Market Overview

The Israel passenger drones market is valued at USD ~, supported by an increasing demand for advanced aerial transportation solutions. The market is driven by technological advancements in drone technology, government support for urban air mobility (UAM) initiatives, and rising demand for air taxis. The Israeli government has actively invested in infrastructure and regulations to promote urban air mobility, with large companies like Urban Aeronautics and EHang making significant strides in the market.

Cities such as Tel Aviv and Jerusalem are at the forefront of the Israel passenger drones market due to their high-tech infrastructure, favorable regulatory environment, and a growing interest in urban air mobility. These cities, coupled with government initiatives and strategic partnerships with international aerospace players, have made Israel a global leader in UAM development, fostering innovation in passenger drone technology.

Market Segmentation

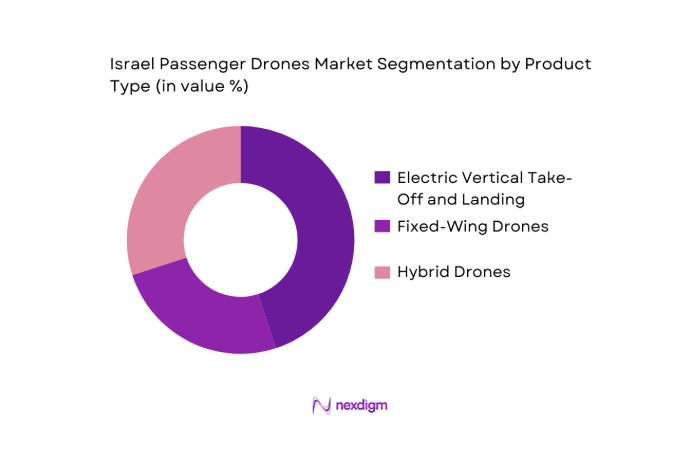

By Product Type

The Israel passenger drones market is segmented by product type into electric vertical take-off and landing drones, fixed-wing drones, and hybrid drones. The eVTOL drones segment has the dominant market share, driven by their versatility and growing interest in urban air mobility solutions. Companies such as Urban Aeronautics and Joby Aviation are leading the development of eVTOL technology, offering solutions for air taxis and other transport needs. This product type is favored for its ability to operate in confined urban spaces, providing an efficient solution for crowded city environments.

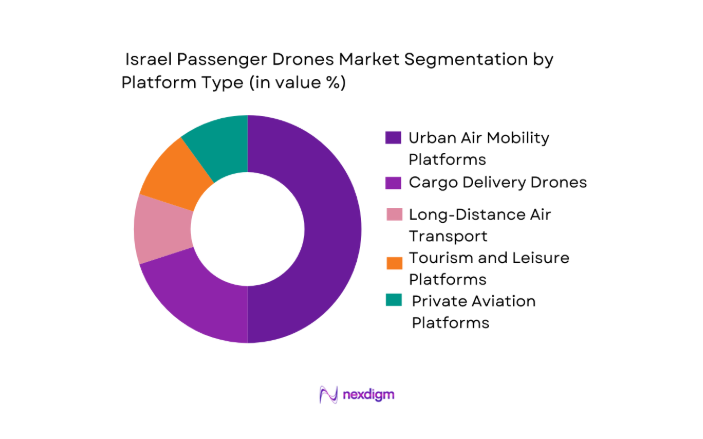

By Platform Type

The platform types in the Israel passenger drones market include urban air mobility platforms, cargo delivery drones, long-distance air transport platforms, tourism and leisure platforms, and private aviation platforms. Urban air mobility platforms dominate the market share due to the increasing need for efficient, rapid transportation in congested cities. Urban areas like Tel Aviv are investing heavily in air mobility infrastructure, making this platform type the most viable solution for passenger drones. The focus on reducing congestion and providing on-demand aerial transport further boosts its market dominance.

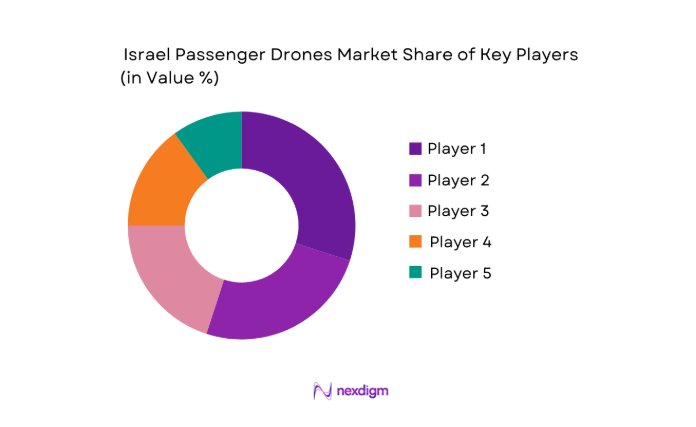

Competitive Landscape

The Israel passenger drones market is highly competitive, dominated by both local and international players. Companies like Urban Aeronautics and EHang are making significant strides in the development of eVTOL technologies, while international players such as Joby Aviation and Volocopter are also contributing to market growth. These key players, along with their investments in infrastructure and technological advancements, highlight the growing potential of this market. As the market matures, collaboration and regulatory approval will be crucial to its success.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Share in Israel | Key Product(s) | Strategic Partnerships |

| Urban Aeronautics | 2007 | Tel Aviv | ~ | ~ | ~ | ~ |

| EHang | 2014 | Guangzhou, China | ~ | ~ | ~ | ~ |

| Joby Aviation | 2009 | California, USA | ~ | ~ | ~ | ~ |

| Volocopter | 2011 | Bruchsal, Germany | ~ | ~ | ~ | ~ |

| Lilium | 2015 | Munich, Germany | ~ | ~ | ~ | ~ |

Israel passenger drones Market Analysis

Growth Drivers

Rising demand for urban air mobility solutions

Urban air mobility (UAM) solutions are gaining traction due to the growing need for efficient transportation in densely populated cities. According to the Israel Ministry of Transport, Israel’s road network congestion costs the economy over USD ~ annually. Urban air mobility can significantly reduce these costs by providing a faster, more efficient means of transportation. In Tel Aviv alone, over ~ of residents face daily traffic congestion, contributing to the demand for alternative solutions. This rising demand is supported by ongoing government initiatives to build the necessary infrastructure for aerial mobility.

Technological advancements in drone autonomy

Technological advancements in autonomous drone technology are significantly driving the Israel passenger drones market. In 2024, Israel’s defense technology sector allocated over USD ~ to advancements in autonomous systems. The Israel Innovation Authority is actively funding projects that enhance drone autonomy, including navigation and collision avoidance systems, which are crucial for passenger drones. These innovations aim to reduce the need for human intervention, making the operation of passenger drones safer and more reliable. Autonomous technologies are expected to play a central role in scaling the market by improving operational efficiency and reducing costs.

Market Challenges

Regulatory hurdles and airspace integration

The integration of passenger drones into existing airspace faces significant regulatory challenges. As of 2024, Israel’s Civil Aviation Authority (ICAA) is still in the process of finalizing regulations for urban air mobility. These regulations are essential to ensure the safe integration of drones into national airspace, especially in urban areas. As of 2023, over ~ of Israel’s airspace is congested, leading to difficulties in integrating new aerial transport solutions. Additionally, restrictions on drone operations near airports and densely populated areas have slowed market growth. These regulatory barriers need to be addressed to unlock the full potential of passenger drones.

High development and manufacturing costs

The high cost of developing and manufacturing passenger drones remains a significant barrier to market growth. In 2024, the average cost of a commercial passenger drone prototype in Israel is estimated to exceed USD ~, primarily due to the need for advanced technologies such as electric propulsion systems, autonomous flight software, and lightweight materials. While costs are expected to decrease over time, the current investment required to bring a drone to market is a challenge for many companies. Additionally, the cost of maintaining and operating these drones remains high, affecting the scalability of the market.

Opportunities

Collaborations between aerospace companies and tech firms

Collaborations between aerospace companies and technology firms are providing significant opportunities for growth in the Israel passenger drones market. Israel’s high-tech ecosystem, which includes companies like Intel, Microsoft, and Elbit Systems, is fostering partnerships to enhance the capabilities of passenger drones. These collaborations are focused on developing autonomous flight systems, navigation technology, and communication infrastructure essential for air taxis. In 2024, Israel’s tech sector invested over USD ~ into drone technology, contributing to the development of safe, efficient, and scalable air mobility solutions. This growing partnership between aerospace and tech firms is expected to accelerate market growth.

Growth in the tourism and leisure sectors

The tourism and leisure sectors in Israel present a promising opportunity for passenger drone services, particularly for scenic aerial tours. Israel’s Ministry of Tourism reported in 2024 that tourism revenue reached USD ~, with significant interest in unique travel experiences. Passenger drones offer a new way to explore Israel’s landscape, including cities, historical sites, and beaches. These drones can cater to the growing demand for innovative tourist experiences, providing a competitive edge to Israel’s tourism industry. As demand for leisure activities continues to rise, the integration of passenger drones into the tourism sector is seen as a key growth opportunity.

Future Outlook

Over the next decade, the Israel passenger drones market is expected to show significant growth driven by the continuous development of eVTOL technology, expanding regulatory frameworks, and increasing investment from both private and public sectors. As Israel strengthens its position as a leader in urban air mobility, advancements in infrastructure and the integration of autonomous systems will continue to fuel the demand for passenger drones, with applications ranging from air taxis to cargo transportation. The growth of the market is also expected to be supported by collaborations between aerospace firms and government bodies working together to create favorable policies and regulatory environments.

Major Players

- Urban Aeronautics

- EHang

- Joby Aviation

- Volocopter

- Lilium

- Terrafugia

- Vertical Aerospace

- Bell Textron

- Hyundai Urban Air Mobility

- Aurora Flight Sciences

- Karem Aircraft

- L3 Technologies

- Elbit Systems

- Aeromobil

- Textron Systems

Key Target Audience

- Investments and venture capitalist firms

- Ministry of Transport

- Israel Civil Aviation Authority

- Aerospace and Aviation Enterprises

- Government defense agencies

- Logistics and transportation firms

- Urban planners and infrastructure developers

- Technology companies involved in drone development

Research Methodology

Step 1: Identification of Key Variables

In this phase, a detailed ecosystem map will be created to understand all significant stakeholders involved in the Israel passenger drones market. This step will rely on secondary research, including industry reports and government data, to identify variables that influence the market.

Step 2: Market Analysis and Construction

Historical data will be gathered to analyze the market’s past growth and trends, focusing on product penetration and revenue generation. The service quality of passenger drones will also be evaluated to assess reliability and consumer preferences.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts using interviews and surveys. These experts will provide insights into the operational, technical, and financial aspects of the passenger drone industry.

Step 4: Research Synthesis and Final Output

Finally, detailed consultations with aerospace companies will be conducted to confirm and verify findings from the bottom-up approach. These consultations will help ensure the comprehensive and validated insights into the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Rising demand for urban air mobility solutions

Technological advancements in drone autonomy

Increasing investment in air taxi services - Market Challenges

Regulatory hurdles and airspace integration

High development and manufacturing costs

Public acceptance and safety concerns - Opportunities

Collaborations between aerospace companies and tech firms

Growth in the tourism and leisure sectors

Government support for infrastructure development - Trends

Advances in battery and energy storage technology

Growing investment in urban air mobility research - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Electric Vertical Take-Off and Landing

Fixed-Wing Drones

Hybrid Drones

Autonomous Flight Systems

Passenger Drone Prototypes - By Platform Type (In Value%)

Urban Air Mobility Platforms

Long-Distance Air Transport Platforms

Tourism & Leisure Platforms

Cargo Delivery Drones

Private Aviation Platforms - By Fitment Type (In Value%)

Passenger Drones with Autonomous Capabilities

Passenger Drones with Pilot-Assisted Operations

Passenger Drones with Hybrid Propulsion Systems

Electric Passenger Drones

Battery-Powered Drones - By EndUser Segment (In Value%)

Government and Defense

Private Companies (Air Taxi Services)

Tourism Industry

Logistics and Transportation

Aerospace and Aviation Enterprises - By Procurement Channel (In Value%)

Direct Sales

Online Marketplaces

Partnerships and Collaborations

- Market Share Analysis

- Cross Comparison Parameters (Technology Adoption, Regulatory Compliance, Production Scale, Cost Efficiency, Market Reach)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

Urban Aeronautics

EHang

Lilium

Terrafugia

Vertical Aerospace

Joby Aviation

AeroMobil

Volocopter

Lilium

Opener

Vertical Aerospace

Bell Textron

Hyundai Urban Air Mobility

Aurora Flight Sciences

Karem Aircraft

L3 Technologies

- Government agencies developing airspace infrastructure

- Private companies providing air taxi services

- Tourism businesses integrating passenger drones into travel packages

- Logistics companies exploring last-mile delivery using drones

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035