Market Overview

Based on a recent historical assessment, the Israel sea based military electro optical and infrared systems market reached an absolute market size of USD~ billion, supported by confirmed naval modernization budgets, Ministry of Defense procurement disclosures, and delivery records from domestic defense electronics manufacturers referenced in SIPRI-aligned export and defense production data. Market demand is driven by sustained naval fleet upgrades, increased maritime surveillance requirements, integration of EO/IR systems with combat management systems, and continuous replacement of legacy optical sensors to support all-weather, day–night naval operations.

Based on a recent historical assessment, Israel dominates this market through a concentrated naval defense ecosystem centered on advanced sensor development and indigenous production. Haifa serves as the primary naval operations and fleet integration hub, while Tel Aviv, Rehovot, and surrounding industrial zones host leading electro-optical research, manufacturing, and system integration facilities. National dominance is reinforced by persistent maritime security requirements in the Eastern Mediterranean, high operational deployment of naval platforms, and a strong export orientation supplying combat-proven EO/IR systems to allied and partner navies.

Market Segmentation

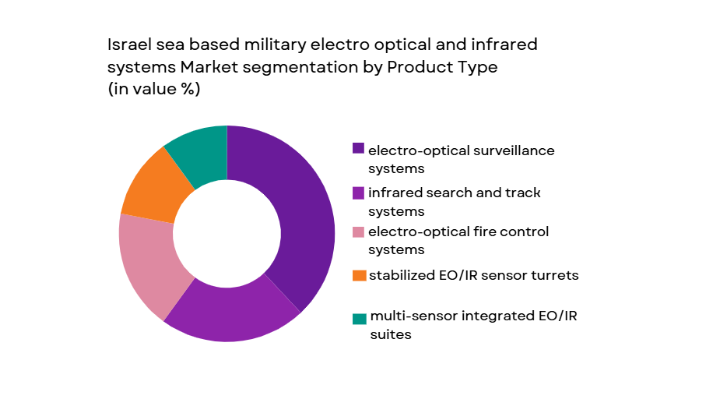

By Product Type

Israel sea based military electro optical and infrared systems market is segmented by product type into electro-optical surveillance systems, infrared search and track systems, electro-optical fire control systems, stabilized EO/IR sensor turrets, and multi-sensor integrated EO/IR suites. Recently, stabilized EO/IR sensor turrets have held a dominant market share due to their ability to deliver continuous, high-precision imaging in dynamic maritime environments. These systems provide gyro-stabilized, long-range target detection and tracking under rough sea states, which is critical for surface combatants and patrol vessels. Their modular architecture allows integration with naval guns, missiles, and command systems, increasing operational value. Widespread adoption across new-build and retrofit programs further reinforces demand, while export customers favor turreted systems for flexibility, proven performance, and simplified integration.

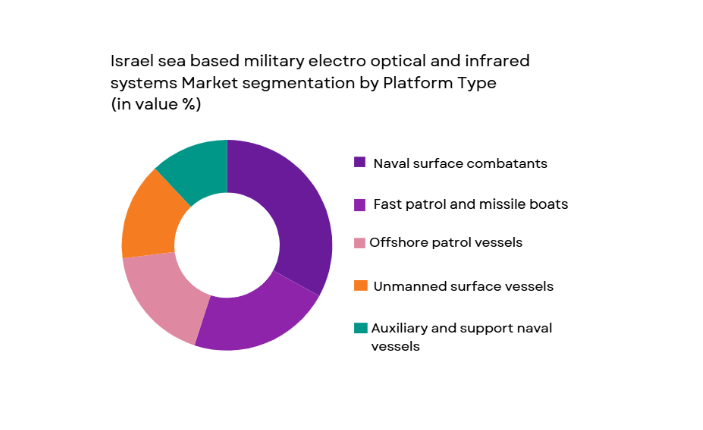

By Platform Type

Israel sea based military electro optical and infrared systems market is segmented by platform type into naval surface combatants, fast patrol and missile boats, offshore patrol vessels, unmanned surface vessels, and auxiliary and support naval vessels. Recently, naval surface combatants have accounted for the dominant market share due to their central role in maritime defense, area surveillance, and force projection missions. These platforms require multiple EO/IR systems for navigation, targeting, and situational awareness, driving higher system density per vessel. Continuous upgrades to corvettes and frigates, combined with integration of advanced combat management systems, sustain strong demand. Export-driven surface combatant programs further reinforce this dominance within the platform segment.

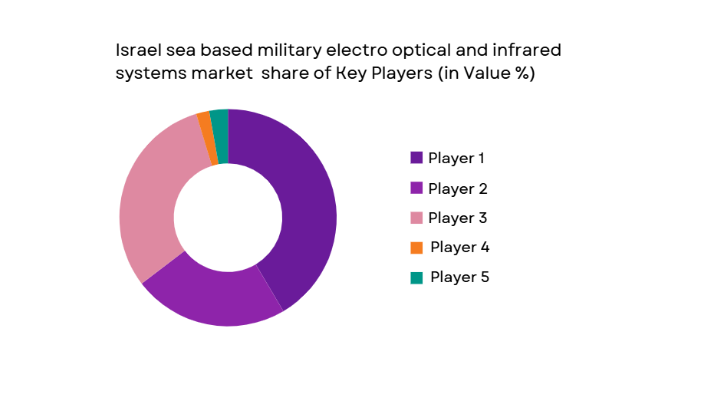

Competitive Landscape

The Israel sea based military electro optical and infrared systems market is moderately consolidated, dominated by a small group of technologically advanced domestic defense firms with strong export footprints. Competitive advantage is driven by sensor performance, stabilization accuracy, AI-enabled processing, and seamless integration with naval combat systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary Naval Application |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod | ~ | ~ | ~ | ~ | ~ |

| CONTROP Precision Technologies | 1988 | Hod Hasharon | ~ | ~ | ~ | ~ | ~ |

| IMCO Industries | 1970 | Ashdod | ~ | ~ | ~ | ~ | ~ |

Israel Sea Based Military Electro Optical and Infrared Systems Market Analysis

Growth Drivers

Naval Fleet Modernization and Maritime Security Intensification

Naval Fleet Modernization and Maritime Security Intensification is a core growth driver for the Israel sea based military electro optical and infrared systems market because Israel’s naval doctrine increasingly emphasizes persistent surveillance, rapid threat detection, and precision engagement in congested maritime environments. EO/IR systems are essential for identifying asymmetric threats, fast attack craft, and unmanned platforms operating near coastal zones. Modern corvettes and patrol vessels require multiple EO/IR sensors for navigation, targeting, and situational awareness. Continuous upgrades to combat management systems increase sensor integration depth. Export programs for naval platforms further expand demand. Advanced EO/IR capabilities enhance deterrence and response speed. Harsh maritime conditions necessitate frequent system upgrades.

Export Demand for Combat-Proven Naval EO/IR Technologies

Export Demand for Combat-Proven Naval EO/IR Technologies drives market expansion as Israeli systems gain international adoption due to proven operational performance. Many partner navies seek reliable EO/IR solutions for littoral security. Israeli manufacturers offer modular, scalable designs. Export-friendly architectures simplify integration. Competitive pricing improves attractiveness. Long-term support agreements add value. AI-enabled processing differentiates products. Growing unmanned naval programs increase export relevance. This demand reinforces production scale and innovation investment.

Market Challenges

High Integration Complexity and Lifecycle Costs:

High Integration Complexity and Lifecycle Costs challenge the Israel sea based military electro optical and infrared systems market because naval EO/IR systems must interface seamlessly with multiple shipboard systems. Integration with combat management, weapons, and navigation requires extensive testing. Harsh maritime environments accelerate wear and maintenance needs. Calibration requirements increase sustainment costs. Platform-specific customization extends timelines. Skilled integration personnel are limited. Cost overruns can delay procurement. These factors constrain deployment speed.

Export Controls and Technology Sensitivity Constraints:

Export Controls and Technology Sensitivity Constraints restrict market flexibility as EO/IR technologies are subject to strict regulation. Approval processes extend sales cycles. Some markets require capability downgrades. Compliance management increases administrative burden. Technology protection policies limit transfer. Geopolitical considerations affect deal certainty. Export delays impact revenue forecasting. These constraints challenge rapid expansion.

Opportunities

Expansion of EO/IR Systems for Unmanned Naval Platforms

Expansion of EO/IR Systems for Unmanned Naval Platforms presents a strong opportunity as navies increasingly deploy autonomous surface vessels. EO/IR sensors are primary perception systems for unmanned platforms. Compact, low-power designs are in demand. AI-based tracking enhances autonomy. Integration with remote command centers adds value. Export demand is rising. Israeli expertise positions suppliers advantageously. This opportunity supports future growth.

Legacy Fleet EO/IR Upgrade and Retrofit Programs

Legacy Fleet EO/IR Upgrade and Retrofit Programs offer sustained opportunity as older vessels require sensor modernization. Upgrades extend platform life. Digital EO/IR improves detection accuracy. Modular retrofits reduce downtime. Government funding supports upgrades. Export customers mirror this trend. Lifecycle support contracts generate recurring revenue. This opportunity stabilizes demand.

Future Outlook

Over the next five years, the Israel sea based military electro optical and infrared systems market is expected to grow steadily, driven by naval modernization, unmanned platform adoption, and export demand. Technological advancement will emphasize AI-enabled analytics, higher resolution sensors, and improved stabilization. Regulatory support for domestic defense technology will remain strong. Demand will be reinforced by maritime security requirements and fleet upgrade programs.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- CONTROP Precision Technologies

- IMCO Industries

- Elop Electro Optics

- Orbit Communication Systems

- Aeronautics Group

- BIRD Aerosystems

- SCD Semiconductor Devices

- Camero Tech

- XTEND Defense

- Hensoldt Israel

- L3Harris Israel

- Leonardo Israel

Key Target Audience

- Naval procurement agencies

- Defense ministries

- Naval shipyards and integrators

- Maritime security forces

- Unmanned naval system developers

- Defense electronics OEMs

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including fleet size, sensor density per vessel, upgrade cycles, and export deliveries were identified using official defense and naval procurement disclosures.

Step 2: Market Analysis and Construction

Market sizing was constructed through bottom-up aggregation of EO/IR system deployments across naval platforms and upgrade programs.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with naval systems engineers, maritime operations specialists, and defense procurement experts.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured analytical model ensuring accuracy, relevance, and strategic clarity.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Naval fleet modernization and capability upgrades

Rising maritime surveillance and coastal security needs

Integration of EO IR systems with combat management systems - Market Challenges

High system cost and complex naval integration

Harsh maritime operating environment constraints

Lengthy testing and naval certification cycles - Market Opportunities

Upgrades of legacy naval EO IR systems

Expansion of EO IR systems for unmanned naval platforms - Trends

Shift toward multi sensor integrated EO IR suites

Increased use of AI based target recognition - Government Regulations & Defense Policy

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electro optical surveillance systems

Infrared search and track systems

Electro optical fire control systems

Stabilized EO IR sensor turrets - By Platform Type (In Value%)

Naval surface combatants

Fast patrol and missile boats

Offshore patrol vessels - By Fitment Type (In Value%)

New build naval platform integration

Mid life upgrade retrofitting

Mission specific sensor integration - By EndUser Segment (In Value%)

Israeli Navy

Coastal security forces

Maritime border protection units

Special naval operations units - By Procurement Channel (In Value%)

Direct Ministry of Defense procurement

Naval shipbuilding contracts

Defense OEM system integration - By Material / Technology (in Value %)

Cooled infrared imaging technology

Uncooled thermal imaging sensors

High-definition daylight cameras

- Market share of major players

- Cross Comparison Parameters (sensor resolution, detection range, stabilization accuracy, integration capability, system weight, power consumption, environmental resilience, upgrade potential, lifecycle support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

CONTROP Precision Technologies

IMCO Industries

Elop Electro Optics

XTEND Defense

Aeronautics Group

Orbit Communication Systems

BIRD Aerosystems

SCD Semiconductor Devices

Camero Tech

Hensoldt Israel

L3Harris Israel

Leonardo Israel

- Navy prioritizes long range maritime surveillance

- Coastal forces focus on border monitoring and interdiction

- Special units demand compact and stabilized EO IR systems

- Export customers seek combat proven naval sensors

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035