Market Overview

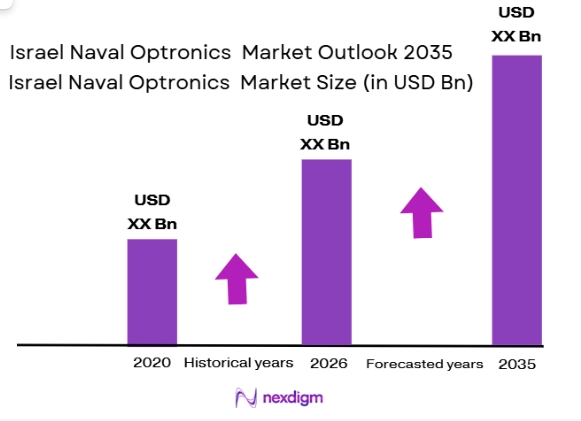

The Israel Naval Optronics Market is valued at approximately USD ~ billion in 2024, supported by the country’s continued investment in its defense capabilities. Israel’s defense budget in 2024 exceeded USD~ billion, with a significant portion directed towards naval defense modernization. The demand for advanced optronics technologies such as infrared sensors, electro-optical systems, and sonar technologies is driven by Israel’s strategic need for enhanced surveillance, reconnaissance, and targeting capabilities, particularly in the Mediterranean and surrounding regions where security challenges remain prominent.

These investments are critical for maintaining Israel’s competitive edge in modern naval warfare.Israel, with Tel Aviv and Haifa as key hubs for defense technology, dominates the naval optronics market. Tel Aviv, as the heart of Israel’s defense innovation, houses leading defense contractors, including Rafael Advanced Defense Systems and Israel Aerospace Industries (IAI). Haifa is home to Israel’s naval port and serves as a center for the development and integration of naval defense systems, including advanced optronics. Israel’s dominance is attributed to its strong military infrastructure, regional security needs, and its expertise in cutting-edge defense technologies, which positions it as a global leader in naval optronics.

Market Segmentation

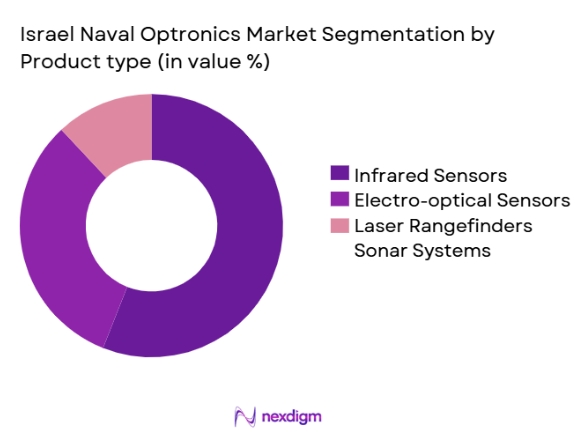

By Product Type

The Israel Naval Optronics Market is segmented into infrared sensors, electro-optical sensors, laser rangefinders, and sonar systems. Among these, infrared sensors hold the largest market share due to their essential role in naval surveillance and targeting, especially in low-visibility conditions. Israel’s advanced infrared optronics, such as thermal imaging systems, are crucial for identifying targets at long ranges, providing a significant tactical advantage in naval warfare. This technology’s demand is further amplified by the Israeli Navy’s focus on maintaining surveillance in the Mediterranean Sea, where visibility can often be obstructed by weather conditions.

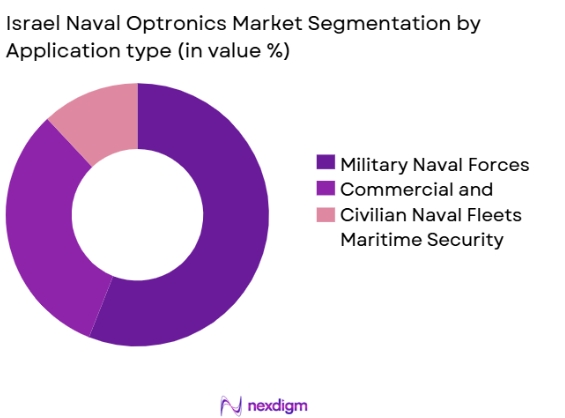

By Application

The market is further segmented by application into military naval forces, commercial and civilian naval fleets, and maritime security. The military naval forces segment dominates due to Israel’s substantial focus on enhancing its naval defense capabilities. Israel’s strategic need for advanced optronics systems to support its military operations, particularly for surveillance, reconnaissance, and targeting in regional conflicts, drives this dominance. Israel’s military forces rely heavily on integrated optronics systems for the detection of underwater and aerial threats, making this segment the largest in the market.

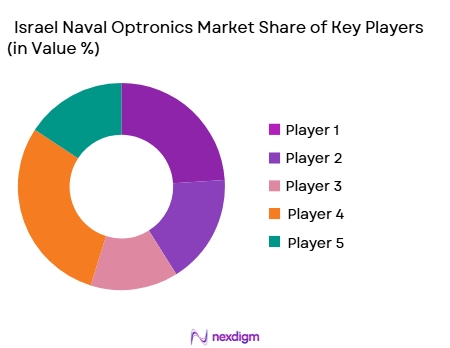

Competitive Landscape

The Israel Naval Optronics Market is competitive, with several prominent companies leading the development and supply of advanced naval optronics systems. Rafael Advanced Defense Systems, Israel Aerospace Industries (IAI), and Elbit Systems are the primary players, providing a wide range of naval surveillance and targeting systems. These companies leverage Israel’s strong defense infrastructure and technological expertise, allowing them to maintain a dominant position in both domestic and international markets. Israel’s continued investment in defense technologies and its strategic need for advanced optronics ensure that these companies remain at the forefront of the market.

| Company Name | Year Established | Headquarters | Core Products | Technology Strengths | Key Markets of Influence |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ |

Israel Naval Optronics Market Analysis

Growth Drivers:

Increasing Naval Defense Budgets

Israel’s defence budget in 2024 exceeded USD ~ billion, with a significant portion dedicated to naval defense modernization, supporting the development and acquisition of advanced optronics systems. The Israeli government continues to prioritize naval defense, especially as the regional security situation in the Middle East remains volatile. As part of its defense strategy, Israel has increased investments in technologies that enhance surveillance, reconnaissance, and targeting capabilities. The continued growth of Israel’s defense budget ensures the sustained demand for advanced naval optronics systems to maintain its competitive advantage in the region.

Technological Advancements in Naval Optronics

Israel is at the forefront of technological innovation in the defense sector, particularly in the field of naval optronics. The Israeli Defense Forces (IDF) have made significant strides in integrating advanced infrared sensors, electro-optical systems, and laser rangefinders into naval platforms. In 2024, Israel’s Ministry of Defense invested heavily in upgrading the country’s naval fleet, with a focus on incorporating the latest in optronic systems for enhanced surveillance and targeting. These technological advancements are vital for Israel’s strategic needs, ensuring that its naval forces are equipped with the most advanced and capable systems available.

Market Challenges

High Production and Integration Costs

The integration and production of advanced naval optronics systems come with significant costs, primarily due to the complexity of the technology and the need for precise calibration and integration with other naval systems. The cost of infrared sensors, electro-optical systems, and sonar technologies is high due to their specialized components and the research and development required to maintain cutting-edge capabilities. Additionally, as Israel’s naval fleet modernizes, the integration of these systems into existing platforms adds another layer of expense, posing a challenge for maintaining cost-effective procurement strategies.

Complex Regulatory Environment for Military Technologies

The regulatory environment surrounding military technologies in Israel is complex and evolving, creating challenges for companies involved in developing and deploying naval optronics systems. Strict export controls and compliance requirements govern the distribution of sensitive technologies, which can delay procurement timelines. In addition, the integration of optronics systems with other defense technologies must adhere to both national and international regulations, including military export guidelines. These regulatory hurdles increase the complexity of entering international markets and limit the speed of technological adoption and integration within Israel’s naval forces.

Opportunities

Rising Demand for Autonomous Naval Systems

The demand for autonomous naval systems is increasing, and Israel is making substantial investments in this area. Autonomous systems, such as unmanned underwater vehicles (UUVs) and autonomous surface vessels, are increasingly being integrated with advanced optronics to enhance surveillance, reconnaissance, and defensive capabilities. Israel’s Ministry of Defense is focused on incorporating these systems into its naval fleets, as evidenced by investments in autonomous ship and submarine technologies. These systems rely heavily on advanced optronics, creating significant opportunities for growth in this segment of the market.

Growing Investments in Naval Modernization Programs

Israel’s naval modernization programs are driving substantial investments in advanced optronics technologies. The Israeli Navy has committed to upgrading its fleet, including the acquisition of advanced infrared sensors, electro-optical systems, and sonar technologies. In 2024, Israel’s Defense Ministry allocated significant funding to modernize the Navy, which includes the replacement of older systems with state-of-the-art optronics platforms. This investment is poised to continue growing as Israel strengthens its naval capabilities, particularly in areas of surveillance and targeting to maintain its regional military advantage.

Future Outlook

The Israel Naval Optronics Market is expected to experience substantial growth over the next several years, driven by Israel’s continued focus on strengthening its naval capabilities. The increasing reliance on autonomous systems, the development of multi-function optronics systems, and Israel’s expanding defense budget are key factors that will contribute to the market’s growth. As regional threats evolve and the need for precision surveillance and targeting increases, Israel’s naval forces will continue to integrate more advanced optronics solutions to maintain strategic superiority in the Mediterranean and surrounding areas.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Thales Group

- Lockheed Martin

- Northrop Grumman

- Saab AB

- BAE Systems

- Leonardo S.p.A

- L3 Technologies

- General Dynamics

- Raytheon Technologies

- General Electric

- Honeywell International

- Mitsubishi Heavy Industries

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military Contractors

- Naval Research Institutions

- Aerospace and Defense Manufacturers

- Naval Defense Agencies

- Shipbuilding Companies

- Maritime Security Agencies

Research Methodology

Step 1: Identification of Key Variables

This step involves understanding the ecosystem of the Israel Naval Optronics Market by identifying all key players, technologies, and market drivers. It includes analyzing government defense strategies and technology trends to define the critical elements influencing the market.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed to track the growth and adoption of various optronic systems, such as infrared and electro-optical sensors. The market construction also involves examining defense expenditure trends and naval modernization programs to forecast market growth.

Step 3: Hypothesis Validation and Expert Consultation

We develop market hypotheses and validate them by conducting expert consultations with naval optronics manufacturers, defense personnel, and key stakeholders within the Israeli naval defense ecosystem. These insights help refine the assumptions and projections made during the analysis phase.

Step 4: Research Synthesis and Final Output

Finally, a comprehensive report is synthesized by gathering and analyzing all data points, including product adoption rates, end-user applications, and competition analysis. This phase also includes validating the information through interviews and surveys with industry professionals to ensure the report is accurate and actionable.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Naval Defense Spending

Technological Advancements in Optronic Systems

Geopolitical Tensions and Naval Expansion - Market Challenges

High Costs of Advanced Systems

Integration Complexities with Existing Naval Platforms

Dependence on Government Contracts and Regulations - Market Opportunities

Growth in Unmanned Naval Platforms

Increasing Demand for Surveillance and Reconnaissance

Collaborations and Joint Ventures with Global Naval Powers - Trends

Rise in Autonomous Naval Systems

Advancements in Multi-spectral Imaging

Adoption of Artificial Intelligence for Target Detection - Government Regulations

International Export Control Regulations

Government Procurement Policies

Naval Defense Technology Standards - SWOT analysis

- Porters 5 Forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Electro-optical Systems

Infrared Sensors

Laser Systems

Night Vision Systems

Marine Surveillance Systems - By Platform Type (In Value%)

Surface Vessels

Submarines

Aircraft

Unmanned Aerial Vehicles (UAVs)

Helicopters - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Retrofit

Upgrade

Replacement

Maintenance - By EndUser Segment (In Value%)

Naval Forces

Coast Guard

Private Marine Operators

Research Organizations

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Purchases

International Defense Contracts

Distributor Partnerships

- Cross Comparison Parameters (Technology Integration Level, Cost Efficiency, System Reliability, Compatibility with Existing Platforms, Customer Support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries (IAI)

Tadiran Communications

Opgal Optronic Industries

IWI Ltd.

Magal Security Systems

Waterfall Security Solutions

Sintec Optronics

Camero-Tech Ltd.

Chemring Countermeasures

Aeronautics Ltd.

Plasan Sasa

Meprolight Ltd.

Smart Shooter Ltd.

- Adoption of Advanced Optronics by Israel’s Navy

- Integration with Emerging Naval Platforms

- Demand for Real-time Surveillance and Imaging

- Private Sector’s Interest in Naval Security

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035