Market Overview

The Israel radar simulators market is expected to experience robust growth, driven by the continuous demand for advanced defense and aviation systems. Based on recent assessments, the market size for radar simulators is valued at approximately USD ~ million. This growth is primarily fueled by increasing defense budgets and technological advancements in radar and simulation systems. Israel’s strategic positioning in the defense sector, particularly with its focus on innovation and high-tech solutions, has driven its market expansion. The demand for simulators in both military and civilian sectors is expected to rise as these technologies become integral to training, mission planning, and defense capabilities.

Countries such as Israel, the United States, and several European nations are dominant in the radar simulators market. Israel’s dominance stems from its advanced defense sector, with companies like Elbit Systems and Rafael Advanced Defense Systems leading in technological innovations. These countries have a well-established defense infrastructure, significant government investments in military technology, and a strong focus on defense modernization. Israel’s radar simulators market thrives due to its expertise in high-tech solutions, partnerships with global defense contractors, and its role as a global leader in advanced military systems.

Market Segmentation

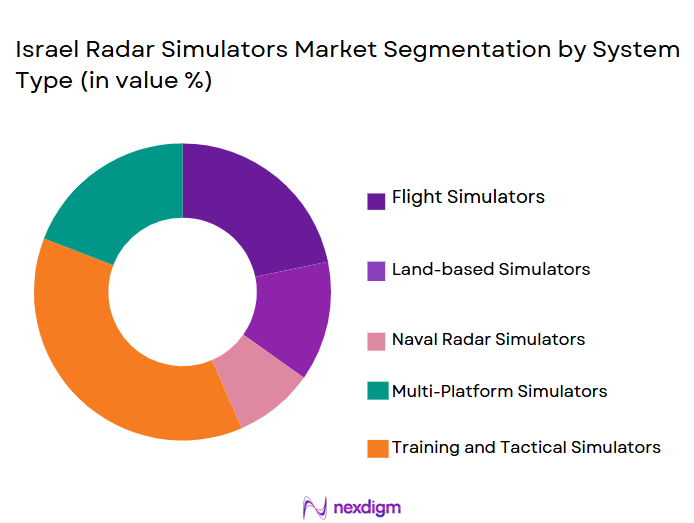

By System Type

The Israel radar simulators market is segmented by product type into flight simulators, land-based simulators, naval radar simulators, multi-platform simulators, and training and tactical simulators. Recently, the flight simulators segment has dominated the market share due to increasing demand from the aviation and defense sectors for realistic pilot and crew training environments. This sub-segment is further driven by advancements in simulation technology, with systems becoming more integrated and capable of replicating real-world flight scenarios. The adoption of flight simulators has been particularly strong in military air forces and civilian aviation sectors, which continue to rely on simulators for cost-effective, risk-free training.

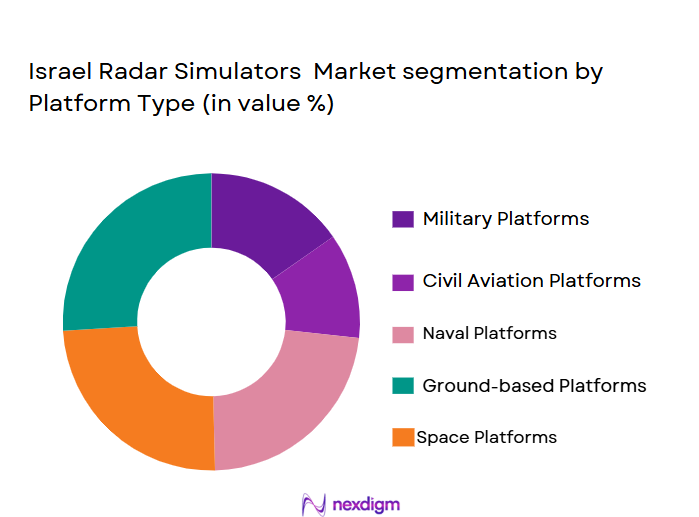

By Platform Type

The Israel radar simulators market is segmented by platform type into military platforms, civil aviation platforms, naval platforms, ground-based platforms, and space platforms. Among these, military platforms hold the dominant market share, driven by the ongoing modernization of defense forces and the need for advanced simulation systems in training environments. The demand from military sectors, particularly air force and army units, has been a key factor in this dominance. The ability to provide realistic, high-fidelity training solutions for complex military operations has made military platforms the largest consumer of radar simulators in Israel.

Competitive Landscape

The competitive landscape of the Israel radar simulators market is marked by the presence of major defense contractors and high-tech simulation solution providers. With consolidation in the sector, key players have expanded their market reach through strategic collaborations and technological advancements. Israel-based companies, such as Elbit Systems and Rafael, dominate the radar simulator market, leveraging their expertise in defense technologies. These companies continuously innovate to meet the growing demand for high-performance simulators, supported by government defense contracts and international partnerships.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Defense Technology Focus |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense | 1950 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| IAI (Israel Aerospace Industries) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Saab Group | 1937 | Stockholm, Sweden | ~ | ~ | ~ | ~ | ~ |

Israel radar simulators Market Analysis

Growth Drivers

Increased Defense Spending

The growth in defense spending, particularly by Israel and other nations in the Middle East, continues to drive the radar simulators market. As defense budgets increase, governments are allocating more funds for advanced training technologies to improve the effectiveness and efficiency of military operations. The growing complexity of modern warfare demands high-fidelity training environments, leading to greater adoption of radar simulators in military and defense sectors. Israel, in particular, has seen an increase in defense investments, with a significant portion directed towards enhancing its military capabilities. This trend is expected to continue, fueling demand for radar simulation systems across various platforms, including aviation, naval, and land forces.

Technological Advancements in Radar Simulation Systems

Advancements in radar and simulation technologies have further accelerated the growth of the Israel radar simulators market. Innovations in virtual reality (VR) and artificial intelligence (AI) are making simulators more immersive and capable of replicating complex real-world scenarios. These advancements have significantly improved the fidelity of simulations, enabling more realistic training environments for military personnel and civilians alike. As Israel remains at the forefront of technology, its defense contractors are leveraging these advancements to create cutting-edge radar simulators that meet the increasing demands of military and civilian users worldwide. This technological progress is expected to drive further growth in the radar simulators market over the coming years.

Market Challenges

High Development Costs

One of the major challenges facing the Israel radar simulators market is the high cost of developing advanced radar simulation systems. These systems require cutting-edge technology, extensive testing, and significant investment in research and development (R&D). This results in high upfront costs for manufacturers, which can limit the affordability of simulators for smaller or less-developed defense forces. The expensive nature of these simulators can also lead to longer procurement cycles, with defense agencies sometimes delaying purchases until funding is available. This challenge could slow the pace of market adoption, especially in regions with budget constraints.

Regulatory and Compliance Issues

Another challenge in the Israel radar simulators market is the complex regulatory and certification processes involved in developing and deploying radar simulation systems. These systems must meet stringent standards for accuracy, reliability, and performance, which can be difficult to achieve. Additionally, regulatory bodies in different regions may have varying requirements for certification, adding another layer of complexity for manufacturers seeking to expand their market reach. The compliance costs associated with meeting these standards can further hinder the growth of the market.

Opportunities

Expansion of Training Programs

The expansion of simulation-based training programs presents a significant opportunity for the Israel radar simulators market. With the increasing complexity of military operations and the growing need for highly skilled personnel, defense agencies worldwide are investing heavily in advanced training systems. Radar simulators provide a cost-effective, risk-free environment for personnel to practice and refine their skills. This shift towards simulation-based training is not only prevalent in military applications but is also expanding into civilian sectors, such as aviation and maritime industries. As governments and defense organizations recognize the value of simulators, demand for these systems is expected to grow.

Collaborations with Global Defense Contractors

Israel’s radar simulators market has significant growth potential through strategic collaborations with global defense contractors. By partnering with international firms, Israeli companies can expand their market presence and tap into new regions. These collaborations can also facilitate the development of more advanced radar simulators, incorporating the latest technologies in artificial intelligence, virtual reality, and data analytics. With an established reputation for high-quality defense products, Israeli companies are well-positioned to lead the radar simulators market by forming strategic alliances with key players in the global defense industry.

Future Outlook

The future of the Israel radar simulators market looks promising, with anticipated growth driven by increasing defense investments, technological advancements, and expanding training needs across both military and civilian sectors. Over the next five years, the market is expected to see a significant uptick in demand for high-performance simulators that integrate artificial intelligence, machine learning, and immersive training environments. Regulatory support from global defense bodies is also likely to drive further adoption of radar simulators, especially as governments focus on modernizing their military capabilities. With technological advancements and the growing importance of simulation-based training, the Israel radar simulators market is well-positioned for sustained growth.

Major Players

• Rafael Advanced Defense Systems

• IAI (Israel Aerospace Industries)

• Thales Group

• Saab Group

• Lockheed Martin

• BAE Systems

• Northrop Grumman

• Raytheon Technologies

• L3Harris Technologies

• Leonardo

• General Dynamics

• Harris Corporation

• AeroVironment

• Tactical and Simulation Technologies

Key Target Audience

• Government and regulatory bodies

• Military and defense organizations

• Aerospace and aviation companies

• Research and development firms

• Civil aviation training providers

• Naval forces and maritime training organizations

• Defense contractors and system integrators

Research Methodology

Step 1: Identification of Key Variables

Identifying the key market variables, such as market size, product types, and regional demand, to form the foundation for the analysis.

Step 2: Market Analysis and Construction

Building a comprehensive analysis based on historical data, current market conditions, and projections for future growth.

Step 3: Hypothesis Validation and Expert Consultation

Validating the initial hypotheses through consultation with industry experts, manufacturers, and stakeholders to ensure accuracy and reliability.

Step 4: Research Synthesis and Final Output

Synthesizing research findings and finalizing the report, ensuring that all insights are clearly presented and substantiated with credible data.

- Executive Summary

- Israel Radar Simulators Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for defense and military training simulators

Technological advancements in radar simulation technologies

Government investments in defense and aviation sectors - Market Challenges

High development and maintenance costs for radar simulators

Regulatory compliance and certification hurdles

Limited availability of advanced components and raw materials - Market Opportunities

Growing focus on simulation-based training programs

Expanding defense budgets globally

Technological collaboration with international defense contractors - Trends

Integration of AI and machine learning in radar simulations

Shift towards mobile and portable simulation systems

Growing adoption of virtual and augmented reality technologies in simulations

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Simulators

Land-based Simulators

Naval Radar Simulators

Multi-Platform Simulators

Training and Tactical Simulators - By Platform Type (In Value%)

Military Platforms

Civil Aviation Platforms

Naval Platforms

Ground-based Platforms

Space Platforms - By Fitment Type (In Value%)

Fixed Systems

Portable Systems

Mobile Systems

Compact Systems

Modular Systems - By EndUser Segment (In Value%)

Defense Forces

Aerospace & Aviation Industry

Naval Forces

Security Agencies

Civilian Sector - By Procurement Channel (In Value%)

Direct Purchase

Government Contracts

OEM Partnerships

Distributors and Resellers

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Product Innovation, Regional Presence, Technology Integration, Customer Loyalty) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

IAI (Israel Aerospace Industries)

Rafael Advanced Defense Systems

AeroVironment

Tactical and Simulation Technologies

BAE Systems

Thales Group

Saab Group

Harris Corporation

Leonardo

Lockheed Martin

Northrop Grumman

Raytheon Technologies

L3Harris Technologies

General Dynamics

- Military and defense agencies’ increasing focus on advanced simulation technologies

- Rising demand from commercial aviation for realistic training systems

- Naval forces adopting radar simulators for better tactical training

- Civil aviation and aerospace companies investing in pilot training simulators

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035