Market Overview

The precision-guided artillery ammunition market is driven by significant investments in defense modernization programs, especially in countries with advanced military infrastructures. The market size in 2024 is expected to be USD ~ billion, based on current market demand and the growing emphasis on more accurate, long-range artillery solutions. Technological innovations, such as enhanced guidance systems and improved explosive materials, are pivotal in this growth, with advanced economies and defense forces pushing for more reliable and effective weaponry systems.

In terms of dominant regions, countries such as the United States, Israel, and several European nations lead the market due to their focus on defense modernization and technological advancements. These regions invest heavily in research and development to improve the precision and versatility of artillery systems. The strategic geopolitical positioning, coupled with robust defense policies and budgets, makes these nations key players in the precision-guided artillery ammunition market.

Market Segmentation

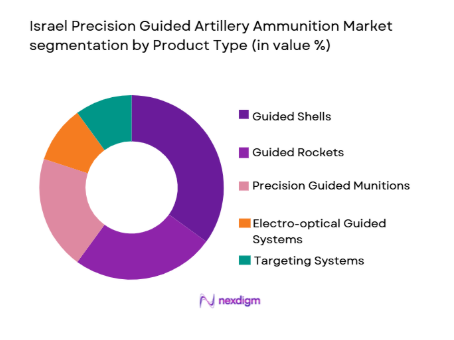

By Product Type

The precision-guided artillery ammunition market is segmented by product type into guided shells, guided rockets, precision-guided munitions (PGMs), electro-optical guided systems, and targeting systems. The guided shells sub-segment holds a dominant market share due to their wide usage in modern artillery systems. This is driven by increasing demand from military forces for long-range, high-precision munitions that can effectively target distant and highly protected adversaries. Enhanced accuracy and the ability to adapt to various combat scenarios are major contributors to the rising demand for guided shells.

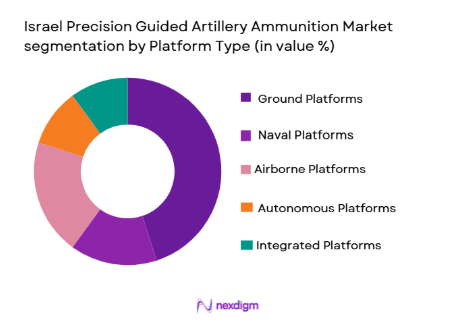

By Platform Type

The market is segmented by platform type into ground platforms, naval platforms, airborne platforms, autonomous platforms, and integrated platforms. Ground platforms dominate the market, primarily because they offer versatility and cost-effectiveness. These platforms are commonly used across multiple military operations, including field artillery and heavy weapon systems, where precision and range are paramount. The increasing adoption of integrated systems that combine various platform types further strengthens the presence of ground-based systems in military arsenals.

Competitive Landscape

The precision-guided artillery ammunition market is competitive, with key players dominating the industry through innovation, technological advancements, and global reach. Companies are focusing on developing advanced targeting and guidance systems to enhance the precision and efficacy of their products. The market has seen consolidation as companies seek to expand their product offerings and strengthen their technological capabilities. Partnerships and joint ventures are also common as players aim to increase market penetration and diversify their product portfolios.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

Israel Precision Guided Artillery Ammunition Market Analysis

Growth Drivers

Increasing Military Expenditure

The growing military expenditure in both established and emerging economies has been a significant driver for the precision-guided artillery ammunition market. As nations focus on improving their defense capabilities, modernizing existing weaponry, and ensuring the operational effectiveness of their forces, there has been an increase in demand for advanced munitions. Precision-guided artillery systems, known for their accuracy and range, offer an effective solution to modern warfare scenarios, particularly in asymmetric conflicts and high-intensity engagements. Military modernization programs in nations like the United States, Israel, and countries in Europe are contributing to the increasing adoption of these technologies. Furthermore, the geopolitical landscape, with escalating tensions and conflicts, further boosts the need for these high-performance weapons. Increasing recognition of the strategic advantages offered by precision-guided artillery systems continues to fuel investment and research in this segment, resulting in steady market growth. As defense budgets expand, particularly in defense-heavy nations, this growth driver is expected to maintain its importance in driving demand. Furthermore, emerging economies are also ramping up their defense capabilities, which is projected to increase the market for precision-guided artillery ammunition over the next few years.

Technological Advancements in Guidance System

Another key growth driver is the continued technological advancement of guidance systems that enhance the precision and performance of artillery munitions. The increasing accuracy of artillery systems, through innovations like GPS-guided and laser-guided technologies, ensures that weapons can achieve highly accurate hits, even in difficult environments or at long ranges. This reduces collateral damage, a major concern in military operations, and increases the operational efficiency of artillery units. The development of advanced guidance systems has made it possible to use existing artillery platforms with greater accuracy, thereby reducing the need for specialized equipment and making them more cost-effective. Additionally, there is a rising focus on multi-functionality, where these systems can be adapted for various missions, including counter-terrorism, peacekeeping, and conventional warfare. As more nations invest in upgrading their artillery systems, the demand for precision-guided ammunition systems is set to increase, particularly as militaries seek to reduce both their environmental footprint and logistical requirements in the field.

Market Challenges

High Development and Manufacturing Costs

One of the significant challenges faced by the precision-guided artillery ammunition market is the high cost associated with developing and manufacturing these systems. The complexity of the technologies involved in creating accurate guidance systems, such as GPS, laser guidance, and sensors, significantly increases production costs. These high costs may pose a barrier, particularly for smaller nations with limited defense budgets, which limits their ability to adopt advanced precision-guided systems. In addition, the time required to develop and integrate these technologies into existing military infrastructure can extend the timeline for achieving full deployment, thus delaying returns on investment for defense contractors. For companies in the defense sector, balancing the need for innovation with cost-effectiveness remains an ongoing challenge. Furthermore, rising raw material prices and the increasing demand for higher-end materials in these systems could further increase the cost burden, limiting the accessibility of these systems to only a few highly funded nations. The cost challenge is a crucial barrier that the industry must address through advancements in manufacturing technologies and through strategic partnerships that can help share the financial burden.

Interoperability and Integration Issues

Another challenge to the growth of the precision-guided artillery ammunition market is the issue of interoperability and integration with existing military systems. While advanced guidance technologies are crucial, the success of these systems heavily depends on their ability to integrate seamlessly with current artillery platforms. Military forces often rely on legacy systems, which may not be compatible with newer precision-guided ammunition, creating a need for costly upgrades or complete replacements. This integration challenge can be particularly difficult for nations with mixed or outdated military inventories, which lack the necessary infrastructure to support such advanced systems. Additionally, defense forces may face issues in training personnel to effectively utilize new technology, which can delay the adoption of these systems. As the pace of technological advancements accelerates, there is an increasing need for flexible systems that can integrate with a wide variety of platforms, which adds another layer of complexity to the development and implementation process. Overcoming these interoperability and integration barriers will be crucial for unlocking the full potential of the precision-guided artillery ammunition market.

Opportunities

Growth in Emerging Markets

As military spending continues to rise in emerging markets, there is a significant opportunity for precision-guided artillery ammunition manufacturers to expand their presence in these regions. Countries in Asia, the Middle East, and Africa are investing heavily in modernizing their defense capabilities, recognizing the need for more precise and reliable weapon systems. The precision-guided artillery ammunition market is expected to see growth in these regions as governments seek to strengthen their defense postures. Additionally, the increasing importance of counter-insurgency and anti-terrorism operations in these regions has accelerated the demand for precision artillery systems that can target specific threats with minimal collateral damage. Furthermore, as geopolitical tensions grow, particularly in regions such as the South China Sea and the Middle East, the demand for precision-guided munitions will continue to increase. As these nations seek advanced defense systems, there is a growing opportunity for market players to establish partnerships and provide tailored solutions to meet the unique needs of emerging markets. The future of this market in emerging regions is bright, with the potential for significant growth in the coming years.

Technological Partnerships for Enhanced Capabilities

Another significant opportunity in the precision-guided artillery ammunition market lies in forming strategic partnerships between technology firms and defense contractors. By collaborating with companies specializing in sensor technologies, artificial intelligence, and data analytics, manufacturers can enhance the capabilities of their systems, making them smarter and more efficient. These partnerships can help develop ammunition that is not only more precise but also capable of adaptive targeting and real-time decision-making, which could revolutionize the battlefield. Moreover, collaborations with tech firms can assist in overcoming some of the challenges related to cost, integration, and interoperability. By combining expertise in advanced guidance systems, AI, and machine learning, manufacturers can create artillery munitions that offer higher accuracy, reliability, and flexibility. This opportunity is crucial for staying competitive in the rapidly evolving defense industry, as both governmental and private sector players look to leverage emerging technologies to enhance their defense capabilities.

Future Outlook

The precision-guided artillery ammunition market is expected to continue its upward trajectory over the next five years, driven by advancements in technology, increased defense spending, and the growing need for more efficient military solutions. New technologies such as AI-based guidance, autonomous targeting, and enhanced explosives will further elevate the capabilities of these systems. Furthermore, government support for defense modernization programs, particularly in advanced and emerging economies, will continue to fuel the demand for such ammunition. The market’s future looks promising, with both technological developments and increasing demand side factors contributing to its growth.

Major Players

- Lockheed Martin

- BAE Systems

- Thales Group

- Elbit Systems

- Rheinmetall AG

- Northrop Grumman

- Raytheon Technologies

- L3Harris Technologies

- General Dynamics

- Saab Group

- IMI Systems

- Leonardo

- MBDA

- Israel Aerospace Industries (IAI)

- Leonardo DRS

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense contractors

- Security agencies

- Aerospace companies

- National defense ministries

- Private defense technology firms

- Military supply chain partners

Research Methodology

Step 1: Identification of Key Variables

We identify key variables impacting the precision-guided artillery ammunition market, such as technological developments, geopolitical trends, and defense spending patterns.

Step 2: Market Analysis and Construction

Market analysis is conducted through qualitative and quantitative methods, analyzing historical data and market dynamics to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through consultations with industry experts and stakeholders to ensure accuracy and relevance in market trends.

Step 4: Research Synthesis and Final Output

The final output synthesizes data, expert insights, and market forecasts into actionable information, providing a detailed market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in precision guidance systems

Increased demand for efficient and cost-effective ammunition

Rising military defense budgets globally

Strategic partnerships with international defense organizations

Innovation in long-range artillery systems - Market Challenges

High cost of precision-guided artillery munitions

Technological limitations in battlefield environments

Complexity in integrating new systems into existing infrastructure

Geopolitical tensions influencing international sales

Regulatory hurdles in cross-border artillery sales - Market Opportunities

Emerging markets in Asia-Pacific for advanced artillery systems

Demand for enhanced artillery targeting and range capabilities

Growing focus on environmental sustainability in ammunition development - Trends

Advancements in real-time artillery targeting systems

Integration of artificial intelligence in artillery systems

Increased focus on multi-platform artillery systems

Development of environmentally sustainable ammunition

Enhanced military interoperability for joint operations

Government Regulations & Defense Policy

Global arms trade regulations impacting artillery sales

Country-specific export control policies for military munitions

Defense funding policies favoring local production and R&D - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Guided shells

Artillery smart munitions

Enhanced range munitions

Laser-guided artillery shells

Guided rocket artillery rounds - By Platform Type (In Value%)

Self-propelled howitzers

Towed artillery

Multiple rocket launchers

Artillery reconnaissance platforms

Integrated defense systems - By Fitment Type (In Value%)

Weaponized platforms

Autonomous artillery units

Modular artillery systems

Tactical artillery units

Cross-border artillery platforms - By End User Segment (In Value%)

Military defense forces

National security agencies

Private defense contractors

International defense collaborations

Artillery training and simulation centers - By Procurement Channel (In Value%)

Government defense procurement

Private defense procurement

International defense deals

Defense procurement agencies

Research and development organizations - By Material / Technology (in Value%)

Composite materials

Advanced metal alloys

Thermal management materials

Precision guidance technologies

Electronics and sensor systems

- Market share snapshot of major players

- Cross Comparison Parameters (Price, Technology, Innovation, Market Reach, Customer Support, Global Presence, Delivery Time, Regulatory Compliance, R&D Investment, Product Reliability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Military Industries

Rafael Advanced Defense Systems

Elbit Systems

IAI (Israel Aerospace Industries)

IMI Systems

Elbit Systems of America

General Dynamics Ordnance and Tactical Systems

BAE Systems

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Thales Group

SAAB AB

Hanwha Defense

Rheinmetall AG

- Growing demand for smart munitions in military forces

- Increasing adoption of advanced artillery systems in defense agencies

- Emphasis on artillery training programs for end-users

- Rising collaboration between defense ministries and private sector

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035