Market Overview

The Israel Satellite Manufacturing and Launch Systems Market is valued at approximately USD ~ billion, driven by advancements in satellite technology, government investments, and increasing demand for space-based services such as communication, navigation, and Earth observation. The market is further propelled by the need for low-cost satellite launches, growing global interest in space exploration, and the demand for advanced communication infrastructure. Israel’s strategic focus on space innovation and its government-driven support contribute to the market’s robust growth, with companies in the country leading technological advancements in satellite design and manufacturing.

Countries like Israel, the United States, and several European nations dominate the satellite manufacturing and launch systems market, with Israel emerging as a significant player due to its technological expertise and government-backed initiatives. Israel’s geographic location and strategic alliances with international partners enhance its position in the global satellite manufacturing ecosystem. Furthermore, Israel’s strong defense and aerospace sectors, which heavily rely on satellite technology, further cement the country’s dominance in the market. These nations continue to make substantial investments in satellite research, contributing to the growth of the global satellite market.

Market Segmentation

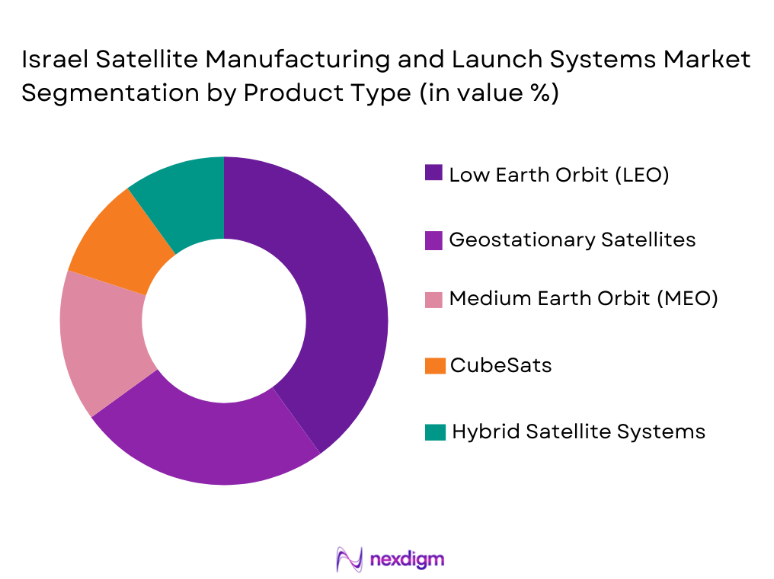

By Product Type

The Israel Satellite Manufacturing and Launch Systems Market is segmented by product type into low Earth orbit (LEO) satellites, geostationary satellites (GEO), medium Earth orbit (MEO) satellites, CubeSats, and hybrid satellite systems. Recently, low Earth orbit (LEO) satellites have a dominant market share due to factors such as the increasing demand for high-speed internet services, communication applications, and satellite constellations for global coverage. LEO satellites are more cost-effective for launch, provide lower latency, and are gaining traction in both commercial and defense sectors. The development of LEO constellations, such as those by SpaceX’s Starlink, is fueling the demand for these satellites, driving their adoption and increasing market share. With governments and private players increasingly investing in LEO satellite technology, this segment is poised to dominate the market for the foreseeable future.

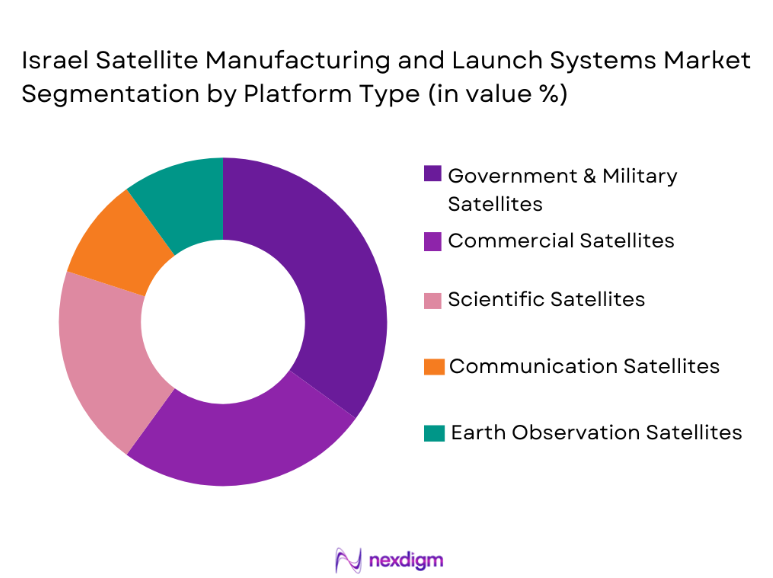

By Platform Type

The market is segmented by platform type into commercial satellites, government and military satellites, scientific satellites, communication satellites, and Earth observation satellites. Government and military satellites have a dominant market share due to the significant demand for national security applications, surveillance, and intelligence-gathering missions. Governments worldwide, especially those in defense-focused nations like Israel, invest heavily in military satellite technologies for secure communication, navigation, and reconnaissance. These satellites are critical for defense strategy, making them a high-priority market segment. Military satellites not only support national security but are also integrated into defense systems, which enhances their market dominance.

Competitive Landscape

The competitive landscape of the Israel Satellite Manufacturing and Launch Systems Market is marked by strong competition among global and regional players, with a heavy concentration on technological advancements, strategic partnerships, and military collaborations. Israel’s key players are highly innovative, focusing on research and development to create efficient and advanced satellite systems for commercial and government applications. Major international companies compete in the market, influencing consolidation and partnerships to enhance technological capabilities and expand market reach. Collaborative efforts between Israel and other nations also shape the competitive environment, ensuring Israel’s position as a key player in the space industry.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) | Satellite Launch Frequency |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| SpaceIL | 2011 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| IAI Systems | 1998 | Herzliya, Israel | ~ | ~ | ~ | ~ | ~ |

| Rocket Lab | 2006 | Long Beach, USA | ~ | ~ | ~ | ~ | ~ |

Israel Satellite Manufacturing and Launch Systems Market Analysis

Growth Drivers

Technological Advancements in Satellite Design

The Israel Satellite Manufacturing and Launch Systems Market is significantly driven by technological advancements in satellite design and manufacturing. Israel has emerged as a leader in satellite technology, particularly in terms of miniaturization, propulsion systems, and payload integration. These advancements allow for the creation of smaller, lighter, and more cost-effective satellites, which are highly appealing for both commercial and government sectors. Technological developments, such as the integration of artificial intelligence, machine learning, and improved sensors, are transforming satellite capabilities, enabling more advanced communication, Earth observation, and scientific exploration. Furthermore, the miniaturization of satellites has allowed for the creation of satellite constellations that provide global internet coverage, further driving demand for these technologies. Israel’s continued focus on space innovation, along with government investment and support, ensures that the country remains at the forefront of satellite manufacturing. This technological momentum supports the growth of Israel’s satellite industry, as both private companies and defense agencies seek cutting-edge satellite solutions to address communication, security, and research needs.

Government Investments and Strategic Partnerships

Government investments in satellite technology and strategic partnerships have been instrumental in the growth of Israel’s satellite manufacturing and launch systems market. The Israeli government has been actively involved in supporting the development of advanced space systems, which include providing funding for research and development and fostering collaborations with global defense contractors and space agencies. Israel’s participation in international space programs, such as its partnerships with NASA and the European Space Agency, has enhanced its technological capabilities and market position. Additionally, the country’s strong defense sector, which heavily relies on satellites for national security and intelligence, continues to drive demand for satellite systems. Israel’s government-driven initiatives, combined with its private sector’s technological prowess, have positioned the country as a key player in global satellite manufacturing and launch services. The support of the Israeli government, alongside these strategic international partnerships, is expected to fuel market growth in the coming years.

Market Challenges

High Cost of Satellite Manufacturing

One of the primary challenges facing the Israel Satellite Manufacturing and Launch Systems Market is the high cost of satellite manufacturing. The development of advanced satellites involves significant capital investment in research and development, cutting-edge technology, and high-precision materials. Additionally, the cost of launching satellites into orbit remains expensive, which limits the accessibility of satellite services for smaller companies and emerging markets. The high costs associated with manufacturing and launching satellites present a significant barrier for new entrants and smaller players, especially in markets where cost constraints limit the adoption of space-based technologies. Despite efforts to reduce manufacturing costs through the use of miniaturization and reusable launch systems, the overall financial burden of satellite systems remains substantial. As a result, this challenge may hinder the growth of the market, particularly for low-budget nations and smaller enterprises looking to deploy satellites for communications or Earth observation purposes.

Space Debris and Safety Concerns

Space debris management has become a critical challenge for the Israel Satellite Manufacturing and Launch Systems Market. The increasing number of satellites in orbit, particularly with the advent of satellite constellations, has exacerbated the problem of space debris. Collisions with debris can damage or destroy operational satellites, posing a significant risk to satellite missions and space operations. This issue is particularly relevant for Israel, as the country is highly reliant on satellite technology for defense, communication, and intelligence purposes. Moreover, the increasing density of objects in low Earth orbit (LEO) presents challenges in tracking and avoiding collisions. As a result, Israel and other nations must invest in space debris mitigation technologies, orbital management strategies, and regulatory frameworks to ensure safe operations in space. However, addressing these concerns adds an additional layer of complexity and cost to satellite manufacturing and operation, affecting the long-term viability of satellite missions.

Opportunities

Expansion of Satellite Constellations

One significant opportunity in the Israel Satellite Manufacturing and Launch Systems Market is the expansion of satellite constellations. Satellite constellations, such as SpaceX’s Starlink and OneWeb, have revolutionized satellite-based services by providing global broadband coverage. Israel has the opportunity to capitalize on this trend by enhancing its satellite manufacturing capabilities and developing advanced technologies for satellite constellation deployment. As the demand for low-latency global communication grows, Israel’s defense and commercial sectors are well-positioned to lead in the development of satellite constellations, particularly in the domains of Internet of Things (IoT) connectivity, communications, and Earth observation. The Israeli government and private enterprises have already shown significant interest in these technologies, and as the cost of manufacturing and launching smaller satellites continues to decrease, the market for satellite constellations will likely expand. This presents an opportunity for Israel to strengthen its global position in the satellite manufacturing and launch systems market.

Growing Demand for Earth Observation Satellites

Another opportunity lies in the increasing demand for Earth observation satellites. As global concerns over climate change, natural disasters, and environmental monitoring rise, the demand for Earth observation data has surged. Earth observation satellites provide critical information for climate monitoring, disaster management, agricultural monitoring, and urban planning. Israel, with its expertise in satellite technology and defense systems, is well-positioned to meet this growing demand. The development of advanced Earth observation satellites, equipped with high-resolution imaging and monitoring capabilities, presents significant growth prospects for Israel’s satellite manufacturing sector. Furthermore, the use of Earth observation data for commercial applications, such as precision agriculture and resource management, adds to the market potential. The expansion of Earth observation satellite programs, backed by government and private sector investment, presents a significant opportunity for growth in the Israel Satellite Manufacturing and Launch Systems Market.

Future Outlook

The future outlook for the Israel Satellite Manufacturing and Launch Systems Market is positive, with significant growth expected over the next five years. Driven by technological advancements, increasing government investments, and the rise of satellite constellations, the market will witness further expansion. Regulatory support and global demand for communication, Earth observation, and defense applications will continue to fuel growth. Israel’s position as a leader in satellite manufacturing and launch systems will be strengthened by its focus on innovation, strategic partnerships, and investment in cutting-edge technologies.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- SpaceIL

- IAI Systems

- Rocket Lab

- Boeing

- Lockheed Martin

- AirbusDefenceand Space

- Thales Alenia Space

- Northrop Grumman Innovation Systems

- SpaceX

- Arianespace

- Blue Origin

- Relativity Space

- OneWeb

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite communication providers

- Aerospace and defense contractors

- Space research institutions

- Telecommunications service providers

- Commercial space companies

- Satellite operators

Research Methodology

Step 1: Identification of Key Variables

The identification of key variables involves gathering data on market drivers, challenges, technological advancements, and key players.

Step 2: Market Analysis and Construction

The market analysis includes segmenting the market by system type, platform, technology, and end-users, constructing a comprehensive model.

Step 3: Hypothesis Validation and Expert Consultation

Experts in satellite manufacturing and space technology validate the market model and hypotheses based on their insights.

Step 4: Research Synthesis and Final Output

The final report synthesizes data from primary and secondary research to provide a comprehensive analysis of market dynamics, trends, and future opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in satellite design and manufacturing

Increasing demand for broadband connectivity

Government investments in space exploration

Rising demand for satellite-based Earth observation data

Cost reduction in satellite launch services - Market Challenges

High cost of satellite manufacturing

Space debris management and safety concerns

Limited launch vehicle availability

Technological complexities in satellite integration

Political and regulatory challenges in space cooperation - Market Opportunities

Expansion of commercial satellite constellations

Government push for space exploration missions

Growing private sector involvement in satellite manufacturing - Trends

Miniaturization of satellites

Development of reusable launch vehicles

Advancement in satellite communication technologies

Increase in international space collaborations

Growing focus on sustainable space operations - Government Regulations & Defense Policy

International space treaties and regulations

National space agencies’ regulatory frameworks

Defense and security policies affecting satellite launches

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By Product Type (In Value%)

Low Earth Orbit Satellites

Geostationary Satellites

Medium Earth Orbit Satellites

CubeSats

Hybrid Satellite Systems - By Platform Type (In Value%)

Commercial Satellites

Government & Military Satellites

Scientific Satellites

Communication Satellites

Earth Observation Satellites - By Fitment Type (In Value%)

Standalone Satellites

Integrated Launch Systems

Satellite Constellations

Launch Vehicle Modules

Spacecraft with Propulsion Systems - By EndUser Segment (In Value%)

Government & Defense Agencies

Private Space Companies

Telecommunications

Earth Observation Agencies

Academic and Research Institutions - By Procurement Channel (In Value%)

Direct Sales

Government Contracts

OEM Partnerships

Space Agencies & Collaborations

Commercial Resellers - By Material / Technology (In Value%)

Composite Materials

Solar Panels

Propulsion Systems

Thermal Control Systems

Payload Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Technological Innovation, Market Share, Financial Stability, R&D Investment, Product Portfolio, Geographic Presence, Strategic Alliances, Launch Frequency, Pricing Strategy, Regulatory Compliance)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Rafael Advanced Defense Systems

SpaceIL

UP Aerospace

SDS International

Rocket Lab

SpaceX

Northrop Grumman Innovation Systems

Arianespace

Boeing

Lockheed Martin

Airbus Defence and Space

Thales Alenia Space

Blue Origin

Relativity Space

- Increasing involvement of private sector players in satellite manufacturing

- Growing demand for high-speed communication satellites

- Government-driven space initiatives

- Collaborations between commercial and academic institutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035