Market Overview

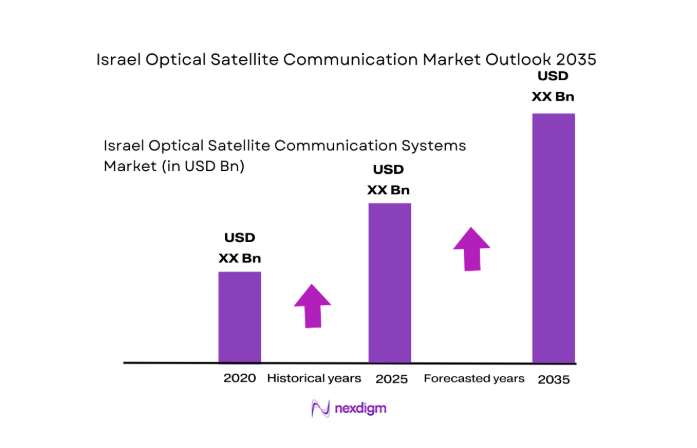

The Israel optical satellite communication market is a rapidly growing sector with a valuation of USD ~. This growth is driven by the rising demand for secure, high-bandwidth communication technologies, which are necessary for various sectors like defense, telecommunications, and space exploration. Optical satellite communication provides faster and more efficient communication compared to traditional radio frequency systems, making it increasingly attractive. Additionally, government investments in satellite infrastructure and advancements in optical communication technologies are key contributors to the market’s expansion.

The market is primarily dominated by countries such as the United States, Israel, and several European nations. Israel, in particular, plays a pivotal role due to its robust defense sector and active participation in space technology. Tel Aviv serves as a hub for space startups and satellite communication innovation, aided by government-backed initiatives and partnerships with private companies. Furthermore, the nation’s strategic location and advanced technological capabilities position it as a leader in optical satellite communications.

Market Segmentation

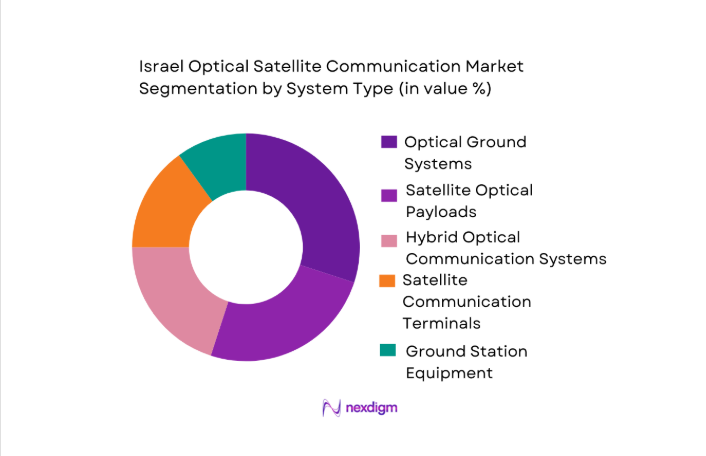

By System Type

Israel’s optical satellite communication market is segmented by system type into optical ground systems, satellite optical payloads, hybrid optical communication systems, satellite communication terminals, and ground station equipment. The dominant subsegment in this category is optical ground systems. This is primarily due to the increasing demand for high-speed ground stations capable of receiving and transmitting optical signals. As the need for faster communication networks grows, optical ground systems have become crucial, offering advantages such as higher data throughput and reduced latency compared to traditional radio frequency systems. Optical ground systems are now integral to both military and civilian satellite communication operations, thus maintaining their leading market position.

By Platform Type

The platform type segmentation of the Israel optical satellite communication market includes low Earth orbit (LEO) satellites, medium Earth orbit (MEO) satellites, geostationary orbit (GEO) satellites, high altitude platforms (HAPS), and ground-based communication systems. The dominant subsegment in this category is LEO satellites. These satellites are gaining significant traction due to their ability to provide lower latency and higher speed compared to MEO and GEO satellites. Furthermore, LEO satellites are cost-effective and ideal for providing global broadband services. This has led to a surge in investments and launches from both governmental and private entities, making LEO satellites the most dominant platform in Israel’s optical satellite communication market.

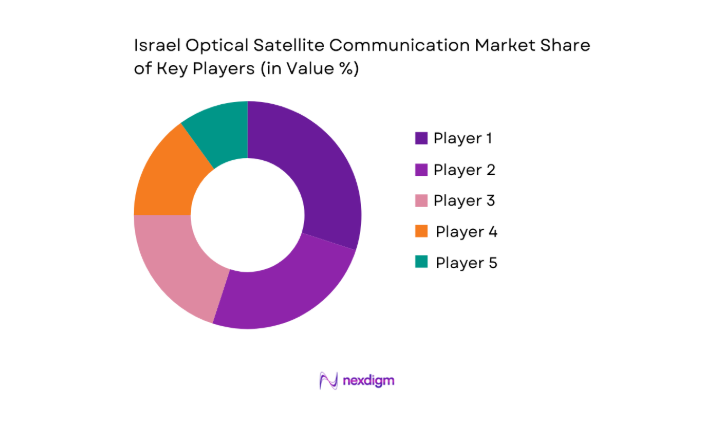

Competitive Landscape

The Israel optical satellite communication market is characterized by a few major players, including both local and international entities. The market is competitive, with companies vying for government contracts, defense deals, and partnerships with private enterprises. Local players in Israel benefit from strong government support for the defense and space sectors, while global players bring extensive technological expertise. Israel’s strategic location and its ongoing innovations in satellite communication technology further enhance the competitive landscape, ensuring a high level of market activity.

| Company | Establishment Year | Headquarters | Technology Focus | Market Focus | Key Customers | Global Reach |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Spacecom | 1999 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Starburst Communications | 2014 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| OneWeb | 2012 | London, UK | ~ | ~ | ~ | ~ |

Israel Optical Satellite Communication Market Analysis

Growth Drivers

Shift toward high-speed, secure data communication

The shift towards high-speed, secure data communication is being fueled by the rising demand for efficient connectivity across various sectors, including defense, telecommunications, and space exploration. The global market for high-speed internet connectivity continues to grow as governments and businesses strive for improved infrastructure. According to the International Telecommunication Union (ITU), in 2024, over ~ of the world’s population will be connected to high-speed broadband, driving demand for satellite-based systems to complement terrestrial networks. This expansion is expected to benefit the optical satellite communication market as demand for faster, more secure transmission of sensitive information grows. The growing emphasis on cybersecurity also contributes to the need for secure communication systems in both military and civilian applications.

Rising demand for satellite-based communication in remote areas

Satellite communication is becoming increasingly critical for providing reliable internet access to remote and underserved regions. In 2024, the World Bank’s Digital Economy Report highlighted that over ~ people still lack access to the internet, primarily in rural and remote areas. This gap is being addressed by satellite providers, with initiatives such as SpaceX’s Starlink aiming to provide broadband connectivity to remote regions. Governments worldwide are also investing in satellite infrastructure to bridge the digital divide, as evidenced by the European Union’s recent plan to allocate EUR ~ for satellite connectivity to rural regions. As the demand for global connectivity continues to rise, optical satellite communication will play a pivotal role in delivering high-speed, low-latency services to these regions.

Market Challenges

High infrastructure and maintenance costs

The development and maintenance of optical satellite communication infrastructure remain costly, posing a significant challenge for companies operating in this market. The cost of launching satellites, equipping them with optical payloads, and maintaining the ground infrastructure required for optical communications remains high. According to the European Space Agency (ESA), the cost of launching a single satellite, including its optical communication system, can exceed USD ~. Additionally, maintenance costs for these systems, including the upkeep of ground stations and satellite servicing, further add to the financial burden. These high upfront and ongoing costs are a barrier for smaller firms and governments with limited budgets, which may slow the adoption of optical satellite communication systems.

Regulatory complexities in satellite communications

Satellite communications, especially optical systems, are subject to complex regulations regarding frequency allocation, international treaties, and launch approvals. In 2024, the International Telecommunication Union (ITU) continues to play a key role in managing satellite communications by coordinating the global use of satellite orbits and frequencies. However, as demand for satellite services increases, regulatory bodies face challenges in keeping up with new technology and ensuring fair access to orbital slots and frequencies. Countries like the United States and European nations have stringent regulatory frameworks, while regions such as Asia are working toward harmonizing satellite communication standards. The slow pace of regulatory reforms in some regions can impede the deployment of optical satellite networks.

Opportunities

Miniaturization of optical components for cost reduction

The miniaturization of optical components presents a significant opportunity to reduce costs in optical satellite communication systems. Advances in materials science and microelectronics are making it possible to create smaller, lighter optical payloads that retain high performance. For example, optical transceivers have become more compact, and new laser technologies have been developed for use in space. According to the European Space Agency (ESA), miniaturization has already led to a ~ reduction in satellite payload weight over the last decade. As optical components become more affordable and efficient, the overall cost of deploying optical satellite communication systems is expected to decrease, opening up the market to new entrants and expanding the potential for global satellite networks.

Expansion of commercial satellite launches and services

The global expansion of commercial satellite launches presents a significant opportunity for the optical satellite communication market. As private companies like SpaceX, Blue Origin, and Rocket Lab continue to reduce the cost of satellite launches, more companies can participate in the satellite communications market. By 2024, the global satellite launch market is expected to see over 200 launches per year, many of which will include optical communication payloads. The increasing number of commercial satellites and the lower cost of satellite launches will drive the demand for optical communication systems, particularly as they offer higher capacity and faster data rates than traditional radio-frequency satellites.

Future Outlook

Over the next decade, the Israel optical satellite communication market is expected to witness significant growth, driven by technological advancements and increasing demand for high-capacity communication systems. The continuous evolution of optical communication technology, coupled with the rising need for fast and secure communication networks across the globe, will contribute to the expansion of this market. Moreover, growing collaboration between Israel and international space agencies will further bolster the development and deployment of optical satellite communication systems. Israel’s role as a leader in optical communication will be pivotal as satellite constellations and global internet connectivity become more widespread.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Spacecom

- Starburst Communications

- OneWeb

- SpaceX

- SES S.A.

- Intelsat

- Thales Alenia Space

- Telesat

- Avanti Communications

- Viasat

- Hughes Network Systems

- Iridium Communications

- Lockheed Martin

Key Target Audience

- Investments and Venture Capitalist Firms

- Israel Ministry of Defense

- Israel Space Agency

- International Space Agencies

- Telecommunications Service Providers

- Satellite Communication Equipment Manufacturers

- Aerospace Manufacturers

- Government Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step in our research methodology involves constructing a comprehensive ecosystem map, identifying the key stakeholders in the optical satellite communication market. This includes secondary research from credible sources and proprietary databases to gather the most accurate and up-to-date industry-level data. Key market dynamics, such as technological advancements and regulatory trends, will be mapped to define the critical variables for market growth.

Step 2: Market Analysis and Construction

In this phase, we will analyze the historical data of the optical satellite communication market, assessing market trends, key technology adoption rates, and revenue generation patterns. We will also study market penetration and identify the key factors influencing the growth of subsegments such as LEO satellites and optical ground systems. This step ensures the validity and reliability of the market estimates.

Step 3: Hypothesis Validation and Expert Consultation

We will develop and validate market hypotheses through consultations with industry experts, including satellite communication engineers, project managers, and government officials. These expert consultations will provide a deeper understanding of operational and financial insights, helping us refine the market dynamics and strengthen our analysis.

Step 4: Research Synthesis and Final Output

In this final step, we will synthesize all data collected from previous phases, cross-checking it with multiple satellite communication manufacturers to validate the statistics. Interviews with key players in the industry will be conducted to further verify product performance, technological trends, and consumer demand. This final synthesis will ensure a comprehensive and accurate analysis of the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Shift toward high-speed, secure data communication

Rising demand for satellite-based communication in remote areas

Advancements in optical technologies for space communication - Market Challenges

High infrastructure and maintenance costs

Regulatory complexities in satellite communications

Limited availability of suitable satellite frequencies - Opportunities

Miniaturization of optical components for cost reduction

Expansion of commercial satellite launches and services

Emerging markets in IoT and global connectivity - Trends

Increased collaboration between private companies and governments

Growth in satellite constellations for global coverage - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Optical Ground Systems

Satellite Optical Payloads

Hybrid Optical Communication Systems

Satellite Communication Terminals

Ground Station Equipment - By Platform Type (In Value%)

Low Earth Orbit (LEO) Satellites

Medium Earth Orbit (MEO) Satellites

Geostationary Orbit (GEO) Satellites

High Altitude Platforms (HAPS)

Ground-Based Communication Systems - By Fitment Type (In Value%)

Retrofit

New Installation

Embedded Solutions

Custom-Built Systems

Hybrid Solutions - By EndUser Segment (In Value%)

Telecommunications Operators

Government & Defense

Aerospace & Aviation

Commercial Enterprises

Research & Education - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Third-Party Resellers

- Market Share Analysis

- Cross Comparison Parameters(Optical Payloads, Market Penetration, Technological Innovation, Cost Efficiency, Regulatory Compliance)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

SpaceX

SES S.A.

OneWeb

Iridium Communications

Intelsat

Hughes Network Systems

Thales Alenia Space

Telesat

Avanti Communications

ViaSat

Eutelsat Communications

Hispasat

Orbital ATK

Lockheed Martin

Northrop Grumman

- Rising demand from defense agencies for secure communications

- Telecom companies investing in satellite communication infrastructure

- Government contracts for national defense and emergency communication

- Increased adoption of satellite communication in remote research areas

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035