Market Overview

The Israel remote weapon systems market is valued at approximately USD ~ billion in 2024, primarily driven by increasing defense expenditures, particularly within the Middle East region, as well as demand for advanced weaponry in modern warfare. The market is fueled by technological advancements in automation, remote operations, and autonomous systems. The growth is also supported by the rising need for precision strikes in combat zones, pushing investments in unmanned weapon systems for both land and naval platforms. The integration of AI and improved targeting capabilities has further contributed to this demand.

Israel leads in the development and deployment of remote weapon systems, with its dominance rooted in the country’s robust defense industry and advanced technological infrastructure. The nation’s focus on research and development in the defense sector, coupled with its strategic geopolitical position, makes it a key player in the global market. Additionally, Israel’s long-standing alliances with Western powers and defense partnerships with nations in Asia and the Middle East have enhanced its position as a leader in weapon system exports, particularly in the unmanned and autonomous defense technologies sector.

Market Segmentation

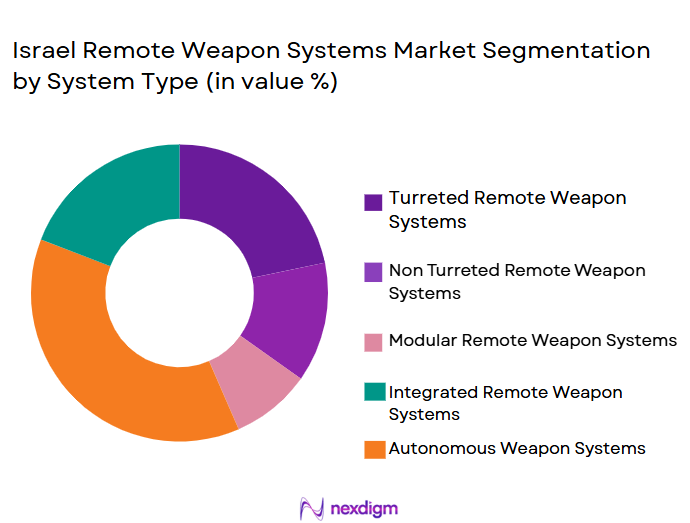

By System Type

The Israel remote weapon systems market is segmented by product type into turreted and non-turreted systems. Recently, turreted remote weapon systems have dominated the market share due to their versatility and enhanced targeting capabilities. These systems, typically mounted on land-based or naval platforms, allow for precise engagement of targets while maintaining operator safety. The demand for turreted systems has grown due to the increasing need for adaptable weapon platforms capable of responding to diverse battlefield scenarios. This growth is attributed to the operational advantages of turreted systems in combat environments, such as their ability to provide 360-degree defense coverage and improve force protection. The continued demand for turreted solutions is further driven by military modernization programs across multiple countries, where they are deployed in armored vehicles, naval vessels, and military drones.

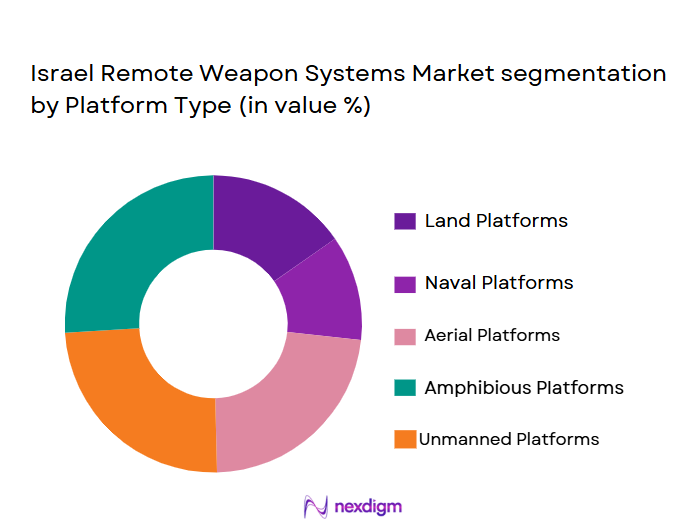

By Platform Type

The market is segmented by platform type into land platforms, naval platforms, and aerial platforms. Land-based platforms, especially armored vehicles, have the dominant share of the market due to the high demand for ground combat systems. The increasing importance of ground-based defense systems in modern warfare, which require flexibility and enhanced firepower, has driven the demand for remote weapon systems designed specifically for land platforms. These systems provide an essential edge in urban and tactical combat situations. As military forces continue to adapt to evolving warfare tactics, the demand for advanced land platforms integrated with remote weapon systems has surged. The land segment’s market dominance is a reflection of its vital role in national defense strategies.

Competitive Landscape

The Israel remote weapon systems market is characterized by significant competition, with major defense companies leading the sector. The market sees a mix of established players and new entrants striving for technological advancements, product diversification, and global reach. The influence of major companies is evident through their extensive R&D investments, particularly in unmanned systems, and their ability to secure government contracts. Consolidation in the defense sector has been visible, with collaborations between companies to integrate advanced technologies, further strengthening the market position of key players.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ |

| IAI (Israel Aerospace Industries) | 1953 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat Gan | ~ | ~ | ~ | ~ | ~ |

| Magal Security Systems | 1971 | Airport City | ~ | ~ | ~ | ~ | ~ |

Israel Remote Weapon Systems Market Analysis

Growth Drivers

Technological Advancements in Remote Weapon Systems

Technological advancements in remote weapon systems are a key driver of market growth. As military forces demand more precision and efficiency, the integration of advanced technologies, such as AI and machine learning, into weapon systems has been transformative. This technological evolution has made remote weapon systems more autonomous, capable of identifying and engaging targets with minimal human intervention. The increased deployment of unmanned aerial and ground systems further enhances operational efficiency, reducing risks for personnel. Military modernization programs worldwide are heavily investing in these advancements to ensure enhanced defense capabilities, leading to significant growth in the remote weapon systems market. The rapid development of these technologies, supported by ongoing R&D and government defense budgets, ensures the continual evolution of remote weapon systems in the coming years.

Defense Budget Increases and Geopolitical Instability

Another major growth driver is the increase in defense budgets in several nations, driven by ongoing geopolitical instability and security concerns. Countries are prioritizing the modernization of their military forces and investing in advanced weaponry, including remote systems. In volatile regions, such as the Middle East and Eastern Europe, governments are enhancing their defense capabilities to counter rising security threats. The rising demand for these systems is particularly evident in nations like Israel, the United States, and countries in NATO, which continue to lead in the development and adoption of remote weapon technologies. With defense spending expected to remain strong amid evolving security dynamics, the market for remote weapon systems is poised for continued growth.

Market Challenges

High Costs of Development and Production

A major challenge for the remote weapon systems market is the high cost of development and production. The integration of cutting-edge technologies, such as artificial intelligence, remote operation systems, and advanced weaponry, often requires significant investment in R&D and manufacturing capabilities. This drives up production costs, making these systems expensive to produce and acquire. Smaller nations or those with limited defense budgets may face challenges in acquiring these systems, limiting their widespread adoption. Moreover, the complexity of manufacturing these systems involves specialized components, further increasing production costs. As such, balancing cost with technological capability remains a critical hurdle for companies in this market.

Regulatory and Certification Hurdles

Regulatory and certification hurdles pose another significant challenge to the market. Remote weapon systems, especially those integrating AI and autonomous capabilities, are subject to stringent defense regulations and oversight. Governments must ensure compliance with national and international laws governing the use of unmanned systems and autonomous weapons. This regulatory environment can delay the deployment of new systems and complicate international trade and defense agreements. Furthermore, countries must balance the integration of cutting-edge technologies with the need for robust security and ethical considerations, complicating the approval processes for these advanced systems.

Opportunities

Integration with Unmanned Ground Vehicles (UGVs)

One significant opportunity for the remote weapon systems market is the integration with unmanned ground vehicles (UGVs). As military forces around the world continue to adopt autonomous systems, UGVs equipped with remote weapon systems are becoming increasingly popular. These vehicles provide enhanced mobility and firepower, allowing military forces to execute complex operations with reduced risk to human life. With ongoing investments in autonomous vehicle technologies, UGVs can be equipped with remote weaponry to provide a tactical advantage on the battlefield. This trend is expected to grow as governments look to modernize their ground forces with advanced systems that can operate in hostile environments without endangering troops.

Expansion in Emerging Markets

The expansion of the remote weapon systems market into emerging markets presents another significant opportunity. As geopolitical tensions rise in regions like Asia and Africa, countries are investing more in strengthening their defense capabilities. Remote weapon systems offer an affordable yet highly effective means to enhance security in these regions. Emerging economies are increasingly adopting these systems as part of their modernization programs, benefiting from the cost-efficiency and effectiveness of these technologies. With security concerns on the rise in several emerging markets, there is significant potential for growth in the adoption of remote weapon systems in these regions.

Future Outlook

The market for Israel remote weapon systems is expected to see continued growth over the next five years, driven by technological innovations, defense modernization programs, and increasing demand for unmanned systems. Anticipated advancements in AI, automation, and targeting capabilities will further expand the capabilities of these systems, making them more effective in diverse combat environments. Additionally, geopolitical tensions and rising defense budgets globally will fuel demand for advanced weapon systems, ensuring robust growth for Israel’s defense industry. The future of the market will likely include greater integration of unmanned ground and aerial platforms, enhancing operational flexibility and reducing risks to personnel.

Major Players

• Rafael Advanced Defense Systems

• IAI (Israel Aerospace Industries)

• IMI Systems

• Magal Security Systems

• Aeronautics Defense Systems

• UVision Air

• Kongsberg Gruppen

• Sagem Défense Sécurité

• Thales Group

• Lockheed Martin

• General Dynamics

• BAE Systems

• Northrop Grumman

• Leonardo DRS

Key Target Audience

• Government and regulatory bodies

• Military contractors and defense agencies

• Aerospace and defense technology providers

• Security solution integrators

• Unmanned systems manufacturers

• Defense ministries

• International defense alliances

Research Methodology

Step 1: Identification of Key Variables

This involves recognizing the key drivers, challenges, and growth potential within the Israel remote weapon systems market.

Step 2: Market Analysis and Construction

Analysis is conducted on current market dynamics, technological advancements, and political factors shaping the defense industry.

Step 3: Hypothesis Validation and Expert Consultation

Expert opinions and insights from industry leaders and defense analysts are gathered to validate market hypotheses.

Step 4: Research Synthesis and Final Output

Final outputs are derived by synthesizing all gathered data into comprehensive market forecasts, recommendations, and conclusions.

- Executive Summary

- Israel Remote Weapon Systems Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for modern defense technologies

Government defense budget allocations

Advancements in automation and autonomous weapons technology - Market Challenges

High R&D and production costs

Stringent regulations and certification processes

Geopolitical tensions affecting supply chains - Market Opportunities

Rising demand for unmanned and autonomous platforms

Growth in defense spending in emerging markets

Collaborations for joint defense projects - Trends

Integration of AI in remote weapon systems

Shift towards modular and customizable systems

Miniaturization of weapon systems for unmanned vehicles - Government Regulations & Defense Policy

Evolving export control regulations

Strengthening defense cooperation agreements

Emphasis on cybersecurity in weapon systems - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Turreted Remote Weapon Systems

Non-turreted Remote Weapon Systems

Modular Remote Weapon Systems

Integrated Remote Weapon Systems

Autonomous Weapon Systems - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Aerial Platforms

Amphibious Platforms

Unmanned Systems - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrades - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Private Security

Law Enforcement Agencies

Government Defense Ministries - By Procurement Channel (In Value%)

Direct Government Procurement

Indirect Government Procurement

Defense Contractors

Private Sector

International Agencies

- Market Share Analysis

- Cross Comparison Parameters

(System Type, Platform Type, Fitment Type, EndUser Segment, Procurement Channel, Key Players, Pricing Strategy, Technology Innovation, R&D Investment) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

IAI (Israel Aerospace Industries)

IMI Systems

UVision Air

Aeronautics Defense Systems

Magal Security Systems

AeroVironment

Kongsberg Gruppen

Sagem Défense Sécurité

Thales Group

Lockheed Martin

General Dynamics

BAE Systems

Northrop Grumman

- Growing demand from military forces

- Increasing adoption by private security contractors

- Rising integration with unmanned systems

- Expanding use in law enforcement operations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035