Market Overview

The Israel NATO Defense market is a key sector within the global defense industry, reflecting Israel’s strong defense capabilities and strategic role in NATO collaborations. The market size in 2024 is expected to be USD ~billion, driven by increased defense spending and technological advancements. Israel’s reputation for cutting-edge defense technologies, including air defense systems, cybersecurity solutions, and missile defense platforms, has led to its market growth. Key drivers include increased defense budgets from NATO countries and rising demand for advanced military systems, specifically air and missile defense solutions.Israel remains the dominant player in this market due to its technological innovations, strong defense industry, and collaborations with NATO countries. Tel Aviv is at the forefront, being home to Israel’s defense companies such as Elbit Systems and Rafael Advanced Defense Systems. Additionally, NATO member countries such as the United States, Germany, and the UK contribute significantly to the market. The geopolitical importance of these nations in global defense strategies and their continued investments in defense technologies ensures their dominance in this sector.

Market Segmentation

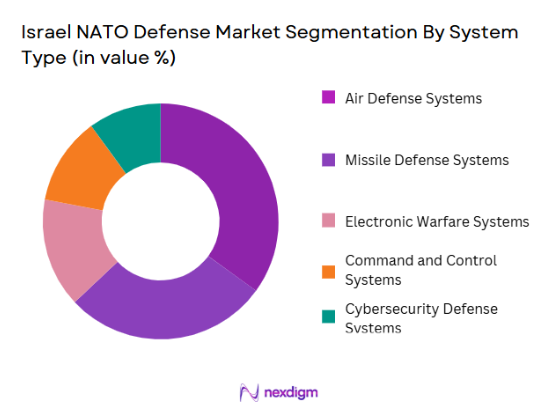

By System Type

The Israel NATO Defense market is segmented by system type into air defense systems, missile defense systems, electronic warfare systems, command and control systems, and cybersecurity defense systems. Among these, air defense systems hold a dominant market share. Israel’s Iron Dome, developed by Rafael, is widely regarded as one of the most effective air defense systems globally, contributing significantly to the dominance of this segment. The system’s advanced technology, including its ability to intercept short-range threats, has been pivotal in both Israeli defense and NATO collaborations. These systems’ proven track record, coupled with increasing demand for robust defense systems from NATO nations, positions air defense as the leading segment in the market.

By Platform Type

The market is also segmented by platform type, which includes land platforms, naval platforms, aerial platforms, space platforms, and C4ISR platforms. Among these, land platforms dominate the market. Israel has a strong defense presence in land-based military systems, such as the Merkava tanks and the Iron Dome missile defense system, which integrates seamlessly with land-based platforms. The strong defense budget, coupled with Israel’s innovations in unmanned systems and defense vehicles, makes land platforms the most dominant in the sector. The increasing need for mobility, rapid deployment, and ground-based defense systems in the Middle East and NATO countries has significantly boosted the market for land platforms.

Competitive Landscape

The Israel NATO Defense market is primarily dominated by major players such as Elbit Systems, Rafael Advanced Defense Systems, and Israel Aerospace Industries (IAI). The market is highly competitive, with these companies focusing on continuous innovation to maintain their market leadership. Israel’s defense sector is highly consolidated, with a few key players holding a significant share of the market. Furthermore, international collaborations with NATO countries have provided these companies with broader market access, expanding their influence beyond Israel.

| Company | Establishment Year | Headquarters | Key Product(s) | Market Focus | Global Presence |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1980 | Haifa, Israel | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ |

Israel NATO Defense Market Analysis

Growth Drivers

Urbanization

Urbanization is a key driver in the Israel NATO Defense market, as it directly influences the demand for advanced defense technologies in urban areas. As cities grow, the need for enhanced security and defense infrastructure increases. Urban areas often become high-value targets, necessitating the implementation of sophisticated defense systems such as air defense, cybersecurity, and surveillance technologies. In Israel, cities like Tel Aviv and Jerusalem are prime examples of urban areas where cutting-edge defense systems are deployed to ensure national security. The increasing complexity of modern warfare, which involves threats from various domains such as cyber-attacks and missile strikes, drives demand for advanced defense solutions tailored to urban environments. Urbanization in NATO member countries also emphasizes the necessity for advanced defense systems that can operate efficiently in densely populated areas, including missile defense systems, electronic warfare, and unmanned vehicles.

Industrialization

Industrialization in both Israel and NATO countries is fueling the demand for advanced defense technologies. The rapid development of the defense industry, characterized by increased production capacities, research and development (R&D), and technological advancements, is pushing the market forward. The adoption of advanced manufacturing techniques, such as 3D printing and automation, is significantly reducing production costs and accelerating innovation in defense equipment. This has allowed Israel to strengthen its position as a leader in defense technology, with companies like Elbit Systems and Rafael being at the forefront of industrializing new defense systems. Moreover, industrialization within NATO countries is driving increased collaboration in defense procurement, strengthening Israel’s role as a supplier of cutting-edge defense systems to the global market. This trend is expected to continue as countries prioritize military modernization to address evolving security threats.

Restraints

High Initial Costs

The high initial costs of advanced defense systems remain a significant restraint in the Israel NATO Defense market. These defense systems require significant capital investment, particularly for air defense, missile defense, and cybersecurity technologies. The development, testing, and deployment of such systems require substantial financial resources, making them less accessible for countries with constrained defense budgets. Israel’s defense industry, while highly advanced, faces challenges in convincing NATO allies to allocate the necessary funds for acquiring these sophisticated systems. For instance, while Israel’s Iron Dome and other air defense systems are highly effective, their cost-per-intercept remains a critical factor limiting widespread adoption, particularly in countries facing economic challenges. Additionally, the need for continual upgrades and system integration increases the lifetime cost of these defense solutions. The high initial investment in defense technologies can deter some countries from procuring these systems, thereby limiting market growth.

Technical Challenges

Technical challenges associated with integrating advanced defense systems into existing military infrastructure present a major restraint in the Israel NATO Defense market. These systems require seamless interoperability with a variety of platforms and technologies, often from different manufacturers and defense contractors. Achieving this level of compatibility is a significant challenge, as the defense systems must work efficiently across land, air, sea, and cyber platforms. The complexity of ensuring that advanced systems like Israel’s Iron Dome or cybersecurity solutions integrate with NATO’s existing technology infrastructure can delay deployment and increase costs. Additionally, the evolving nature of threats, such as cyber warfare and missile technology, demands that defense systems continuously evolve. This constant need for upgrades and adaptations adds another layer of technical complexity, which could hinder market growth and implementation.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for growth in the Israel NATO Defense market. Israel has long been a leader in defense technology, with innovative products such as the Iron Dome, missile defense systems, and advanced UAVs. These technologies are continually evolving, and the integration of artificial intelligence (AI), machine learning (ML), and autonomous systems in defense solutions is opening up new possibilities for the market. For instance, AI-driven cybersecurity systems and autonomous drones offer faster decision-making capabilities and more efficient defense strategies, making them highly attractive to NATO and allied countries. The development of next-generation radar and electronic warfare systems is also enhancing the capabilities of air defense and missile systems. The convergence of various technologies, such as 5G connectivity, AI, and big data analytics, is also expected to lead to more sophisticated defense systems, offering enhanced surveillance, intelligence gathering, and real-time responses to threats. This technological evolution presents a significant opportunity for Israel’s defense industry to expand its market share.

International Collaborations

International collaborations, particularly between Israel and NATO, represent a major opportunity for the Israel NATO Defense market. Israel’s defense industry has consistently played a pivotal role in international defense partnerships, especially with NATO countries. The growing emphasis on joint defense operations, including multi-domain operations that span land, sea, air, and cyberspace, has increased demand for integrated defense solutions. NATO’s commitment to modernizing its military infrastructure and addressing emerging security threats, such as cyberattacks and missile defense, aligns with Israel’s expertise in these areas. Collaborative defense projects, joint military exercises, and technology-sharing agreements between Israel and NATO members open up new avenues for defense contractors in Israel to expand their presence in the global market. Furthermore, Israel’s partnerships with NATO provide access to new markets and customer bases, enabling Israeli defense companies to penetrate previously untapped regions. This international collaboration is expected to play a critical role in shaping the future of the defense industry, creating new revenue streams and growth opportunities for Israeli companies in the global defense ecosystem.

Future Outlook

Over the next decade, the Israel NATO Defense market is poised for substantial growth, driven by technological advancements, growing defense budgets, and ongoing geopolitical tensions. Key drivers include an increased emphasis on cybersecurity, missile defense systems, and multi-domain defense strategies. With the global shift towards modernizing defense systems and increasing joint defense operations, Israel’s technological expertise in defense systems such as the Iron Dome and UAVs will play a critical role in shaping the market. Furthermore, NATO’s increasing collaboration with Israel in defense technology will enhance the prospects of the Israeli defense sector in the global market.

Major Players in the Market

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- Thales Group

- BAE Systems

- General Dynamics

- Leonardo

- Kongsberg Gruppen

- L3 Technologies

- Saab AB

- Leonardo

- Mitsubishi Heavy Industries

Key Target Audience

- Defense contractors and suppliers

- Aerospace manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

- International defense agencies

- Technology and R&D companies focusing on military and defense applications

- Military end-users

- Private defense consultants

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying key variables that affect the Israel NATO Defense market, including geopolitical factors, technological advancements, and defense spending trends. The variables are defined through extensive desk research using secondary sources like government reports, defense agency publications, and defense industry reports.

Step 2: Market Analysis and Construction

In this phase, historical data regarding defense expenditures, military collaborations, and technological advancements is gathered. An analysis of Israel’s defense systems, particularly air defense, missile defense, and UAVs, will provide valuable insights into the market’s past and current trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with experts from defense companies, military agencies, and government bodies. Interviews with industry practitioners and NATO representatives will ensure the reliability and accuracy of the forecasted trends.

Step 4: Research Synthesis and Final Output

The final phase will include synthesizing all collected data and insights, ensuring the data is accurate and comprehensive. Feedback from experts, manufacturers, and government stakeholders will be used to finalize the report’s findings, ensuring a thorough analysis of the Israel NATO Defense market.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense spending by NATO and allied countries

Growing need for cybersecurity and defense against cyber warfare

Technological advancements in missile defense and air defense systems - Market Challenges

High defense budget constraints across NATO members

Complex geopolitical dynamics affecting defense strategies

Technological integration challenges with legacy systems - Trends

Increasing focus on multi-domain operations

Integration of AI and machine learning in defense systems

Emerging importance of joint defense operations between NATO and Israel

- Market Opportunities

Collaborations between Israel and NATO members on defense technologies

Increasing demand for unmanned systems and autonomous defense technologies

Rise of advanced electronic warfare systems - Government regulations

Defense procurement regulations in NATO member countries

Export control regulations for advanced defense technologies

Military interoperability standards between NATO allies - SWOT analysis

Strength: Advanced technological capabilities of Israeli defense systems

Weakness: Dependence on external markets for defense system components

Opportunity: Expansion of defense collaborations with NATO and EU countries - Porters 5 forces

Bargaining power of defense contractors

Threat of new entrants from emerging defense markets

Competitive rivalry among defense technology companies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Air Defense Systems

Missile Defense Systems

Electronic Warfare Systems

Command and Control Systems

Cybersecurity Defense Systems - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Aerial Platforms

Space Platforms

C4ISR Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Upgrades

Modular Fitment

Custom Fitment - By EndUser Segment (In Value%)

Military & Defense Forces

NATO Defense Organizations

Government Agencies

Private Defense Contractors

Security Forces - By Procurement Channel (In Value%)

Direct Procurement

Defense Procurement Agencies

Government Tendering

Private Contractors

International Collaboration

- Market Share Analysis

- CrossComparison Parameters(Defense system reliability, technology integration, procurement cost, geopolitical stability, system adaptability)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

IMI Systems

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Thales Group

BAE Systems

General Dynamics

Saab AB

Leonardo

Kongsberg Gruppen

L3 Technologies

BAE Systems

- Growing demand for advanced defense systems from NATO military forces

- Increased collaboration between Israeli and NATO defense sectors

- Government agencies seeking technological support for border defense

- Private defense contractors focusing on innovative defense technology solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035