Market Overview

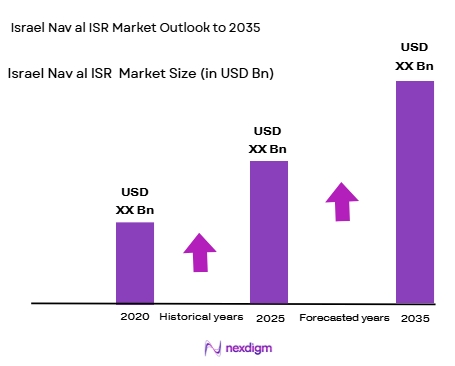

The Israel Naval ISR market, valued at USD ~billion in 2024, is driven by continuous advancements in defense technologies, significant investments from both government and private sectors, and the growing need for advanced maritime surveillance. With increasing security concerns in the Middle East and the broader region, Israel’s strong defense industry invests heavily in ISR (Intelligence, Surveillance, and Reconnaissance) technologies. The demand for robust, real-time data to combat threats and the increasing complexity of maritime security solutions are key factors accelerating market growth. Rising defense budgets and strategic international alliances have been instrumental in shaping the market’s expansion.

Israel is the dominant player in the Naval ISR market due to its strong defense sector, technological advancements, and strategic geopolitical location. Other prominent countries such as the United States and several European nations, including the UK and France, also contribute significantly to the global demand for advanced ISR systems. These countries leverage their technological prowess and maintain active naval operations in global waters, necessitating robust ISR capabilities. Israel’s major cities such as Tel Aviv, where defense companies like Israel Aerospace Industries and Elbit Systems are headquartered, further enhance the country’s dominance in the naval ISR market.

Market Segmentation

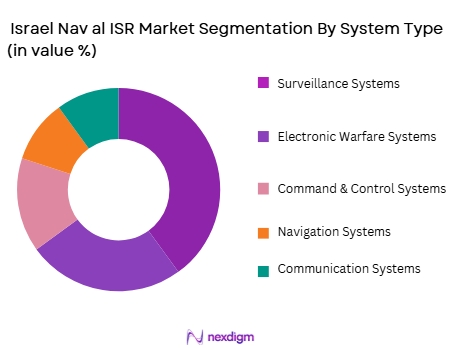

By System Type

The Israel Naval ISR market is segmented into various system types, including surveillance systems, electronic warfare systems, command and control systems, navigation systems, and communication systems. The surveillance systems segment holds a dominant market share, largely due to their essential role in ensuring real-time situational awareness in maritime operations. Surveillance systems enable the detection, identification, and tracking of both surface and submerged threats, which is critical for national defense and counterterrorism efforts. Israel, with its strategic naval operations, heavily invests in these systems, making them integral to the country’s defense strategies.

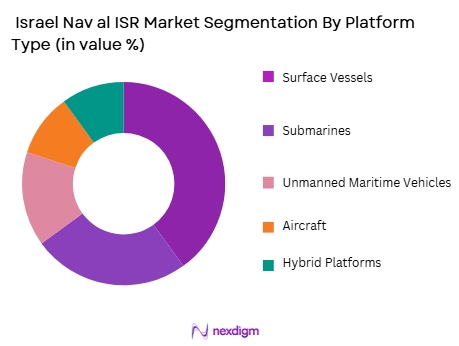

By Platform Type

The Israel Naval ISR market is also segmented by platform type, which includes surface vessels, submarines, unmanned maritime vehicles (UMVs), aircraft, and hybrid platforms. Surface vessels have a dominant market share in 2024, driven by their multifaceted role in naval defense. These platforms serve as the backbone of Israel’s naval operations, enabling the deployment of various ISR systems to monitor large maritime zones. Additionally, Israel’s advanced naval ships, such as Sa’ar-class corvettes, are equipped with state-of-the-art ISR technologies, reinforcing the dominance of surface vessels in the market.

Competitive Landscape

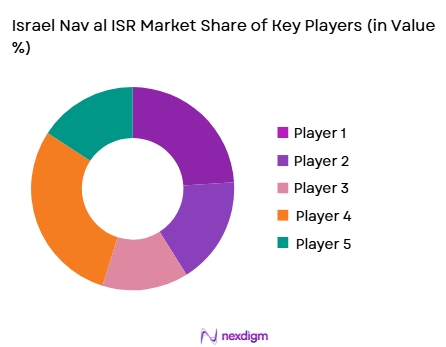

The Israel Naval ISR market is highly competitive, with a few major players controlling the majority of the market. Companies like Israel Aerospace Industries, Elbit Systems, and Rafael Advanced Defense Systems dominate the industry, leveraging years of expertise in defense technology and their strategic position within Israel’s defense industry. These companies focus on providing integrated solutions for naval ISR, encompassing both hardware and software components. The market’s competitive landscape highlights the significant role of these players, as well as the growing demand for technological advancements in maritime defense systems.

Competitive Landscape Table

| Company | Establishment Year | Headquarters | Product Portfolio | Technology Integration | Global Presence | Research & Development Investment | Government Collaborations | Defense Contracts |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Naval ISR Market Analysis

Growth Drivers

Increased Geopolitical Tensions and Defense Spending

The growing geopolitical instability in the Middle East and surrounding regions is a major growth driver for the Israel Naval ISR market. Israel’s strategic location and its complex security environment necessitate constant upgrades to its naval defense systems, particularly in intelligence, surveillance, and reconnaissance. As Israel faces growing threats from neighboring nations and non-state actors, the demand for advanced ISR technologies has risen significantly. Defense spending by Israel’s government remains high, with continuous investment in developing sophisticated ISR systems to ensure maritime security. The country’s naval forces rely heavily on ISR technologies for real-time surveillance, threat detection, and intelligence gathering in both national and international waters. As global tensions in the region persist, Israel will continue to allocate substantial resources to maintain its edge in naval defense capabilities, which fuels demand for the latest ISR systems. Furthermore, collaborations with international partners such as the United States also help enhance the technological sophistication of Israel’s naval ISR systems, positioning them at the forefront of the global market.

Technological Advancements in ISR Systems

The rapid pace of technological innovation in ISR systems plays a pivotal role in driving the growth of the Israel Naval ISR market. Advances in artificial intelligence (AI), machine learning, big data analytics, and sensor technologies have significantly enhanced the capabilities of naval ISR systems. These technologies enable better detection, classification, and tracking of targets in real-time, improving the overall effectiveness of ISR operations. Israel has been at the forefront of integrating cutting-edge technologies such as unmanned aerial vehicles (UAVs), autonomous underwater vehicles (AUVs), and advanced radar systems into its naval defense strategies. The integration of AI and data analytics into ISR platforms allows for faster decision-making and more efficient resource allocation, which is crucial in defense operations. With ongoing research and development efforts by key players like Israel Aerospace Industries and Elbit Systems, Israel’s naval ISR systems continue to evolve, offering more advanced features and greater capabilities. The continuous development of these technologies positions Israel as a leader in the global naval ISR market, attracting interest from other countries looking to enhance their maritime surveillance and defense capabilities.

Market Challenges

High Capital and Maintenance Costs

One of the key challenges in the Israel Naval ISR market is the high cost of deploying and maintaining advanced ISR systems. These systems, which include surveillance satellites, radars, sonar systems, and unmanned platforms, are costly to acquire, integrate, and maintain over their operational life. The capital-intensive nature of these systems can be a barrier, especially for smaller nations or naval forces operating with limited defense budgets. Moreover, the maintenance of such sophisticated systems requires specialized skills and continuous investment in technological upgrades to ensure their reliability and effectiveness. Israel’s defense budget is extensive, but the ongoing need for innovation and system upgrades creates a financial burden. While defense spending in Israel remains high, the costs associated with maintaining and upgrading ISR technologies often require careful budget management. As a result, Israel must continue to balance its defense investments to ensure its naval ISR systems remain state-of-the-art without overextending its financial resources.

Integration and Interoperability Issues

The complexity of integrating various ISR technologies and ensuring their interoperability within a cohesive defense network presents another significant challenge for the Israel Naval ISR market. As Israel continues to adopt more advanced and diverse ISR systems, the challenge of seamlessly integrating these systems becomes more pronounced. Different platforms, including surface vessels, submarines, and unmanned systems, often require unique software and hardware configurations, making integration complex and time-consuming. Furthermore, ensuring these systems can operate in unison to provide accurate and real-time data is essential for effective maritime defense operations. Israel’s defense sector faces the added challenge of ensuring that these diverse systems are compatible with those of its international allies, as many collaborative defense initiatives require interoperability across different nations’ defense technologies. As the market grows and more advanced technologies emerge, ensuring that Israel’s ISR systems can communicate and operate efficiently within a broader defense ecosystem will be crucial for maintaining its competitive edge in naval defense.

Opportunities

Expansion of Autonomous and Unmanned Systems

One of the most promising opportunities in the Israel Naval ISR market is the expansion of autonomous and unmanned systems. Unmanned aerial vehicles (UAVs), unmanned underwater vehicles (UUVs), and unmanned surface vehicles (USVs) are increasingly being integrated into Israel’s naval ISR operations. These autonomous systems offer significant advantages in terms of cost-effectiveness, flexibility, and the ability to operate in dangerous or high-risk environments without endangering human lives. Israel’s defense industry is already a leader in developing autonomous systems for various applications, and this trend is expected to continue growing. The increasing reliance on unmanned systems for intelligence gathering, surveillance, and reconnaissance will enable Israel to extend its naval ISR capabilities while reducing the logistical and operational burden associated with manned platforms. This also presents a significant opportunity for Israel to export its advanced autonomous systems to other countries, further strengthening its position as a global leader in naval ISR technology. As technological advancements continue, the market for unmanned and autonomous ISR systems will expand, driving new opportunities for innovation and growth in the Israel Naval ISR sector.

International Collaboration and Export Opportunities

Another key opportunity for the Israel Naval ISR market lies in international collaboration and export potential. Israel’s defense sector has long benefited from strategic partnerships with global powers such as the United States, Europe, and several Middle Eastern countries. These partnerships have fostered technological exchange and co-development of advanced ISR systems. As countries around the world increasingly prioritize maritime security in response to rising global threats, there is growing demand for sophisticated ISR solutions. Israel’s reputation as a leader in defense technologies, coupled with its established relationships with key global defense agencies, positions it well to meet this rising demand. Furthermore, Israel’s ability to develop tailor-made solutions for specific national defense needs opens up significant export opportunities for its ISR systems. This not only allows Israel to strengthen its defense industry but also enhances its geopolitical influence by providing critical technologies to allied nations. As more countries look to modernize their naval defense capabilities, Israel’s export potential in the ISR market is expected to increase, presenting a significant growth opportunity in the coming years.

Future Outlook

Over the next decade, the Israel Naval ISR market is expected to grow significantly, driven by continuous advancements in defense technologies, an increased focus on cybersecurity, and a rising need for more sophisticated surveillance systems. Israel’s strategic location in the Middle East, coupled with escalating security threats, will further propel demand for robust ISR solutions. Additionally, increasing investments from the government and private sector into unmanned maritime platforms and the development of autonomous systems will be major contributors to market growth. As technological innovation continues, Israel will remain a key player in driving the future direction of the naval ISR industry.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Lockheed Martin

- Thales Group

- Raytheon Technologies

- BAE Systems

- L3 Technologies

- General Dynamics Mission Systems

- Leonardo

- Northrop Grumman

- Saab AB

- Harris Corporation

- Huntington Ingalls Industries

- Navantia

Key Target Audience

- Defense Ministries

- Naval Forces

- Government Agencies

- Investments and Venture Capitalist Firms

- Military Technology Providers

- Security and Surveillance Contractors

- Government and Regulatory Bodies

- System Integrators for Naval Platforms

Research Methodology

Step 1: Identification of Key Variables

In this phase, we will construct an ecosystem map of the Israel Naval ISR market, encompassing all major stakeholders such as defense contractors, government agencies, and technology providers. Data will be collected from primary and secondary sources, ensuring the identification of critical market drivers, challenges, and trends that influence the market.

Step 2: Market Analysis and Construction

This step involves compiling and analyzing historical data of the Israel Naval ISR market, including the growth rate, system types, platform types, and government expenditure on defense technologies. Data will be collected from both open-source publications and proprietary research to ensure comprehensive insights.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to the market growth drivers and challenges will be tested through expert interviews. This phase will involve discussions with industry leaders and professionals in the defense sector, ensuring that the market insights are both accurate and relevant to current market dynamics.

Step 4: Research Synthesis and Final Output

The final phase focuses on synthesizing the collected data and expert insights. The research team will interact with manufacturers, suppliers, and end-users to validate the research findings, ensuring that the final report provides a comprehensive and detailed overview of the Israel Naval ISR market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising geopolitical tensions in the Middle East

Increased defense budgets and naval investments

Advances in ISR technology integration - Market Challenges

High capital investment and maintenance costs

Complexities in system integration and interoperability

Vulnerabilities to cyber threats and electronic warfare - Market Opportunities

Development of autonomous naval ISR systems

Growing demand for multi-platform ISR integration

Expansion of naval ISR capabilities in emerging markets - Trends

Adoption of AI and machine learning in naval ISR systems

Increased focus on unmanned systems for maritime surveillance

Integration of naval ISR with national defense networks - Government regulations

Naval defense regulations for ISR equipment

Export control laws on advanced ISR systems

International maritime security agreements - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tie,2020-2025

- By System Type (In Value%)

Surveillance Systems

Electronic Warfare Systems

Command & Control Systems

Navigation Systems

Communication Systems - By Platform Type (In Value%)

Surface Vessels

Submarines

Unmanned Maritime Vehicles

Aircraft

Hybrid Platforms - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Modular Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Defense Forces

Coast Guard Agencies

Research Organizations

Private Security Contractors

Naval Operators - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Government Contracts

Private Sector Contracts

Online Platforms

- Cross Comparison Parameters (Price, Technology Adoption, System Integration, After-sales Service, Regulatory Compliance, here are additional Cross Comparison Parameters for the Israel Naval ISR market, Price, Technology Adoption, System Integration, After-sales Service)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Raphael Advanced Defense Systems

General Dynamics Mission Systems

Northrop Grumman

Lockheed Martin

BAE Systems

Leonardo

Thales Group

L3 Technologies

Raytheon Technologies

Harris Corporation

Huntington Ingalls Industries

Saab AB

Navantia

- Demand for advanced ISR solutions from defense agencies

- Growing need for real-time data sharing and communication

- Shift towards unmanned and autonomous naval systems

- Rising focus on cybersecurity and data protection in ISR systems

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035