Market Overview

The Israel short range air defense system market was valued at approximately USD ~ billion based on a recent historical assessment, driven by sustained national investment in missile interception, rocket defense, and counter-UAV capabilities. Market expansion is supported by continuous operational deployment, accelerated system replenishment cycles, and ongoing upgrades to interceptor missiles, radars, and command systems. High operational usage rates, government-funded procurement programs, and integration of short-range systems into layered air defense architecture collectively sustain market size and reinforce consistent demand across land and naval defense applications.

Israel’s short range air defense ecosystem is dominated by Tel Aviv, Haifa, and Be’er Sheva due to the concentration of defense manufacturing facilities, R&D centers, and military command infrastructure. Tel Aviv leads through defense headquarters, system integration hubs, and policy coordination, while Haifa benefits from naval defense deployment and sensor manufacturing clusters. Be’er Sheva has emerged as a critical defense technology and cyber integration center supporting command-and-control functions. National dominance is reinforced by Israel’s security environment, advanced domestic defense industry, and continuous operational validation of deployed systems.

Market Segmentation

By Product Type

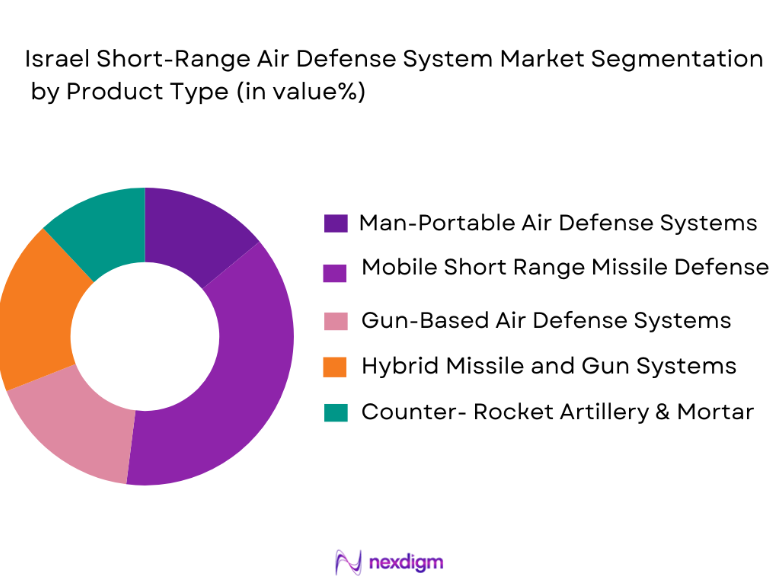

Israel short range air defense system market is segmented by system type into man-portable air defense systems, mobile short range missile defense systems, gun-based air defense systems, hybrid missile and gun systems, and counter-rocket artillery and mortar systems. Recently, mobile short range missile defense systems have held a dominant market share due to their proven operational effectiveness, rapid reaction capability, and seamless integration with radar and command networks. These systems are heavily deployed to intercept rockets, UAVs, and short-range missiles, making them central to national defense strategy. Their dominance is further reinforced by continuous interceptor replenishment, software upgrades, and sensor enhancements driven by real-time threat evolution. Government prioritization of layered missile defense, combined with domestic production capacity and export success, strengthens this segment’s leadership. The ability to protect population centers, military bases, and critical infrastructure underpins sustained procurement and long-term dominance within the market.

By Platform Type

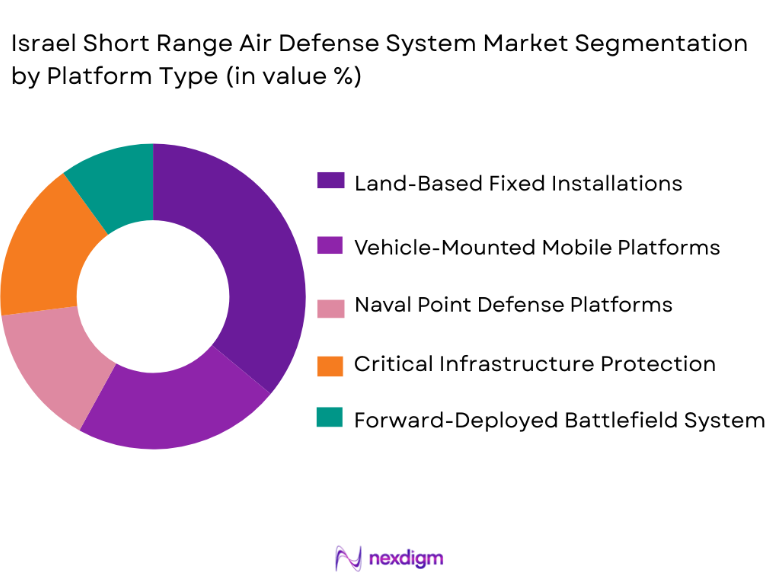

Israel short range air defense system market is segmented by platform type into land-based fixed installations, vehicle-mounted mobile platforms, naval point defense platforms, critical infrastructure protection systems, and forward-deployed battlefield systems. Recently, land-based fixed installations have dominated the market due to their role in protecting urban areas, strategic assets, and national infrastructure from persistent short-range threats. These installations support continuous radar coverage, centralized command-and-control, and rapid interceptor launch capability. Their dominance is reinforced by high operational tempo, constant system upgrades, and integration with national early warning networks. Fixed platforms allow efficient interceptor stockpiling and maintenance while enabling coordinated multi-battery defense operations. Government funding stability, population protection priorities, and proven interception performance collectively support the sustained leadership of land-based fixed installations in overall platform deployment.

Competitive Landscape

The Israel short range air defense system market is highly consolidated, led by a small group of domestic prime contractors with deep integration across missile, radar, and command technologies. These players benefit from strong government backing, continuous operational feedback, and export partnerships, creating high entry barriers and reinforcing long-term dominance.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Core Capability |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Military Industries | 1933 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elta Systems | 1967 | Israel | ~ | ~ | ~ | ~ | ~ |

Israel Short Range Air Defense System Market Analysis

Growth Drivers

Persistent Rocket, Missile, and UAV Threat Environment

Israel’s short range air defense system market is fundamentally driven by an enduring and evolving threat landscape characterized by frequent rocket launches, increasing use of unmanned aerial vehicles, and short-range missile proliferation. The constant requirement to defend civilian populations, military assets, and strategic infrastructure necessitate continuous deployment and replenishment of interceptor systems. Operational usage leads to high interceptor consumption, creating recurring procurement cycles rather than one-time acquisitions. Threat diversification, including low-cost rockets and swarm-based UAV tactics, compels investment in rapid-reaction and high-precision interception technologies. National defense doctrine emphasizes active defense, reinforcing prioritization of short range systems. Continuous system validation under real combat conditions accelerates upgrades and capability enhancements. Government funding remains consistent due to the direct link between system performance and national security. This driver ensures stable long-term demand independent of global defense cycles.

Domestic Defense Innovation and Integrated Air Defense Architecture

Israel’s emphasis on indigenous defense development significantly drives its short range air defense system market by enabling rapid technological adaptation and system integration. Domestic firms collaborate closely with the military, allowing real-time operational feedback to influence design improvements. Short range systems are increasingly integrated into a layered architecture combining sensors, interceptors, and command networks. This integration improves interception efficiency and justifies continued investment. Local production reduces dependency on foreign suppliers and accelerates deployment timelines. Advanced radar, AI-enabled tracking, and networked command systems enhance system value. Government policy actively supports domestic innovation through long-term contracts. This ecosystem sustains continuous modernization and market expansion.

Market Challenges

High Interceptor Cost and Sustainment Burden

One of the primary challenges in the Israel short range air defense system market is the high cost associated with interceptor production, deployment, and sustainment. Frequent operational use leads to rapid depletion of interceptor inventories, requiring constant replenishment. Maintenance of radar, launchers, and command systems adds to lifecycle costs. Budgetary pressure intensifies during prolonged conflict periods. Cost management becomes complex as threats evolve faster than procurement cycles. Export revenues partially offset costs but do not eliminate fiscal strain. System upgrades further increase expenditure. Balancing affordability with effectiveness remains a persistent challenge.

Technological Complexity and Rapid Threat Evolution

The market faces challenges from the accelerating pace of threat innovation, including low-signature UAVs and saturation attacks. Systems must continuously evolve to maintain interception effectiveness. Integration of new sensors and software increases complexity and testing requirements. Rapid upgrades risk interoperability issues across legacy platforms. Development timelines are compressed by operational urgency. Skilled workforce dependency adds execution risk. Export restrictions complicate collaboration. Managing complexity while ensuring reliability remains a structural challenge.

Opportunities

Counter-UAV and Drone Swarm Defense Expansion

The rapid increase in UAV and loitering munition threats presents a major opportunity for the Israel short range air defense system market. Existing systems can be enhanced with specialized sensors and interceptors optimized for small, low-altitude targets. Development of cost-effective interception solutions addresses economic sustainability. Integration with electronic warfare and directed energy technologies expands capability portfolios. Export demand for counter-UAV solutions is rising globally. Domestic deployment accelerates validation and refinement. Government prioritization ensures funding continuity. This opportunity supports both domestic growth and international market expansion.

Export-Driven Modernization and Allied Demand

Israel’s proven operational performance creates strong export opportunities for short range air defense systems. Allied nations seek battle-tested solutions adaptable to diverse threat environments. Export contracts support production scale and cost efficiency. Co-development programs strengthen diplomatic ties. Export revenues fund further R&D investment. Customization for allied requirements expands product variants. Regulatory alignment supports controlled technology transfer. This opportunity reinforces long-term market resilience.

Future Outlook

The Israel short range air defense system market is expected to maintain steady growth over the next five years, supported by continuous threat exposure and defense modernization priorities. Advancements in radar, interceptor efficiency, and AI-enabled command systems will shape capability evolution. Government funding stability and domestic innovation will remain key enablers. Export demand and counter-UAV requirements are expected to further strengthen market momentum.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Elbit Systems

- Israel Military Industries

- Elta Systems

- Aeronautics Defense Systems

- RT LTA Systems

- Controp Precision Technologies

- UVision Air

- BlueBirdAero Systems

- BIRD Aerosystems

- TadirahCommunications

- SCD Semiconductor Devices

- Imco Industries

- Cyclone Aviation Products

Key Target Audience

- Defense Ministries

- Armed forces and air defense commands

- Homeland security agencies

- Critical infrastructure operators

- Defense system integrators • Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace and defense manufacturers

Research Methodology

Step 1: Identification of Key Variables

Key variables include threat types, interceptor consumption, system deployment density, and government procurement patterns influencing market behavior.

Step 2: Market Analysis and Construction

Defense budgets, deployment data, and industry disclosures are analyzed to structure market size and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Insights are validated through consultations with defense analysts, engineers, and procurement specialists.

Step 4: Research Synthesis and Final Output

Validated data is synthesized into structured analysis, forecasts, and competitive assessment.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Persistent regional security threats and asymmetric warfare risks

Continuous modernization of national air defense architecture

High frequency of rocket, UAV, and short-range missile threats - Market Challenges

High system development and sustainment costs

Technological complexity and rapid obsolescence risks

Export control and geopolitical sensitivity constraints - Market Opportunities

Integration of counter-UAV and loitering munition defense

Export demand from allied and partner nations

Upgrades and life extension of deployed defense systems - Trends

Shift toward multi-layered integrated air defense

Growing focus on counter-UAV capabilities

Increased automation and artificial intelligence integration

Emphasis on rapid intercept and high kill probability

Enhanced interoperability across defense branches - Government Regulations & Defense Policy

Strong government backing for domestic defense development

Priority funding for missile and air defense programs

Alignment of procurement with national security doctrine - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Man-portable air defense systems

Mobile short-range missile defense systems

Gun-based air defense systems

Hybrid missile and gun systems

Counter-rocket artillery and mortar systems - By Platform Type (In Value%)

Land-based fixed installations

Vehicle-mounted mobile platforms

Naval point-defense platforms

Critical infrastructure protection systems

Forward-deployed battlefield systems - By Fitment Type (In Value%)

Standalone interceptor systems

Radar-integrated defense systems

Command and control networked systems

Electro-optical sensor integrated systems

Multi-layer air defense integrated fitments - By EndUser Segment (In Value%)

Israeli Defense Forces ground units

Air force air defense commands

Naval defense units

Homeland security and civil defense authorities

Strategic infrastructure protection agencies - By Procurement Channel (In Value%)

Direct government procurement

Defense ministry long-term acquisition programs

Emergency and operational requirement procurement

Domestic development and production contracts

Export-driven co-development programs - By Material / Technology (in Value %)

Advanced interceptor missile technologies

Active electronically scanned array radars

Electro-optical and infrared tracking systems

Battle management and command software

High-speed data link and communication systems

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (interceptor range, reaction time, radar capability, system mobility, integration flexibility, unit cost, kill probability, upgrade potential)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elbit Systems

Israel Military Industries

Aeronautics Defense Systems

RT LTA Systems

Vision Air

Bluebird Aero Systems

Control Precision Technologies

Cyclone Aviation Products

BIRD Aerosystems

Elta Systems

Tadirah Communications

SCD Semiconductor Devices

IMCO Industries

- Ground forces prioritize mobility and rapid deployment capability

- Air defense units focus on interception accuracy and response time

- Naval forces emphasize compact and ship-integrated solutions

- Homeland defense authorities demand high reliability and continuous readiness

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035