Market Overview

The Israel Naval Combat Weapons market is valued at approximately USD ~billion in 2024, reflecting the country’s ongoing investment in upgrading and modernizing its naval fleet. Israel’s strategic location in the Middle East and its focus on maintaining a robust defense posture to counter potential regional threats are the primary drivers for the growth of this market. The Israeli military places a high emphasis on acquiring advanced naval combat systems, including missile defense, naval guns, and air defense systems, to enhance its capabilities in the Mediterranean and Red Sea. Furthermore, Israel’s increasing defense budget allocation and the technological sophistication of local defense contractors such as Rafael and Israel Aerospace Industries (IAI) contribute to the steady demand for advanced naval weapons. The combination of geopolitical tensions, regional security challenges, and Israel’s technological expertise in defense systems drives the continuous growth in the naval combat weapons sector.

Israel dominates the naval combat weapons market in the Middle East, with key activity centered in cities such as Tel Aviv, Haifa, and Herzliya. Tel Aviv serves as the economic and defense industry hub, where most defense contractors and military agencies are based. Haifa is home to the primary naval base and shipyards, which are integral to the development and maintenance of Israel’s naval fleet. Herzliya, known for its advanced defense technology companies, plays a significant role in the development of cutting-edge naval combat systems. Additionally, Israel’s close cooperation with international defense powers, including the United States and NATO countries, bolsters its position in the global naval weapons market. The strategic alliances and Israel’s position as a regional leader in defense technology and innovation contribute significantly to its market dominance.

Market Segmentation

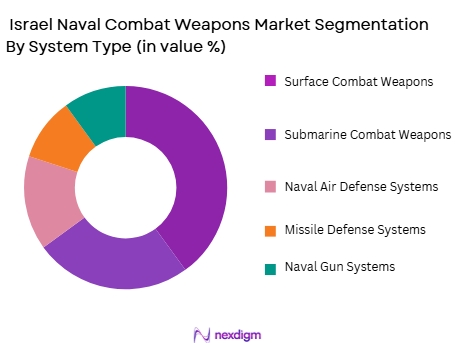

By System Type

The Israel Naval Combat Weapons market is segmented by system type into Surface Combat Weapons, Submarine Combat Weapons, Naval Air Defense Systems, Missile Defense Systems, and Naval Gun Systems. Among these, Missile Defense Systems dominate the market, driven by the increasing threats from regional missile attacks and Israel’s focus on securing its borders. Israel’s development of advanced defense technologies, such as the Iron Dome and David’s Sling systems, plays a pivotal role in this dominance. The strategic importance of missile defense systems is amplified by Israel’s need to protect its naval assets from a growing range of missile threats. These systems are integrated into both surface combatants and submarines, further driving their demand in Israel’s naval fleet modernization efforts. The Israeli Navy’s investment in robust missile defense solutions is a reflection of the country’s emphasis on high-tech, reliable, and effective defense systems.

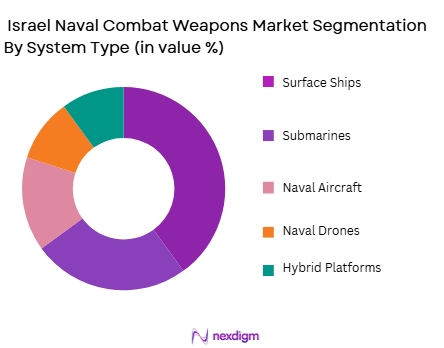

By Platform Type

The Israel Naval Combat Weapons market is also segmented by platform type into Surface Ships, Submarines, Naval Aircraft, Naval Drones, and Hybrid Platforms. Surface Ships are the dominant segment due to Israel’s focus on enhancing the versatility and firepower of its naval fleet. The Israeli Navy operates a variety of surface ships, including missile boats and corvettes, which are critical in defending its coastal waters and maintaining dominance in the Mediterranean. The demand for advanced surface combatants has been bolstered by Israel’s ongoing investment in state-of-the-art systems such as advanced radar, anti-submarine warfare systems, and multi-role missile systems. Furthermore, surface ships are essential for Israel’s maritime security strategy, capable of carrying out both defensive and offensive operations. The importance of surface ships in the Israeli Navy’s defense architecture contributes to their leading position in this market segment.

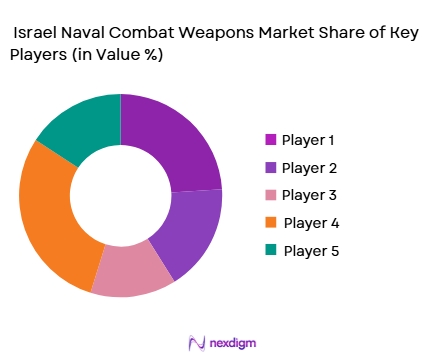

Competitive Landscape

The Israel Naval Combat Weapons market is characterized by the presence of several major players, both local and international. Leading defense contractors, such as Israel Aerospace Industries (IAI), Rafael Advanced Defense Systems, and Elbit Systems, play a crucial role in providing cutting-edge naval technologies. These companies are known for their expertise in missile defense systems, radar technologies, and integrated combat solutions. Israel’s advanced naval capabilities are built on a strong foundation of domestic innovation, supported by strategic partnerships with global defense powers. The Israeli government’s focus on strengthening its national defense systems further promotes the growth of these domestic companies in the global defense market. These companies are vital in shaping the Israeli naval defense landscape, driving technological advancements and contributing to Israel’s global leadership in naval combat systems. Their focus on innovation and their strong ties with the Israeli government ensure they remain competitive in the global defense market.

| Company Name | Establishment Year | Headquarters | Key Product Categories | Market Focus | R&D Investment | Government Contracts |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Herzliya, Israel | ~ | ~ | ~ | ~ |

| Thales Israel | 2000 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Lockheed Martin Israel | 1994 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

Israel Naval Combat Weapons Market Analysis

Growth Drivers:

Geopolitical Tensions and Regional Security Needs

Israel’s naval combat weapons market is significantly driven by the ongoing geopolitical tensions in the Middle East. The country faces multiple security threats, including missile attacks, maritime piracy, and territorial disputes in the Mediterranean and Red Sea. This has prompted Israel to strengthen its naval capabilities, focusing on advanced naval combat systems like missile defense systems, anti-submarine warfare (ASW) technologies, and long-range strike capabilities. The need to safeguard vital maritime routes, as well as protect Israel’s strategic interests, is driving continuous investment in modernizing the naval fleet. As a result, Israel is committed to enhancing its naval defense technologies to ensure dominance over emerging maritime threats.

Technological Advancements and Innovation

Israel has established itself as a global leader in defense innovation, and this is a significant growth driver in its naval combat weapons market. The country is renowned for developing cutting-edge technologies in areas such as missile defense, radar systems, and electronic warfare (EW). The integration of artificial intelligence (AI) and autonomous systems into naval combat weapons systems is revolutionizing the way Israel approaches naval defense. These technological advancements, including systems like the Iron Dome for naval applications, are expected to continue fueling growth in the market, as Israel seeks to maintain technological superiority over adversaries.

Market Challenges:

High Cost of Integration and Maintenance

A major challenge faced by Israel’s naval combat weapons market is the high cost associated with integrating new technologies into existing systems. Modern naval combat systems require advanced software and hardware upgrades, which often demand significant financial resources. Moreover, maintaining these complex systems over their lifecycle can be costly, especially as Israel’s naval fleet is increasingly relying on high-tech systems with sophisticated maintenance requirements. Balancing the need for technological advancements with budget constraints is a continual challenge for the Israeli Ministry of Defense and defense contractors.

Dependency on International Suppliers for Advanced Components

Despite Israel’s advancements in defense technology, the country still faces challenges related to its dependency on international suppliers for certain advanced components, such as radar systems, sensors, and missile technologies. This reliance on foreign suppliers for some critical systems creates vulnerabilities, especially when geopolitical tensions affect the global supply chain. In addition, intellectual property concerns and the transfer of sensitive technology can complicate procurement strategies. To address this, Israel is investing in local capabilities, but the need for cutting-edge components from global defense contractors remains a significant challenge.

Opportunities:

Export Potential for Advanced Naval Combat Systems

One of the major opportunities in Israel’s naval combat weapons market lies in the growing demand for high-tech naval defense systems in other countries. Israel has a strong reputation for developing advanced missile defense, surveillance systems, and naval combat solutions. As regional conflicts persist in the Middle East and beyond, Israel can leverage its technological expertise to export naval combat systems to other nations, particularly those in the Middle East and the Indo-Pacific region. By enhancing its defense export capabilities, Israel can not only boost its defense industry but also strengthen alliances with countries looking to modernize their naval forces.

Collaboration with International Defense Contractors

Israel has the opportunity to expand its naval defense capabilities through collaborations with international defense contractors, including companies from the United States, Europe, and other allies. These partnerships can help Israel access the latest technologies and innovative solutions in the naval combat sector, such as advanced missile systems, radar technologies, and artificial intelligence-based systems. Collaborations can also lead to joint production agreements, technology transfer, and co-development of next-generation naval combat systems, thereby strengthening Israel’s defense posture while enhancing the country’s position as a global leader in naval combat technology.

Future Outlook

Over the next decade, the Israel Naval Combat Weapons market is expected to experience substantial growth, driven by continued investments in advanced technologies and a rising emphasis on naval security. Israel’s geopolitical challenges and strategic location in the Middle East continue to fuel demand for high-tech, reliable defense systems. The market will likely benefit from advancements in autonomous systems, artificial intelligence (AI), and next-generation missile defense technologies. As regional tensions persist, Israel’s commitment to modernizing its naval fleet will contribute to long-term growth in the naval combat weapons market.

Major Players

- Israel Aerospace Industries (IAI)

- Rafael Advanced Defense Systems

- Elbit Systems

- Thales Israel

- Lockheed Martin Israel

- Raytheon Israel

- BAE Systems Israel

- Saab Israel

- Northrop Grumman Israel

- L3 Technologies Israel

- General Dynamics

- Israel Shipyards

- Mitsubishi Heavy Industries Israel

- Navantia Israel

- Kongsberg Gruppen

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Israeli Navy

- Defense Contractors

- Naval Technology Manufacturers

- Private Sector Security Companies

- International Defense Forces

- Government Defense Procurement Agencies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical factors influencing the Israel Naval Combat Weapons market, including advancements in technology, defense spending, and regional security dynamics. This step relies on desk research using secondary data sources such as industry reports and government publications.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data related to naval procurement, technological developments, and defense budgets. Market segmentation by system and platform type is also explored to understand the various drivers and challenges in the industry.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses regarding the market’s growth, challenges, and trends are validated through consultations with industry experts, naval contractors, and government officials. These consultations provide deeper insights into operational practices, procurement cycles, and technological needs.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from secondary and primary research to create a comprehensive and accurate market report. Expert feedback and product segment performance are used to refine estimates and provide reliable market insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in missile defense and naval systems

Israel’s strategic focus on enhancing defense capabilities

Geopolitical security concerns driving investment in naval systems - Market Challenges

High integration costs of advanced naval combat systems

Dependency on international suppliers for advanced technologies

Complexity in maintaining advanced naval systems - Market Opportunities

Collaborations with global defense contractors for innovation

Rising demand for export of advanced naval systems

Increased investment in autonomous systems and AI integration - Trends

Adoption of AI in naval combat systems

Increasing demand for advanced missile defense capabilities

Rising use of unmanned naval systems - Government regulations

Israel Defense Forces (IDF) procurement policies

National Security Strategy and Naval Procurement Guidelines

Israeli Defense Export Control Regulations - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Surface Combat Weapons

Submarine Combat Weapons

Naval Air Defense Systems

Missile Defense Systems

Naval Gun Systems - By Platform Type (In Value%)

Surface Ships

Submarines

Naval Aircraft

Naval Drones

Hybrid Platforms - By Fitment Type (In Value%)

New Installations

Upgrades

Retrofits

Modular Systems

Custom Integrations - By EndUser Segment (In Value%)

Israeli Navy

Defense Contractors

Government Agencies

Private Sector / Civilian Applications

International Defense Forces - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Resellers

Online Platforms

Government Tenders

OEMs

- Cross Comparison Parameters (Technological innovation, Integration with legacy systems, Cost of procurement, Regional security dynamics, Supplier diversification)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Elbit Systems

Thales Israel

Saab Israel

Lockheed Martin Israel

Raytheon Israel

BAE Systems Israel

General Dynamics

Navantia Israel

Northrop Grumman Israel

Kongsberg Gruppen

L3 Technologies Israel

Israel Shipyards

Mitsubishi Heavy Industries Israel

- Israeli Navy’s increasing reliance on modern naval combat systems

- Government agencies’ focus on national defense security

- Private sector investment in defense technology innovation

- International defense collaborations and partnerships

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035