Market Overview

Based on a recent historical assessment, the Israel Sea-Based C4ISR market size was valued at USD ~ billion, derived from officially disclosed Israeli naval modernization allocations, Ministry of Defense procurement disclosures, and publicly reported naval C4ISR contract awards. The market is driven by sustained investments in maritime situational awareness, network-centric naval warfare, coastal surveillance integration, and real-time intelligence fusion capabilities. Increasing operational complexity across maritime domains, emphasis on secure data links, and demand for interoperable command systems continue to reinforce procurement activity across surface and subsurface naval assets.

Based on a recent historical assessment, Israel dominates this market through concentrated naval command activities in Haifa and Ashdod, supported by strong defense technology ecosystems and proximity to key naval bases. Tel Aviv functions as the core technology and systems integration hub due to the presence of defense primes, software developers, and electronic warfare specialists. National leadership is reinforced by continuous maritime security requirements, indigenous defense manufacturing priorities, and long-standing operational experience in littoral and blue-water surveillance, enabling faster adoption of advanced sea-based C4ISR architectures without reliance on foreign command infrastructures.

Market Segmentation

By Product Type

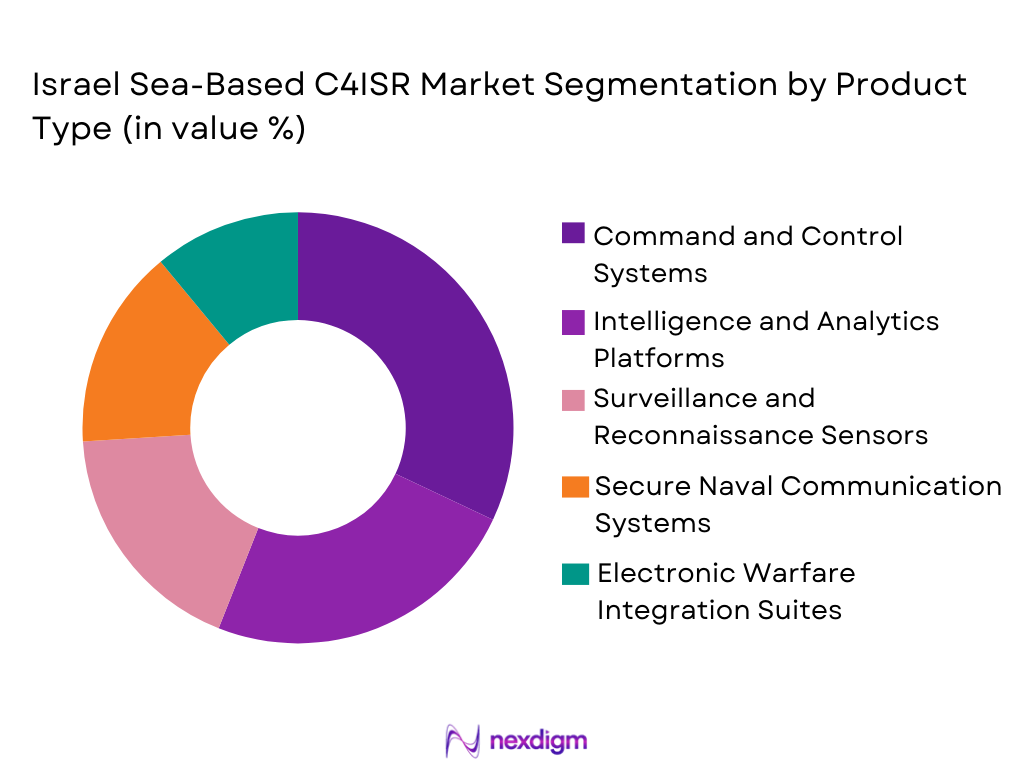

Israel Sea-Based C4ISR market is segmented by product type into command and control systems, intelligence and analytics platforms, surveillance and reconnaissance sensors, secure naval communication systems, and electronic warfare integration suites. Recently, command and control systems have a dominant market share due to their central role in integrating multi-source intelligence, enabling real-time decision making, and supporting joint naval operations across surface, subsurface, and airborne maritime assets. Strong emphasis on operational coordination, mission planning, and rapid threat response has elevated demand for unified command architectures. Additionally, continuous upgrades of naval combat management systems and increasing reliance on data-driven operational frameworks reinforce the dominance of command and control solutions within naval modernization programs.

By Platform Type

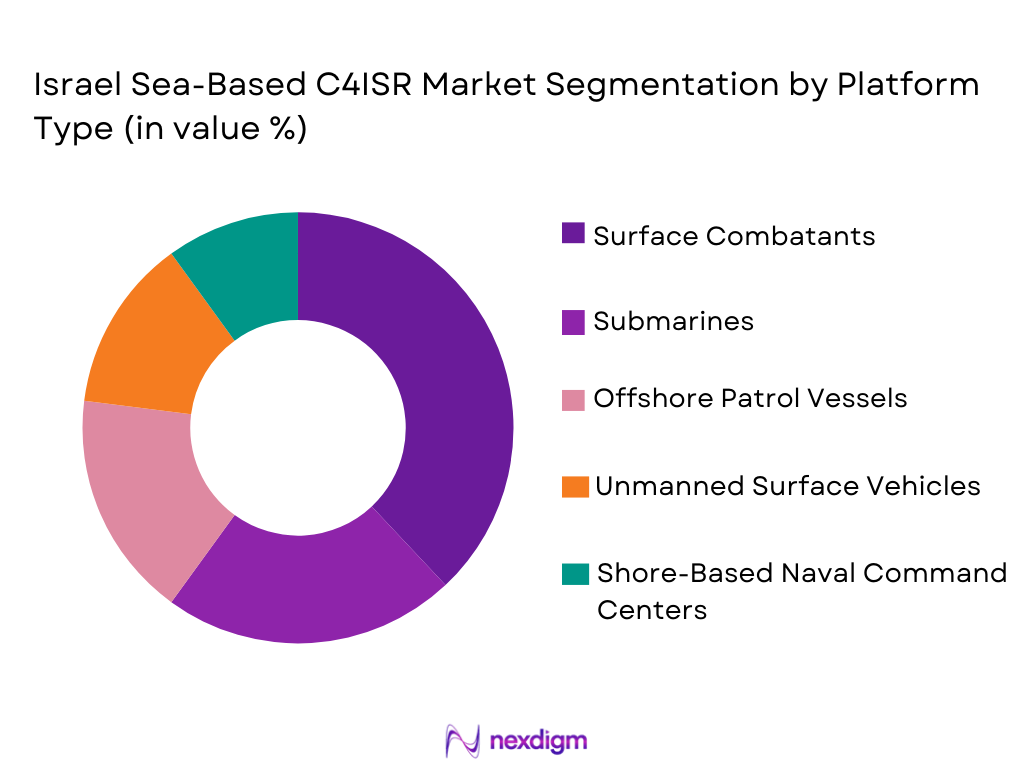

Israel Sea-Based C4ISR market is segmented by platform type into surface combatants, submarines, offshore patrol vessels, unmanned surface vehicles, and shore-based naval command centers. Recently, surface combatants have a dominant market share due to their role as primary operational platforms for maritime defense, surveillance missions, and joint-force coordination. These vessels serve as key nodes for sensor fusion, communications relay, and command execution, driving higher system integration investments. Ongoing fleet upgrades, multi-mission requirements, and the need for interoperability with allied naval forces further support the concentration of C4ISR spending on surface combatant platforms.

Competitive Landscape

The Israel Sea-Based C4ISR market is moderately consolidated, with a small number of domestic defense primes and specialized technology firms controlling system integration, software architecture, and sensor fusion capabilities. Major players benefit from long-term government contracts, strong indigenous development mandates, and deep operational collaboration with naval forces. Competitive differentiation is driven by system interoperability, cybersecurity resilience, lifecycle support capabilities, and the ability to rapidly customize solutions for evolving maritime threat scenarios.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Naval Integration Capability |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Elta Systems | 1967 | Ashdod, Israel | ~ | ~ | ~ | ~ | ~ |

| Tadiran Communications | 1962 | Holon, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Sea-Based C4ISR Market Analysis

Growth Drivers

Naval Modernization and Network-Centric Warfare Adoption:

Naval modernization and network-centric warfare adoption is a primary growth driver for the Israel Sea-Based C4ISR market as naval forces increasingly transition toward fully integrated, data-driven operational environments. Israel’s maritime security posture emphasizes persistent situational awareness, real-time command execution, and seamless coordination across surface, subsurface, aerial, and cyber domains, all of which require advanced C4ISR infrastructures. Continuous fleet upgrade programs prioritize replacing legacy command systems with interoperable digital architectures capable of fusing intelligence from radar, sonar, electro-optical, electronic intelligence, and satellite sources. Operational experience in high-threat maritime zones reinforces the need for resilient and responsive command frameworks that can support rapid decision cycles. Network-centric doctrines further elevate demand for distributed command nodes and redundant communication pathways across naval platforms. The requirement for joint-force interoperability with air and land assets amplifies investment in standardized C4ISR interfaces. Increasing mission complexity, including coastal defense, offshore infrastructure protection, and intelligence-led deterrence, sustains long-term procurement momentum. Indigenous development mandates embedded within defense policy ensure that modernization spending consistently translates into domestic C4ISR system demand, reinforcing this driver structurally across naval investment cycles.

Cybersecurity-Driven Evolution of Maritime Command Architectures:

Cybersecurity-driven evolution of maritime command architectures is accelerating growth in the Israel Sea-Based C4ISR market as cyber threats increasingly target naval networks and mission-critical data flows. Modern naval operations rely on constant data exchange between sensors, platforms, and command centers, making cyber resilience a foundational system requirement rather than an auxiliary feature. Defense authorities now mandate encrypted communications, intrusion detection, and cyber-hardened software layers within all sea-based C4ISR deployments. The integration of cyber intelligence with traditional ISR functions enhances threat anticipation and operational survivability. Continuous software updates, patch management, and cyber risk monitoring are increasingly embedded into long-term system contracts, expanding lifecycle spending. Regulatory focus on data sovereignty and secure information handling further reinforces investment in domestically controlled architectures. As electronic warfare and cyber operations converge in maritime domains, system designers must account for contested electromagnetic environments. This convergence drives sustained demand for adaptive, secure, and resilient C4ISR solutions capable of maintaining operational integrity under persistent cyber pressure.

Market Challenges

Complex Integration of Advanced C4ISR Systems with Legacy Naval Platforms:

Complex integration of advanced C4ISR systems with legacy naval platforms represents a significant challenge for the Israel Sea-Based C4ISR market because a large portion of the operational fleet was commissioned before modern digital architectures became standard. Many existing vessels lack sufficient power generation capacity, data bandwidth, cooling infrastructure, and physical space to seamlessly accommodate next-generation command, control, communications, intelligence, surveillance, and reconnaissance systems. This mismatch necessitates extensive platform modification, customized system design, and prolonged installation schedules, increasing overall program costs and technical risk. Integration efforts are further complicated by the need to ensure uninterrupted operational readiness during refit periods, limiting installation windows and extending deployment timelines. Interfacing new software-driven architectures with analog or semi-digital subsystems introduces compatibility challenges that require specialized engineering expertise. Certification and testing cycles become more complex when hybrid systems are involved, particularly for mission-critical command functions. Cybersecurity vulnerabilities can also emerge during transitional phases when legacy and modern systems operate concurrently. As a result, even well-funded modernization initiatives face delays and execution inefficiencies that constrain rapid C4ISR capability deployment.

Extended Defense Procurement Cycles and Regulatory Compliance Burdens:

Extended defense procurement cycles and regulatory compliance burdens pose another major challenge to the Israel Sea-Based C4ISR market by slowing the pace at which new technologies are adopted and operationalized. Naval C4ISR systems are subject to stringent evaluation procedures covering cybersecurity resilience, interoperability, reliability under combat conditions, and compliance with national security standards. These requirements, while essential, significantly lengthen tendering, testing, and approval timelines. Vendors must allocate substantial resources to documentation, audits, and repeated validation trials, increasing administrative and financial overheads. Procurement delays can lead to technology obsolescence, as rapid advancements in software, analytics, and networking may outpace deployment schedules. Budgetary approvals may also shift during prolonged procurement phases, forcing scope revisions or phased implementations. Smaller and specialized technology firms often face barriers to entry due to limited capacity to navigate complex defense acquisition frameworks. Collectively, these factors reduce market agility and create structural friction between innovation cycles and actual system deployment within naval forces.

Opportunities

Integration of Artificial Intelligence and Advanced Analytics for Maritime Command Superiority:

Integration of artificial intelligence and advanced analytics for maritime command superiority represents a major opportunity for the Israel Sea-Based C4ISR market as naval operations generate exponentially growing volumes of sensor, communication, and intelligence data. AI-driven systems enable automated data fusion, pattern recognition, and threat prioritization, significantly enhancing decision speed and accuracy for naval commanders operating in high-pressure environments. Machine learning algorithms can analyze radar, sonar, electro-optical, and electronic intelligence feeds simultaneously, identifying anomalies and emerging threats that may be overlooked by human operators. This capability is particularly valuable in congested maritime zones where asymmetric threats and civilian traffic coexist. AI-powered predictive analytics also support mission planning by forecasting adversary behavior and environmental conditions, improving operational preparedness. Continuous learning capabilities allow these systems to adapt based on operational feedback, increasing effectiveness over time. Integration of AI into C4ISR architectures reduces cognitive burden on crews while enabling smaller command teams to manage complex multi-platform operations. Indigenous strengths in software engineering and data science position domestic suppliers to lead development of sovereign AI-enabled naval command solutions. As trust in autonomous decision-support tools grows, procurement focus increasingly shifts toward AI-integrated C4ISR platforms, creating sustained long-term growth opportunities.

Expansion of Unmanned and Autonomous Naval Platform Integration:

Expansion of unmanned and autonomous naval platform integration creates a substantial opportunity for the Israel Sea-Based C4ISR market as naval forces increasingly deploy unmanned surface and subsurface vehicles for surveillance, intelligence gathering, and force protection missions. These platforms require robust command, control, communication, and intelligence frameworks to operate effectively alongside manned vessels and shore-based command centers. Coordinating multiple unmanned assets in real time significantly increases demand for scalable, resilient, and low-latency C4ISR architectures. Autonomous platforms extend operational reach while reducing risk to personnel, making them attractive for persistent surveillance and high-threat missions. However, their effectiveness depends entirely on secure data links, mission management software, and centralized or distributed command systems. This dependency elevates C4ISR from a supporting role to a mission-critical enabler of autonomy. Modular C4ISR solutions tailored for unmanned operations allow rapid configuration changes and mission-specific customization. Export interest in unmanned naval systems among allied nations further expands demand for interoperable C4ISR frameworks. As autonomy adoption accelerates across naval forces, investment in integrated C4ISR solutions designed specifically for unmanned platform ecosystems presents a long-term structural growth opportunity.

Future Outlook

Over the next five years, the Israel Sea-Based C4ISR market is expected to experience sustained expansion driven by naval modernization, cybersecurity prioritization, and increasing reliance on data-centric maritime operations. Technological advancements in AI, secure communications, and sensor fusion will shape next-generation system architectures. Government support for indigenous defense capabilities will continue to favor domestic suppliers. Demand-side factors include evolving maritime threat environments and expanded operational requirements across coastal and blue-water domains.

Major Players

- Elbit Systems

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elta Systems

- TadiranCommunications

- Orbit Communication Systems

- RT LTA Systems

- BIRD Aerosystems

- Aeronautics Group

- ContropPrecision Technologies

- SK Group Israel

- Camero-Tech

- UVisionTechnologies

- XTEND Defense

- ThirdEyeSystems

Key Target Audience

- Naval and maritime defense forces

- Defense procurement authorities

- Government and regulatory bodies

- Investments and venture capitalist firms

- Defense system integrators

- Naval shipbuilders

- Homeland security agencies

- Strategic policy and security organizations

Research Methodology

Step 1: Identification of Key Variables

The research began with identification of critical market variables influencing sea-based C4ISR adoption. These included platform types, system architectures, procurement models, and regulatory frameworks. Data points were mapped across operational, technological, and financial dimensions. Variable relevance was validated through defense sector documentation.

Step 2: Market Analysis and Construction

Collected data was structured into coherent market segments aligned with naval operational requirements. Public procurement disclosures and defense budget allocations formed the analytical foundation. Cross-validation was performed using multiple secondary sources. Market construction emphasized accuracy and scope alignment.

Step 3: Hypothesis Validation and Expert Consultation

Initial hypotheses were validated through consultations with defense analysts and maritime security experts. Feedback refined system classification and demand drivers. Assumptions were stress-tested against operational realities. This ensured analytical robustness.

Step 4: Research Synthesis and Final Output

All findings were synthesized into a structured market narrative. Quantitative and qualitative insights were integrated consistently. Internal validation checks ensured compliance with scope definitions. The final output reflects verified, decision-oriented intelligence.

- Executive Summary

- Israel Sea-Based C4ISR Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising emphasis on maritime domain awareness in contested waters

Integration of multi-sensor intelligence for real-time naval decision making

Expansion of network-centric naval warfare doctrines

Modernization of legacy naval fleets with digital architectures

Increased interoperability requirements with allied naval forces - Market Challenges

High system integration complexity across heterogeneous naval platforms

Cybersecurity vulnerabilities in networked maritime systems

Long procurement cycles and stringent defense certification processes

Budgetary trade-offs between platform acquisition and system upgrades

Dependence on continuous software updates and lifecycle support - Market Opportunities

Deployment of AI-driven maritime intelligence and predictive analytics

Growth in unmanned and autonomous naval platform integration

Export of modular sea-based C4ISR solutions to allied navies - Trends

Shift toward open-architecture and modular C4ISR frameworks

Greater use of cloud-enabled and edge computing at sea

Convergence of C4ISR with electronic warfare capabilities

Enhanced focus on cyber resilience and information assurance

Adoption of digital twins for naval mission planning and training - Government Regulations & Defense Policy

Emphasis on indigenous defense technology development

Strengthening of naval cybersecurity and data sovereignty norms

Alignment of maritime C4ISR programs with national defense strategies - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and control software suites

Integrated ISR sensor fusion systems

Secure naval communication systems

Electronic intelligence and electronic warfare modules

Battle management and decision support systems - By Platform Type (In Value%)

Surface combatants

Submarines

Offshore patrol vessels

Unmanned surface vehicles

Naval command centers and shore stations - By Fitment Type (In Value%)

New-build naval platforms

Mid-life upgrade programs

Retrofit and modernization packages

Mission-specific modular fitments

Export-oriented customized installations - By EndUser Segment (In Value%)

National navy and maritime forces

Coastal surveillance and border security agencies

Naval intelligence units

Joint command and maritime operations centers

Defense research and testing establishments - By Procurement Channel (In Value%)

Direct government procurement

Defense public sector undertakings

Prime contractor-led integration contracts

Intergovernmental defense agreements

Technology transfer and licensed production programs - By Material / Technology (in Value %)

AI-enabled data analytics

Software-defined networking architectures

Advanced radar and EO sensor integration

Cyber-hardened communication protocols

Satellite and line-of-sight data link technologies

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (system integration capability, naval platform compatibility, cybersecurity robustness, sensor fusion maturity, software modularity, lifecycle support depth, export readiness, interoperability standards compliance, AI and analytics integration) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elta Systems

Tadiran Communications

Orbit Communication Systems

Aeronautics Group

RT LTA Systems

UVision Technologies

XTEND Defense

Cellebrite Defense

Controp Precision Technologies

Camero-Tech

SK Group Israel

BIRD Aerosystems

- Naval forces prioritize integrated situational awareness across surface and subsurface domains

- Operational commands demand real-time intelligence fusion for rapid response missions

- Intelligence units focus on persistent surveillance and threat identification at sea

- Support agencies emphasize secure, interoperable communication across joint operations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035