Market Overview

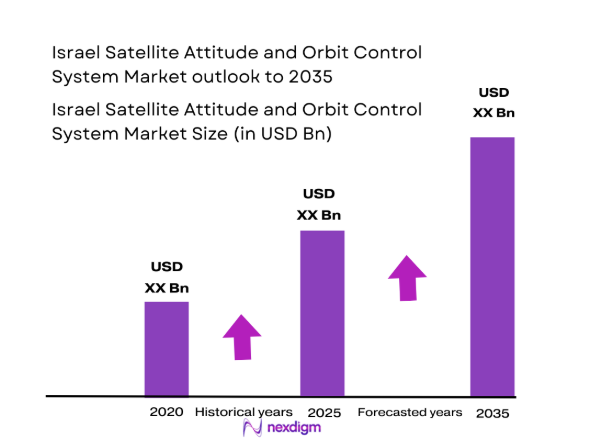

The market for satellite attitude and orbit control systems is valued at approximately USD ~ billion, driven by rising global satellite launches, technological advancements, and demand for satellite miniaturization. The market’s growth is bolstered by increasing investments in space exploration, defense sectors, and communications infrastructure. Growing interest in small satellites, which require precise attitude control, also fuels demand. Governments and private companies are focusing on deploying more satellites for various purposes such as Earth observation, communications, and scientific research, and further driving market growth.

Dominant regions such as the United States, China, and Russia lead the satellite attitude and orbit control systems market. These countries possess robust space programs with extensive satellite fleets, supported by substantial government investments. The U.S. continues to dominate in space infrastructure development due to its large private sector involvement, while China’s expanding space ambitions and advancements in satellite technology place it as a close competitor. Russia’s long-standing history in space exploration, particularly with military satellites, further solidifies its position in the global market.

Market Segmentation

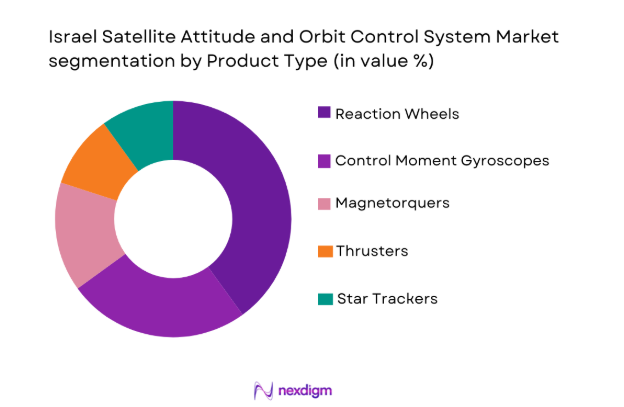

By Product Type

The satellite attitude and orbit control systems market is segmented by product type into reaction wheels, control moment gyroscopes, magnetorquers, thrusters, and star trackers. Among these, reaction wheels dominate the market due to their high precision, reliability, and extensive use in Earth observation satellites. Reaction wheels enable fine control of satellite orientation and are crucial for applications requiring high-level accuracy in positioning. As space missions become more complex, the demand for such systems continues to grow, driven by the need for better satellite stability and operational efficiency.

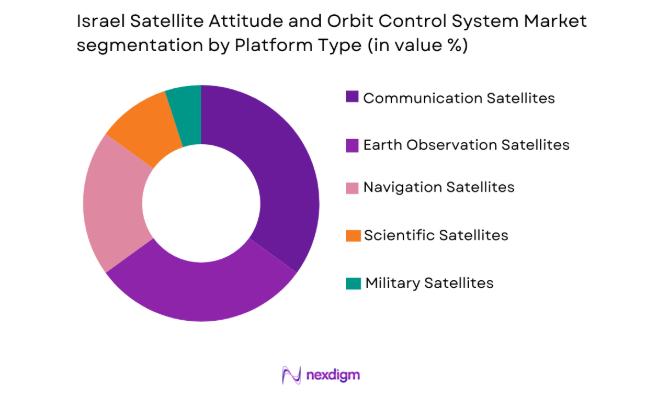

By Platform Type

The market is further segmented by platform type into communication satellites, Earth observation satellites, navigation satellites, scientific satellites, and military satellites. Communication satellites hold the largest share, driven by the increased demand for global communication infrastructure, particularly in remote and underserved regions. As governments and private companies expand satellite constellations for broadband internet and other communication needs, the demand for attitude and orbit control systems tailored to these platforms continues to rise.

Competitive Landscape

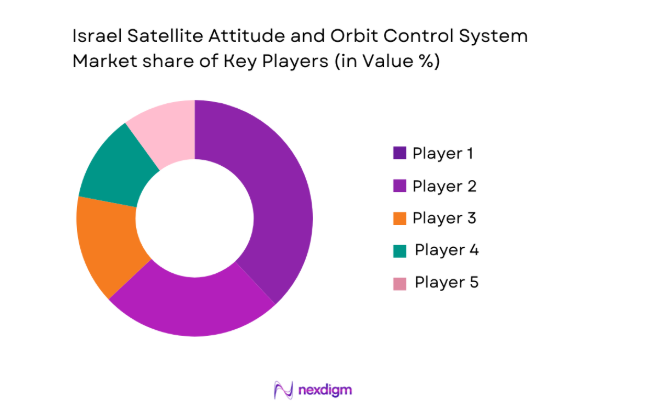

The satellite attitude and orbit control systems market is competitive, with major players like Israel Aerospace Industries, Northrop Grumman, and Airbus Defence and Space leading the sector. These companies benefit from significant government contracts and have a strong technological presence, particularly in defense and commercial sectors. Mergers and acquisitions within the industry have contributed to further consolidation, with companies expanding their product portfolios and R&D capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-specific Parameter |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2005 | France | ~ | ~ | ~ | ~ | ~ |

Israel Satellite Attitude and Orbit Control System Market Analysis

Growth Drivers

Increased Demand for Small Satellite Constellations

The growing deployment of small satellite constellations is a significant driver of growth for the satellite attitude and orbit control systems market. These small satellites, especially in low Earth orbit (LEO), are being utilized for a variety of applications, such as global communications, Earth observation, and scientific research. The need for satellite constellations to provide global coverage for services like broadband internet has accelerated the demand for attitude and orbit control systems. A prime example of this is the global satellite constellations being developed by private companies like SpaceX’s Starlink and Amazon’s Project Kuiper, which aim to provide fast, low-cost internet globally. These constellations rely on thousands of small satellites, each of which requires precise control over its orientation and position, which is made possible by advanced attitude and orbit control systems. Small satellites are often launched in groups, and their effective operation requires high-precision control to ensure that each satellite maintains its designated orbit and orientation. While small satellites are less expensive and more flexible than traditional large satellites, they still require highly reliable control systems to perform their mission effectively. The demand for these systems is being driven not only by private companies but also by governments and research organizations launching satellites for Earth observation and scientific exploration. The rise in small satellite constellations and the need for operational precision in low Earth orbit have created significant opportunities for the satellite attitude and orbit control systems market to grow. As more companies enter the space industry and satellite launches increase, the demand for attitude control systems is expected to continue rising, driving the market forward.

Technological Advancements in Satellite Systems

Technological advancements in satellite systems have played a pivotal role in driving the growth of the satellite attitude and orbit control systems market. Innovations in propulsion technology, such as ion thrusters and electric propulsion systems, have enabled satellites to operate more efficiently and for longer durations. These advancements allow satellites to conserve fuel and extend their operational lifespans, which is particularly important for deep space missions and satellite constellations that require constant repositioning. Additionally, innovations in attitude control mechanisms, such as gyroscopes, magnetorquers, and reaction wheels, have significantly enhanced satellite performance and stability. These systems are essential for ensuring that satellites maintain their correct orientation in space, especially for applications that require precise data collection and communication, such as Earth observation and communications. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into satellite systems has provided the capability for autonomous operations and improved decision-making. With AI, satellites can automatically adjust their orientation and maneuvering, reducing the need for human intervention. This autonomous functionality is crucial for satellite constellations that require high efficiency and continuous monitoring. The use of advanced sensors, such as star trackers, has also improved the accuracy of satellite orientation, making it possible for satellites to conduct more sophisticated and complex missions. As the space industry continues to innovate, these advancements in satellite control technology are driving the demand for more sophisticated attitude and orbit control systems. The continued development of new technologies will further boost the demand for these systems, leading to sustained market growth in the coming years.

Market Challenges

High Cost of Advanced Systems

One of the most significant challenges facing the satellite attitude and orbit control systems market is the high cost associated with advanced control systems. These systems, such as control moment gyroscopes, ion propulsion systems, and star trackers, are essential for ensuring the precise operation of satellites. However, they come with a high price tag due to the specialized technology, R&D, and manufacturing required to produce them. The high upfront cost of procuring these systems is a considerable barrier for smaller satellite manufacturers and private companies, especially startups, that may not have the financial resources to invest in such sophisticated technology. For many satellite operators, especially in emerging markets, the cost of advanced attitude and orbit control systems can account for a significant portion of their overall budget. This presents a challenge for expanding the satellite market to new entrants and developing regions, where cost-effective solutions are crucial. While larger satellite manufacturers and governmental space agencies can absorb these high costs, smaller players in the market may struggle to secure funding or financing to procure the required systems. Furthermore, the ongoing maintenance and replacement costs for these complex systems can place a financial strain on satellite operators, especially for satellite constellations that require constant upkeep and operation. As the demand for smaller, more affordable satellites grows, there is a need for more cost-effective attitude and orbit control systems. Innovations that reduce the cost of these systems while maintaining their performance will be crucial for addressing this challenge and enabling broader market participation.

Regulatory Barriers for Space-Based Technologies

Another major challenge that the satellite attitude and orbit control systems market faces is the increasingly complex regulatory landscape surrounding space technologies. As more satellites are launched into orbit and the space sector continues to grow, governments and international regulatory bodies are enforcing stricter regulations to ensure space safety and sustainability. These regulations cover a wide range of aspects, including satellite licensing, orbital debris management, frequency spectrum allocation, and the prevention of satellite collisions. While these regulations are essential for maintaining the safety of space operations, they also introduce significant barriers for satellite manufacturers and operators. The process of obtaining licenses and meeting regulatory requirements can be time-consuming and costly, leading to delays in satellite launches and increased operational expenses. Additionally, the growing concerns over space debris, which poses risks to both operational satellites and future missions, have led to more stringent guidelines for satellite disposal and end-of-life procedures. These regulatory measures can slow down the deployment of new satellites and increase the overall cost of satellite operations. For smaller satellite manufacturers or companies in developing regions, navigating these complex regulations can be particularly challenging, as it may require significant resources to ensure compliance with international space laws. The regulatory environment can also impact the development and testing of new attitude and orbit control technologies, as manufacturers must meet specific safety standards before they can deploy their systems. As the number of satellite missions continues to grow, the regulatory landscape will need to adapt to accommodate the increasing demand for space-based technologies, while still ensuring the safety and sustainability of space operations.

Opportunities

Growth in Government and Commercial Satellite Projects

One of the most promising opportunities in the satellite attitude and orbit control systems market lies in the continued growth of both government and commercial satellite projects. Governments worldwide are investing heavily in satellite infrastructure for a variety of purposes, including defense, national security, scientific research, and telecommunications. Programs like NASA’s Artemis mission, which aims to send astronauts back to the Moon, and the European Space Agency’s ongoing satellite initiatives, are driving demand for advanced attitude and orbit control systems. Furthermore, government-led initiatives in developing countries are also expected to fuel market growth as nations look to develop their own satellite capabilities for communication, weather monitoring, and disaster management. On the commercial side, private companies are increasingly deploying satellite constellations for broadband internet services, Earth observation, and communications. For instance, companies such as SpaceX with its Starlink project, and Amazon with its Project Kuiper, are deploying large constellations of small satellites that require sophisticated attitude and orbit control systems to ensure precise positioning and operation. As the demand for satellite connectivity continues to rise, so too does the need for advanced control systems capable of maintaining satellite stability and efficiency. Government and commercial satellite projects are expected to continue expanding over the next decade, creating significant opportunities for companies involved in satellite attitude and orbit control systems. As new players enter the space industry, the demand for these control systems will increase, contributing to the growth of the market.

Emerging Space Markets in Developing Regions

The emergence of space markets in developing regions, such as Africa, Latin America, and Asia-Pacific, presents another significant opportunity for the satellite attitude and orbit control systems market. Countries in these regions are increasingly recognizing the value of satellite technology for addressing local challenges such as improving communications, enhancing weather forecasting, and supporting disaster management. Many governments are now investing in space programs to launch satellites for telecommunications, Earth observation, and environmental monitoring. As these regions develop their own space capabilities, the demand for reliable and affordable satellite attitude and orbit control systems will rise. In particular, the demand for low-cost, efficient control systems for small satellites will be high, as many countries in these regions look to launch smaller satellite fleets to meet their local needs. Additionally, private sector players are also beginning to enter these emerging markets, offering commercial satellite services such as satellite-based internet and connectivity solutions. As satellite technology becomes more accessible, the number of satellite deployments in these regions is expected to grow, leading to an increased demand for attitude control systems. Companies that can offer cost-effective and high-performance systems tailored to the needs of these emerging markets will be well-positioned to capitalize on this opportunity. With the continued support of international space organizations and private sector investments, these emerging space markets are set to become key growth drivers for the satellite attitude and orbit control systems industry in the coming years.

Future Outlook

The satellite attitude and orbit control systems market is poised for steady growth, driven by increasing satellite deployments, advancements in space technology, and the expansion of satellite constellations. In the coming years, the market is expected to benefit from the growing demand for miniaturized satellite systems, which require advanced control mechanisms. Technological advancements, such as the development of ion propulsion and AI-based control systems, are expected to further enhance satellite performance. Moreover, continued support from governments and private sector investments in space exploration and satellite infrastructure will continue to fuel market growth, providing a positive outlook for the next five years.

Major Players

- Israel Aerospace Industries

- Northrop Grumman

- AirbusDefenceand Space

- Lockheed Martin

- Thales Alenia Space

- Raytheon Technologies

- Rocket Lab

- Boeing

- Maxar Technologies

- MDA Space

- SpaceX

- Orbital ATK

- OHB System

- RUAG Space

- Sierra Nevada Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Satellite operators

- Defense contractors

- Space agencies

- Telecommunication companies

- Earth observation organizations

Research Methodology

Step 1: Identification of Key Variables

Identifying the critical market variables, including technological trends, demand patterns, and regulatory factors, that affect the satellite attitude and orbit control systems market.

Step 2: Market Analysis and Construction

Analyzing data from primary and secondary sources and constructing a detailed market model based on key variables.

Step 3: Hypothesis Validation and Expert Consultation

Validating the initial hypothesis by consulting with industry experts, analyzing trends, and reviewing market intelligence reports.

Step 4: Research Synthesis and Final Output

Synthesizing research findings and finalizing the report with detailed insights, including market segmentation, competitive analysis, and growth forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in demand for satellite constellations

Advancements in miniaturization of satellite technologies

Rising demand for high-precision satellite control

Increase in satellite launches for telecommunications

Government space exploration programs - Market Challenges

High costs of advanced attitude and orbit control systems

Technological limitations in power consumption

Dependence on space debris mitigation strategies

Complexities in system integration and compatibility

Limited availability of skilled workforce - Market Opportunities

Emerging commercial space sector

Collaborations between private and governmental space entities

Integration of new sensor technologies to enhance system precision - Trends

Integration of AI for autonomous satellite control

Adoption of electric propulsion for attitude control

Development of small, low-cost attitude control systems

Trends toward multi-satellite constellation management

Growing focus on space debris tracking and avoidance - Government Regulations & Defense Policy

Space traffic management regulations

Space-based communication policy reforms

Satellite launch and space debris legislation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Reaction Wheels

Control Moment Gyroscopes

Magnetorquers

Thrusters

Star Trackers - By Platform Type (In Value%)

Communication Satellites

Earth Observation Satellites

Navigation Satellites

Scientific Satellites

Military Satellites - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Upgrades and Retrofits

System Integrations

Stand-alone Units - By EndUser Segment (In Value%)

Commercial Satellite Operators

Government & Military Agencies

Space Exploration Agencies

Telecommunications Providers

Earth Observation Companies - By Procurement Channel (In Value%)

Direct Sales

Distribution Channels

Online Procurement

Government Procurement Contracts

Third-Party Vendors - By Material / Technology (in Value%)

Hydraulic Systems

Electromechanical Systems

Solar-Powered Systems

Optical Sensors

Magnetic Torquing Technology

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (System Efficiency, Platform Compatibility, Technology Integration, Innovation, Cost-Efficiency)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Spacecom Satellite Communications

Rafael Advanced Defense Systems

Telespazio

Thales Alenia Space

Lockheed Martin

Boeing

Airbus Defence and Space

Northrop Grumman

Sierra Nevada Corporation

Ball Aerospace

L3 Technologies

RUAG Space

Arianespace

- Growing investment in satellite communication

- Military and defense applications driving demand

- Rising adoption of satellite constellations in space exploration

- Shift towards small and micro satellites for commercial use

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035