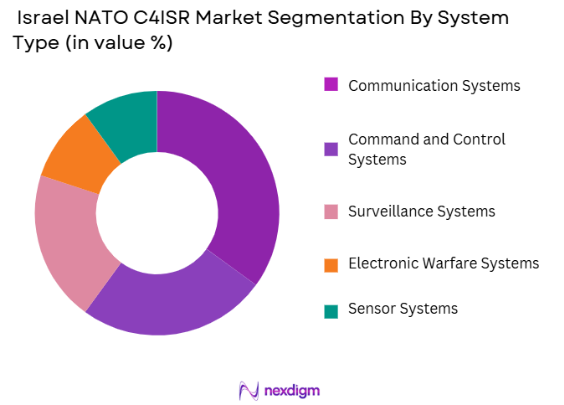

By System Type

The Israel NATO C4ISR market is segmented by system type into communication systems, command and control systems, surveillance systems, electronic warfare systems, and sensor systems. Among these, the communication systems segment holds a dominant market share due to their fundamental role in military operations. The demand for communication systems has been propelled by the increasing complexity of modern warfare, where real-time communication and data transmission are critical for mission success. Israel, being at the forefront of communication technology, has developed advanced satellite communication, secure network systems, and other communication devices that are integral to both Israel and NATO forces. This demand is further supported by Israel’s expertise in secure communication solutions that are essential for defense applications.

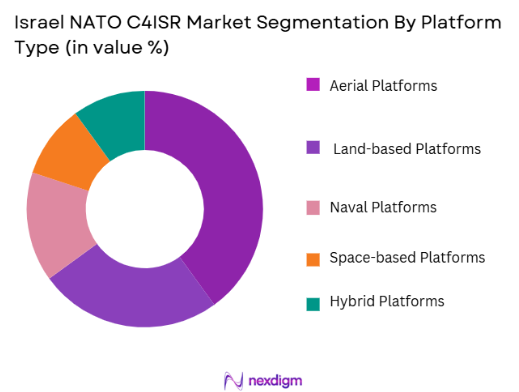

By Platform Type

The market is further segmented by platform type into land-based platforms, aerial platforms, naval platforms, space-based platforms, and hybrid platforms. Aerial platforms dominate the market due to the increasing reliance on unmanned aerial vehicles (UAVs) and manned aircraft for surveillance and reconnaissance missions. These platforms are essential in modern warfare for gathering real-time intelligence and providing situational awareness to military commanders. Israel’s advanced UAV capabilities, particularly in surveillance, reconnaissance, and strike operations, contribute significantly to the global demand for aerial platform-based C4ISR systems. This segment is also driven by advancements in autonomous systems, which have revolutionized the role of aerial platforms in military strategies.

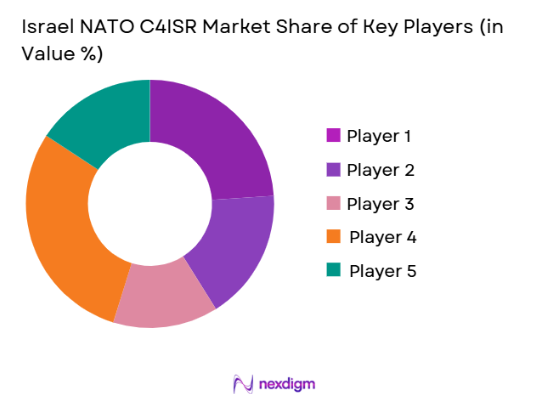

Competitive Landscape

The Israel NATO C4ISR market is dominated by a few major players, including both domestic companies and international defense giants. Companies like Elbit Systems, Israel Aerospace Industries (IAI), and Rafael Advanced Defense Systems play a central role due to their longstanding partnerships with NATO member states and their continuous innovation in military technologies. These companies benefit from Israel’s strong defense technology sector, which allows them to deliver high-quality, cutting-edge solutions for C4ISR systems. Furthermore, global defense contractors such as Lockheed Martin and Raytheon Technologies are key players, bringing in their extensive resources and capabilities for system integration, enhancing the global competitiveness of the market.

| Company Name | Establishment Year | Headquarters | Key Market Specific Parameters |

| Elbit Systems | 1966 | Haifa, Israel | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ |

| Rafael Advanced Defense Systems | 1985 | Haifa, Israel | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ |

Israel NATO C4ISR Market Analysis

Growth Drivers

Geopolitical Tensions and Military Modernization

The primary growth driver of the Israel NATO C4ISR market is the escalating geopolitical tensions, particularly in the Middle East and surrounding regions. With constant shifts in global power dynamics, NATO and Israeli defense forces are focused on ensuring technological superiority. C4ISR systems are central to modern warfare, providing real-time intelligence, surveillance, and command capabilities that are crucial in responding to rapid changes in combat scenarios. Countries are investing heavily in modernizing their military forces, and this trend is especially evident in NATO member states, which are incorporating cutting-edge C4ISR technologies to bolster their defense readiness. As Israel continues to enhance its military capabilities, its expertise in C4ISR solutions influences the broader market, further promoting innovation and adoption by NATO and allied forces.

Technological Advancements in AI and Automation

The integration of Artificial Intelligence (AI) and automation into military systems is transforming the C4ISR market. These technologies improve the efficiency, accuracy, and speed of intelligence gathering, analysis, and dissemination. NATO and Israeli forces are increasingly relying on AI-driven systems for data fusion, predictive analytics, and autonomous decision-making in combat environments. These advancements are pushing the demand for sophisticated C4ISR solutions, as AI and automation enable real-time responses to emerging threats. As these technologies mature, they will continue to drive demand for next-generation C4ISR systems, enhancing overall defense capabilities across global military forces.

Market Challenges

High Cost of Advanced Systems

One of the major challenges facing the Israel NATO C4ISR market is the high cost of deploying advanced systems. Cutting-edge C4ISR solutions require significant investment in both hardware and software, including satellite systems, sensors, communication infrastructure, and command systems. For many countries, especially smaller NATO members or those with limited defense budgets, the cost of maintaining or upgrading these systems presents a significant barrier. While defense spending has been increasing globally, the high cost of advanced technology can restrict access to these systems, limiting the market’s potential for broader adoption in certain regions.

Integration and Interoperability Issues

Another challenge is the integration and interoperability of C4ISR systems across various military platforms. NATO countries operate diverse military systems with different communication standards, sensors, and network architectures. Ensuring seamless integration between these systems while maintaining high operational standards is a complex task. Mismatched technologies, legacy systems, and regional customization requirements can hinder the effective implementation of unified C4ISR solutions across different nations. To achieve interoperability, extensive effort is needed in terms of software and hardware upgrades, training, and coordination, which can slow down the market’s expansion and increase operational costs for defense agencies.

Opportunities

Expansion of Autonomous Systems in Defense

The rise of autonomous systems in military operations presents a significant opportunity for the Israel NATO C4ISR market. Drones, autonomous vehicles, and unmanned systems are increasingly being deployed for surveillance, reconnaissance, and combat missions, and they require sophisticated C4ISR systems to function effectively. This trend is particularly strong within NATO forces, where autonomous systems are becoming integral to operational strategies. As these systems evolve, the need for advanced C4ISR solutions to integrate and control these autonomous platforms will grow. Israel’s leadership in autonomous defense technology positions it as a key player in this emerging market, opening up opportunities for the development and deployment of new C4ISR technologies.

Increasing Investment in Cybersecurity and Digital Warfare

As military forces transition to more digital and networked operations, cybersecurity has become a crucial component of C4ISR systems. The growing threat of cyberattacks on critical infrastructure, especially in defense, presents a significant opportunity to strengthen C4ISR capabilities. NATO and Israel are increasingly investing in cybersecurity technologies to secure communication networks, data transmission, and operational systems. This shift toward digital warfare requires more robust C4ISR systems that can not only collect and disseminate intelligence but also protect it from external threats. The growing emphasis on securing military systems against cyber threats presents a unique opportunity for C4ISR technology providers to innovate and provide solutions that ensure both the reliability and security of military operations.

Future Outlook

Over the next decade, the Israel NATO C4ISR market is expected to continue expanding due to rising global defense budgets and advancements in military technology. This growth will be largely driven by an increase in global geopolitical tensions, which require more robust and integrated defense systems. Countries, especially NATO members, will prioritize the modernization of their military infrastructure, including the adoption of next-generation C4ISR technologies. Additionally, the integration of AI and autonomous systems in defense operations will further drive demand. The future of the market will be characterized by a focus on improving communication and surveillance capabilities while ensuring interoperability among different defense platforms.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Lockheed Martin

- Raytheon Technologies

- Thales Group

- Northrop Grumman

- General Dynamics

- BAE Systems

- Leonardo S.p.A.

- L3 Technologies

- Harris Corporation

- Saab Group

- AeroVironment

- Leonardo DRS

Key Target Audience

- Military forces

- Defense contractors

- Investments and venture capitalist firms

- Government and regulatory bodies

- International defense agencies

- Aerospace and defense manufacturers

- Public sector organizations involved in security and defense

- Defense technology innovators

Research Methodology

Step 1: Identification of Key Variables

This phase involves gathering primary and secondary data to identify key variables influencing the Israel NATO C4ISR market. We compile data from industry databases, official defense reports, and stakeholder interviews to construct a comprehensive ecosystem map of the C4ISR domain.

Step 2: Market Analysis and Construction

In this phase, we collect historical data and evaluate the market’s penetration and revenue potential. The focus will be on identifying patterns in C4ISR system adoption across various global defense sectors, enabling accurate market sizing and trend identification.

Step 3: Hypothesis Validation and Expert Consultation

We validate our market hypotheses through expert interviews with defense analysts, military strategists, and C4ISR system manufacturers. These insights will help refine data accuracy, validate findings, and ensure the reliability of market projections.

Step 4: Research Synthesis and Final Output

The final phase involves consolidating all gathered data into a comprehensive report. We engage directly with industry leaders to confirm product segments, sales figures, and consumer preferences, ensuring that all insights reflect the most current market dynamics.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising geopolitical tensions in the Middle East

Ongoing modernization of military assets in NATO member nations

Technological advancements in communication and surveillance systems - Market Challenges

High cost of advanced C4ISR systems

Integration challenges across different platforms

Regulatory and certification hurdles for cross-border sales - Trends

Adoption of artificial intelligence in military communication systems

Transition toward cloud-based C4ISR solutions

Focus on interoperability between NATO forces

- Market Opportunities

Increased defense spending by NATO allies

Expansion of surveillance systems in unmanned platforms

Growing demand for real-time intelligence capabilities - Government regulations

Compliance with NATO interoperability standards

National security regulations governing defense technology exports

Environmental regulations for military-grade equipment - SWOT analysis

Strength: Strong domestic defense innovation in Israel

Weakness: Dependency on foreign defense contracts

Opportunity: Expansion into emerging markets for defense technologies - Porters 5 forces

Threat of new entrants: Moderate

Bargaining power of suppliers: High

Threat of substitutes: Low

Bargaining power of buyers: Moderate

Industry rivalry: High

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Communication Systems

Command and Control Systems

Surveillance Systems

Electronic Warfare Systems

Sensor Systems - By Platform Type (In Value%)

Land-based Platforms

Aerial Platforms

Naval Platforms

Space-based Platforms

Hybrid Platforms

- By Fitment Type (In Value%)

OEM Fitment

Retrofit/Upgrade Fitment

Custom Fitment

Modular Fitment

Mobile/Deployable Fitment - By EndUser Segment (In Value%)

Military

Government Agencies

Defense Contractors

NATO Member Nations

Private Defense Firms - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

Online Procurement

Government Procurement Programs

Regional Partnerships

- Market Share Analysis

- CrossComparison Parameters(Technology innovation, System reliability, Cost-efficiency, Global reach, Customer support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

IAI ELTA Systems

Lockheed Martin

Raytheon Technologies

Thales Group

General Dynamics

Northrop Grumman

BAE Systems

Leonardo S.p.A.

L3 Technologies

Harris Corporation

Saab Group

AeroVironment

- Demand from military forces seeking real-time intelligence capabilities

- Government agencies investing in next-generation communication infrastructure

- Private firms entering the defense sector through technological innovations

- NATO member nations expanding their digital defense ecosystems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035