Market Overview

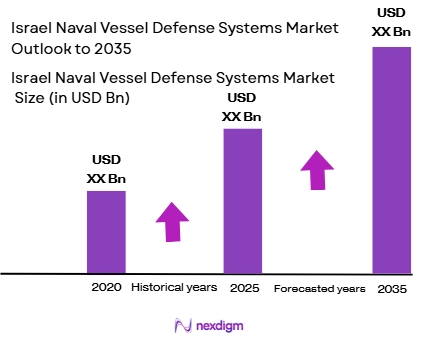

The Israel Naval Vessel Defense Systems market is valued at approximately USD ~billion in 2024. This market is driven by Israel’s strategic focus on maintaining maritime security and defense preparedness in a geopolitically volatile region. Israel’s investment in advanced naval defense technologies, such as missile defense systems and anti-submarine warfare solutions, plays a crucial role in the market’s growth. The country’s defense policies emphasize modernizing its naval fleet, enhancing its capabilities in missile defense, radar systems, and other advanced technologies. Increased government spending, partnerships with international defense manufacturers, and the need to counter regional threats are key factors driving the market forward.

Israel remains the dominant country in the naval vessel defense systems market, largely due to its robust defense sector and its strategic location in the Middle East. The country has a strong naval fleet and defense technology ecosystem, supported by its advanced missile defense systems and modern naval vessels. Jerusalem and Tel Aviv play pivotal roles in this sector, with their proximity to defense procurement agencies, research institutions, and high-tech defense manufacturers. These cities are crucial in shaping Israel’s defense strategy, which includes the development and integration of advanced naval technologies, enabling the country to maintain a competitive edge in maritime defense.

Market Segmentation

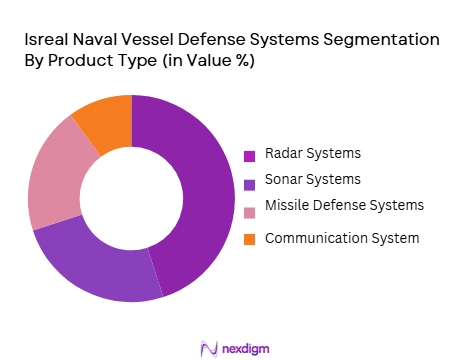

By Product Type

The Israel Naval Vessel Defense Systems market is segmented by product type into radar systems, sonar systems, missile defense systems, and communication systems. Missile defense systems dominate the market, holding the largest market share in 2024. This dominance is largely attributed to the escalating security threats in the region, particularly the rising threat of missile attacks. Israel’s Iron Dome and David’s Sling systems have set the standard for missile defense, showcasing advanced interception capabilities. As a result, missile defense systems continue to be a high priority in the Israeli naval modernization program. Furthermore, ongoing investments in missile defense technologies by the Israeli Ministry of Defense and collaborations with global defense companies such as Raytheon and Lockheed Martin contribute to the widespread adoption of these systems.

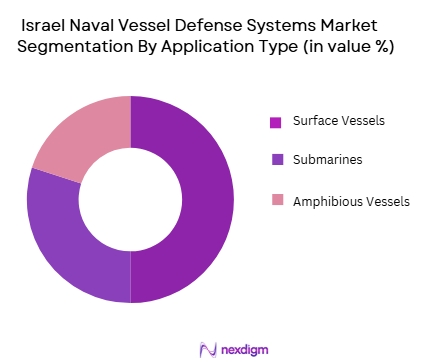

By Application

The Israel Naval Vessel Defense Systems market is also segmented by application into surface vessels, submarines, and amphibious vessels. Surface vessels lead the market share in 2024, owing to Israel’s strategic focus on modernizing its surface fleet. The Israeli Navy operates a range of surface vessels, including corvettes, frigates, and missile boats, all equipped with advanced defense systems. These surface vessels are integral to Israel’s naval defense strategy, ensuring maritime security and protection against various regional threats. The focus on multi-role surface combatants, equipped with state-of-the-art radar, sonar, and missile defense systems, underlines the significance of this segment in the market. Moreover, surface vessels’ ability to integrate advanced technologies ensures that they remain a dominant force in Israel’s naval defense operations.

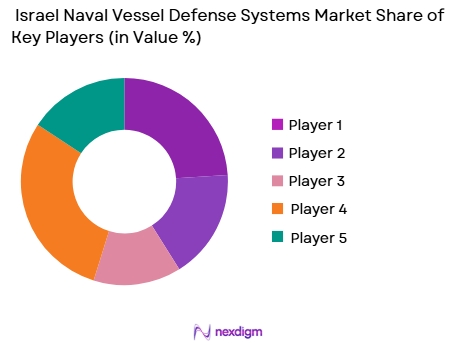

Competitive Landscape

The Israel Naval Vessel Defense Systems market is primarily dominated by a few key players, including Israel Aerospace Industries (IAI), Elbit Systems, Rafael Advanced Defense Systems, Lockheed Martin, and Thales Group. These companies contribute significantly to Israel’s defense capabilities, particularly through the development and supply of advanced naval technologies such as radar systems, missile defense systems, and communication solutions. Israel Aerospace Industries (IAI) and Rafael, both state-owned enterprises, are at the forefront of defense innovation in Israel, with their extensive involvement in naval defense projects. The collaboration between these local players and international companies ensures the continuous advancement of defense technologies, shaping the competitive dynamics of the market.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Key Partnerships | Innovation Focus | Revenue (USD) | Market Reach | R&D Investments |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ | |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Naval Vessel Defense Systems Market Analysis

Growth Drivers

Technological Advancements in Naval Defense Systems

The Israeli naval vessel defense systems market is significantly driven by technological advancements, particularly in anti-missile defense, radar systems, and naval combat management technologies. Israel’s focus on developing cutting-edge technologies, such as autonomous vessels and integrated defense systems, enhances the operational capabilities of its naval forces. The integration of artificial intelligence and cyber defense capabilities into naval platforms further strengthens Israel’s naval superiority, driving demand for advanced defense systems in its naval vessels.

Regional Security Concerns and Defense Modernization

Growing regional security concerns, particularly in the Middle East, have driven Israel’s commitment to modernizing its naval fleet. The increasing threats posed by neighboring nations and non-state actors compel Israel to strengthen its naval defense capabilities. The Israeli government’s substantial investments in defense modernization, including the development of advanced surface combatant systems and submarines, fuel demand for high-performance naval defense technologies, ensuring long-term growth in the sector.

Market Challenges

High Cost of Advanced Defense Systems

A key challenge for the Israeli naval vessel defense systems market is the high cost associated with advanced naval defense technologies. These systems, including integrated combat systems, advanced radars, and missile defense systems, require significant capital investment. The high costs of research, development, and procurement, coupled with budgetary constraints, can slow the pace of naval fleet upgrades and system integration, potentially limiting market growth.

Integration Complexity and Technological Compatibility

Integrating new defense technologies into existing naval vessels is a complex challenge. Israel’s naval fleet, which includes a mix of older vessels and modern platforms, faces compatibility issues when incorporating advanced systems like missile defense, radar, and command management systems. Ensuring seamless integration between new and legacy systems increases operational complexity and costs, making it a significant hurdle in the fleet modernization process.

Opportunities

Export Potential and International Collaborations

Israel’s strong defense industry positions it as a key player in global naval defense markets. The potential for exporting advanced naval defense systems to international allies, particularly those in the Indo-Pacific and European regions, presents significant growth opportunities. Collaborations with NATO members and other defense contractors can help expand Israel’s market share and facilitate technological exchanges, further enhancing the global competitiveness of Israeli naval defense technologies.

Rising Demand for Cybersecurity and Autonomous Naval Systems

With the growing importance of cybersecurity and autonomous operations in defense, Israel has an opportunity to lead in these areas by integrating AI and autonomous capabilities into its naval defense systems. The development of autonomous naval vessels and cyber defense solutions can enhance operational efficiency, providing Israel with a competitive edge in the rapidly evolving global defense landscape, and addressing both security concerns and defense modernization needs.

Future Outlook

Over the next five years, the Israel Naval Vessel Defense Systems market is expected to experience robust growth driven by continued advancements in missile defense technologies, radar systems, and naval vessel capabilities. Israel’s strategic emphasis on maintaining a strong naval presence in the Mediterranean and beyond will continue to shape the demand for advanced naval defense solutions. The increasing threat of missile warfare in the region, along with Israel’s pursuit of advanced defense systems, will further bolster investments in naval defense technologies. The ongoing collaboration with international defense companies and increasing defense budgets will ensure the continuous modernization of Israel’s naval fleet, contributing to long-term market growth.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Lockheed Martin

- Thales Group

- Raytheon Technologies

- Northrop Grumman

- Leonardo S.p.A.

- Saab AB

- General Dynamics

- Huntington Ingalls Industries

- L3 Technologies

- Naval Group

- Rolls-Royce

- Rheinmetall Defence

Key Target Audience

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Naval Procurement and Modernization Units

- Defense Contractors

- Technology Providers

- Defense Technology Manufacturers

- Maritime Defense Agencies

- Global Defense Organizations

Research Methodology

Step 1: Identification of Key Variables

In this phase, we will identify and map key variables that influence the Israel Naval Vessel Defense Systems market. This includes gathering data from secondary sources, such as government reports, industry publications, and proprietary databases, to identify critical technologies, market dynamics, and economic factors.

Step 2: Market Analysis and Construction

This step involves compiling historical data on the Israel Naval Vessel Defense Systems market, focusing on procurement data, government spending, and technological advancements. We will also evaluate trends such as regional defense cooperation and the demand for specific defense systems.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, consultations will be conducted with industry experts, including representatives from the Israeli Ministry of Defense, defense contractors, and defense technology providers. These consultations will offer insights into market developments, challenges, and key drivers shaping the sector.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing the gathered data and expert insights into a comprehensive market report. Direct engagement with manufacturers and stakeholders in the defense sector will validate the product segment information, ensuring the accuracy and reliability of the research findings.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Strengthening of Israel’s defense posture in the Middle East

Technological advancements in naval defense systems

Growing demand for integrated defense solutions - Market Challenges

High costs of naval vessel procurement and system upgrades

Complexity of integrating new technologies into existing fleets

Geopolitical tensions affecting defense spending - Market Opportunities

Increased focus on naval modernization and fleet expansion

Collaborations with international defense partners

Technological advancements in automation and cybersecurity - Trends

Shift towards modular and scalable naval defense systems

Rise in autonomous and AI-driven naval defense technologies

Increasing integration of cyber warfare capabilities in naval systems - Government regulations

Israeli defense procurement regulations

International arms trade regulations

Naval defense system certification standards - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Surface Combatant Systems

Submarine Defense Systems

Naval Anti-Missile Defense Systems

Naval Communication Systems

Naval Combat Management Systems - By Platform Type (In Value%)

Corvettes

Frigates

Destroyers

Submarines

Amphibious Warfare Vessels - By Fitment Type (In Value%)

OEM Systems

Upgraded Systems

Integrated Systems

Retrofit Systems

Hybrid Systems - By EndUser Segment (In Value%)

Israeli Navy

Other Defense Agencies

International Defense Agencies

Commercial Shipping Companies

Naval Research Institutions - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

OEM Partnerships

Defense Distributors

Online Marketplaces

- Cross Comparison Parameters (System Reliability, Operational Range, Defense Capabilities, System Integration Flexibility, Cost of Operation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elbit Systems

IAI (Israel Aerospace Industries)

Thales Israel

Lockheed Martin Israel

General Dynamics

BAE Systems

Navantia

Leonardo

Northrop Grumman

L3 Technologies

Saab Israel

Raytheon Israel

Kongsberg Gruppen

- Israeli Navy’s focus on advanced missile defense systems

- International partnerships and collaborations in naval defense

- Naval defense contractors’ involvement in global defense contracts

- Emerging markets’ demand for Israeli naval defense technologies

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035