Market Overview

The Israel Naval Ammunition market is valued at USD~ billion, primarily driven by technological advancements in defense systems and increasing naval defense budgets. Key contributors to the market’s growth include the strategic focus on strengthening naval defense capabilities in Israel, ongoing investments in research and development, and the rising demand for advanced ammunition systems. As a result, naval ammunition remains a critical component of Israel’s military readiness, attracting attention from both government and defense contractors to meet the growing needs of the naval sector.

Israel, the United States, and key Middle Eastern nations dominate the Israel Naval Ammunition market. Israel’s defense sector, supported by leading companies such as Rafael Advanced Defense Systems, and international defense partners, propels its dominance in the sector. Moreover, the strategic alliances with other countries, particularly the United States, further bolster Israel’s position in the global naval ammunition market. Regional security concerns and naval power projection in the Mediterranean also play significant roles in this dominance.

Market Segmentation

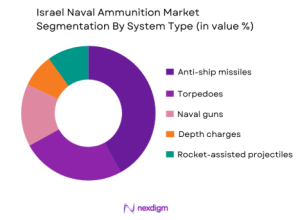

By System Type

The Israel Naval Ammunition market is segmented into Anti-ship missiles, torpedoes, naval guns, depth charges, and rocket-assisted projectiles. Anti-ship missiles dominate the market segment, owing to their essential role in modern naval combat. These missiles are highly valued for their precision and long-range capabilities, making them a preferred choice for defense forces. The continuous improvement in missile technology, coupled with the rising demand for versatile and cost-effective weapons, positions anti-ship missiles as the leading subsegment. Brands like Rafael and IAI have bolstered their market position with advanced missile systems, solidifying the dominance of this segment.

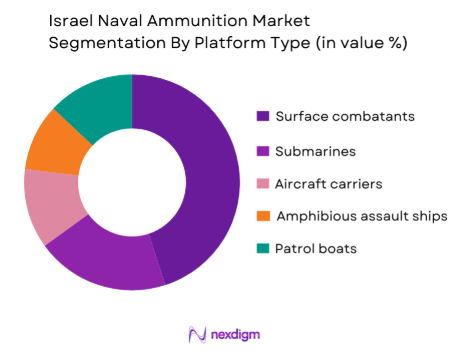

By Platform Type

The Israel Naval Ammunition market is also segmented by platform type, including surface combatants, submarines, aircraft carriers, amphibious assault ships, and patrol boats. Among these, surface combatants hold a dominant position in the market due to their versatility and broader operational deployment. These platforms are extensively used in defense operations, offering a variety of mission profiles, including anti-surface warfare, air defense, and anti-submarine warfare. The integration of advanced ammunition types such as anti-ship missiles and naval guns into surface combatants drives their dominant share in the market.

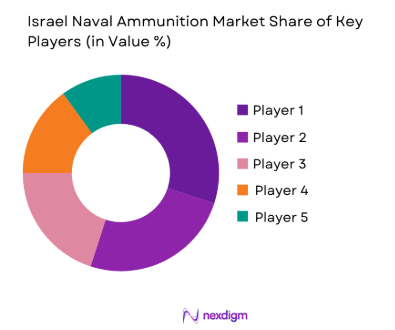

Competitive Landscape

The Israel Naval Ammunition market is consolidated with a few key players leading the space. Companies such as Rafael Advanced Defense Systems, Israel Aerospace Industries (IAI), and Elbit Systems have established themselves as significant contributors, delivering cutting-edge ammunition systems. These companies dominate due to their strong technological capabilities, robust defense contracts, and global defense alliances.

| Company | Establishment Year | Headquarters | Product Range | Market Focus | Technology Advancements | Geographic Reach |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1967 | Lod, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat Hasharon, Israel | ~ | ~ | ~ | ~ |

| Magal Security Systems | 1969 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

Israel Naval Ammunition Market Analysis

Growth Drivers

Technological Advancements in Naval Ammunition Systems

The Israel Naval Ammunition market is significantly driven by the rapid technological advancements in naval weapons systems, particularly in missile technology and guided munitions. With companies like Rafael Advanced Defense Systems and Israel Aerospace Industries leading innovation, Israel has developed state-of-the-art anti-ship missiles, torpedoes, and advanced naval guns. These innovations enhance the precision, range, and effectiveness of naval ammunition, providing Israel’s defense forces with superior firepower and operational flexibility. Furthermore, these technological advancements cater to global demand for high-performance naval ammunition, positioning Israel as a key player in both domestic and international defense markets. This technological edge strengthens Israel’s competitive advantage in the global defense sector, ensuring a strong market presence for naval ammunition systems.

Increasing Defense Budgets in Israel and the Middle East

The growing defense budgets in Israel and neighboring Middle Eastern nations significantly contribute to the expansion of the Israel Naval Ammunition market. Israel’s continued investment in its military infrastructure, including naval defense systems, has resulted in a strong demand for advanced ammunition technologies. The geopolitical tensions in the Middle East, particularly in the Mediterranean region, further drive this demand as nations seek to enhance their naval capabilities to maintain strategic power and security. Israel’s defense spending is focused on both procurement and innovation, ensuring that naval forces are equipped with state-of-the-art weaponry. The rising focus on military readiness in the region ensures long-term growth opportunities for manufacturers of naval ammunition.

Market Challenges

Geopolitical Instability and Regional Conflicts

The Israel Naval Ammunition market faces significant challenges due to the ongoing geopolitical instability in the Middle East. The region’s volatile political climate and frequent conflicts disrupt supply chains and complicate the export of naval ammunition. Moreover, the uncertainty surrounding future military engagements makes it difficult for defense contractors to forecast demand accurately. The political tensions also increase the risk of international sanctions and trade restrictions, which could negatively impact the export of Israeli naval ammunition to foreign markets. Despite these challenges, Israel has maintained a strong defense posture through strategic alliances and adaptability in military procurement, but the persistent volatility remains a significant obstacle to stable market growth.

Regulatory and Export Controls

The Israel Naval Ammunition market is also hindered by strict regulatory and export control measures, which limit the ability to expand globally. Israel has strict government oversight and a complex framework of export laws that govern the sale of defense-related products, including naval ammunition. These controls, designed to prevent the proliferation of advanced weaponry, limit the number of countries that can access Israel’s advanced naval ammunition. Moreover, the regulatory process can be slow, making it difficult for companies to enter new markets or respond quickly to emerging opportunities. While the Israeli government’s defense policies prioritize national security, these regulations pose barriers to the market’s growth, especially in expanding to non-allied nations.

Opportunities

Emerging Naval Defense Contracts in Developing Countries

A significant opportunity for the Israel Naval Ammunition market lies in the increasing demand for naval defense systems in developing nations. Many emerging economies are actively investing in strengthening their naval forces due to growing security concerns, particularly along critical maritime trade routes and coastal areas. Countries in Africa, Asia, and South America are beginning to modernize their defense capabilities, including naval ammunition systems, to deter piracy, secure borders, and protect their economic interests. Israel’s advanced naval technology, including precision-guided missiles and naval guns, is well-suited to meet these demands, creating a lucrative market for Israeli manufacturers. Strategic partnerships and export agreements with developing nations can lead to substantial growth opportunities for Israel’s naval ammunition sector.

Collaborations with Global Defense Alliances

Israel’s strategic position in global defense alliances, especially with the United States and NATO countries, presents a promising opportunity for the Israel Naval Ammunition market. Israel’s reputation as a leader in defense technology makes it a valuable partner for many countries seeking to enhance their naval defense capabilities. Collaborative defense projects, joint ventures, and mutual defense agreements enable the transfer of advanced Israeli naval ammunition systems to international markets. These collaborations provide Israel with access to a broader range of potential customers, including NATO members and other allied nations, fostering growth in both procurement and export of naval ammunition systems. Expanding participation in global defense alliances ensures continued demand and an expanded market reach for Israeli naval ammunition.

Future Outlook

Over the next decade, the Israel Naval Ammunition market is expected to show consistent growth driven by continuous advancements in ammunition technologies, the growing need for naval defense in the Mediterranean and broader Middle East regions, and rising defense budgets globally. Additionally, Israel’s focus on strategic military alliances with the US and European countries will ensure a robust demand for advanced ammunition systems. Israel’s ongoing defense upgrades and the increasing adoption of advanced systems for anti-ship warfare and submarines will propel market expansion.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- Elbit Systems

- IMI Systems

- Magal Security Systems

- Tadiran Communications

- IAI Systems

- Kinneret Aviation

- Ramon Aircraft Industries

- ZIM Integrated Shipping Services

- Milrem Robotics

- Beersheba Defense Industries

- Mekorot Defense Solutions

- Triton Systems

- Magal Security Systems

Key Target Audience

- Defense Ministries and Armed Forces

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Naval Contractors

- Defense Technology Developers

- International Defense Agencies

- Military Research and Development Agencies

- Private Sector Defense Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Israel Naval Ammunition market. Desk research is conducted using a combination of secondary and proprietary databases to identify the key drivers, challenges, and opportunities that shape the market dynamics. This will define the primary variables impacting market growth.

Step 2: Market Analysis and Construction

We analyse historical market data, trends, and consumer behavior patterns to evaluate the Israel Naval Ammunition market. We assess the penetration of ammunition systems across different platforms such as surface combatants and submarines, providing an accurate representation of the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses and refine market models through consultations with industry experts, including defense contractors, naval officers, and ammunition developers. These consultations provide insights into real-time operational challenges, demand forecasts, and technological innovations.

Step 4: Research Synthesis and Final Output

In this phase, we aggregate and synthesize data gathered from primary and secondary sources, including feedback from key industry players. This data is used to produce a comprehensive report that highlights market trends, future forecasts, and actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets in Israel

Growing naval defense capabilities in the Middle East

Technological advancements in ammunition systems - Challenges

High cost of advanced naval ammunition systems

Geopolitical instability affecting supply chains

Regulatory complexities in international sales - Opportunities

Emerging demand for advanced ammunition systems

Increased focus on sustainable and efficient munitions

Collaborations with international defense organizations - Trends

Rise in automation and artificial intelligence for targeting systems

Increased investment in multi-role ammunition platforms

Shift towards environmentally friendly ammunition technologies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Anti-ship missiles

Torpedoes

Depth charges

Naval guns

Rocket-assisted projectiles - By Platform Type (In Value%)

Surface combatants

Submarines

Aircraft carriers

Amphibious assault ships

Patrol boats - By Fitment Type (In Value%)

OEM fitments

Retrofit and upgrades

Modular ammunition systems

Integrated systems

Single-use systems - By End User Segment (In Value%)

Military defense forces

Private naval contractors

Research and development agencies

International defense agencies

Coast guard and border security - By Procurement Channel (In Value%)

Direct procurement from government suppliers

Military auctions

Commercial suppliers

Government-to-government contracts

Private-sector dealers

- Market Share Analysis

- Cross Comparison Parameters (Market growth rate, Market share, Technological innovation, Product pricing, Geographic expansion)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elbit Systems

IAI Systems

IMI Systems

Magal Security Systems

Tadiran Group

Ramon Aircraft Industries

Rafael Advanced Systems

ZIM Integrated Shipping Services

Milrem Robotics

Beersheba Defense Industries

Kinneret Aviation

Triton Systems

Mekorot Defense Solutions

- Adoption of precision-guided naval ammunition

- Growing defense partnerships with international navies

- Rising demand for anti-terrorism naval systems

- Focus on improving ammunition stockpiles and reserves

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035