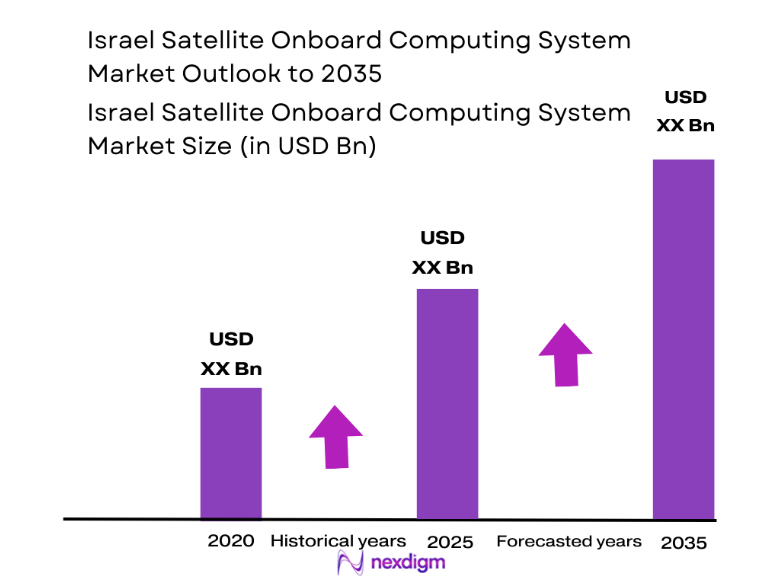

Market Overview

The Israel Satellite Onboard Computing System market is currently valued at approximately USD ~ billion, driven by increasing demand for advanced satellite technologies. Israel’s strong position in the space industry, including its governmental and private sector investments, has spurred substantial growth in this segment. The demand for high-performance computing systems used in satellite communications, earth observation, and defense has been a significant driver. Furthermore, the rapid advancement of miniaturization technologies, which allows for more efficient and powerful systems, has resulted in a broader adoption of satellite-based solutions across various industries, including telecommunications and scientific research.

In terms of geographic dominance, Israel remains a key player due to its robust space program, backed by both government agencies such as the Israel Space Agency (ISA) and leading private companies like Israel Aerospace Industries (IAI). Tel Aviv and Herzliya are the primary hubs for research and development, where major satellite manufacturing and testing facilities are located. The country’s strong military sector also plays a vital role in driving innovation and adoption of satellite onboard computing systems, particularly for defense applications. This dominance is further supported by Israel’s international partnerships with other global leaders in satellite technology, contributing to its position as a major exporter of satellite systems and components.

Market Segmentation

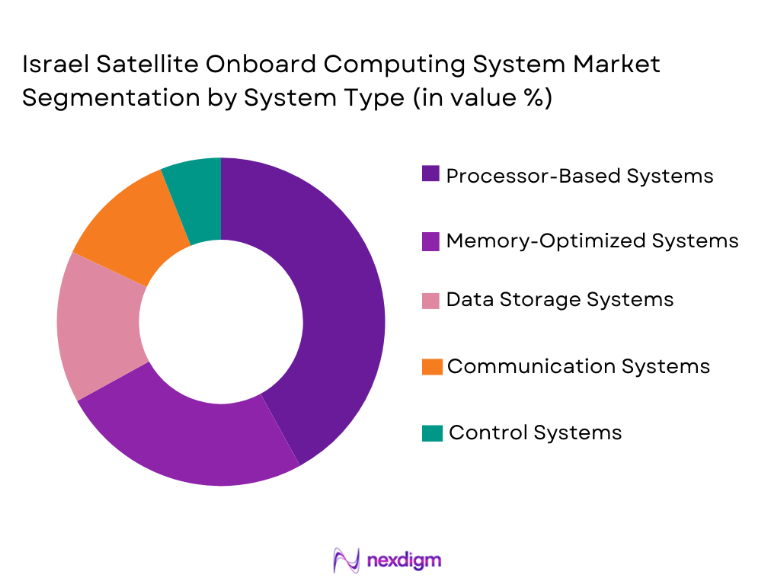

By System Type

The Israel Satellite Onboard Computing System market is segmented by system type into processor-based systems, memory-optimized systems, data storage systems, communication systems, and control systems. Recently, processor-based systems have dominated the market share due to their central role in managing the core functions of satellite operations, including communication, data processing, and navigation. The rising demand for real-time data processing, particularly for applications in defense and telecommunications, has contributed significantly to the growth of this sub-segment. Additionally, advances in processing power, along with the miniaturization of components, have made processor-based systems more efficient and cost-effective, further solidifying their market leadership. This dominance is also driven by Israel’s expertise in semiconductor technologies and integration with satellite platforms that require high-speed data transmission and processing capabilities.

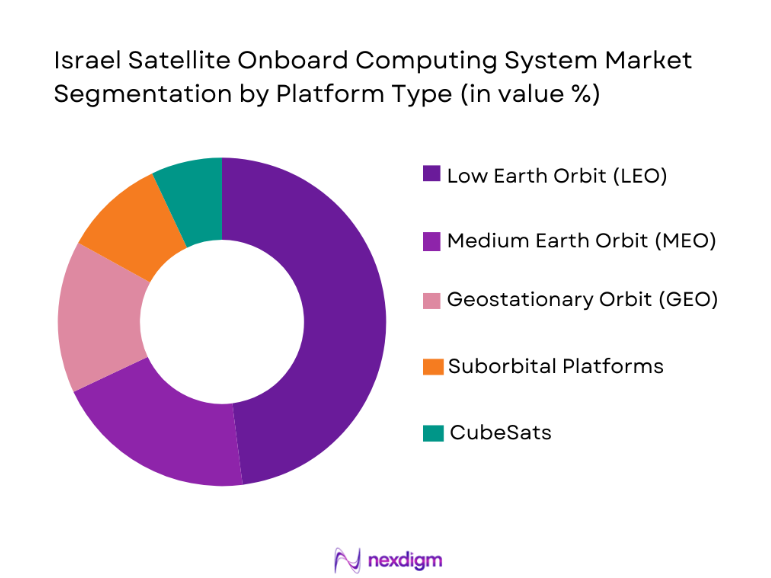

By Platform Type

The market is segmented by platform type into low earth orbit (LEO) satellites, medium earth orbit (MEO) satellites, geostationary orbit (GEO) satellites, suborbital platforms, and CubeSats. The LEO satellite sub-segment currently holds a dominant market share, mainly due to the increasing adoption of LEO constellations for global communication and earth observation purposes. LEO satellites offer lower latency compared to higher orbit satellites, which has made them the preferred choice for communication service providers, particularly in the growing demand for 5G and broadband services in remote areas. Additionally, the cost-effectiveness and shorter deployment times of LEO satellites contribute to their rising popularity. Israel has been a key player in developing and launching LEO satellites, further strengthening its position in this market.

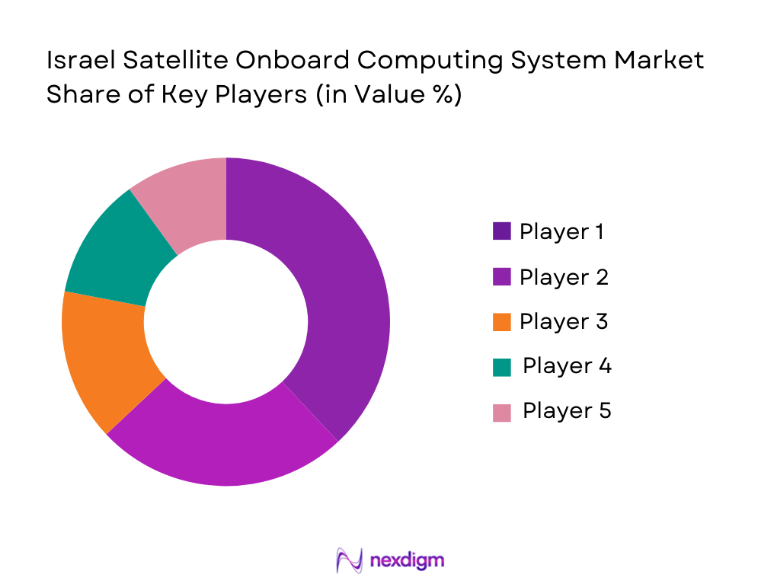

Competitive Landscape

The Israel Satellite Onboard Computing System market is highly competitive, with several global players contributing to the innovation and supply of satellite systems. The industry is marked by strategic collaborations and joint ventures, often between Israel’s government entities and private sector companies. Israel Aerospace Industries (IAI) is a dominant player, driving much of the technological advancements in satellite onboard systems. Additionally, companies such as SpaceX and Thales Alenia Space have a significant influence in Israel’s satellite ecosystem, offering complementary technologies and solutions. The market also sees increasing consolidation, with established companies acquiring smaller players to enhance their product offerings and capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| SpaceX | 2002 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

Israel Satellite Onboard Computing System Market Analysis

Growth Drivers

Technological Advancements in Satellite Systems

Israel’s satellite onboard computing systems market is significantly driven by rapid technological advancements. These include the development of highly efficient processors, integrated communication systems, and cutting-edge data storage solutions. Israel has always been at the forefront of innovation, leveraging its strong R&D capabilities to improve performance while minimizing power consumption in satellites. These advancements are particularly valuable in defense applications, where real-time data processing, security, and reliability are paramount. The trend toward smaller, more efficient satellite designs, enabled by miniaturization of onboard systems, is also contributing to the market’s growth. As the demand for high-throughput, low-latency communication increases, Israel’s satellite systems are becoming increasingly integral to telecommunications and global positioning systems (GPS). Furthermore, the push for commercial space ventures and satellite constellations has spurred the need for more reliable, versatile, and cost-effective onboard computing systems.

Rising Demand for Communication and Earth Observation Satellites

The increasing need for satellite-based communication, earth observation, and scientific research is fueling the growth of onboard computing systems. Israel has positioned itself as a key player in the development of advanced satellite technology for these purposes. Earth observation satellites, in particular, are gaining traction in sectors such as environmental monitoring, agriculture, and disaster management. With the growing demand for global broadband internet access, especially in remote areas, there is an increased need for satellite communication systems. This has led to the proliferation of LEO constellations, which demand efficient and high-performance onboard computing systems to manage large volumes of data in real-time. Israel’s expertise in satellite manufacturing and its favorable government policies supporting space exploration contribute to the steady growth of the market.

Market Challenges

High Development and Manufacturing Costs

One of the primary challenges facing the Israel Satellite Onboard Computing System market is the high cost associated with developing and manufacturing these complex systems. Satellite components are typically expensive due to the specialized materials required, the precision manufacturing processes, and the stringent testing and validation procedures. This can make it difficult for smaller companies or emerging space nations to enter the market, as they may lack the financial resources necessary to develop competitive systems. Additionally, the long lead times associated with satellite development can delay market entry, further raising costs. For Israel, balancing the need for high-performance systems while maintaining affordability for both governmental and commercial clients remains a key challenge.

Geopolitical and Regulatory Barriers

The Israel Satellite Onboard Computing System market faces challenges stemming from geopolitical tensions and regulatory barriers. Israel’s geopolitical situation often affects its ability to engage in satellite collaborations with certain countries, which can limit market access and international partnerships. Additionally, satellite technologies are subject to export controls and restrictions, particularly for defense-related applications. These regulations can make it difficult for Israeli companies to engage in global trade or to access the technologies and components needed for satellite development. Such barriers hinder the market’s expansion and may slow down the growth potential of Israel’s satellite systems in emerging markets.

Opportunities

Expanding Global Satellite Market

With the rapid growth of the satellite industry, there are significant opportunities for Israel’s satellite onboard computing systems. The rising demand for global communication networks, remote sensing, and space exploration presents a lucrative market for Israeli technology. As nations and corporations across the globe invest in satellite constellations for telecommunications and earth observation, Israel’s expertise in developing high-performance onboard systems positions the country as a leader in this expanding market. The development of commercial space ventures, coupled with the increasing interest in satellite-based data services, creates ample opportunities for Israel to enhance its global footprint. The Israeli government’s ongoing support for space exploration and satellite technologies further strengthens the market outlook, ensuring continued innovation and growth.

Development of Next-Generation Small Satellites

The increasing use of small satellite constellations presents an exciting opportunity for Israel’s satellite onboard computing systems. With smaller satellites requiring lighter, more efficient computing systems, Israel’s expertise in miniaturization aligns perfectly with this market shift. Israel’s capacity to produce compact, high-performance systems that can function in harsh space environments positions it to lead in this rapidly growing segment. As small satellites become more widely used for both commercial and military applications, Israel has the potential to become a key supplier of satellite onboard computing systems for these new platforms. The focus on smaller, more cost-effective satellites allows Israel to leverage its competitive advantage in the global satellite supply chain.

Future Outlook

The future of Israel’s Satellite Onboard Computing System market appears promising, with expectations of steady growth driven by technological advancements, increased demand for satellite services, and continued government support. As Israel continues to innovate in satellite technology, including the development of next-generation onboard computing systems, the market will likely see significant expansion. The increased focus on space exploration, defense, and commercial satellite constellations, along with favorable regulatory environments, will further propel the market forward. Technological developments such as AI integration and miniaturization will continue to shape the future of satellite onboard computing systems, ensuring their crucial role in satellite operations.

Major Players

- Israel Aerospace Industries

- SpaceX

- Thales Alenia Space

- Boeing

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- Maxar Technologies

- Airbus

- L3 Technologies

- Rocket Lab

- Orbital Sciences Corporation

- Blue Origin

- Ball Aerospace

- Inmarsat

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Commercial satellite operators

- Telecommunications companies

- Earth observation agencies

- Defense contractors

- Space exploration organizations

- Satellite manufacturing companies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying critical market variables that influence the Israel Satellite Onboard Computing System market, including system types, technologies, and applications.

Step 2: Market Analysis and Construction

The market is analyzed using both primary and secondary data sources to create a comprehensive understanding of the market structure, trends, and future outlook.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted to validate the findings and assumptions, ensuring that the market dynamics are correctly represented.

Step 4: Research Synthesis and Final Output

The research is synthesized into a final report, which provides a comprehensive analysis of the market, including key findings and actionable insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in miniaturization

Increased demand for high-performance onboard processing

Rising commercial satellite launches

Growth of the global space exploration sector

Government investments in satellite-based defense systems - Market Challenges

High development and production costs

Complexity in system integration

Reliability concerns in space environments

Regulatory and certification hurdles

Limited availability of skilled workforce in satellite technology - Market Opportunities

Growing demand for advanced communication technologies

Expanding commercial space market

Emerging market for small satellite constellations - Trends

Miniaturization of satellite systems

Integration of AI and machine learning in onboard computing

Use of 5G for satellite communication

Increase in private sector satellite investments

Growth of satellite-as-a-service models - Government Regulations & Defense Policy

Stringent export control regulations for satellite technologies

Policy changes encouraging private sector involvement in space

Regulations on satellite debris management - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Processor-Based Systems

Memory-Optimized Systems

Data Storage Systems

Communication Systems

Control Systems - By Platform Type (In Value%)

Low Earth Orbit (LEO) Satellites

Medium Earth Orbit (MEO) Satellites

Geostationary Orbit (GEO) Satellites

Suborbital Platforms

CubeSats - By Fitment Type (In Value%)

Dedicated Fitment

Integrated Fitment

Modular Fitment

Scalable Fitment

Miniaturized Fitment - By EndUser Segment (In Value%)

Government & Defense

Commercial Telecommunication

Earth Observation

Navigation & Positioning

Scientific Research - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Procurement through Systems Integrators

Procurement through Contractors

Procurement via Satellite Operators

Third-party Procurement - By Material / Technology (In Value%)

Silicon-Based Materials

Gallium Arsenide (GaAs) Technology

Carbon Nanotube Technology

Custom Integrated Circuits

Advanced Semiconductor Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Fitment Type, End-User Segment, Procurement Channel, Technology, Region, System Complexity, Pricing, Reliability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

SpaceX

Northrop Grumman

Lockheed Martin

Harris Corporation

Thales Alenia Space

Boeing

Airbus

Ball Aerospace

Raytheon Technologies

Blue Origin

Maxar Technologies

L3 Technologies

Rocket Lab

Orbital Sciences Corporation

- Increased satellite demand in defense and security

- Expansion of commercial satellite operators

- Integration of AI-based systems in satellite operations

- Collaborations between governmental and private sectors

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035