Market Overview

The Israel Satellite Cable and Assemblies market is valued at USD ~ million, driven by the growing demand for high-performance satellite-based communication systems. The market is fueled by technological advancements in satellite communication and the expansion of telecom networks, including the government’s push for better satellite infrastructure. The growing number of satellite launches and demand for satellite services, especially in defense and broadcasting, propels the market forward.

The key cities driving the market include Tel Aviv, Herzliya, and Be’er Sheva. Tel Aviv, being the country’s technology hub, is home to many satellite communication companies and startups focusing on space technologies. Herzliya, with its proximity to military research centers, has a high concentration of defense contractors, while Be’er Sheva, known for its innovation in cybersecurity and satellite communications, is becoming a central player in satellite technology.

Market Segmentation

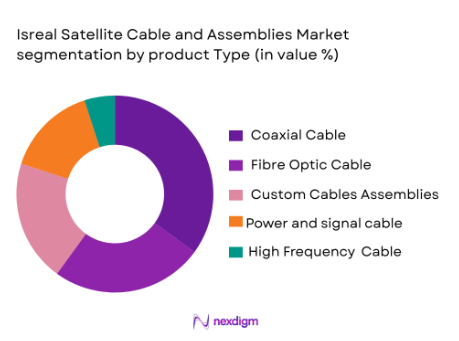

By Product Type

The Israel Satellite Cable and Assemblies market is segmented by product type into coaxial cables, fiber optic cables, custom cable assemblies, power and signal cables, and high-frequency cables. Coaxial cables hold a dominant market share due to their established role in satellite communication networks. Coaxial cables are widely used for signal transmission in television broadcast systems and satellite links, offering both durability and high performance. Their dominance is further supported by the continuing need for legacy systems that require these robust solutions for seamless data and video transmission.

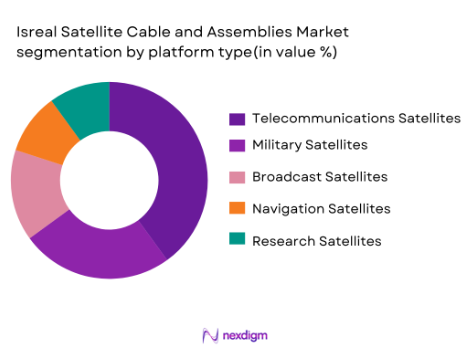

By Platform Type

The market is segmented by platform type into telecommunications satellites, military satellites, broadcast satellites, navigation satellites, and research satellites. Telecommunications satellites dominate the market, driven by the increasing demand for broadband services in rural and underserved areas. These satellites provide essential communication infrastructure, and their demand is rising with the expanding reach of global networks and the increase in internet penetration. Their critical role in providing reliable internet and communication services across regions contributes to their dominance in the market.

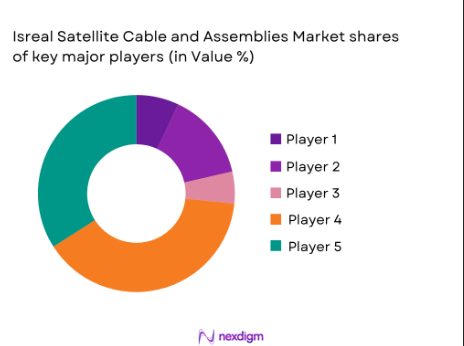

Competitive Landscape

The Israel Satellite Cable and Assemblies market is consolidated with a few dominant players, including global satellite communication leaders and local manufacturers. Companies such as Israel Aerospace Industries (IAI), SpaceX, and SES S.A. lead the market by supplying critical satellite systems and cable assemblies. The industry sees significant investment from both government entities and private sector players aiming to increase their presence in the rapidly expanding satellite communications sector.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | – | – | – | – | – |

| SpaceX | 2002 | Hawthorne, USA | – | – | – | – | – |

| SES S.A. | 1985 | Luxembourg | – | – | – | – | – |

| Viasat Inc. | 1986 | California, USA | – | – | – | – | – |

| Thales Alenia Space | 2005 | Cannes, France | – | – | – | – | – |

Israel Satellite Cable and Assemblies Market Analysis

Growth Drivers

Increasing demand for satellite-based communication services

The demand for satellite-based communication systems is rising due to the increased need for reliable internet and communication infrastructure in both rural and urban areas. The push for global connectivity, along with the expansion of the 5G network in areas that are hard to reach with terrestrial systems, is contributing to this demand. Satellite communication is seen as a long-term solution for providing broadband to remote regions where fiber optics or conventional internet infrastructure are not feasible. This growth driver is supported by investments in satellite communication by both government and private sectors. Furthermore, innovations in satellite technology, such as low-earth orbit (LEO) satellites, are further increasing the scalability and cost-efficiency of satellite communication services. As governments worldwide increase investments in communication satellites, the Israel Satellite Cable and Assemblies market will continue to benefit from this trend.

Government initiatives supporting space technology growth

Israel’s government has made significant strides in expanding the nation’s space technology capabilities, and these initiatives are directly driving the growth of satellite cable and assemblies. Israel’s space agency (ISA) plays a crucial role in advancing satellite technology and communication systems, with projects like the Amos series of communication satellites. Government-backed programs are fostering collaborations between private companies and military contractors to enhance satellite communication systems. Furthermore, Israel’s strong defense industry, which relies heavily on satellite systems for secure communication, supports the continuous demand for high-quality cable assemblies designed for military applications. The robust governmental push toward space exploration and satellite communication ensures sustained growth in this market.

Market Challenges

High cost of manufacturing advanced satellite cables

One of the biggest challenges facing the Israel Satellite Cable and Assemblies market is the high cost of manufacturing advanced satellite cables. The cost of raw materials such as copper and specialized alloys for high-frequency cables continues to rise, driving up production costs. Furthermore, the advanced manufacturing techniques required to produce high-quality satellite cables that can withstand the harsh environments of space add to the overall expenses. The challenge is exacerbated by the global supply chain issues affecting the availability and cost of raw materials. This makes it difficult for smaller manufacturers to compete with larger players, leading to consolidation in the market. While technological advancements in cable materials may help reduce costs in the future, current production methods remain expensive, putting financial strain on companies involved in satellite cable manufacturing.

Regulatory compliance and certification issues

The Israel Satellite Cable and Assemblies market faces stringent regulations and certification requirements for satellite communication systems, which can be a challenge for manufacturers. Both national and international regulations governing the design, production, and deployment of satellite communication systems can be complex, requiring adherence to a variety of standards. These regulations often require extensive testing and certification processes, which can delay product development and increase costs. Compliance with these regulations is critical, as failure to meet required standards can lead to regulatory penalties or product rejection. As the demand for more advanced and diverse satellite technologies increases, regulatory frameworks will continue to evolve, further complicating the certification process and potentially slowing market growth.

Opportunities

Expansion of satellite constellations for global broadband coverage

The expansion of satellite constellations for global broadband coverage presents a major opportunity for the Israel Satellite Cable and Assemblies market. Companies such as SpaceX with their Starlink project are working to deploy thousands of small satellites in low-earth orbit, providing high-speed internet access to remote and underserved regions. Israel, with its advanced satellite technology capabilities, stands to benefit significantly from these global efforts. The increasing use of LEO satellites for low-latency, high-speed internet and other communication services creates new demand for satellite cable and assembly solutions. This global trend is expected to increase the adoption of satellite-based communication systems, further driving the need for advanced satellite cables.

Development of sustainable and eco-friendly manufacturing practices

As the global market moves toward sustainability, there is growing demand for environmentally friendly satellite cable manufacturing processes. The adoption of green technologies in manufacturing not only helps to reduce carbon footprints but also attracts consumers who are increasingly concerned about environmental issues. In Israel, where technology and sustainability go hand in hand, companies are focusing on developing eco-friendly materials for satellite cables, such as recyclable materials and energy-efficient manufacturing processes. The rise in sustainability initiatives will open new avenues for manufacturers, enabling them to tap into markets that prioritize green solutions. Companies that invest in sustainable manufacturing practices will be well-positioned to meet both regulatory standards and consumer demand for environmentally responsible products.

Future Outlook

The Israel Satellite Cable and Assemblies market is expected to continue growing in the coming years, driven by technological advancements, government support, and the increasing need for satellite-based communication systems. The market will see significant innovation, especially in satellite constellations and communication technologies, which will further expand the demand for high-quality satellite cables. Government initiatives to enhance space infrastructure and the growing commercial satellite sector will contribute to the market’s continued expansion. As sustainability becomes a key priority, companies are expected to focus more on green technologies in manufacturing processes, opening new opportunities for market participants.

Major Players

- Israel Aerospace Industries

- SpaceX

- SES S.A.

- Viasat Inc.

- Thales Alenia Space

- Intelsat

- Maxar Technologies

- Arianespace

- OneWeb

- Lockheed Martin

- Hughes Network Systems

- Telesat

- Eutelsat Communications

- Boeing Space and Launch

- L3Harris Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Israel Space Agency, Ministry of Communications)

- Telecommunications service providers

- Broadcasting companies

- Satellite manufacturers

- Military contractors

- Research organizations

- Private satellite operators

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research process involves identifying key variables impacting the Israel Satellite Cable and Assemblies market. This includes the technological advancements, regulatory frameworks, and growth drivers influencing satellite communication systems.

Step 2: Market Analysis and Construction

In this phase, historical data and market penetration rates are analyzed to understand the current state of the market. This includes assessing the demand for satellite-based communication services and the types of cable products used in satellite systems.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated by consulting with industry experts and stakeholders involved in the development and production of satellite communication systems. This includes manufacturers, telecom operators, and government agencies.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the collected data with insights from key market players. This provides a comprehensive, validated understanding of the market’s current dynamics and future projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing demand for satellite-based communication services

Rising government investments in space and defense sectors

Increased focus on broadband connectivity for rural areas - Market Challenges

High cost of raw materials for cable production

Complex regulatory compliance for satellite components

Limited infrastructure in remote regions - Market Opportunities

Expansion of satellite constellations for global communication

Adoption of sustainable manufacturing practices in cable production

Technological advancements in high-frequency cable systems - Trends

Miniaturization of satellite components

Integration of satellite constellations for global broadband services

Shift towards eco-friendly manufacturing processes - Government Regulations

Satellite Licensing and Regulatory Frameworks

Emission Standards for Satellite Systems

Export Control Regulations on Satellite Components

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- Growth Drivers

Growing demand for satellite-based communication services

Rising government investments in space and defense sectors

Increased focus on broadband connectivity for rural areas - Market Challenges

High cost of raw materials for cable production

Complex regulatory compliance for satellite components

Limited infrastructure in remote regions - Market Opportunities

Expansion of satellite constellations for global communication

Adoption of sustainable manufacturing practices in cable production

Technological advancements in high-frequency cable systems - Trends

Miniaturization of satellite components

Integration of satellite constellations for global broadband services

Shift towards eco-friendly manufacturing processes - Government Regulations

Satellite Licensing and Regulatory Frameworks

Emission Standards for Satellite Systems

Export Control Regulations on Satellite Components

- Market Share Analysis

- Cross Comparison Parameters (Product Quality, Innovation, Customer Service, Production Capacity, Supply Chain Efficiency)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Company profiles

ISRO

SES S.A.

Intelsat

Viasat Inc.

Boeing Space and Launch

Thales Alenia Space

Telesat

Maxar Technologies

Hughes Network Systems

Arianespace

Eutelsat Communications

OneWeb

Lockheed Martin

L3Harris Technologies

SpaceX

- Government Defense and Space Agencies

- Private Satellite Operators

- Telecommunications Service Providers Broadcasters

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035