Market Overview

The Israel naval smart weapons market is valued at USD ~, with a clear upward trend driven by the increasing demand for advanced naval defense systems. These systems are designed to enhance operational capabilities, improve precision targeting, and integrate AI-driven features for greater autonomy. The market growth is primarily influenced by advancements in missile systems, smart torpedoes, and unmanned underwater vehicles (UUVs). Israel’s technological leadership and extensive military R&D investments contribute to market growth, positioning the country as a global leader in smart naval weapons technology.

Israel, as the leading force in this market, dominates due to its strategic military alliances and strong defense infrastructure. Other prominent nations that influence the market include the United States, India, and several European countries, which are actively investing in smart naval weapons for their maritime security needs. Israel’s dominance is rooted in its innovative defense technologies, including the development of precision-guided munitions and smart systems for naval forces. These countries are leveraging Israel’s expertise in developing integrated solutions for modern naval operations.

Market Segmentation

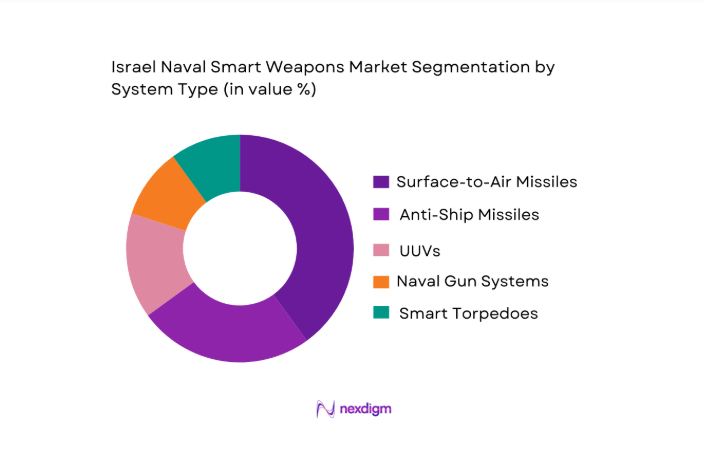

By System Type

The Israel naval smart weapons market is segmented by system type into surface-to-air missiles, anti-ship missiles, unmanned underwater vehicles (UUVs), naval gun systems, and smart torpedoes. Currently, surface-to-air missiles hold the dominant market share in Israel’s naval defense systems. Their superiority lies in their precision, versatility, and capability to neutralize aerial threats in a naval environment. The growing focus on multi-role platforms, coupled with the increasing necessity for comprehensive missile defense, has propelled the demand for these systems.

By Platform Type

The market is also segmented by platform type, with significant shares attributed to corvettes, frigates, submarines, patrol boats, and amphibious assault ships. Among these, frigates lead the market due to their versatility and increasing integration with advanced smart weapon systems. Frigates are highly regarded for their ability to carry and launch a variety of smart weapon systems, including anti-ship missiles and surface-to-air missiles, which make them central to modern naval operations.

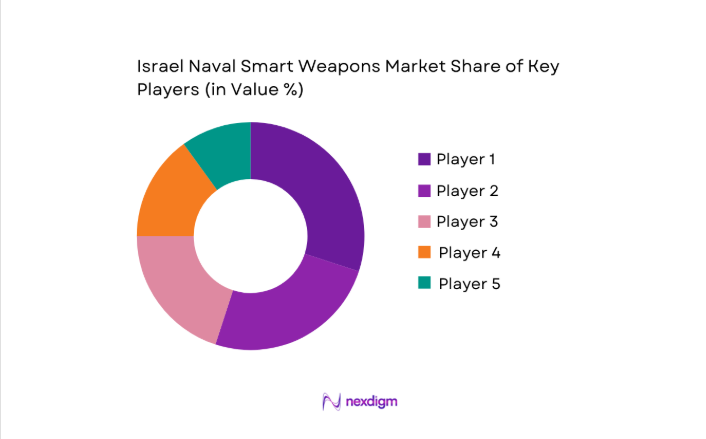

Competitive Landscape

The Israel naval smart weapons market is dominated by a few major players, including local companies such as Rafael Advanced Defense Systems and Israel Aerospace Industries. These companies have established strong positions due to their continuous innovations in smart missile systems and other advanced naval defense technologies. Additionally, global players like Lockheed Martin and Raytheon Technologies have significant influence due to their large-scale manufacturing capabilities and strategic partnerships with defense organizations.

| Company Name | Establishment Year | Headquarters | System Types | Platform Integration | Technological Innovation | International Partnerships | Product Range |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | Le Plessis-Robinson, France | ~ | ~ | ~ | ~ | ~ |

Israel Naval Smart Weapons Market Analysis

Growth Drivers

Rising demand for advanced naval defense systems

The growing need for advanced naval defense systems is a key driver in the Israel naval smart weapons market. Countries are investing heavily in technologies that improve the precision and lethality of their naval fleets. Israel, with its robust defense capabilities, has become a leader in producing cutting-edge weapons systems. These systems are designed to counteract emerging threats in the maritime domain, contributing to the rise in demand for advanced naval technologies worldwide.

Shift towards autonomous maritime operations

The shift towards autonomous maritime operations is transforming the naval defense landscape. Unmanned systems, including underwater vehicles and surface drones, are being increasingly deployed for surveillance, reconnaissance, and offensive operations. Israel’s focus on developing these technologies, paired with the demand for reducing human risk in high-stakes military operations, is accelerating the integration of autonomous systems within the naval defense sector.

Market Challenges

High development and procurement costs

The high cost of developing and procuring advanced naval smart weapons presents a significant challenge. These systems often require substantial investment in R&D, as well as the integration of complex technologies. The long development cycles, coupled with the need for highly specialized components, increase the overall cost of manufacturing. For countries with limited defense budgets, this can limit their ability to procure the most advanced systems.

Export restrictions and international regulations

Export restrictions, including stringent regulations like the International Traffic in Arms Regulations (ITAR), pose challenges to global distribution. These regulations limit the export of advanced military technologies, making it difficult for companies to expand their market reach. Israel, as a major player in the defense industry, faces such restrictions when it comes to selling its naval weapons systems to other countries. Compliance with these regulations often results in delays and additional costs.

Opportunities

Advancements in AI and machine learning for smart weapon systems

The rapid advancements in artificial intelligence (AI) and machine learning are opening up new opportunities in the Israel naval smart weapons market. These technologies are enhancing the precision, autonomy, and decision-making capabilities of naval weapon systems. With AI-enabled smart weapons, naval forces can detect, track, and neutralize threats more effectively. Israel’s expertise in AI and machine learning makes it well-positioned to capitalize on these developments, creating significant growth opportunities in this segment.

Growing adoption of unmanned systems in naval operations

The growing adoption of unmanned systems, such as drones and autonomous underwater vehicles (AUVs), is creating new opportunities in the naval defense sector. These systems offer enhanced capabilities in terms of surveillance, reconnaissance, and offensive action, while reducing the risk to human personnel. Israel has been at the forefront of developing and deploying unmanned systems, and their increasing integration into naval operations is expected to drive market growth in the coming years.

Future Outlook

Over the next decade, the Israel naval smart weapons market is expected to witness substantial growth driven by increased defense budgets and the growing demand for cutting-edge naval technologies. Key factors contributing to this growth include the rising geopolitical tensions and Israel’s continued commitment to enhancing its naval defense capabilities. The market will also benefit from advancements in autonomous weapon systems and artificial intelligence, which are expected to improve the precision and efficiency of naval operations.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Lockheed Martin

- Raytheon Technologies

- MBDA

- Northrop Grumman

- BAE Systems

- Kongsberg Gruppen

- General Dynamics

- Thales Group

- L3 Technologies

- Saab Group

- Harris Corporation

- Leonardo

- Naval Group

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors and military equipment manufacturers

- Naval defense agencies

- Global security and intelligence agencies

- Military technology developers

- National and international naval forces

- Defense technology integrators

Research Methodology

Step 1: Identification of Key Variables

The first phase involves defining the key variables influencing the Israel naval smart weapons market. This includes understanding the defense infrastructure, technological advancements, and geopolitical factors. Extensive secondary research is performed, utilizing a combination of industry reports, government publications, and proprietary databases.

Step 2: Market Analysis and Construction

Historical data is collected and analyzed, focusing on technological trends, market demand, and the role of key defense players in shaping the market. This step also includes the evaluation of past defense budgets, naval procurement strategies, and the market penetration of smart weapons systems.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts are carried out to validate initial hypotheses regarding market dynamics, including growth drivers and challenges. These consultations involve interviews with senior officials, naval defense experts, and leading technology developers to gather actionable insights.

Step 4: Research Synthesis and Final Output

Final market forecasts and insights are synthesized by analyzing data from primary and secondary research. The synthesis process includes a detailed assessment of the competitive landscape, technological innovations, and future trends. The final report provides a comprehensive, data-backed outlook for the Israel naval smart weapons market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Rising demand for advanced naval defense systems

Shift towards autonomous maritime operations

Increased naval security threats and territorial protection needs - Market Challenges

High development and procurement costs

Export restrictions and international regulations

Complex integration with existing naval platforms - Opportunities

Advancements in AI and machine learning for smart weapon systems

Growing adoption of unmanned systems in naval operations

Collaborative defense initiatives with global allies - Trends

Increasing emphasis on missile defense systems

Integration of cyber-defense capabilities into naval platforms - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Surface-to-Air Missiles

Anti-Ship Missiles

Unmanned Underwater Vehicles

Naval Gun Systems

Smart Torpedoes - By Platform Type (In Value%)

Corvettes

Frigates

Submarines

Patrol Boats

Amphibious Assault Ships - By Fitment Type (In Value%)

Retrofit

New Installation

Hybrid

Upgrade Kits

Custom Fitment - By EndUser Segment (In Value%)

Military Forces

Naval Defense Contractors

Government Defense Agencies

Private Security Companies

International Defense Partners - By Procurement Channel (In Value%)

Direct Government Contracts

Third-Party Defense Contractors

Public Bidding

- Market Share Analysis

- Cross Comparison Parameters (System Integration, Platform Compatibility, Weapon Range, Operational Flexibility, Cost Efficiency)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elbit Systems

Kongsberg Gruppen

Northrop Grumman

Lockheed Martin

Raytheon Technologies

BAE Systems

General Dynamics

Thales Group

MBDA

L3 Technologies

Harris Corporation

BAE Systems

Navantia

- Rising demand for high-tech naval platforms

- Shift to smart weapons for defense and deterrence

- Need for multi-role platforms in naval defense

- Collaborations with international naval forces

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035