Market Overview

The Israel satellite payload market has been growing significantly, driven by an increasing demand for satellite services such as communication, imaging, and navigation. The market is largely influenced by advancements in space technology and government policies supporting the development of satellite payload systems.Israel remains one of the leading countries in the satellite payload market, supported by the Israeli Space Agency (ISA) and defense agencies. The country’s strong technological infrastructure, including the highly advanced satellite payload systems developed by Israeli Aerospace Industries (IAI), has positioned it as a global player in satellite payload development. Major cities like Tel Aviv and Herzliya, home to key defense contractors and research institutions, contribute significantly to Israel’s dominance in the market.

Market Segmentation

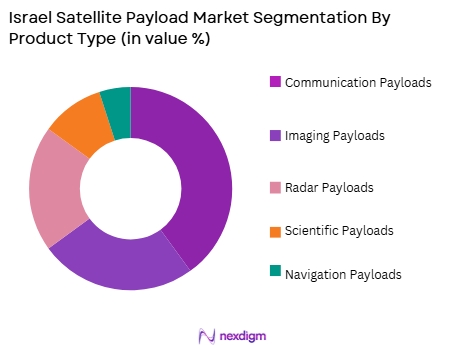

By Product Type:

The Israel satellite payload market is segmented by product type into communication payloads, imaging payloads, radar payloads, scientific payloads, and navigation payloads. Communication payloads dominate the market due to the increasing demand for satellite-based communication systems, driven by the need for secure and reliable communication networks. The strategic importance of communication payloads for military and governmental applications in Israel further boosts their market presence. These systems play a crucial role in providing connectivity, enhancing data transmission, and supporting national security operations.

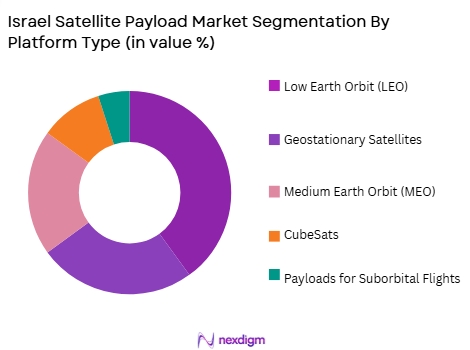

By Platform Type:

The market is segmented by platform type into geostationary satellites, low Earth orbit (LEO) satellites, medium Earth orbit (MEO) satellites, CubeSats, and payloads for suborbital flights. Low Earth orbit (LEO) satellites hold the dominant market share due to their cost-effectiveness and ability to provide faster data transmission with lower latency. LEO satellites are primarily used for Earth observation, reconnaissance, and communication services, which align with Israel’s military and commercial needs. The high demand for LEO satellites is driven by their use in both defense applications and commercial ventures like broadband satellite constellations.

Competitive Landscape

The Israel satellite payload market is characterized by strong competition among a few key players, including Israel Aerospace Industries (IAI), Elbit Systems, and Spacecom. These companies dominate the market through their strong R&D capabilities, collaborations with government defense sectors, and robust technological advancements. Israel’s strategic importance in the global space arena, along with its highly developed defense industry, positions these companies as critical contributors to the nation’s space capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Spacecom | 1993 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2003 | Paris | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda | ~ | ~ | ~ | ~ | ~ |

Israel Satellite Payload Market Analysis

Growth Drivers

Government Support for Space Development:

Israel’s government plays a crucial role in driving the satellite payload market through funding and policy support. The Israeli Space Agency (ISA) has facilitated the development of advanced satellite payloads, with a focus on enhancing national security, communication systems, and space exploration. Furthermore, Israel’s partnerships with global space agencies and private enterprises have accelerated innovation and technology transfer, positioning Israel as a leader in satellite payload systems. Investments in R&D are expected to continue, ensuring the country’s growing influence in space technologies.

Technological Advancements in Satellite Payload Systems:

The ongoing advancements in satellite payload technology, including miniaturization and the integration of AI, are major drivers in the Israel satellite payload market. These innovations have led to more efficient, cost-effective payloads, which are essential for Israel’s space-based communication and defense systems. The development of smaller, more powerful payloads with enhanced capabilities has enabled Israel to meet the increasing demand for satellite-based services across telecommunications, defense, and scientific sectors. The continuous improvement in payload systems makes them more adaptable and versatile for a variety of applications.

Market Challenges

High Development and Launch Costs:

Despite the technological advancements, the Israel satellite payload market faces significant challenges related to the high costs of payload development and satellite launches. These costs include research, manufacturing, testing, and regulatory compliance, which can be prohibitive for smaller companies or startups entering the market. Israel’s defense sector mitigates some of these costs by consolidating efforts with government agencies, but high initial investments remain a key challenge for many companies. Furthermore, satellite launches remain expensive, with the cost of launching a satellite payload weighing heavily on the overall project budget.

Regulatory Compliance and Bureaucratic Hurdles:

The regulatory landscape in Israel presents challenges for companies developing satellite payloads. The Israeli Space Agency (ISA) imposes strict compliance requirements to ensure the security and safety of satellite systems. Additionally, international regulations and export controls can hinder collaboration between Israel-based companies and foreign entities. The complex regulatory environment increases the time and cost of bringing new satellite payloads to market and limits the ability of companies to freely operate in global markets.

Opportunities

Growing Demand for Commercial and Military Satellite Payloads:

The demand for satellite payloads in both commercial and military applications is expanding, driven by global needs for enhanced communication, surveillance, and data collection. Israel’s satellite payload market is well-positioned to benefit from this trend due to the country’s strong defense sector and technological expertise. With the rise of satellite constellations for global broadband services and the increasing use of satellites for defense and intelligence gathering, Israel’s satellite payload industry has ample opportunities to capture new markets and expand its global footprint.

International Partnerships and Collaborations:

Israel’s satellite payload market stands to benefit significantly from international collaborations and partnerships. As the country continues to build relationships with space agencies and private companies across the world, it opens up new opportunities for joint satellite missions, technology exchange, and market expansion. The potential for partnerships with countries looking to enhance their satellite communication capabilities or develop satellite constellations presents an excellent growth opportunity for Israeli firms.

Future Outlook

The future of the Israel satellite payload market looks promising, with continued technological advancements, government backing, and increased demand for satellite-based services. Israel is expected to maintain its competitive edge in the global satellite payload industry, with a focus on further innovation, especially in small satellite technologies and AI-driven payload systems. As international collaborations and commercial ventures expand, Israel’s satellite payload sector will continue to grow and diversify, offering new opportunities across communication, defense, and scientific fields.

Major Players

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Spacecom

- Thales Alenia Space

- Lockheed Martin

- Northrop Grumman

- Airbus Defence and Space

- Rocket Lab

- SpaceX

- Arianespace

- Blue Origin

- Boeing

- Orbital ATK

- Virgin Galactic

- Planet Labs

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite payload manufacturers

- Telecommunication service providers

- Space agencies and defense contractors

- Aerospace engineering firms

- Satellite data analytics companies

- Commercial spaceflight operators

Research Methodology

Step 1: Identification of Key Variables

The identification of key market variables that influence the satellite payload market, including technological advancements, market demand, and industry challenges.

Step 2: Market Analysis and Construction

Conducting in-depth market analysis using primary and secondary research sources to build a comprehensive market model based on data and trends.

Step 3: Hypothesis Validation and Expert Consultation

Validating hypotheses and market assumptions through consultations with industry experts and stakeholders to ensure accurate market predictions.

Step 4: Research Synthesis and Final Output

Compiling all research findings, data, and expert inputs to generate the final market report, including actionable insights and forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for advanced communication infrastructure

Government investment in space exploration

Advancements in satellite technology - Market Challenges

High cost of satellite payload development

Regulatory hurdles and certification processes

Limited domestic manufacturing capabilities for complex payloads - Market Opportunities

Growing demand for small satellite payloads

Expansion of satellite constellations for broadband services

Potential for partnerships with global space agencies - Trends

Miniaturization of payload systems

Rise in private sector participation in satellite development

Integration of AI and machine learning in payload functionality - Government Regulations

Israeli Space Agency (ISA) policies

Satellite payload certification requirements by ISA

Foreign collaboration agreements in satellite technology

- SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Communication Payloads

Imaging Payloads

Radar Payloads

Scientific Payloads

Navigation Payloads - By Platform Type (In Value%)

Geostationary Satellites

Low Earth Orbit Satellites

Medium Earth Orbit Satellites

CubeSats

Payloads for Suborbital Flights - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Telecommunications

Government & Defense

Commercial Enterprises

Research Institutions

Space Exploration Agencies - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

Government Contracts

Private Sector Collaboration

International Partnerships

- Cross Comparison Parameters (Market Value, Installed Units, System Complexity, Regional Presence, Research & Development Investment, Market Value, Installed Units, System Complexity, Regional Presence, Research & Development Investment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Space Agency (ISA)

ISRO

IAI (Israel Aerospace Industries)

Elbit Systems

Spacecom

Singtel

Hughes Communications

Thales Alenia Space

Airbus Defence and Space

Lockheed Martin

Northrop Grumman

Rocket Lab

SpaceX

Arianespace

Blue Origin

- Telecommunications companies increasing reliance on satellite payloads

- Government and defense sectors pushing for advanced surveillance payloads

- Commercial enterprises seeking cost-effective small satellite payloads

- Research institutions utilizing payloads for scientific data collection

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035