Market Overview

Based on a recent historical assessment, the Israel shotgun and rifles market recorded spending of approximately USD ~ million, reflecting confirmed procurement by defense forces, law enforcement agencies, private security operators, and licensed civilian channels. The market size is driven by sustained military readiness requirements, continuous replacement cycles due to intensive training and operational use, and demand for reliable firearms suited for urban combat and border security. Additional drivers include domestic manufacturing capabilities, technology upgrades, and steady institutional demand under strict regulatory oversight.

Based on a recent historical assessment, Tel Aviv, Haifa, and Jerusalem dominate the Israel shotgun and rifles market due to their concentration of defense headquarters, manufacturing facilities, and security institutions. Tel Aviv leads through defense procurement authorities and private security demand. Haifa supports dominance with domestic production and defense industrial infrastructure. Jerusalem contributes through national law enforcement, border police command centers, and centralized licensing and regulatory bodies that influence procurement and distribution.

Market Segmentation

By Product Type

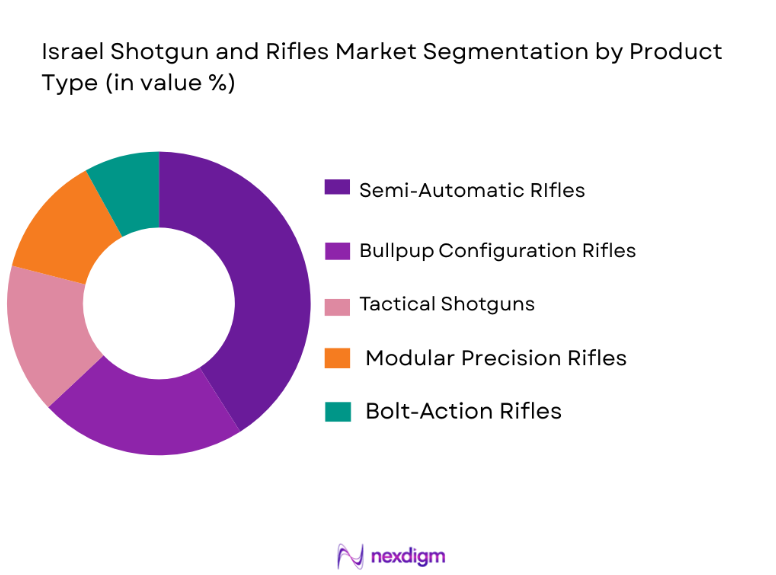

Israel shotgun and rifles market is segmented by product type into tactical shotguns, semiautomatic rifles, boltaction rifles, bullpup configuration rifles, and modular precision rifles. Recently, semiautomatic rifles have a dominant market share due to their extensive use as standardissue infantry weapons across the Israel Defense Forces and specialized security units. These rifles combine high reliability, rapidfire capability, and adaptability for various combat environments. Integration with modern optics, fire control accessories, and modular components enhances operational effectiveness. Domestic manufacturing strength and long service life further reinforce preference. Continuous training, replacement cycles, and compatibility with emerging soldier systems support persistent demand. These factors collectively position semiautomatic rifles as the dominant product type.

By Platform Type

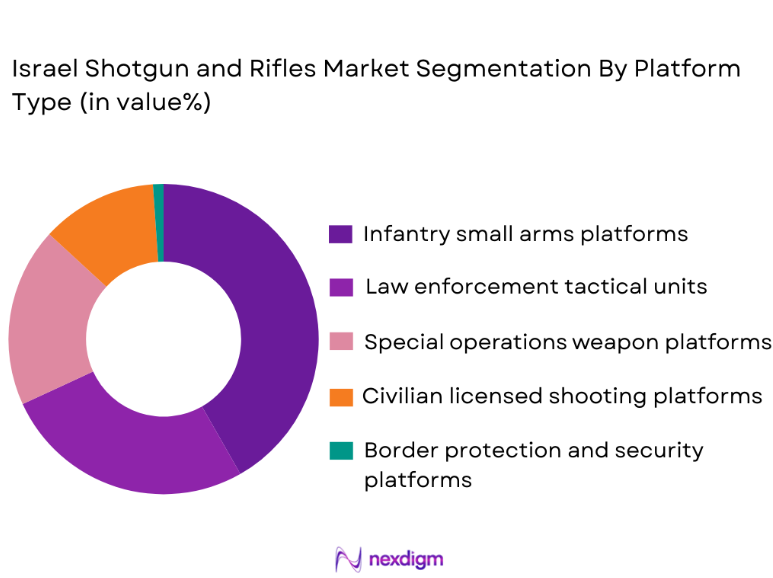

Israel shotgun and rifles market is segmented by platform type into infantry small arms platforms, special operations weapon platforms, law enforcement tactical units, border protection and security platforms, and civilian licensed shooting platforms. Recently, infantry small arms platforms hold a dominant market share due to largescale deployment of rifles and tactical shotguns by the Israel Defence Forces for standard combat and patrol operations. These platforms require versatile, reliable firearms capable of supporting varied mission profiles. Adoption is driven by doctrinal emphasis on agile, multirole infantry units. Continuous replacement cycles, extensive training requirements, and integration with soldier systems enhance procurement. Local production and licensed imports reinforce supply continuity. Operational experience further influences platform preference and sustained demand.

Competitive Landscape

The Israel shotgun and rifles market is moderately to highly consolidated, dominated by domestic manufacturers with deep integration into national defense and security procurement frameworks. Israeli players benefit from combat-proven product portfolios, close collaboration with the Israel Defense Forces, and strong R&D ecosystems. High regulatory barriers, strict licensing requirements, and the need for operational validation limit new entrants. International manufacturers participate mainly through imports, partnerships, or niche civilian and law-enforcement segments, while domestic firms maintain strong influence across military and security applications.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Primary End-User Focus |

| Israel Weapon Industries (IWI) | 1933 | Ramat HaSharon, Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat HaSharon, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Beretta | 1526 | Gardone Val Trompia, Italy | ~ | ~ | ~ | ~ | ~ |

Israel Shotgun and Rifles Market Analysis

Growth Drivers

Defense Force Modernization and Urban Security Requirements

Defense force modernization and urban security requirements are a primary growth driver for the Israel shotgun and rifles market as the country maintains high operational readiness across military, law enforcement, and internal security forces. The Israel Defense Forces continuously upgrade rifles and tactical shotguns to improve lethality, reliability, and adaptability in both conventional and asymmetric combat environments. Urban warfare, border security operations, and counterterrorism missions demand compact, accurate, and rapidly deployable firearms suited for close-quarters and mixed-terrain engagements. Rifles remain central to infantry effectiveness, while shotguns are increasingly valued for breaching, crowd control, and specialized tactical roles. Ongoing replacement cycles driven by intensive training and operational use sustain procurement volumes. Integration of modern optics, accessories, and modular components further accelerates demand. Domestic familiarity with combat conditions drives preference for proven platforms. These factors collectively support sustained growth in the market.

Law Enforcement Expansion and Licensed Civilian Demand Stability

Law enforcement expansion and licensed civilian demand stability significantly drive the Israel shotgun and rifles market as internal security agencies and regulated civilian users maintain consistent acquisition patterns. Police, border security units, and special response teams require reliable rifles and tactical shotguns for patrol, rapid response, and counterterror operations. Rising emphasis on public safety and rapid incident response increases weapon standardization and modernization. Continuous training requirements generate steady replacement and maintenance demand. In parallel, Israel’s licensed civilian market, while highly regulated, sustains demand through sport shooting, hunting, and private security needs. Civilian users favor high-quality, compliant firearms with long service life. Domestic manufacturing and authorized imports support availability. Together, institutional and civilian demand creates a stable foundation for market growth.

Market Challenges

Stringent Firearms Regulation and Export Control Constraints

Stringent firearms regulation and export control constraints represent a major challenge for the Israel shotgun and rifles market due to rigorous national security oversight and tightly enforced compliance frameworks. Licensing, certification, and authorization requirements govern every stage of the value chain, including design, manufacturing, testing, domestic distribution, and end-user ownership. Manufacturers and exporters must comply with extensive documentation, security clearances, end-use verification, and government approval processes, which significantly extend lead times and complicate production planning. Export controls further restrict access to international markets despite strong global demand for Israeli-designed firearms, particularly in allied defense and security sectors. Differences in regulatory regimes across importing countries add another layer of complexity, requiring alignment with international arms trade regulations and local firearms laws. Compliance obligations increase administrative workload and operational costs for suppliers. These constraints limit flexibility in responding to urgent procurement needs and rapid demand shifts. While essential for national and international security, regulatory intensity slows market scaling and reduces overall responsiveness.

High Customization Costs and Lifecycle Sustainment Pressure

High customization costs and lifecycle sustainment pressure pose significant challenges to efficiency and profitability in the Israel shotgun and rifles market as end users increasingly demand mission-specific weapon configurations. Military, law enforcement, and special operations units require tailored solutions involving specific barrel lengths, calibers, ergonomics, modular components, and compatibility with optics and accessories. Such customization increases production complexity, engineering effort, and per-unit manufacturing costs, particularly when orders are small or highly specialized. Intensive operational use in demanding environments accelerates wear and tear, raising maintenance, refurbishment, and replacement expenses over the weapon lifecycle. Ensuring consistent spare parts availability and long-term sustainment support becomes a critical cost driver for both manufacturers and users. Limited production volumes for specialized variants restrict economies of scale and increase inventory management challenges. Balancing high performance expectations with cost control and sustainment efficiency remains difficult, constraining margins and slowing deployment and upgrading cycles.

Opportunities

Advanced Modular Rifle Platforms and Multi-Role Shotgun Adoption

Advanced modular rifle platforms and multi-role shotgun adoption present a strong opportunity for the Israel Shotgun and Rifles Market as modern security forces increasingly demand adaptable weapon systems capable of supporting diverse operational requirements. Modular rifle architectures enable rapid reconfiguration for urban combat, border security, counterterrorism, training, and special operations without the need for complete weapon replacement, improving lifecycle efficiency and procurement flexibility. Interchangeable barrels, calibers, stocks, and fire-control components allow forces to tailor weapons to mission-specific conditions while maintaining standardized platforms. Compatibility with advanced optics, suppressors, targeting aids, and digital fire-control accessories further enhances accuracy, situational awareness, and operational effectiveness. Multi-role shotguns equipped with modular barrels, adjustable stocks, and compatibility with varied ammunition types expand tactical use cases ranging from breaching and crowd control to close-quarters combat. Israeli manufacturers’ combat-driven design expertise, rapid prototyping capability, and close collaboration with end users support continuous innovation. Rising export demand for modular and multi-role small arms reinforces this opportunity, driving product differentiation, technological advancement, and sustained market competitiveness.

Export Growth to Allied Security and Defense Markets

Export growth to allied security and defense markets represents a significant opportunity for the Israel Shotgun and Rifles Market, even in the presence of strict regulatory and export control frameworks. Israeli rifles and shotguns are widely recognized for their reliability, durability, and combat-proven performance in diverse operational environments, enhancing their appeal among allied militaries and security forces. Demand from armed forces, police units, border security agencies, and private security operators continues to rise, particularly for urban warfare, counterterrorism, and close quarters combat applications. Strategic partnerships with allied nations, including licensed manufacturing, technology transfer, and co-development agreements, enable broader international market access while addressing local procurement requirements. Export diversification reduces reliance on domestic demand cycles and strengthens revenue stability. Strong government enhanced defense exports, combined with established diplomatic and military alliances, enhances global credibility. This opportunity supports long-term market growth, sustained production capacity, and improved international competitiveness.

Future Outlook

Over the next five years, the Israel shotgun and rifles market is expected to grow steadily, supported by sustained defense readiness, urban security requirements, and continuous modernization of infantry and law-enforcement weapons. Technological focus will remain on modular rifle platforms, improved ergonomics, and compatibility with advanced optics and accessories. Regulatory oversight will continue to shape structured demand, while export opportunities to allied security forces will support incremental growth.

Major Players

- Israel Weapon Industries (IWI)

- IMI Systems

- Rafael Advanced Defense Systems

- Elbit Systems

- Beretta

- Heckler & Koch

- FN Herstal

- SIG Sauer

- Colt Defense

- Smith & Wesson

- CZ Group

- Remington Arms

- Steyr Mannlicher

- Blaser Group

- Mapul Industries

Key Target Audience

- Israel Defense Forces procurement divisions

- Law enforcement and border police agencies

- Government and regulatory bodies

- Investments and venture capitalist firms

- Domestic defense manufacturers

- Licensed firearm distributors

- Private security companies

- Export-oriented defense suppliers

Research Methodology

Step 1: Identification of Key Variables

Key variables such as defense procurement volumes, regulatory frameworks, weapon replacement cycles, and export controls were identified. Demand and supply indicators were mapped.

Step 2: Market Analysis and Construction

Data from defense programs, procurement disclosures, and industry sources were analyzed. Market segmentation and competitive structure were constructed.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense and security experts. Assumptions were refined based on operational insights.

Step 4: Research Synthesis and Final Output

Validated data and insights were synthesized into structured outputs. Accuracy, consistency, and relevance checks were applied.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Capacity Development

- Growth Drivers

Defense modernization and soldier lethality enhancements

Tactical force expansion and law enforcement upgrading

Domestic weapon system indigenization initiatives

Integration of modular and multi-role rifle platforms

Training and replacement demand cycles - Market Challenges

Stringent weapon certification and compliance regimes

Limited domestic production capacity for advanced firearms

Procurement complexity due to strategic export guidelines

Competition from established global firearms OEMs

Lifecycle sustainability and maintenance cost pressures - Market Opportunities

Co-development and licensing for advanced rifle systems

Export expansion to allied military, police, and security partners

Adoption of ergonomic and lightweight precision shotguns and rifles - Trends

Modular rifle systems with accessory interoperability

Growth in tactical shotgun procurement for close-quarters operations

Focus on reliability, accuracy, and ergonomic design

Integration of digital fire-control accessories and optics

Increasing dual-use demand from civilian and security segments - Government Regulations & Defense Policy

National firearms regulation and export control frameworks

Defense procurement policies for small arms and light weapons

Security-clearance and ballistic certification mandates - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average Weapon Price, 2020-2025

- By Weapon Complexity Tier, 2020-2025

- By Weapon Type (In Value%)

Tactical shotguns

Semi-automatic rifles

Bolt-action rifles

Bullpup configuration rifles

Modular precision rifles - By Caliber Segment (In Value%)

Small caliber infantry rifles

Medium caliber precision rifles

Shotgun caliber systems

Special purpose and tactical calibers

multi-caliber modular weapon platforms - By Fitment Type (In Value%)

Defense procurement and standard issue

Special forces and tactical unit’s fitments

Law enforcement and internal security use

Training and simulation platforms

Civilian licensed sporting firearms - By End User Segment (In Value%)

Israel Defence Forces ground units

Special operations units

Law enforcement and border police

Private security operators

Civilian recreational and sport shooting - By Procurement Channel (In Value%)

Direct defense acquisition

Law enforcement procurement contracts

Licensed domestic manufacturing

Foreign imports and joint supply agreements

Civilian licensed retail channels

- Market structure and positioning of key players

- Market share snapshot of major manufacturers

- Cross Comparison Parameters (product reliability, modularity, caliber versatility, production scale, after-sales support, certification compliance, strategic partnerships, export readiness, customization capability)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Weapon Industries (IWI)

IMI Systems

Rafael Advanced Defense Systems

Elbit Systems

Beretta

Heckler & Koch

FN Herstal

SIG Sauer

Colt Defense

Smith & Wesson

CZ Group

Remington Arms

Steyr Mannlicher

Blaser Group

Magpul Industries

- IDF ground forces demand for reliable rifles and shotguns

- Special operations emphasis on modularity and weight reduction

- Law enforcement need for versatile tactical firearms

- Civilian recreational and licensed shooting market segments

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by Weapon Type, 2026-2035

- Future Demand by End User Segment, 2026-2035