Market Overview

The Israel satellite bus market is seeing a strong growth trajectory, driven by the increasing demand for satellites in communication, Earth observation, and navigation applications. The market size is estimated at USD ~ billion, influenced by both governmental and commercial investments in space technologies. Advancements in satellite bus technologies, especially in terms of miniaturization and cost-effectiveness, are helping to make satellite systems more affordable and accessible. This has led to an increased adoption of small satellite constellations, such as LEO systems, by companies and governments around the world. Technological innovation, coupled with strong defense sector support, is fueling market expansion.

Israel has emerged as a global leader in the satellite bus market due to its advanced technological capabilities and strong government backing. Cities like Tel Aviv and Herzliya are key hubs for satellite research and development, where companies such as Israel Aerospace Industries (IAI) and Elbit Systems are based. The country’s established infrastructure, highly skilled workforce, and strategic partnerships with international organizations contribute to its market dominance. Israel’s role as a key player in the defense and space sectors, both in terms of manufacturing and innovation, has helped it maintain a competitive edge on the global stage.

Market Segmentation

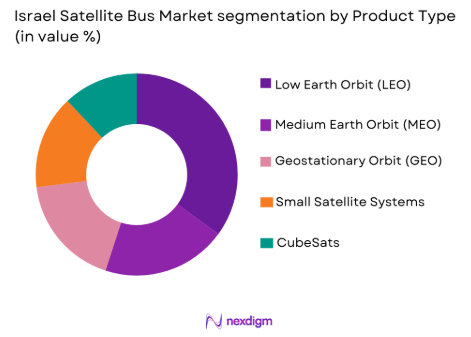

By Product Type

The Israel satellite bus market is segmented by product type into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Orbit (GEO), Small Satellite Systems, and CubeSats. Recently, the Low Earth Orbit (LEO) segment has seen the highest growth due to the increasing deployment of satellite constellations for global communication, broadband services, and Earth observation. LEO satellites are gaining traction due to their cost-effectiveness, short latency, and frequent revisit times, making them ideal for a wide range of applications. The rise of commercial ventures like SpaceX’s Starlink and OneWeb is fueling the demand for LEO satellite systems, driving growth in this segment. Furthermore, advancements in miniaturization and the decreasing cost of satellite manufacturing make LEO systems an attractive choice for operators.

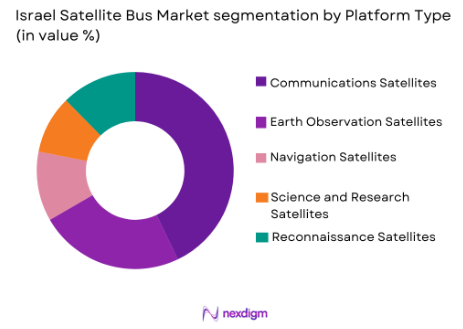

By Platform Type

The market is divided into several platform types: Communications Satellites, Earth Observation Satellites, Navigation Satellites, Science and Research Satellites, and Reconnaissance Satellites. The Communications Satellites segment holds the dominant share due to the growing demand for connectivity, television broadcasting, and secure communication systems. With global broadband expansion and the increase in the number of data-intensive applications, communications satellites are essential for connecting remote and underserved areas. The demand for high-throughput satellites and efficient satellite buses is rising, especially with the growth of satellite constellations and the expansion of 5G services globally. Communications satellites, being the backbone for many satellite-based services, have witnessed a consistent increase in demand for both low Earth orbit (LEO) and geostationary systems.

Competitive Landscape

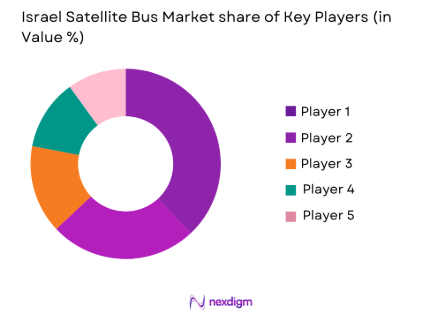

The Israel satellite bus market is characterized by intense competition, with major players such as Israel Aerospace Industries, Elbit Systems, and Rafael Advanced Defense Systems playing a pivotal role in shaping the market landscape. The industry is also seeing an increasing number of private sector companies entering the space, with firms like SpaceX and OneWeb focusing on launching satellite constellations, which fuels further growth and innovation. The consolidation trend is visible as larger companies absorb smaller ones or form strategic partnerships to enhance their market reach and technological capabilities. The involvement of defense contractors in satellite bus manufacturing adds an element of exclusivity to the market, with large-scale government contracts driving the growth of these firms.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Million) | Additional Parameter |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1980 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| SpaceX | 2002 | Hawthorne, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2000 | Leiden, Netherlands | ~ | ~ | ~ | ~ | ~ |

Israel satellite bus market Analysis

Growth Drivers

Technological Advancements

Technological advancements are one of the primary growth drivers in the Israel satellite bus market, propelling the development of more efficient, cost-effective, and technologically advanced satellite buses. A major factor influencing this trend is the rapid miniaturization of satellite systems, which allows for the deployment of more affordable, lightweight satellites without compromising their functionality. This has opened the door for satellite constellations, particularly in Low Earth Orbit (LEO), where miniaturized satellite buses are critical to supporting global communication and Earth observation systems. Advances in propulsion technologies, particularly electric propulsion systems, have further fueled the demand for more efficient satellite buses. Electric propulsion allows for longer operational lifetimes and lower fuel consumption, thereby increasing the cost-effectiveness of satellite missions, especially for commercial satellite constellations like SpaceX’s Starlink and OneWeb. The cost reduction achieved through the miniaturization of satellites is also being complemented by innovations in satellite bus integration, where multiple payloads can be integrated into a single bus to optimize operational costs. These advances also include innovations in solar power systems, battery technology, and the development of highly integrated systems that reduce the overall mass and complexity of satellites. The combination of these factors makes satellite buses not only more affordable but also more flexible and scalable, supporting a broader range of missions across communication, navigation, defense, and scientific fields. The adoption of new materials such as composite structures also plays a critical role in reducing satellite bus weight, thereby further lowering launch costs and expanding the market for smaller satellite buses. The technological momentum driven by Israel’s strong capabilities in space systems and defense technologies ensures that it remains a leading player in satellite bus development, continuing to drive market growth in both the commercial and defense sectors.

Government Investments in Space Programs

Government investments in space programs have proven to be a significant driver for the Israel satellite bus market. Israel’s government has consistently supported its aerospace and defense sector, with a strong emphasis on satellite technology to bolster national security, communications, and space exploration. The Israeli government has invested heavily in both the research and development of satellite systems and the establishment of infrastructure for satellite manufacturing and testing. These investments have led to the creation of some of the world’s most advanced satellite buses, which are used for both commercial and defense applications. Israel Aerospace Industries (IAI) and Elbit Systems are prime examples of companies that benefit from government contracts, with products ranging from military communication satellites to reconnaissance and Earth observation systems. The government’s active participation in space programs has also spurred the growth of private sector satellite manufacturers, which are able to benefit from government-led initiatives to develop advanced space capabilities. This has created a favorable environment for technological advancements, as Israel’s satellite bus manufacturers benefit from government-sponsored projects such as military reconnaissance systems and satellite constellations. Moreover, Israel’s national security interests drive investments in advanced satellite technologies, as satellite buses are critical for defense-related applications, including secure communications, reconnaissance, and surveillance. The Israeli government has actively participated in international collaborations with space agencies such as NASA and the European Space Agency (ESA), increasing the market visibility of Israeli satellite bus manufacturers. These government initiatives, combined with Israel’s strong defense industry, make the country an attractive market for satellite bus developers. Furthermore, the Israeli government’s consistent funding for space programs ensures the growth and sustainability of the satellite bus sector, providing a stable foundation for long-term market expansion.

Market Challenges

High Development Costs

High development costs remain a significant challenge for the Israel satellite bus market. Satellite buses are highly complex systems that require substantial financial investment in research and development, as well as in production and testing. The intricate nature of these systems involves cutting-edge technologies such as propulsion systems, power management, satellite bus integration, and payload accommodations, all of which contribute to the high costs. Each satellite bus is built to meet specific requirements for payload capacity, mission objectives, and operational life, which adds further complexity to the design and manufacturing processes. The costs involved in obtaining the necessary materials, such as specialized electronics, high-strength materials, and radiation-hardened components, are considerable. Additionally, satellite buses must undergo rigorous testing to ensure they meet industry standards for reliability and performance in harsh space environments. This extensive testing process increases the time required for development, which in turn raises costs for satellite manufacturers. While innovations in miniaturization and advanced manufacturing techniques have led to some cost reductions, the high initial investment required for research and development continues to limit the affordability of satellite buses. Smaller firms entering the satellite bus market face particular challenges, as they often lack the financial resources to compete with large, established players like Israel Aerospace Industries and Elbit Systems, which have the backing of government contracts and long-standing relationships with international space agencies. The cost barrier also affects customers, especially smaller countries or emerging space programs that may struggle to secure sufficient funding for satellite bus procurement. As satellite systems become more complex, with additional payloads and enhanced capabilities, the costs of satellite buses are likely to remain high, further slowing down market growth in certain sectors. These high development costs present ongoing challenges for manufacturers looking to expand their product offerings and reach new markets.

Regulatory and Compliance Issues

The regulatory landscape for the Israel satellite bus market presents another significant challenge, as manufacturers must navigate a complex web of national and international regulations. Israel’s satellite sector, particularly in defense-related applications, is subject to stringent national security regulations, which govern the design, production, and export of satellite buses. These regulations ensure that satellite technology used for military purposes is not misused or transferred to unauthorized parties. As a result, satellite bus manufacturers are required to comply with export controls and licensing requirements that limit the markets in which they can sell their products. Additionally, international regulations such as those governing space debris management, satellite collision avoidance, and frequency spectrum allocation further complicate the regulatory landscape. These regulations vary across different countries and space agencies, making it difficult for satellite bus manufacturers to ensure compliance across multiple markets. Manufacturers must also comply with space law agreements that address environmental concerns related to space debris, which can lead to delays in product development and regulatory approval. These challenges are compounded by the increasing volume of satellite launches, particularly with the growing trend of satellite constellations, which require new regulatory frameworks to ensure safe and efficient operation in space. The complexity of managing space traffic and preventing interference between satellites requires satellite bus manufacturers to adopt new technologies and integrate safety features into their systems, adding to the overall development cost. Navigating these regulations can be particularly challenging for smaller players in the market, who may lack the legal expertise and resources needed to meet compliance requirements. As the satellite industry expands and more companies enter the space, the regulatory environment will continue to be a major hurdle for manufacturers, especially as the international regulatory framework evolves to address the growing challenges of space traffic management and space debris mitigation.

Opportunities

Expansion of Commercial Satellite Constellations

The expansion of commercial satellite constellations is a prime opportunity for the Israel satellite bus market. Companies like SpaceX with its Starlink project, OneWeb, and Amazon’s Project Kuiper are heavily investing in deploying large-scale satellite constellations designed to provide global broadband internet coverage, especially in underserved regions. These commercial constellations will require the mass production of satellite buses capable of supporting various payloads, such as communication systems, Earth observation tools, and navigation sensors. The demand for reliable, affordable, and efficient satellite buses for these large-scale projects is expected to grow exponentially. Israel’s satellite bus manufacturers, particularly Israel Aerospace Industries (IAI) and Elbit Systems, are well-positioned to take advantage of this booming market. With their advanced technology in satellite bus design and manufacturing, they can meet the growing demand for small and medium-sized satellite buses that are lightweight, cost-effective, and capable of carrying multiple payloads. Additionally, Israel’s strong defense industry, which has a history of developing sophisticated satellite systems, enables local manufacturers to offer secure, high-performance solutions to meet commercial satellite operators’ needs. The push for global internet coverage through satellite constellations presents an opportunity to capitalize on the increasing need for both communication and non-communication satellites. As the cost of satellite production and launches continues to decrease due to advancements in satellite bus technology, more players will enter the market, driving further demand for satellite buses. The shift from traditional satellite communication systems to more complex, dynamic satellite constellations is expected to increase the production of smaller, more cost-effective satellite buses, which will continue to be a growing segment in the satellite bus market. This transition presents a substantial opportunity for Israeli manufacturers to become key suppliers to these international commercial satellite ventures, securing long-term contracts and broadening their market reach.

Technological Collaborations with Global Space Agencies

Another significant opportunity lies in forming strategic technological collaborations with global space agencies such as NASA, the European Space Agency (ESA), and others. Israel has developed a strong reputation for its cutting-edge satellite technologies, particularly in the areas of defense and communication. By forming partnerships with these space agencies, Israeli satellite bus manufacturers can expand their footprint in international space missions, ranging from planetary exploration to Earth observation and telecommunications. These collaborations often come with long-term contracts, offering a stable source of revenue and providing Israeli manufacturers with access to larger, more complex space programs. These space agencies require highly specialized satellite buses for missions that involve scientific research, deep space exploration, and global communications, which presents a substantial market opportunity. Israeli companies, with their technological expertise in satellite systems and their ability to design compact and highly efficient satellite buses, are well-positioned to contribute to these missions. In addition, these partnerships foster technological innovation, as Israeli manufacturers gain access to international expertise, resources, and funding. Collaborating with leading global space agencies also helps Israeli companies stay at the forefront of new technological developments, such as propulsion systems, payload integration, and satellite miniaturization. Furthermore, as space exploration continues to gain traction globally, the demand for more advanced satellite buses will increase, particularly for deep space exploration missions. By aligning with space agencies, Israeli manufacturers can gain access to high-profile space programs, enhancing their global market presence and securing new business opportunities in both the commercial and defense sectors. These collaborations help Israel strengthen its position as a leader in space technology, not only in satellite buses but also in broader aerospace and defense applications, providing a significant long-term growth opportunity for its satellite bus manufacturers.

Future Outlook

Over the next five years, the Israel satellite bus market is expected to experience steady growth, fueled by technological advancements and an expanding global demand for satellite constellations. As private and public sector investment in space exploration continues to rise, demand for satellite buses is set to increase, particularly in communication, navigation, and Earth observation applications. Advancements in satellite propulsion systems and miniaturization will continue to drive innovation, making satellite buses more efficient and affordable. The regulatory landscape will play a significant role in shaping the market’s future, with space debris management and international cooperation becoming increasingly important. The ongoing collaboration between Israel’s aerospace sector and global players will also contribute to the market’s long-term success.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- SpaceX

- Airbus Defence and Space

- Boeing

- Lockheed Martin

- Northrop Grumman

- Arianespace

- Thales Group

- Ball Aerospace

- OneWeb

- SES S.A.

- Viasat

- Iridium Communications

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite system manufacturers

- Defense contractors

- Space technology developers

- Satellite service providers

- Aerospace technology companies

- Telecom companies

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology involves identifying the key variables that influence the Israel satellite bus market. These variables include technological advancements, government investments, market demand, regulatory frameworks, and the competitive landscape. By understanding these elements, we can frame a comprehensive approach for analyzing market dynamics and trends. This process sets the foundation for further analysis, ensuring the research remains focused on the most impactful factors.

Step 2: Market Analysis and Construction

In this phase, we conduct in-depth analysis using both primary and secondary research methods to construct a clear market model. Data is gathered through industry reports, interviews with key stakeholders, and analysis of historical trends. The focus is on determining market size, growth drivers, barriers to entry, and competitive advantages of market players. This stage helps in establishing a baseline understanding of market conditions and its key segments.

Step 3: Hypothesis Validation and Expert Consultation

Once the initial analysis is conducted, we validate the developed hypotheses by consulting with experts in the satellite and aerospace sectors. These experts include professionals from satellite manufacturers, government agencies, and commercial entities involved in space programs. Expert feedback helps refine the assumptions and forecasts, ensuring the research reflects current and future market realities. This step ensures that all findings are well-supported by industry expertise.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all collected data, insights, and expert consultations into a comprehensive market report. This report provides actionable recommendations, insights on growth trends, and forecasts for future market developments. The final output is carefully reviewed for accuracy, ensuring it provides a complete overview of the Israel satellite bus market, including its dynamics, opportunities, and challenges. This step delivers a polished and reliable document for decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for satellite communication services

Technological advancements in satellite bus systems

Rising government investments in space exploration

Growing need for earth observation data

Expanding demand for global broadband services - Market Challenges

High initial cost of satellite bus systems

Complex regulatory and licensing procedures

Limited availability of qualified workforce in the sector

Dependency on specialized raw materials

Challenges in launching and maintaining satellite systems - Market Opportunities

Advancements in miniaturization of satellite systems

Partnerships between private companies and government agencies

Expansion of satellite services in emerging markets - Trends

Shift toward small satellite buses

Integration of advanced propulsion systems

Growth in commercial satellite constellations

Focus on satellite bus reusability

Development of AI-driven satellite systems - Government Regulations & Defense Policy

Regulations for satellite frequency usage

Space debris management and mitigation policies

National space exploration programs

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Low Earth Orbit (LEO) Satellite Buses

Medium Earth Orbit (MEO) Satellite Buses

Geostationary Orbit (GEO) Satellite Buses

Small Satellite Buses

Modular Satellite Buses - By Platform Type (In Value%)

Communication Satellites

Earth Observation Satellites

Navigation Satellites

Science and Research Satellites

Military Satellites - By Fitment Type (In Value%)

Standard Fitment

Custom Fitment

Modular Fitment

Integrated Fitment

Compact Fitment - By EndUser Segment (In Value%)

Government Agencies

Telecommunications Operators

Commercial Enterprises

Research Institutions

Defense Sector - By Procurement Channel (In Value%)

Direct Purchase

Third-Party Procurement

Public-Private Partnerships

Defense Contracts

Commercial Agreements - By Material / Technology (in Value%)

Carbon Fiber Reinforced Plastic (CFRP)

Aluminum Alloy

Titanium

Composite Materials

Silicon-Based Components

- Market share snapshot of major players

- Cross Comparison Parameters (Market Value, System Complexity, Technology Adoption, Procurement Channel, EndUser Segment, Pricing Strategies, Material Usage, Market Penetration)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Aerospace Industries

Spacecom

Rafael Advanced Defense Systems

Elbit Systems

Comtech Telecommunications

Arianespace

Airbus Defence and Space

Northrop Grumman Innovation Systems

Lockheed Martin

Thales Alenia Space

Telespazio

Boeing

MDA Space

Astroscale

SpaceX

- Demand from telecommunications companies

- Role of space agencies in satellite bus deployment

- Growing reliance on satellite systems in defense

- Commercial demand for satellite constellation services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035