Market Overview

Based on a recent historical assessment, the Israel service handgun market recorded an absolute market size of USD ~ billion, supported by confirmed procurement allocations from the Ministry of Defense, internal security budgets, and replacement contracts issued to domestic small-arms manufacturers. Market demand is driven by continuous operational readiness requirements, routine replacement cycles for service pistols, expansion of special operations units, and sustained procurement for police, border security, and reserve forces. Domestic manufacturing capability and standardization across services further reinforce consistent purchasing volumes.

Based on a recent historical assessment, Israel dominates this market through centralized defense procurement and a highly mature domestic small-arms ecosystem. Tel Aviv and Jerusalem function as command, policy, and contracting hubs, while Karmiel and central industrial zones host key handgun manufacturing and testing facilities. National dominance is reinforced by mandatory military service, high reserve force utilization, and persistent internal security operations, which collectively sustain continuous demand for standardized, reliable service handguns across military and law enforcement institutions.

Market Segmentation

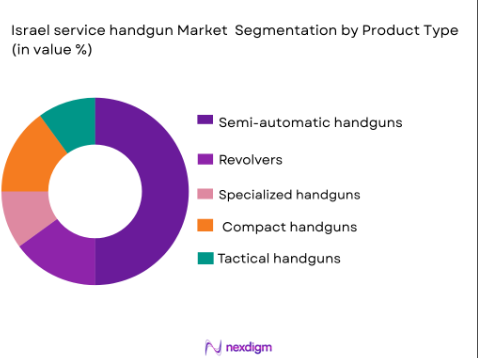

By Product Type

The Israel service handgun market is segmented by product type into semi-automatic handguns, revolvers, specialized handguns, compact handguns, and tactical handguns. Recently, semi-automatic handguns have dominated the market due to their superior firepower, faster reloading capabilities, and versatility in both law enforcement and military applications. Compact handguns are growing in demand due to their portability and suitability for concealed carry. Tactical handguns, designed for high-performance in combat or special operations, are also gaining traction. While revolvers still maintain a portion of the market, their dominance is less compared to more modern systems like semi-automatic handguns.

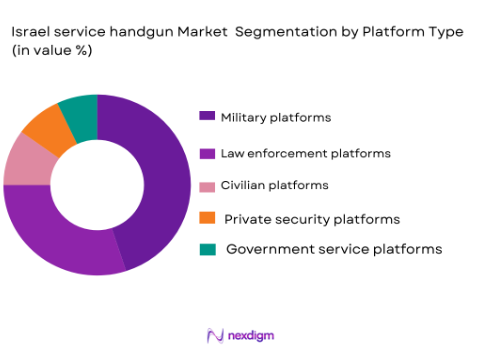

By Platform Type

The Israel service handgun market is segmented by platform type into military platforms, law enforcement platforms, civilian platforms, private security platforms, and government service platforms. Recently, military platforms have dominated the market share due to continued government investments in defense infrastructure and ongoing procurement programs for handguns. The demand for firearms that offer high performance, versatility, and operational efficiency in tactical operations has driven this dominance. However, law enforcement platforms follow closely, with steady growth in demand for service handguns used for urban security and counterterrorism.

Competitive Landscape

The Israel service handgun market is moderately consolidated, dominated by a limited number of domestic manufacturers that maintain close alignment with national defense requirements. Competitive positioning is shaped by reliability, domestic production capacity, compliance with military standards, and long-term lifecycle support agreements.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary End User |

| Israel Weapon Industries | 1933 | Ramat Hasharon | ~ | ~ | ~ | ~ | ~ |

| BUL Armory | 1990 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

| Emtan Karmiel | 2012 | Karmiel | ~ | ~ | ~ | ~ | ~ |

| Silver Shadow | 1994 | Holon | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

Israel service handgun Market Analysis

Growth Drivers

Sustained Military and Internal Security Readiness Requirements:

Sustained Military and Internal Security Readiness Requirements drive the Israel service handgun market due to persistent operational demands across military, police, and border security forces. Mandatory service and reserve duty ensure broad distribution of sidearms. High readiness standards require continuous training, maintenance, and replacement of service pistols. Urban security operations elevate daily handgun usage. Reserve mobilization cycles create additional procurement needs. Standardization across units simplifies logistics and accelerates purchasing decisions. Domestic manufacturers can rapidly respond to requirements. Continuous operational exposure necessitates durability-focused replacements. These factors collectively sustain long-term market demand.

Standardization and Domestic Production of Service Pistols:

Standardization and Domestic Production of Service Pistols drive growth by ensuring supply security and consistent lifecycle management. Centralized procurement favors locally produced designs. Domestic manufacturing reduces dependence on foreign suppliers. Rapid customization supports mission-specific needs. Lifecycle support remains integrated within national industry. Training efficiency improves through standardized platforms. Cost predictability enhances budget planning. Export success reinforces domestic production scale. These dynamics strengthen sustained procurement momentum.

Market Challenges

Strict Firearms Regulation and Centralized Procurement Controls:

Strict Firearms Regulation and Centralized Procurement Controls challenge market flexibility by limiting procurement diversity and civilian spillover demand. All service handgun acquisition is state-controlled. Licensing requirements restrict alternative suppliers. Centralized decision-making slows adoption cycles. Extensive testing requirements extend qualification timelines. Compliance costs burden smaller manufacturers. Export approvals add complexity. Procurement volumes remain tightly planned. These constraints limit rapid market expansion.

Budget Prioritization Toward Advanced Weapon Systems:

Budget Prioritization Toward Advanced Weapon Systems constrains growth as resources increasingly shift toward missiles, air defense, and cyber capabilities. Handguns represent lower strategic priority. Procurement cycles may be extended. Modernization budgets Favor high-end platforms. Small arms upgrades compete for funding. Delayed replacement impacts manufacturers. Planning uncertainty affects production scheduling. These pressures restrain market acceleration.

Opportunities

Adoption of Optics-Ready and Modular Service Handguns:

Adoption of Optics-Ready and Modular Service Handguns presents opportunity as operational preferences evolve. Red-dot sights improve accuracy. Modular frames enhance ergonomics. Accessory compatibility increases mission flexibility. Training modernization supports adoption. Domestic manufacturers are well positioned. Replacement cycles accelerate upgrades. Export-aligned designs increase scale. This opportunity supports value growth.

Modernization of Police and Border Security Sidearms:

Modernization of Police and Border Security Sidearms offers growth as internal security demands increase. Police modernization programs expand. Border security operations intensify. Ergonomic upgrades improve officer effectiveness. Standardization simplifies logistics. Government funding supports replacement. Domestic supply ensures continuity. This opportunity broadens non-military demand.

Future Outlook

Over the next five years, the Israel service handgun market is expected to grow steadily, supported by ongoing security operations, replacement cycles, and police modernization initiatives. Technological development will emphasize optics-ready designs and modularity. Regulatory support for domestic manufacturing will remain strong. Demand will be sustained by reserve force requirements and internal security priorities.

Major Players

- Israel Weapon Industries

- BUL Armory

- Emtan Karmiel

- Silver Shadow

- IMI Systems

- Tavor Arms

- Zahal Armory

- E-Lynx Defense

- Sarsılmaz Israel

- Glock Israel

- SIG Sauer Israel

- Beretta Israel

- CZ Israel

- Rafael Land Systems

- Elbit Systems Land

Key Target Audience

- Defense ministries

- Military procurement agencies

- National police forces

- Border security agencies

- Government security services

- Domestic arms manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including unit issuance rates, replacement cycles, procurement contracts, and domestic production capacity were identified using official defense and internal security disclosures.

Step 2: Market Analysis and Construction

Market sizing was constructed through bottom-up aggregation of service handgun procurement volumes across military and law enforcement agencies.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through consultations with defense procurement officials, firearms engineers, and retired security personnel.

Step 4: Research Synthesis and Final Output

Validated data were synthesized into a structured analytical framework ensuring accuracy, relevance, and strategic usability.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Sustained military and internal security readiness

Regular replacement cycles of service pistols

Operational demand from special forces units

Emphasis on domestically produced small arms

Continuous training and reserve force requirements - Market Challenges

Strict firearms regulation and licensing controls

Budget prioritization toward advanced weapon systems

Limited civilian market spillover

Export compliance and geopolitical constraints

High qualification and testing standards - Market Opportunities

Modernization of police and border force sidearms

Adoption of modular and optics ready handguns

Export oriented production for allied forces - Trends

Shift toward striker fired service pistols

Growing use of polymer frame designs

Integration of optics ready handgun platforms

Focus on ergonomics and reduced recoil

Preference for domestically manufactured weapons - Government Regulations & Defense Policy

Tight state control over service weapon procurement

Support for domestic defense manufacturing

Alignment with military small arms standardization - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Semi-automatic service pistols

Striker fired handguns

Hammer fired duty pistols

Compact service handguns

Modular frame service pistols - By Platform Type (In Value%)

Military issued sidearms

Police service handguns

Special forces duty pistols

Border security and paramilitary use

Government agency service weapons - By Fitment Type (In Value%)

New service handgun induction

Replacement of legacy pistols

Specialized mission fitment

Standard issue fleet modernization

Training and reserve force fitment - By End User Segment (In Value%)

Israel Defense Forces

National police forces

Special operations units

Border security agencies

Government security services - By Procurement Channel (In Value%)

Direct government procurement

Defense ministry framework contracts

Domestic defense manufacturer supply

Inter agency transfer programs

Export linked domestic production - By Material / Technology (in Value %)

Polymer frame handguns

Steel frame duty pistols

Advanced recoil management systems

Optics ready service pistols

Enhanced safety and trigger mechanisms

- Market share snapshot of major players

- Cross Comparison Parameters (Caliber compatibility, magazine capacity, frame material, weight, accuracy, durability, ergonomics, maintenance ease, lifecycle cost)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Weapon Industries

BUL Armory

Emtan Karmiel

IMI Systems

Tavor Arms

Zahal Armory

Silver Shadow

E-Lynx Defense

Rafael Advanced Defense Systems

Elbit Systems Land

Sarsılmaz Israel

Glock Israel

SIG Sauer Israel

Beretta Israel

CZ Israel

- Military units prioritize reliability and durability

- Police forces focus on ergonomics and safety

- Special forces demand modular and compact designs

- Border agencies emphasize high-capacity sidearms

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035