Market Overview

The Israel passive radar market is a vital segment within the global radar industry, focusing on advanced radar technologies that use existing environmental signals to detect and track objects without emitting signals themselves. This feature makes passive radar systems ideal for use in defense, border surveillance, and critical infrastructure protection, where stealth and undetectable monitoring are crucial. The technology has gained prominence due to its ability to provide highly accurate surveillance while reducing the likelihood of detection, a significant advantage in modern warfare and security operations.

The market is primarily driven by increasing defense budgets and growing security concerns across the globe, particularly in North America and Europe, where investments in defense and surveillance technologies have been rising. In Israel, passive radar systems have gained substantial traction within the defense sector due to their advanced capabilities and Israel’s emphasis on innovative defense technologies. This market’s size has been expanding, with Israel being one of the leaders in the development and deployment of passive radar systems, largely because of the country’s strategic security needs and technological prowess.

Market Segmentation

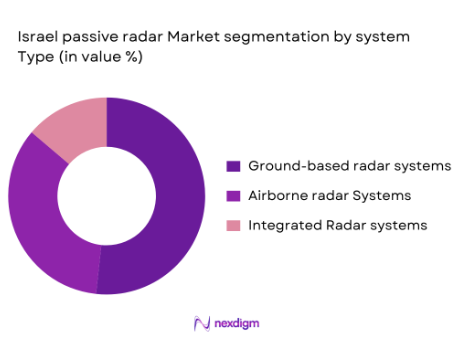

By System Type

The Israel passive radar market is segmented by system type into airborne radar systems, ground-based radar systems, and integrated radar systems. Among these, ground-based radar systems hold a dominant share in the market. This is primarily due to their extensive use in border surveillance, monitoring airspace, and controlling military installations. Their ability to detect objects without emitting signals makes them invaluable for military and civilian surveillance purposes. The market demand for ground-based systems is expected to grow, driven by increasing concerns regarding border security and the protection of critical infrastructure.

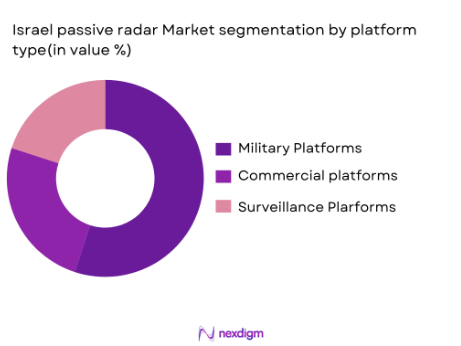

By Platform Type

The market is also segmented by platform type, which includes military platforms, commercial platforms, and surveillance platforms. Military platforms dominate the market, accounting for a substantial share. This is due to the high adoption of passive radar systems for defense applications, particularly in reconnaissance, anti-aircraft defense, and border protection. Military organizations prioritize these radar systems for their ability to detect threats without being detected themselves, which is crucial in modern warfare scenarios.

Competitive Landscape

The Israel passive radar market is competitive with a strong presence of key players. The market is dominated by several defense giants, including Elbit Systems, Israel Aerospace Industries, and Rafael Advanced Defense Systems. These companies have a strong technological foundation, enabling them to develop advanced radar solutions for both military and civilian applications. Their extensive research and development capabilities, along with their established customer base, ensure their dominance in the market.

| Company Name | Establishment Year | Headquarters | R&D Investment | Product Innovation | Market Focus | Revenue (USD) | Global Presence |

| Elbit Systems | 1966 | Haifa, Israel | – | – | – | – | – |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | – | – | – | – | – |

| Rafael Advanced Defense Systems | 1980 | Haifa, Israel | – | – | – | – | – |

| Lockheed Martin | 1912 | Bethesda, USA | – | – | – | – | – |

| Raytheon Technologies | 2020 | Waltham, USA | – | – | – | – | – |

Israel Passive Radar Market Dynamics

Growth Drivers

Increasing Defense Expenditure in North America

North America continues to see rising defense expenditures, with the U.S. government spending USD ~ billion on defense in 2022, a figure projected to stay consistent through 2025. This investment supports the adoption of advanced radar systems, including passive radar, which are integral to modern defense strategies. A significant portion of this spending is focused on enhancing surveillance capabilities to monitor and secure borders, airspace, and critical infrastructure. These investments are critical for advancing radar technologies and ensuring national security.

Rising Demand for Surveillance and Border Protection

The global security landscape, especially in North America and Europe, has seen an increase in demand for surveillance solutions, driven by concerns over national security and border protection. The U.S. allocated USD 24 billion in 2022 to enhance border security technology, including surveillance radar systems, aiming to prevent illegal activities and protect critical infrastructure. As international tensions rise and new threats emerge, the importance of radar technology for surveillance grows, pushing demand for advanced passive radar systems.

Market Challenges

High Cost of Passive Radar System Installation

The installation costs associated with passive radar systems remain a significant challenge for many countries, especially given the complexity of integrating these systems into existing defense infrastructure. For instance, setting up a new radar installation for border security can cost up to USD 150 million, factoring in infrastructure, technology, and operational costs. These high upfront investments may deter smaller nations or municipalities from adopting the technology, limiting broader market penetration.

Regulatory Hurdles in Defense Equipment Procurement

Regulatory and compliance issues continue to slow the adoption of passive radar systems. Governments must adhere to strict defense procurement regulations that may delay or limit the deployment of new radar technologies. In the U.S., the International Traffic in Arms Regulations (ITAR) governs the export of military technologies, including radar systems, making international trade and deployment more challenging. These regulations can extend procurement timelines and increase operational costs for firms seeking to implement radar solutions globally.

Market Opportunities

Growth of Smart Cities and Urban Surveillance Networks

The rapid expansion of smart cities across North America and Europe is driving demand for advanced surveillance solutions, including passive radar. Smart cities incorporate interconnected devices, data analytics, and security systems to optimize urban living. As of 2022, over 250 cities globally have adopted smart city technologies, and the U.S. government alone has invested more than USD 10 billion to enhance urban surveillance networks. Passive radar is increasingly being used to monitor traffic, public spaces, and critical infrastructure in urban settings, presenting significant growth opportunities for the market.

Expansion of Defense Budgets in North America

Defense spending in North America, particularly in the U.S., remains a critical driver for the passive radar market. In 2023, U.S. defense spending increased by USD 30 billion to improve security and modernize military infrastructure, including radar and surveillance systems. The growing defense budgets allow for the procurement of advanced technologies, enhancing border protection and military defense mechanisms. This is expected to create substantial demand for passive radar solutions, further fueling the market’s growth.

Future Outlook

Over the next decade, the Israel passive radar market is expected to experience robust growth, driven by increased defense budgets, technological advancements, and expanding applications in smart cities. Continuous advancements in radar signal processing, AI integration, and reduced operational costs are set to push the adoption of passive radar systems. The market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 10% from 2026 to 2035.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- Thales Group

- BAE Systems

- L3 Technologies

- Leonardo S.p.A

- Saab AB

- General Dynamics

- IMI Systems

- Aeronautics Ltd

- Rockwell Collins

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace and Defense Manufacturers

- Telecommunications and Surveillance Service Providers

- Border Security Agencies

- Urban Development Agencies

- Military Contractors

- Technology Integrators for Defense Systems

Research Methodology

Step 1: Identification of Key Variables

The first phase involves constructing a detailed map of stakeholders in the Israel passive radar market. Secondary research is conducted through proprietary databases to identify key drivers, restraints, and opportunities. This step ensures an in-depth understanding of variables that influence the market.

Step 2: Market Analysis and Construction

In this phase, historical data regarding market value and adoption trends are compiled. The analysis includes exploring market penetration, the ratio of platform types, and revenue generation from these systems. The quality of service and accuracy of data are also evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by conducting interviews with industry experts, including radar system manufacturers, government agencies, and defense contractors. This expert consultation provides real-time insights into the operational and financial aspects of the market.

Step 4: Research Synthesis and Final Output

The final phase involves combining data from bottom-up and top-down approaches. Direct engagement with manufacturers provides critical data on product segments, pricing trends, and consumer preferences, validating and refining the findings.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense expenditure in North America

Rising demand for surveillance and border protection

Technological advancements in radar system integration - Market Challenges

High cost of passive radar system installation

Regulatory hurdles in defense equipment procurement

Integration complexities with existing military systems - Market Opportunities

Growth of smart cities and urban surveillance networks

Expansion of defense budgets in North America

Technological innovations in radar signal processing - Trends

Shift toward low-maintenance radar systems

Growing use of radar systems in civil applications

Integration of AI and machine learning for enhanced radar performance

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Ground-based Radar Systems

Airborne Radar Systems

Maritime Radar Systems

Integrated Passive Radar Systems

Mobile Radar Systems - By Platform Type (In Value%)

Military Platforms

Commercial Platforms

Surveillance Platforms

Defense Communication Platforms

Smart City Platforms - By Fitment Type (In Value%)

Fixed Systems

Mobile Systems

Portable Systems

Integrated Systems

Modular Systems - By End User Segment (In Value%)

Military & Defense

Aerospace & Aviation

Homeland Security

Public Safety & Emergency Services

Private Sector (Telecommunications, Weather Forecasting) - By Procurement Channel (In Value%)

Direct Procurement

Public Tenders

Private Procurement

Integrated Procurement

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters (Market Share, System Complexity, Installation Cost, Technology Integration, Platform Compatibility)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Company Profiles

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

IMI Systems

Aeronautics Ltd

Thales Group

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Saab AB

General Dynamics

BAE Systems

Leonardo S.p.A

L3 Technologies

Rockwell Collins]

- Government agencies’ growing reliance on passive radar

- Military organizations enhancing border surveillance

- Aerospace companies adopting radar for air traffic control

- Telecommunications industry seeking radar for spectrum management

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035