Market Overview

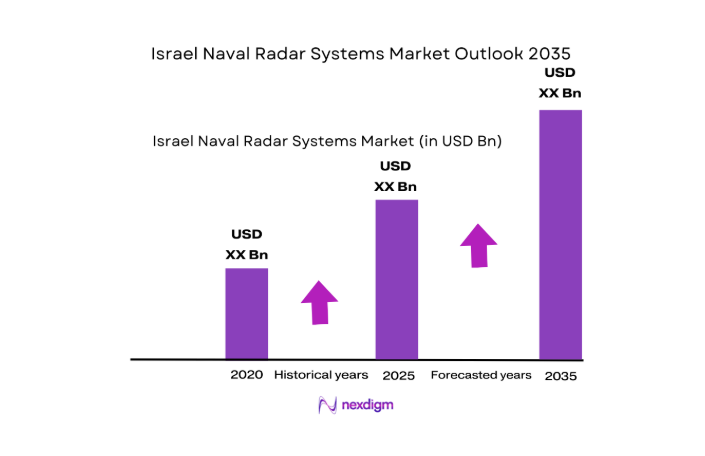

The Israel Naval Radar Systems market is valued at approximately USD ~, based on a five-year historical analysis. This market is driven by Israel’s strategic focus on naval defense, technological advancements in radar systems, and the growing demand for enhanced maritime security. The Israeli defense industry, especially companies like Israel Aerospace Industries and Rafael Advanced Defense Systems, leads the market through innovation in radar technologies that support advanced surveillance, threat detection, and anti-submarine warfare capabilities. The Israeli government’s continuous investment in upgrading its naval fleet further fuels the demand for these sophisticated systems.

Israel dominates the naval radar systems market due to its advanced defense technology sector, with key cities such as Haifa and Tel Aviv being hubs for defense innovation. The country’s strategic location, significant naval operations, and focus on defense spending enable it to stay at the forefront of radar technology development. Additionally, countries like the United States and European nations rely on Israel for advanced radar systems due to their collaboration on defense technologies, ensuring Israel’s influence and leadership in the global market.

Market Segmentation

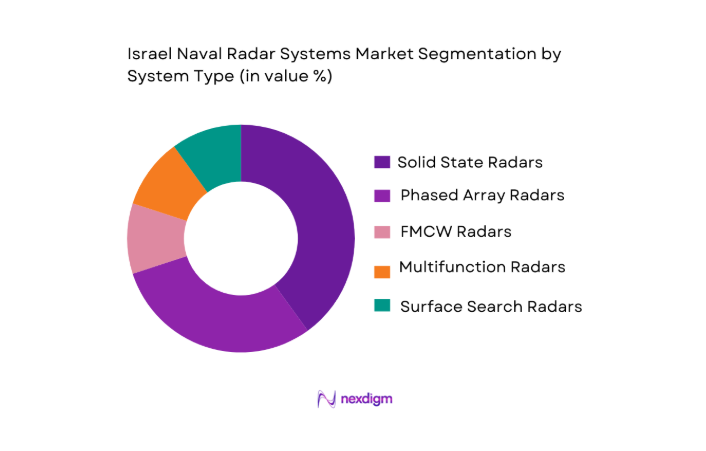

By System Type

The Israel Naval Radar Systems market is segmented by system type, and solid-state radars hold the dominant market share. These radars are favored for their reliability, lower maintenance costs, and smaller form factors compared to older systems. Solid-state radars offer superior performance in complex and challenging maritime environments, such as crowded coastal areas and contested waters, making them essential for modern naval operations. The growing trend toward replacing aging mechanical radars with solid-state technology further bolsters the demand for this system type.

By Platform Type

In terms of platform type, surface vessels dominate the Israel Naval Radar Systems market. Surface vessels account for the largest share of the market due to their significant role in naval defense. These vessels, equipped with advanced radar systems, are critical for surveillance, defense, and targeting. Israel’s strategic use of surface vessels, including missile ships and frigates, contributes to the strong demand for radar systems tailored to their needs. The naval forces’ reliance on surface vessels for various military operations ensures the continued dominance of this platform type in the radar systems market.

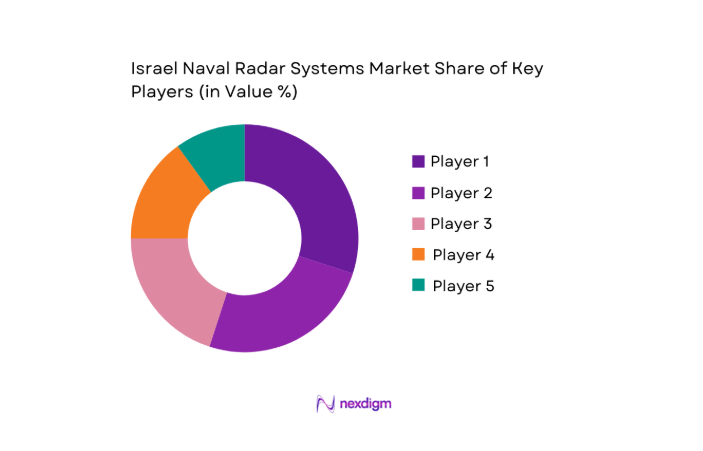

Competitive Landscape

The Israel Naval Radar Systems market is dominated by a few major players, including Israel Aerospace Industries (IAI), Rafael Advanced Defense Systems, and Elbit Systems. These companies have long established themselves as leaders in radar technologies, particularly through their continued innovation and integration of cutting-edge features into naval radar systems. The competitive landscape is marked by technological advancements, significant research and development investments, and the integration of radar systems with other naval defense technologies.

| Company Name | Establishment Year | Headquarters | Radar Technology | Market Position | Key Strength | Global Reach |

| Israel Aerospace Industries | 1953 | Lod, Israel | ||||

| Rafael Advanced Defense | 1985 | Haifa, Israel | ||||

| Elbit Systems | 1966 | Haifa, Israel | ||||

| Thales Group | 2000 | Paris, France | ||||

| Raytheon Technologies | 1922 | Waltham, USA |

Israel Naval Radar Systems Market Analysis

Growth Drivers

Technological Advancements in Radar Systems

Technological innovation plays a significant role in driving growth in Israel’s naval radar systems market. The Israel Defense Forces (IDF) consistently invests in upgrading radar technologies, with systems being integrated with advanced signal processing and detection capabilities. The focus is on increasing the operational range of radar systems, improving resolution, and reducing maintenance costs. In 2024, Israel Aerospace Industries (IAI) introduced a new radar that significantly improves target acquisition in complex naval environments, addressing the growing demand for multi-function radar systems. According to the World Bank’s 2024 defense spending report, Israel’s defense budget is expected to increase by USD ~, supporting technological growth in this area.

Rising Global Naval Defense Budgets

A significant growth driver for the Israel Naval Radar Systems market is the increase in global naval defense budgets. Countries worldwide are investing more in naval defense capabilities to address maritime security concerns, including threats posed by emerging technologies like unmanned systems and cyber-attacks. According to the International Monetary Fund (IMF), global military spending reached USD ~ in 2024, with maritime defense budgets showing a continuous upward trend. This has led to higher demand for sophisticated radar systems, including anti-submarine warfare and surveillance technologies, positioning Israel as a key supplier of advanced naval radar solutions.

Market Challenges

High Initial Investment and Maintenance Costs

A challenge facing the Israel Naval Radar Systems market is the high initial investment and maintenance costs associated with advanced radar technologies. While Israel’s radar systems are known for their high quality, the cost of manufacturing and maintaining these systems is substantial. For instance, the cost of phased-array radar systems, which are widely used in the Israeli Navy, can reach over USD 30 million per unit. This high cost poses a barrier for smaller naval fleets and emerging markets looking to enhance their radar capabilities. The Israel Ministry of Defense has been working on optimizing costs through innovations in radar miniaturization and software upgrades to reduce overall costs.

Export Restrictions and Regulatory Challenges

Israel’s strict defense export regulations can create a barrier for global distribution of its naval radar systems. The Israeli government imposes export restrictions on military technology to ensure national security, which limits the ability of companies to sell to certain international buyers. In 2024, export restrictions were tightened following geopolitical tensions in the Middle East, leading to challenges in reaching potential customers. These regulations can delay procurement and reduce the number of potential contracts for Israeli radar system manufacturers. Furthermore, many countries have their own regulatory frameworks that may conflict with Israel’s export policies, further complicating the process.

Market Opportunities

Expansion of Autonomous Naval Platforms

The growing interest in autonomous naval platforms offers a major opportunity for Israel’s naval radar systems market. As naval forces worldwide look to adopt unmanned vessels for reconnaissance, surveillance, and defense, there is an increased demand for radar systems capable of supporting these platforms. Autonomous naval systems require radar solutions with high detection capabilities, capable of identifying and tracking targets in real-time without human intervention. Israel is positioned to capitalize on this shift, as the country is investing heavily in radar technologies that can be integrated into unmanned systems.

Increasing Demand for Integrated Multi-Sensor Systems

The demand for integrated radar systems that combine multiple sensors is growing, providing an opportunity for Israel’s radar manufacturers. The integration of radar with other sensors, such as infrared and electro-optical systems, offers enhanced detection and situational awareness. Israel has been at the forefront of developing multi-sensor systems that offer superior performance in complex maritime environments. The Israeli Navy, for example, is integrating radar with optical and infrared sensors to enhance its naval operations. As naval forces seek greater operational efficiency and security, integrated radar systems are becoming increasingly essential.

Future Outlook

Over the next 5 years, the Israel Naval Radar Systems market is expected to grow significantly, driven by continuous technological advancements and increasing naval defense budgets. The continued focus on anti-submarine warfare, integrated defense systems, and expanding naval fleets will increase the demand for radar systems that can operate in complex, contested environments. Additionally, the growing emphasis on autonomous naval platforms and integrated defense systems will further propel innovation in radar technology, ensuring Israel’s continued leadership in this sector.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- Thales Group

- Raytheon Technologies

- Lockheed Martin

- Northrop Grumman

- Saab AB

- Leonardo

- General Dynamics

- L3 Technologies

- BAE Systems

- Hensoldt

- Selex ES

- Harris Corporation

Key Target Audience

- Government and regulatory bodies

- Investments and venture capitalist firms

- Military procurement departments

- Defense contractors

- Naval forces

- Security agencies

- Naval defense manufacturers

- Technology integrators

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying critical market variables by gathering extensive data through secondary and primary research, focusing on industry trends, competitive dynamics, and technological innovations.

Step 2: Market Analysis and Construction

Historical data from reputable sources such as defense publications and market reports will be compiled and analyzed. This data will help in constructing the market model, which includes segmentation, market trends, and growth factors.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions will be validated through expert interviews with industry leaders, defense contractors, and radar manufacturers. This phase aims to gather first-hand insights into operational dynamics and market predictions.

Step 4: Research Synthesis and Final Output

Final data synthesis will include in-depth discussions with manufacturers, enabling the integration of comprehensive insights into technological advancements, consumer preferences, and industry trends. This will ensure an accurate, data-backed market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Increasing demand for advanced surveillance and targeting capabilities

Growing naval defense budgets and modernization efforts

Technological advancements in radar signal processing and performance - Market Challenges

High costs associated with advanced radar systems

Integration complexities with existing naval platforms

Regulatory hurdles and export control restrictions - Opportunities

Rising adoption of autonomous naval vessels and drones

Increasing naval modernization programs in emerging markets

Development of radar technologies for anti-submarine warfare - Trends

Shift towards solid-state radar systems for improved reliability and performance

Integration of radar with other sensor technologies for enhanced situational awareness - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Solid State Radars

Phased Array Radars

Frequency Modulated Continuous Wave (FMCW) Radars

Multifunction Radars

Surface Search Radars - By Platform Type (In Value%)

Surface Vessels

Submarines

Aircraft Carriers

Landing Ship Tank (LST)

Amphibious Assault Ships - By Fitment Type (In Value%)

Retrofit

OEM (Original Equipment Manufacturer)

Upgrade Kits

Standalone Systems

Integrated Systems - By EndUser Segment (In Value%)

Military

Coast Guard

Naval Forces

Defense Contractors

Security Agencies - By Procurement Channel (In Value%)

Direct Procurement

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters (Radar Range, Signal Processing, Integration Capability, Cost, Market Penetration)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries (IAI)

Thales Group

Raytheon Technologies

Lockheed Martin

Northrop Grumman

Harris Corporation

General Dynamics

L3 Technologies

BAE Systems

Leonardo

Saab AB

Selex ES

Hensoldt

- Increased adoption by naval forces for maritime security

- Coast guard agencies seeking advanced detection and tracking systems

- Security agencies enhancing capabilities for coastal surveillance

- Naval contractors demanding radar systems for new ship designs

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035