Market Overview

The market for portable communication systems in military applications is currently valued at approximately USD ~ billion, driven by advancements in secure communication technologies. The increasing complexity of defense operations, the need for real-time communication in battlefield environments, and the rise of unmanned systems have all contributed to the market’s growth. The demand for portable communication systems is further supported by military modernization efforts and the integration of digital communication tools, ensuring soldiers and defense personnel can operate effectively in complex and dispersed environments.

Countries such as the United States, Israel, and Russia dominate the market due to their substantial defense budgets, advanced technological capabilities, and strong military infrastructures. These nations have invested heavily in next-generation communication systems to enhance operational effectiveness and ensure strategic superiority. Additionally, ongoing military operations in various conflict zones have led to the adoption of portable communication systems that ensure robust, secure, and seamless communication in highly demanding environments.

Market Segmentation

By Product Type

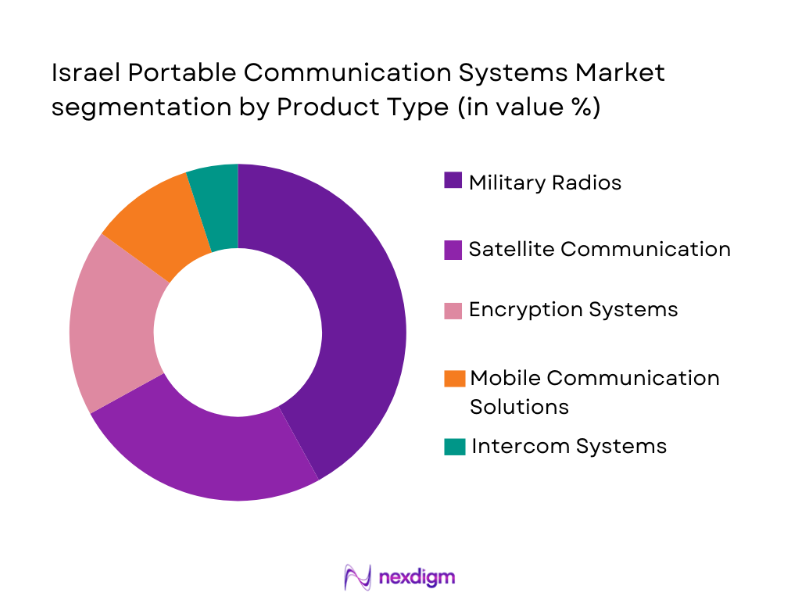

The portable communication systems market is segmented by product type into military radios, satellite communication systems, encryption systems, mobile communication solutions, and intercom systems. Recently, military radios have gained a dominant market share due to factors such as their reliability in critical communication environments, wide usage across different military branches, and compatibility with various communication networks. Furthermore, advancements in radio technology, including software-defined radios (SDR), have significantly enhanced their functionality, making them indispensable in modern military operations.

By Platform Type

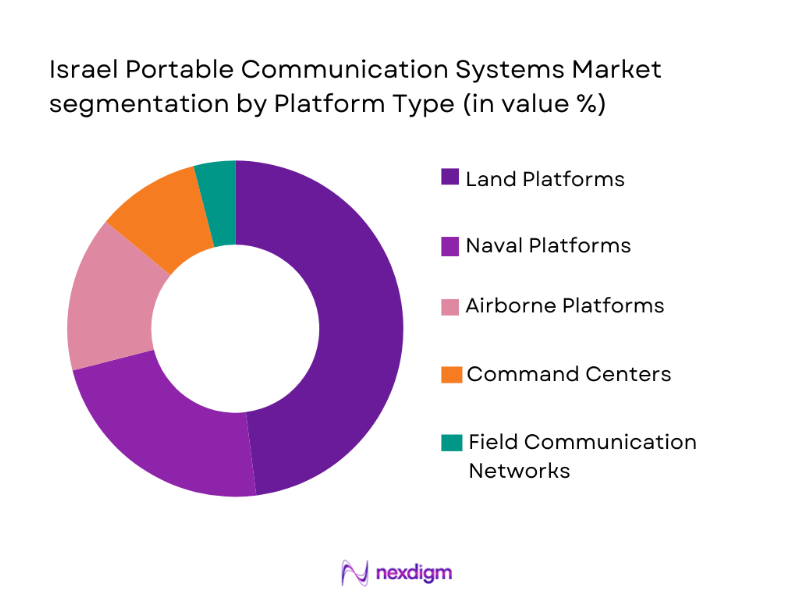

The market is also segmented by platform type into land platforms, naval platforms, airborne platforms, command centers, and field communication networks. Land platforms, particularly ground vehicles and mobile units, hold the largest market share due to the ongoing development of mobile communication units that can be deployed rapidly in the field. The demand for secure and reliable communication systems on land platforms has been fueled by military operations that require continuous communication, especially in hostile environments, where reliable communication is essential for coordination and strategic planning.

Competitive Landscape

The market for portable communication systems in military applications is highly competitive, with a mix of established players and newer entrants working to offer cutting-edge solutions. Consolidation is evident as major players acquire smaller companies to enhance their technological capabilities and market reach. The influence of companies like Elbit Systems, Thales Group, and Harris Corporation plays a significant role in driving technological innovation, particularly in areas like secure communications, satellite integration, and advanced encryption.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Harris Corporation | 1895 | Melbourne, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| Motorola Solutions | 1928 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

Israel Portable Communication Systems in Military Applications Market Analysis

Growth Drivers

Advancements in Communication Technology

The development of secure, real-time communication systems is one of the most significant growth drivers for the market. These advancements, including the adoption of software-defined radios (SDR) and the integration of encryption technologies, enable military forces to maintain communication integrity in highly sensitive operations. Additionally, the transition to 5G technologies in military communications is enhancing the speed, reliability, and security of data exchange, especially in complex and high-stakes environments. Increased defense spending in countries such as the United States, Israel, and China further fuels this growth, as these nations prioritize technology upgrades in their armed forces. Investments in satellite-based communication, which extends coverage to remote and battlefield areas, also drive the market forward. Furthermore, the push for interconnectivity among various military units and platforms, such as drones, unmanned ground vehicles, and command centers, adds to the demand for advanced portable communication systems. As technology advances, military operations become more complex, and there is a rising need for integrated communication systems that can handle diverse requirements. These systems’ ability to ensure seamless communication in critical moments is enhancing their importance in modern defense strategies. Therefore, continued technological progress and military modernization plans will remain pivotal to driving the growth of the portable communication systems market.

Increase in Military Spending

Increased military spending globally is another major factor driving the growth of the portable communication systems market. With geopolitical tensions rising and nations focusing on strengthening their defense capabilities, governments are allocating larger portions of their budgets to military modernization. The integration of advanced communication systems into defense strategies is a critical component of this modernization. Countries like the United States, Russia, and China have significantly increased their defense budgets, enabling them to invest in cutting-edge communication technologies for their armed forces. The growing need for secure, efficient, and resilient communication networks in military operations across land, air, and sea platforms further boosts this trend. Increased military budgets also allow for the procurement of more advanced communication systems for tactical and strategic use. Moreover, these investments extend beyond traditional communication systems to encompass cybersecurity measures, mobile communication infrastructure, and integrated command and control systems. As defense budgets continue to rise, particularly in emerging markets with growing defense needs, there is a clear expectation that military communication systems will evolve, driving the market’s expansion.

Market Challenges

High Cost of Advanced Communication Systems

The high cost of developing and deploying advanced portable communication systems remains one of the significant challenges in the market. The development of secure communication technologies, including encryption and satellite communication systems, requires substantial capital investment, which is often prohibitive for smaller nations or military entities with limited budgets. While developed nations with large defense budgets can absorb these costs, smaller defense forces face difficulties in upgrading their communication systems due to the prohibitive expenses involved. Moreover, the operational cost of maintaining these systems, including regular updates, repairs, and personnel training, adds to the financial burden. This challenge is further compounded by the rapid pace of technological advancements, which means that communication systems can become obsolete relatively quickly, necessitating continuous investments in system upgrades. As a result, many defense forces must carefully balance cost and functionality when choosing communication systems, which can limit their ability to adopt the latest technologies. Therefore, finding cost-effective solutions that do not compromise on security or performance remains a critical challenge for the market.

Integration with Existing Military Infrastructure

The integration of new portable communication systems with existing military infrastructure presents a significant challenge for the market. Many defense forces are already using older communication technologies that may not be compatible with newer, more advanced systems. This incompatibility can result in integration issues that hinder the smooth deployment of new systems. The integration process often requires significant modifications to existing infrastructure, including hardware, software, and network systems, which can be time-consuming and costly. Additionally, the diverse range of platforms used by different military branches—such as land, naval, and airborne units—further complicates the integration process. Communication systems must be capable of operating seamlessly across all platforms, which necessitates the development of highly flexible and adaptable solutions. Furthermore, the integration process often involves overcoming regulatory hurdles and standardization challenges, especially when multiple international entities are involved. As a result, the complex task of ensuring that new communication systems integrate smoothly with legacy infrastructure is a significant challenge for the market.

Opportunities

Expansion of Tactical Communication Systems for Unmanned Platforms

One of the key opportunities for the portable communication systems market is the expansion of tactical communication solutions for unmanned platforms. The increasing adoption of unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and autonomous underwater vehicles (AUVs) in military operations requires specialized communication systems to ensure real-time data transmission and command control. These unmanned systems are often deployed in environments where traditional communication systems may not be effective, making secure and reliable communication solutions even more crucial. As military operations increasingly rely on unmanned systems for surveillance, reconnaissance, and combat, there is a growing need for communication solutions that can maintain connectivity over long distances and in hostile environments. Furthermore, these systems must be capable of communicating with various other platforms and command centers, which adds to the complexity and potential for market growth. With technological advancements, including the miniaturization of communication components, the development of specialized communication networks for unmanned systems presents a significant opportunity for market expansion. As unmanned platforms continue to gain traction across various military applications, the demand for effective communication solutions will likely increase, driving the growth of the portable communication systems market.

Adoption of 5G for Enhanced Military Communication

The adoption of 5G technology is another major opportunity for the portable communication systems market. 5G offers significantly faster data speeds, lower latency, and higher bandwidth, making it an ideal solution for military communication systems that require real-time, high-volume data exchange. The potential of 5G to provide seamless connectivity across multiple platforms, including land, air, and sea, is particularly appealing for military forces seeking to enhance their operational capabilities. The increased speed and efficiency of data transmission enabled by 5G technology can improve everything from situational awareness to the coordination of military operations. Additionally, 5G’s ability to support the simultaneous use of a wide range of devices, including drones, mobile units, and wearable technology, makes it an attractive option for modern military communication systems. As nations and defense contractors explore the potential of 5G, its integration into military applications is expected to open up new avenues for communication and operational coordination. The adoption of 5G will not only improve communication capabilities but also enhance the security and resilience of military communication networks. Therefore, the ongoing rollout of 5G networks and the integration of this technology into military operations represents a significant opportunity for market growth.

Future Outlook

The portable communication systems market is expected to experience significant growth over the next five years, driven by advancements in communication technologies and increasing defense expenditures worldwide. Key trends such as the adoption of 5G, the integration of artificial intelligence, and the expansion of unmanned systems will likely shape the market landscape. As geopolitical tensions persist and defense forces continue to modernize, demand for secure and efficient communication systems will rise, further bolstered by supportive regulatory frameworks. Additionally, technological innovations will provide opportunities for enhanced data transmission speeds, reliability, and security, ensuring that military operations remain effective and adaptable.

Major Players

- Elbit Systems

- Thales Group

- Harris Corporation

- Northrop Grumman

- Motorola Solutions

- L3 Technologies

- General Dynamics

- Raytheon Technologies

- ViasatInc.

- Boeing

- Leonardo S.p.A.

- BAE Systems

- ASELSAN

- SAAB Group

- Rockwell Collins

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors and OEMs

- Defense ministries and agencies

- Private defense contractors

- System integrators

- Commercial satellite communication providers

- Tactical communication service providers

Research Methodology

Step 1: Identification of Key Variables

Identification of the critical market drivers, challenges, and growth opportunities through secondary research and expert consultations.

Step 2: Market Analysis and Construction

Comprehensive analysis of historical market data, current trends, and projections to build a detailed market model for the portable communication systems sector.

Step 3: Hypothesis Validation and Expert Consultation

Validation of hypotheses through expert interviews, surveys, and industry reports to ensure accuracy and reliability of the market model.

Step 4: Research Synthesis and Final Output

Consolidation of findings into a comprehensive market report with detailed insights, forecasts, and recommendations.

- Executive Summary

- Israel Portable Communication Systems in Military Applications Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets and military modernization

Adoption of secure communication networks

Technological advancements in portable communication

Geopolitical tensions and security concerns

Increasing demand for mobility in communication systems - Market Challenges

High cost of advanced communication systems

Integration complexity with legacy systems

Operational limitations in harsh environments

Regulatory and certification delays

High dependence on specialized manufacturing - Market Opportunities

Expansion of defense collaborations with private sectors

Emerging markets’ increasing defense investments

Development of AI-powered communication systems - Trends

Growth of satellite communication integration

Move towards software-defined communication systems

Increased use of encryption technologies

Focus on low-power consumption systems

Automation and AI integration in communication devices - Government Regulations & Defense Policy

Defense technology export restrictions

National security data protection regulations

International defense cooperation agreements - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Military Radios

Satellite Communication Systems

Encryption Systems

Mobile Communication Solutions

Intercom Systems - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Command Centers

Field Communication Networks - By Fitment Type (In Value%)

Handheld devices

Vehicle-mounted systems

Base station setups

Portable field communication kits

Integrated system solutions - By EndUser Segment (In Value%)

Defense agencies

Military contractors

Government defense departments

Private military service providers

Research and development units - By Procurement Channel (In Value%)

Direct government procurement

Military procurement contracts

Private sector purchases

Third-party suppliers

International defense partnerships - By Material / Technology (in Value%)

RF communication components

Satellite communication technology

Secure encryption materials

Miniaturized communication hardware

Integrated circuit and chipset technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Transmission Security Level, Frequency Range & Bandwidth, Form Factor & Weight, Network Capability, Power Consumption & Battery Life)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Motorola Solutions

Harris Corporation

Thales Group

General Dynamics

Northrop Grumman

L3 Technologies

Cobham PLC

Rockwell Collins

BAE Systems

SAAB AB

Leonardo S.p.A.

Sierra Nevada Corporation

- Military forces’ increased demand for advanced, secure communication

- Private contractors enhancing communication systems

- Rise of defense technology startups

- Growing integration of communication systems in defense R&D projects

- Military forces’ increased demand for advanced, secure communication

- Private contractors enhancing communication systems

- Rise of defense technology startups

- Growing integration of communication systems in defense R&D projects