Market Overview

The Israel Russia defense market is expected to witness significant growth driven by ongoing defense collaborations, technological advancements, and a strong demand for advanced defense systems. The market size for 2024 is valued at approximately USD ~, driven by an increasing demand for air defense systems, missile defense, and surveillance platforms. The defense sector in both Israel and Russia is undergoing rapid modernization, contributing to the substantial market size and shaping future investment opportunities.

Dominant players in the market are primarily based in Israel and Russia, with key cities such as Tel Aviv, Moscow, and St. Petersburg at the forefront. The high demand for advanced military technologies in these regions drives the market, with both countries investing heavily in R&D for cutting-edge systems. Israel’s technological expertise and Russia’s robust defense industry infrastructure make these cities key hubs for innovation and collaboration, thereby influencing global defense supply chains.

Market Segmentation

By Product Type:

Israel Russia defense market is segmented by product type into land systems, naval systems, air defense systems, surveillance systems, and missile defense systems. Recently, air defense systems have a dominant market share due to factors such as increasing geopolitical tensions and the growing need for advanced missile defense technologies. Israel’s Iron Dome system and Russia’s S-400 systems are examples of highly sought-after products driving market dominance. The continuous evolution of air defense technologies, coupled with the regional demand for advanced protection against missile threats, has solidified air defense systems as a leading segment.

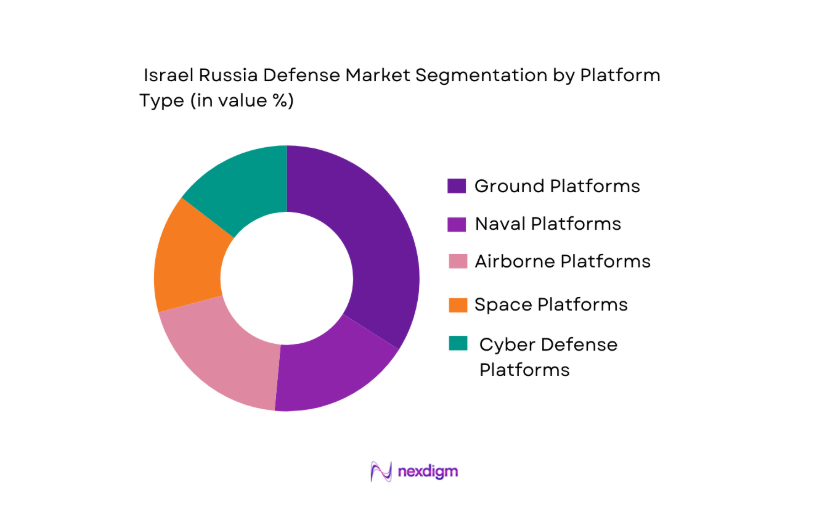

By Platform Type:

Israel Russia defense market is segmented by platform type into ground platforms, naval platforms, airborne platforms, space platforms, and cyber defense platforms. Recently, ground platforms have a dominant market share due to the growing military expenditure in both countries to modernize their ground-based defense systems. The increasing demand for armored vehicles, artillery systems, and drones for military operations has made this segment a crucial part of the defense market. Additionally, the strategic importance of ground forces in regional conflicts has contributed to the strong performance of ground platforms in the market.

Competitive Landscape

The Israel Russia defense market is highly competitive, with both countries focusing on strengthening their defense capabilities through strategic partnerships, joint ventures, and advanced R&D. The market is consolidated, with several key players dominating the landscape due to their technological leadership, innovation, and longstanding expertise in defense systems. Major players continuously upgrade their product portfolios and expand into international markets to secure their position in the global defense sector.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | R&D Investment (USD) |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1980 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| United Instrument Manufacturing Corporation | 1946 | Moscow, Russia | ~ | ~ | ~ | ~ | ~ |

| Almaz-Antey | 2002 | Moscow, Russia | ~ | ~ | ~ | ~ | ~ |

Israel Russia Defense Market Analysis

Growth Drivers

Technological Advancements in Defense Systems

Technological advancements in defense systems are a significant driver for the Israel Russia defense market. Both Israel and Russia are renowned for their innovation in defense technologies. Israel’s development of missile defense systems like Iron Dome and David’s Sling, alongside Russia’s S-400 and S-500 systems, represents the pinnacle of defense system technology. The ongoing demand for sophisticated defense solutions capable of countering missile threats and ensuring air superiority is driving investments and market growth. Additionally, advancements in autonomous systems and cybersecurity technologies further contribute to this growth, with defense contractors prioritizing these technologies in their strategic plans. The high demand for advanced radar, surveillance, and anti-aircraft systems is fueling the market, which is expected to expand in the coming years as nations seek to enhance their defense capabilities. Moreover, technological progress in AI-based defense applications, including drone warfare and cyber warfare, is driving both Israel and Russia to maintain technological superiority, strengthening market demand.

Geopolitical Tensions and Regional Instability

Geopolitical tensions and regional instability are key drivers for the growth of the Israel Russia defense market. As conflicts continue to erupt globally, countries in the Middle East and Eastern Europe are seeking to modernize their military capabilities to safeguard national interests. Israel, located in a volatile region, constantly upgrades its defense technologies to address security threats, while Russia’s defense posture in Eastern Europe and its increasing military involvement in various conflicts significantly boosts demand for defense solutions. The shifting balance of power, particularly in conflict zones like Syria, Ukraine, and the broader Middle East, continues to increase demand for defense systems. Military modernization programs in response to these challenges are vital for maintaining regional dominance, making defense spending a priority. Additionally, both countries benefit from defense exports, with Israel’s technology being highly sought after in regions like Asia and Latin America, further strengthening the market’s growth.

Market Challenges

Political and Diplomatic Risks

Political and diplomatic risks pose significant challenges to the Israel Russia defense market. The ongoing tension between Israel and neighboring countries, particularly Iran, often results in military confrontations, affecting the stability of the market. Similarly, Russia’s geopolitical activities, including its involvement in Ukraine and tensions with NATO, create uncertainties for the defense industry. These risks lead to unpredictable shifts in defense spending, making it challenging for companies to forecast market growth accurately. Furthermore, international sanctions on Russia have impeded access to foreign markets, limiting the flow of defense products globally. The evolving political landscape also impacts strategic alliances and joint ventures, as some countries may hesitate to engage with defense contractors due to concerns about compliance with international regulations or potential backlash from other nations. Such political instability can result in volatile market conditions, which hinders long-term growth prospects for the defense sector.

High Manufacturing Costs and Supply Chain Disruptions

High manufacturing costs and disruptions in the global supply chain present another challenge for the Israel Russia defense market. The cost of developing and producing advanced defense systems, such as missile defense systems, radar equipment, and drones, remains high due to the sophisticated technology involved. Additionally, the global semiconductor shortage has significantly impacted the production of defense technologies, as many systems rely on chips for functionality. These supply chain disruptions, coupled with increasing raw material costs, drive up production expenses, making it more challenging for companies to maintain profitability. While both Israel and Russia have robust defense manufacturing capabilities, the reliance on international suppliers for certain components means that global supply chain issues can directly affect production timelines and cost structures. Moreover, inflationary pressures globally are exacerbating the situation, further increasing production costs, thus limiting the competitiveness of defense products in international markets. These challenges require defense manufacturers to streamline operations and adapt to evolving market conditions.

Opportunities

Expansion of Unmanned Systems

The expansion of unmanned systems represents a promising opportunity in the Israel Russia defense market. The growing demand for drones, UAVs, and autonomous vehicles for both surveillance and combat operations has opened new avenues for defense manufacturers. Israel is a leader in unmanned aerial vehicles (UAVs), with its drones being widely deployed by defense forces globally. Russia, while newer to the market, has been increasing its investment in UAV technology, particularly for reconnaissance and attack purposes. The benefits of unmanned systems in terms of cost-effectiveness, reduced risk to personnel, and the ability to operate in challenging environments make them increasingly attractive to military organizations. Moreover, unmanned aerial systems are expected to play a critical role in future conflicts, and both Israel and Russia are investing heavily in R&D to maintain a competitive edge in this area. The demand for these systems is projected to continue growing, providing a significant opportunity for defense companies in both regions to expand their product offerings and tap into new markets.

Cyber Defense and Information Warfare

As cyber threats and information warfare become increasingly prominent, the Israel Russia defense market sees significant opportunities in cybersecurity and information warfare technologies. Israel has long been a global leader in cybersecurity, with its expertise in protecting critical infrastructure and military assets from cyber-attacks. Russia, too, has ramped up its capabilities in information warfare and cyber defense, creating opportunities for defense contractors to develop and deploy advanced solutions. The growing prevalence of state-sponsored cyber-attacks, particularly in the context of geopolitical tensions, has heightened the need for robust cyber defense systems. Both countries are prioritizing the development of sophisticated cybersecurity tools that can protect sensitive data, disrupt enemy networks, and provide strategic advantage in warfare. The expansion of cyber defense capabilities and the integration of artificial intelligence into these systems is set to drive the market forward, offering significant growth opportunities for companies that specialize in cybersecurity technologies.

Future Outlook

The future of the Israel Russia defense market looks promising, with both countries continuing to innovate and modernize their defense technologies. Over the next five years, advancements in unmanned systems, cyber defense, and missile defense technologies are expected to drive market growth. Additionally, ongoing geopolitical tensions in the Middle East and Eastern Europe are likely to fuel demand for advanced military solutions. Technological developments in AI, autonomous systems, and next-generation radar will further propel market expansion, with both countries playing pivotal roles in shaping the future of global defense capabilities.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- United Instrument Manufacturing Corporation

- Almaz-Antey

- Lockheed Martin

- Boeing Defense

- Northrop Grumman

- Raytheon Technologies

- Thales Group

- General Dynamics

- BAE Systems

- Saab AB

- MBDA

- Airbus Defence and Space

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military and law enforcement agencies

- Aerospace and defense manufacturers

- Security agencies

- Defense technology suppliers

- Research and development institutions

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying the key market variables that influence the Israel Russia defense market. This includes understanding the political, technological, and economic factors that impact the market. The aim is to establish the foundation for comprehensive market analysis.

Step 2: Market Analysis and Construction

Following the identification of key variables, a detailed market analysis is conducted, examining trends, market dynamics, and competitive forces. This helps in building a clear understanding of the market structure and its growth trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and hypothesis validation are crucial steps to ensure the accuracy of the market model. Engaging with industry leaders and professionals allows for the refinement of assumptions and the incorporation of real-world insights.

Step 4: Research Synthesis and Final Output

In the final step, all data and insights are synthesized to produce the market report. This includes validating the market size, identifying key players, and providing actionable recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in bilateral defense cooperation

Rising demand for advanced defense technology

Strategic importance of defense exports - Market Challenges

Political and diplomatic risks

High costs of advanced military systems

Complexity in cross-border defense collaborations - Market Opportunities

Increasing investments in defense innovation

Expanding market for unmanned defense systems

Growth of defense exports in emerging markets - Trends

Shift towards autonomous defense platforms

Increased focus on cybersecurity integration

Advancements in satellite and space-based defense systems - Government Regulations

Regulatory barriers for defense exports

Compliance with international defense agreements

Changes in defense procurement policies - SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Land Systems

Naval Systems

Air Defense Systems

Surveillance Systems

Missile Defense Systems - By Platform Type (In Value%)

Ground Platforms

Naval Platforms

Airborne Platforms

Space Platforms

Cyber Defense Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Defense Forces

Government Agencies

Private Contractors

Security Forces

Research & Development - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Government Contracts

- Market Share Analysis

- Cross Comparison Parameters (Platform Type, Procurement Channel, EndUser Segment, System Complexity, Geographic Region)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elbit Systems

IAI Systems

Kongsberg Gruppen

Lockheed Martin

Boeing Defense

Northrop Grumman

Raytheon Technologies

Thales Group

General Dynamics

BAE Systems

Saab AB

MBDA

Airbus Defence and Space

- Military Forces

- Intelligence and Security Agencies

- Private Military Contractors

- Defense Research Institutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035