Market Overview

The Israel satellite telemetry and control systems market has experienced robust growth, driven by significant government investments, advancements in satellite technology, and increasing demand for satellite-based communication, surveillance, and monitoring systems. The market size is projected to reach several ~based on a recent historical assessment, with continued support from the Israeli Space Agency (ISA) and defense sectors driving further development and adoption of telemetry and control systems.

Israel continues to maintain a dominant position in the satellite telemetry and control systems market due to the strong presence of key players such as Israel Aerospace Industries (IAI) and collaboration with government agencies like ISA. The nation’s high-tech infrastructure and expertise in aerospace technology, along with a strategic location in the Middle East, make Israel a critical player in the global satellite industry. Key cities such as Tel Aviv and Herzliya house major technology hubs and defense contractors, contributing to the country’s dominance in satellite control systems.

Market Segmentation

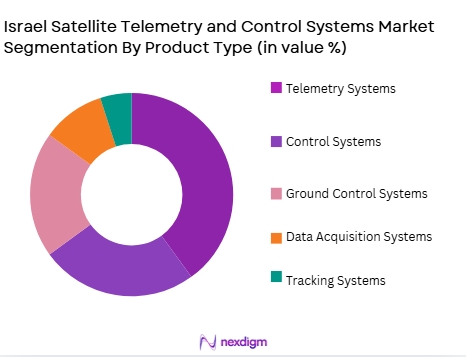

By Product Type:

The Israel satellite telemetry and control systems market is segmented by product type into telemetry systems, control systems, ground control systems, data acquisition systems, and tracking systems. Recently, telemetry systems have captured the dominant market share due to the increasing demand for satellite-based communication and monitoring services. Telemetry systems play a critical role in satellite operations, allowing real-time data transmission and performance tracking, which is essential for government, defense, and commercial applications.

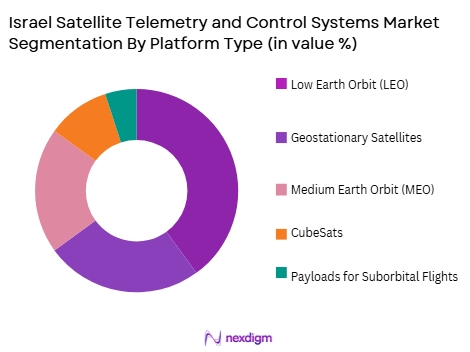

By Platform Type:

The market is segmented by platform type into geostationary satellites, low Earth orbit (LEO) satellites, medium Earth orbit (MEO) satellites, CubeSats, and payloads for suborbital flights. Low Earth orbit (LEO) satellites dominate the market share due to their widespread application in communication, Earth observation, and scientific research. These satellites are highly favored for their cost-effectiveness and low-latency data transmission, making them ideal for both military and commercial purposes, particularly in real-time communication and surveillance.

Competitive Landscape

The Israel satellite telemetry and control systems market is highly competitive, with a strong presence of government-backed entities like Israel Aerospace Industries (IAI) and private firms such as Elbit Systems and Spacecom. These companies lead the market through technological innovation, extensive R&D capabilities, and strategic partnerships with both government agencies and international space organizations. The competitive landscape is marked by ongoing consolidation, as major players continue to expand their portfolio of satellite systems and services to meet the growing demand for advanced telemetry and control solutions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Spacecom | 1993 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2003 | Paris | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda | ~ | ~ | ~ | ~ | ~ |

Israel Satellite Telemetry and Control Systems Market Analysis

Growth Drivers

Government Investment in Space Technology:

The Israeli government has consistently supported the satellite telemetry and control systems market through investments in space exploration and defense technology. This support includes funding for the Israeli Space Agency (ISA) and strategic programs aimed at enhancing Israel’s satellite capabilities. As the government continues to prioritize national security and space exploration, the demand for sophisticated satellite telemetry and control systems is expected to grow. These investments help propel innovation in satellite systems, positioning Israel as a global leader in space technology.

Technological Advancements in Satellite Systems:

Technological advancements in satellite systems, particularly in telemetry and control systems, are key growth drivers for the market. Innovations such as miniaturization, enhanced data processing, and real-time communication capabilities are enabling satellites to perform more efficiently and cost-effectively. The integration of AI and machine learning into satellite control systems is further enhancing the ability to manage and monitor satellite performance, creating more opportunities for Israel’s satellite telemetry market to expand, particularly in the commercial and defense sectors.

Market Challenges

High Development and Operational Costs:

One of the major challenges in the Israel satellite telemetry and control systems market is the high cost of developing and maintaining satellite systems. The advanced nature of telemetry and control technologies requires significant investments in R&D, infrastructure, and operational resources. These costs can limit the ability of smaller players to enter the market, and even established companies face financial constraints when developing complex satellite payloads. Government funding can offset some of these costs, but financial barriers still remain a challenge.

Regulatory Compliance and International Competition:

The regulatory landscape surrounding satellite telemetry and control systems is highly complex, with stringent requirements governing satellite deployment, data security, and international cooperation. Compliance with these regulations can delay satellite launches and increase costs. Moreover, Israel faces increasing competition from other nations and private companies, such as SpaceX, which are also developing advanced satellite technologies. The ability to navigate regulatory hurdles while maintaining a competitive edge in technology is a major challenge for Israel’s satellite telemetry sector.

Opportunities

Growing Demand for Small Satellite Systems:

The rise in demand for small satellite systems, particularly CubeSats and small LEO satellites, presents a significant opportunity for the satellite telemetry and control systems market. These small satellites are used for a variety of applications, including communication, Earth observation, and scientific research, all of which require telemetry and control systems. Israel’s established space infrastructure positions it well to capitalize on this growing demand, as small satellites offer a cost-effective solution for both commercial and government sectors.

International Collaborations and Partnerships:

As Israel continues to strengthen its position in the global satellite market, the opportunity for international collaborations and partnerships grows. Collaborations with space agencies and private sector players in Europe, North America, and Asia provide opportunities for Israel to expand its market reach. These partnerships allow for the joint development of satellite telemetry and control systems, as well as access to new markets and advanced technologies. This growing network of international partnerships enhances Israel’s ability to compete in the global space industry.

Future Outlook

The Israel satellite telemetry and control systems market is expected to continue its growth trajectory, driven by government investments, technological innovations, and increasing demand for satellite services. Over the next five years, the market will benefit from the rising adoption of small satellite systems, advancements in AI and real-time data processing, and the expansion of satellite constellations. Additionally, increased global collaboration will provide Israel with new opportunities to enhance its satellite systems and maintain its leadership in the space industry.

Major Player

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Spacecom

- Thales Alenia Space

- Lockheed Martin

- Northrop Grumman

- Airbus Defence and Space

- Rocket Lab

- SpaceX

- Arianespace

- Blue Origin

- Boeing

- Orbital ATK

- Virgin Galactic

- Planet Labs

ers

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite telemetry and control systems manufacturers

- Telecommunication service providers

- Space agencies and defense contractors

- Aerospace engineering firms

- Satellite data analytics companies

- Commercial spaceflight operators

Research Methodology

Step 1: Identification of Key Variables

Identification of key factors affecting the satellite telemetry and control systems market, including technological advancements, market demand, and regulatory considerations.

Step 2: Market Analysis and Construction

Comprehensive analysis of the market, based on primary and secondary research, including industry trends, competitive landscape, and customer needs.

Step 3: Hypothesis Validation and Expert Consultation

Validating hypotheses through expert consultations, interviews, and feedback from stakeholders in the satellite industry.

Step 4: Research Synthesis and Final Output

Synthesizing the collected data and insights into a comprehensive market report, including forecasts and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for satellite-based communication services

Government initiatives to support space exploration

Technological advancements in satellite control systems - Market Challenges

High development and operational costs of telemetry and control systems

Complex regulatory frameworks governing satellite systems

Limited domestic manufacturing of advanced telemetry systems - Market Opportunities

Growing demand for low-cost small satellite systems

International collaborations and partnerships for satellite missions

Advancements in AI-driven satellite control systems - Trends

Miniaturization of telemetry and control systems

Rise in private sector involvement in space exploration

Integration of real-time data processing and monitoring in satellite systems - Government Regulations

Israeli Space Agency (ISA) policies

Satellite payload certification requirements by ISA

Foreign collaboration agreements in satellite technology

- SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Telemetry Systems

Control Systems

Ground Control Systems

Data Acquisition Systems

Tracking Systems - By Platform Type (In Value%)

Geostationary Satellites

Low Earth Orbit Satellites

Medium Earth Orbit Satellites

CubeSats

Payloads for Suborbital Flights - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Telecommunications

Government & Defense

Commercial Enterprises

Research Institutions

Space Exploration Agencies - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

Government Contracts

Private Sector Collaboration

International Partnerships

- Cross Comparison Parameters (Market Value, Installed Units, System Complexity, Regional Presence, Research & Development Investment, Market Value, Installed Units, System Complexity, Technology Integration)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Space Agency (ISA)

ISRO

IAI (Israel Aerospace Industries)

Elbit Systems

Spacecom

Singtel

Hughes Communications

Thales Alenia Space

Airbus Defence and Space

Lockheed Martin

Northrop Grumman

Rocket Lab

SpaceX

Arianespace

Blue Origin

- Telecommunications companies increasing reliance on satellite telemetry systems

- Government and defense sectors pushing for advanced surveillance payloads

- Commercial enterprises seeking cost-effective small satellite payloads

- Research institutions utilizing telemetry systems for scientific data collection

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035