Market Overview

The Israel NATO Military Aircraft Modernization and Retrofit Market is driven by the continued need for modernization in both Israel’s and NATO’s military fleets. The market is expected to maintain a steady trajectory as countries prioritize cost-effective solutions to extend the operational life of existing aircraft rather than investing in new fleets. This focus on upgrading avionics, airframes, and weapons systems is essential to meeting evolving defense requirements. As a result, the global market value is rising, reflecting the ongoing demand for specialized modernization solutions tailored to complex military platforms. In 2023, the market was valued at USD ~billion, with a projected market value of USD ~billion in 2024.Dominance in the Israel NATO Military Aircraft Modernization and Retrofit Market is primarily seen in countries with extensive defense capabilities such as the United States, Israel, and several NATO members. These countries lead the market due to their substantial defense budgets, well-established defense infrastructure, and strategic military alliances. Israel, for example, remains a dominant player due to its sophisticated air force and the need for continuous upgrades to maintain its technological edge. NATO countries, benefiting from shared defense initiatives, also play a significant role in shaping market trends, driven by collective defense strategies and increasing military budgets.

Market Segmentation

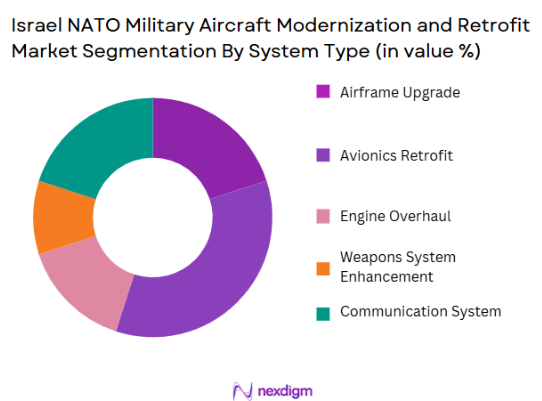

By System Type

The Israel NATO Military Aircraft Modernization and Retrofit Market is segmented by system type into airframe upgrades, avionics retrofit, engine overhaul, weapons system enhancement, and communication system modernization. Among these, avionics retrofit holds a dominant market share. Avionics systems are critical for improving aircraft functionality, safety, and operational capabilities, making this segment indispensable for modern military aircraft. Technological advancements in radar, navigation, and communication systems have led to a surge in demand for avionics upgrades, ensuring compatibility with new military strategies and enhancing the effectiveness of military operations.

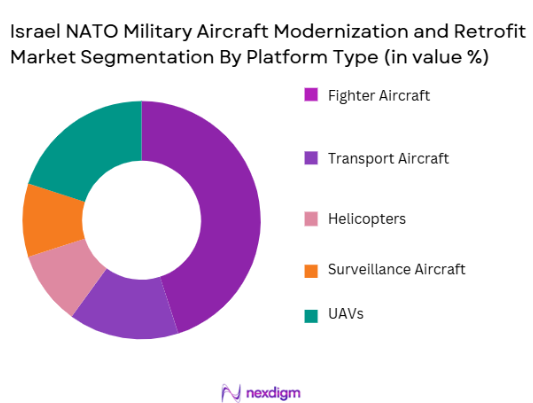

By Platform Type

The market is segmented by platform type into fighter aircraft, transport aircraft, helicopters, surveillance aircraft, and unmanned aerial vehicles (UAVs). Fighter aircraft dominate this segment. The continuous demand for enhanced combat capabilities drives the need for advanced retrofitting in fighter jets. With global geopolitical tensions and the evolution of air combat technology, countries are focusing on modernizing their fighter fleets to ensure they can meet modern threats and maintain air superiority. The dominance of fighter aircraft in this market segment is also supported by the high operational costs and extended service life of these platforms.

Competitive Landscape

The Israel NATO Military Aircraft Modernization and Retrofit Market is dominated by a few major players, including both global defense contractors and regional companies. Key industry players like Lockheed Martin, Northrop Grumman, and Israel Aerospace Industries lead the market due to their extensive experience, technological expertise, and strong relationships with military forces. The consolidation of the market around these companies highlights their significant influence and dominance in the sector.

| Company Name | Establishment Year | Headquarters | Avionics Systems | Airframe Upgrades | Defense Contracts | R&D Investments | Global Presence | Production Capacity |

| Lockheed Martin | 1912 | Bethesda, MD, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | Waltham, MA, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ | ~ |

Israel NATO Military Aircraft Modernization and Retrofit Market Analysis

Growth Drivers

Urbanization

Urbanization plays a significant role in driving the demand for military aircraft modernization and retrofit. As nations, particularly NATO members and Israel, continue to expand their urban infrastructure and defense capabilities, the need to modernize and enhance military technologies becomes more apparent. The growth of urban centers often coincides with increased national security concerns, necessitating stronger defense systems, including air defense. As urban areas grow, countries seek to upgrade their military fleets to ensure that they can protect critical infrastructure and maintain control over key areas, especially in strategic regions. Urbanization also drives the expansion of defense budgets, as governments prioritize security in densely populated areas. This growing focus on urban defense capabilities further fuels the demand for aircraft retrofitting to improve their capabilities in terms of range, speed, and effectiveness in urban warfare environments.

Industrialization

The rapid pace of industrialization, particularly in technologically advanced nations, significantly boosts the Israel NATO Military Aircraft Modernization and Retrofit Market. As countries industrialize, they often increase their military budgets to support both the production and maintenance of advanced weaponry and military assets. The modernization of military aircraft, including avionics systems, engines, and airframes, becomes crucial to keeping up with technological innovations. Industrialization drives the demand for high-tech solutions that can ensure operational effectiveness, particularly in combat scenarios. Additionally, the integration of modern technologies into military aircraft enables greater operational flexibility, allowing forces to meet evolving strategic needs. The combination of industrial growth and advanced military infrastructure pushes for the continuous development of aircraft systems, contributing to the rising demand for aircraft retrofits.

Restraints

High Initial Costs

One of the primary challenges in the Israel NATO Military Aircraft Modernization and Retrofit Market is the high initial costs associated with these projects. Modernizing or retrofitting military aircraft involves significant capital investment, often requiring substantial financial resources for new avionics, engines, and other critical components. This financial burden can limit the ability of some nations, particularly smaller economies or those with constrained defense budgets, to commit to large-scale retrofit projects. The costs of advanced materials, specialized labor, and system integration further contribute to the overall expense, which can delay procurement and modernization efforts. For many defense forces, the decision to modernize fleets rather than procure new aircraft becomes a matter of balancing immediate financial constraints against long-term strategic needs.

Technical Challenges

Technical challenges represent another significant restraint to the growth of the military aircraft modernization and retrofit market. Retrofitting older aircraft with the latest technology often presents compatibility issues, as newer systems may not seamlessly integrate with older airframes or avionics. Upgrading aircraft requires precise engineering to ensure that new components are compatible with existing structures, which can be both time-consuming and costly. Additionally, technical challenges related to system upgrades, such as integrating advanced communication and navigation systems, can impact the reliability and performance of the aircraft. The complexity of the retrofit process demands high levels of expertise and specialized knowledge, making it a challenge for defense contractors to meet modernization timelines and performance expectations.

Opportunities

Technological Advancements

Technological advancements in the defense industry present significant opportunities for the Israel NATO Military Aircraft Modernization and Retrofit Market. The rapid pace of innovation in areas such as avionics, artificial intelligence, machine learning, and unmanned systems provides ample opportunities to enhance the performance of existing military aircraft. Modernizing aircraft with cutting-edge technology can vastly improve operational capabilities, including advanced radar systems, enhanced communication, and improved weapon systems. Additionally, the integration of AI-driven technologies can make aircraft more autonomous and capable of responding to complex combat scenarios in real-time. As nations continue to invest in military technological development, the demand for modernization and retrofit services will grow, creating a robust opportunity for market players to capitalize on.

International Collaborations

International collaborations represent a growing opportunity for the Israel NATO Military Aircraft Modernization and Retrofit Market. Many countries are part of defense alliances, such as NATO, where sharing resources and technology is critical for maintaining operational effectiveness. Collaborative defense efforts often involve joint projects for aircraft upgrades and retrofits, providing access to larger defense budgets and more diverse technological expertise. These collaborations allow for economies of scale in procurement and retrofitting, as well as the sharing of technical know-how between nations. By pooling resources, countries can reduce costs while benefiting from advanced technologies and enhanced aircraft capabilities. Furthermore, such partnerships foster long-term relationships between defense contractors and governments, enabling further opportunities for future modernization projects.

Future Outlook

Over the next decade, the Israel NATO Military Aircraft Modernization and Retrofit Market is expected to witness substantial growth. This growth will be driven by the increasing demand for more advanced and cost-effective upgrades to aging military fleets. As military aircraft ages, the need for modernization to enhance capabilities such as avionics, weapons systems, and communication infrastructure becomes critical. Additionally, advancements in new technologies such as artificial intelligence and unmanned aerial vehicles (UAVs) will further drive demand for retrofits, ensuring that existing fleets are ready for modern combat scenarios.

Major Players

- Lockheed Martin

- Northrop Grumman

- Israel Aerospace Industries

- Raytheon Technologies

- BAE Systems

- General Dynamics

- Honeywell Aerospace

- L3 Technologies

- Leonardo DRS

- Sikorsky Aircraft

- Saab Group

- Collins Aerospace

- Thales Group

- Airbus Defence and Space

- Dassault Aviation

Key Target Audience

- Government agencies

- Aerospace and defense manufacturers

- Military contractors and system integrators

- Investment and venture capitalist firms

- Regulatory bodies

- Commercial defense equipment suppliers

- OEM suppliers

- Private defense companies

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying the major variables driving the Israel NATO Military Aircraft Modernization and Retrofit Market. This involves compiling secondary data from credible sources, including defense agencies, market reports, and financial documents. This will help define the landscape of market drivers and barriers.

Step 2: Market Analysis and Construction

The next phase will involve market construction by examining historical data and current trends. This includes analyzing growth rates, key segments, and demand drivers for modernization services. Additionally, a breakdown of market dynamics, including supply chain analysis, will be integrated to provide a comprehensive overview.

Step 3: Hypothesis Validation and Expert Consultation

Experts in defense technology, military procurement, and aircraft modernization will be interviewed through a combination of CATI and personal interviews. These expert opinions will validate and refine the hypotheses regarding key trends and demand forecasts.

Step 4: Research Synthesis and Final Output

The final phase integrates the data obtained from both primary and secondary sources. These insights will be synthesized into a cohesive research report that is subjected to thorough cross-checking to ensure that the findings are accurate, credible, and actionable for industry stakeholders.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense budgets in NATO and Israel

Advancements in military technology driving retrofit needs

Increased demand for operational longevity of existing aircraft fleets - Market Challenges

High upfront costs of modernization projects

Complexity in retrofitting older aircraft systems

Regulatory hurdles and certification delays

- Trends

Increased emphasis on multi-role aircraft capabilities

Shift towards modular retrofit solutions for cost efficiency

Adoption of 5th generation stealth and avionics technologies

- Market Opportunities

Integration of advanced technologies like AI and cybersecurity

Growing demand for UAVs in modernized fleets

Strategic alliances and partnerships in defense sectors - Government regulations

Compliance with NATO defense standards

Certification requirements for aircraft retrofits

National security regulations regarding military technologies - SWOT analysis

Strength: Strong market demand from NATO member states

Weakness: High cost and extended timelines for retrofitting

Opportunity: Emerging technologies for aircraft communication systems

Threat: Geopolitical instability affecting defense procurement - Porters 5 forces

Threat of new entrants: Low due to high capital requirements

Bargaining power of suppliers: Moderate, especially for advanced avionics

Bargaining power of buyers: High, due to increasing demand for military upgrades

Threat of substitutes: Moderate, with alternatives like new aircraft purchases

Industry rivalry: High due to the presence of established players

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Airframe Upgrade

Avionics Retrofit

Engine Overhaul

Weapons System Enhancement

Communication System Modernization - By Platform Type (In Value%)

Fighter Aircraft

Transport Aircraft

Helicopters

Surveillance Aircraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM Retrofit

Aftermarket Retrofit

Modular Retrofit

Standard Retrofit

Custom Retrofit - By EndUser Segment (In Value%)

Israeli Defense Forces (IDF)

NATO Member States

Defense Contractors

Private Sector Contractors

Government Agencies - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Contracting Agencies

OEM Suppliers

Third-Party Distributors

Private Defense Companies

- Market Share Analysis

- CrossComparison Parameters(Technology adoption rate, retrofit complexity, market share distribution, customer loyalty, pricing strategies)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Lockheed Martin

Northrop Grumman

Raytheon Technologies

BAE Systems

General Dynamics

Honeywell Aerospace

L3 Technologies

Leonardo DRS

Sikorsky Aircraft

Saab Group

Collins Aerospace

Thales Group

Airbus Defence and Space

Dassault Aviation

- IDF’s demand for aircraft upgrades to enhance operational capabilities

- NATO countries’ focus on improving fleet longevity

- Private contractors seeking specialized modernization solutions

- Government agencies focusing on upgrading defense infrastructure

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035