Market Overview

Based on a recent historical assessment, the Israel Shoulder Fired Weapons Market was valued at approximately USD ~ billion, supported by verified national defense procurement disclosures and international defense trade databases. The market is driven by sustained operational requirements of ground forces, continuous modernization of infantry weapon systems, and accelerated replacement of legacy shoulder-fired platforms. High domestic defense budgets, rapid induction of advanced anti-armor and air-defense systems, and strong export pipelines for combat-proven weapons further reinforce overall demand across procurement cycles.

Based on a recent historical assessment, Israel remains the dominant geography within this market due to concentrated defense manufacturing hubs in Tel Aviv, Haifa, and Beersheba, supported by mature defense industrial infrastructure. These cities host major system integrators, guided weapon developers, and electronics specialists, enabling faster development-to-deployment cycles. Strategic alignment between domestic armed forces, state-backed R&D programs, and export-oriented production facilities ensures sustained dominance, while close collaboration with allied countries reinforces Israel’s central position in global shoulder fired weapons supply chains.

Market Segmentation

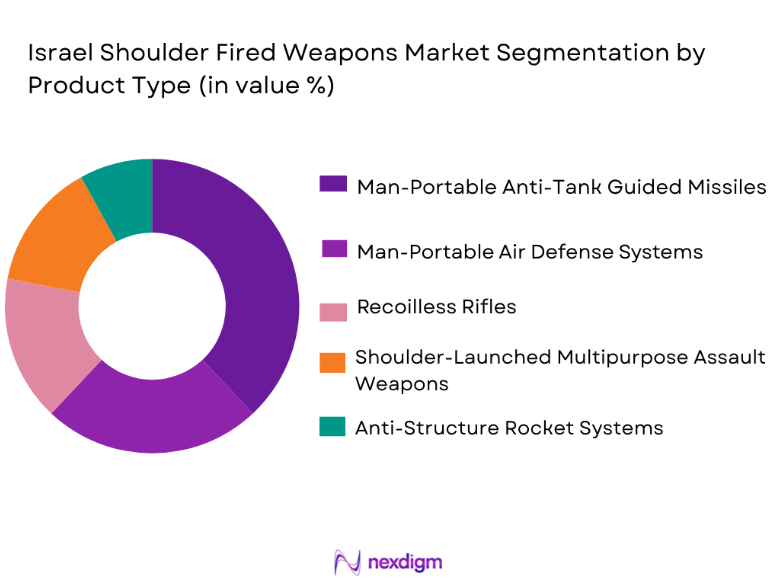

By Product Type

Israel Shoulder Fired Weapons Market is segmented by product type into man-portable anti-tank guided missiles, man-portable air defense systems, recoilless rifles, shoulder-launched multipurpose assault weapons, and anti-structure rocket systems. Recently, man-portable anti-tank guided missiles have held a dominant market share due to their extensive operational deployment, continuous technology upgrades, and strong export demand. These systems benefit from advanced guidance technologies, combat-proven performance, and adaptability across multiple terrain conditions. Ongoing border security requirements, urban warfare preparedness, and asymmetric threat environments have reinforced procurement volumes. Additionally, sustained foreign military sales to allied nations seeking battlefield-tested anti-armor solutions have strengthened production continuity. Domestic innovation capabilities, combined with modular upgrade paths and interoperability with modern battlefield networks, further consolidate the dominance of this sub-segment within overall market revenue

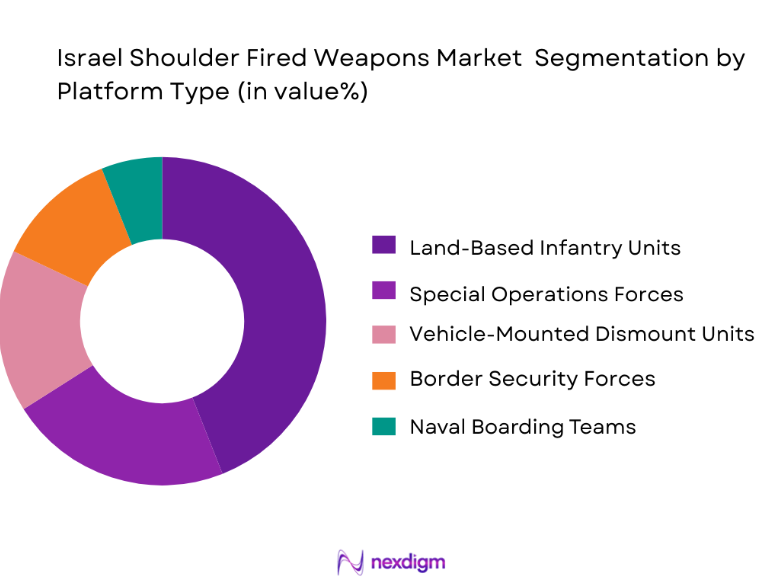

By Platform Type

Israel Shoulder Fired Weapons market is segmented by platform type into land-based infantry units, special operations forces, vehicle-mounted dismount units, border security forces, and naval boarding teams. Recently, land-based infantry units have held a dominant market share due to their central role in frontline combat operations, territorial defense, and rapid response deployments. Infantry formations represent the largest operational user base, requiring continuous replenishment, training stock, and system upgrades. High frequency of deployment in urban and semi-urban environments increases consumption and replacement rates. Standardization across active and reserve units further reinforces procurement concentration. Domestic doctrine prioritizes infantry lethality and survivability, ensuring sustained budget allocation. Export customers similarly emphasize infantry-centric platforms, strengthening this segment’s dominance.

Competitive Landscape

The Israel Shoulder Fired Weapons Market is moderately consolidated, with a small number of dominant defense manufacturers controlling a significant portion of system development, production, and exports. Major players benefit from long-standing government relationships, vertically integrated capabilities, and continuous R&D investments. Barriers to entry remain high due to regulatory controls, technology sensitivity, and certification requirements, reinforcing the influence of established firms with proven combat systems and global distribution networks.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Export Orientation |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat Hasharon, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Weapon Industries | 1933 | Ramat Hasharon, Israel | ~ | ~ | ~ | ~ | ~ |

| Plasan | 1985 | Kibbutz Sasa, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Shoulder Fired Weapons Market Analysis

Growth Drivers

Advanced Anti-Armor and Air Defense Modernization Programs

This growth driver reflects the sustained focus of Israeli defense forces on maintaining technological superiority against evolving armored and aerial threats. Continuous induction of next-generation guided shoulder fired systems supports operational flexibility across diverse combat environments. These programs are reinforced by domestic R&D funding, rapid prototyping capabilities, and close feedback loops from active deployments. Integration of precision guidance, improved lethality, and enhanced survivability increases replacement cycles. Export demand from allied militaries further amplifies production volumes. Interoperability with digital battlefield systems strengthens long-term relevance. Ongoing upgrades and retrofits ensure sustained procurement momentum. Collectively, these factors create a stable demand foundation across multiple operational theaters.

Export Demand for Combat-Proven Infantry Weapon Systems

Israeli shoulder fired weapons benefit from extensive operational validation, enhancing credibility among foreign buyers. Global demand for proven anti-armor and air-defense solutions drives recurring export contracts. Strategic defense cooperation agreements facilitate smoother market access. Customization options allow adaptation to varied doctrinal needs. Lifecycle support packages enhance buyer confidence. Competitive performance-to-cost ratios strengthen positioning. Long-term service agreements stabilize revenue streams. Export diversification reduces reliance on domestic procurement cycles.

Market Challenges

Stringent Export Control and Compliance Frameworks

Regulatory oversight governing advanced weapon exports imposes approval delays and market access limitations. Compliance with international arms control regimes adds administrative complexity. Shifting geopolitical considerations can restrict eligible markets. Lengthy licensing processes affect contract timelines. Technology transfer constraints limit collaborative opportunities. Documentation requirements increase operational costs. Uncertainty in approvals complicates production planning. These factors collectively constrain market agility.

High Research, Development, and Qualification Costs

Developing advanced shoulder fired systems requires significant investment in guidance, propulsion, and materials. Extensive testing and certification cycles extend time-to-market. Integration with existing force structures adds to engineering complexity. Rising component costs increase financial exposure. Smaller production runs to limit economies of scale. Continuous upgrades demand sustained funding. Budget prioritization pressures can delay programs. These challenges affect overall cost efficiency.

Opportunities

Joint Development Programs with Allied Militaries

Collaborative programs enable cost sharing and risk reduction. Access to allied operational insights improves system design. Joint funding accelerates innovation cycles. Shared production expands into addressable markets. Interoperability standards enhance export potential. Long-term partnerships stabilize demand. Political alignment supports sustained cooperation. These initiatives strengthen global positioning.

Lifecycle Support and Upgrade Services Expansion

Aging inventories require modernization rather than replacement. Upgrade packages extend service life cost-effectively. Training and simulation integration enhance value propositions. Predictive maintenance improves readiness. Long-term service contracts generate recurring revenue. Customer retention strengthens market stability. Digital support tools increase efficiency. This opportunity diversifies revenue streams.

Future Outlook

Over the next five years, the Israel Shoulder Fired Weapons Market is expected to maintain steady growth driven by continuous system modernization and export demand. Advancements in guidance, materials, and digital integration will shape future product development. Regulatory alignment and defense cooperation agreements are likely to support international sales. Demand-side momentum will remain strong due to persistent security requirements and infantry force modernization priorities.

Major Players

- Rafael Advanced Defense Systems

- Elbit Systems

- IMI Systems

- Israel Weapon Industries

- Plasan

- Aeronautics Defense Systems

- Tomer Defense

- Elbit Land Systems

- Rafael Missile Systems

- Elbit Electro-Optics

- UVision

- Silver Shadow

- Meprolight

- Israel Shipyards Defense

- SCD

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Border security agencies

- Special operations commands

- Homeland security departments

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense system integrators

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, system categories, procurement patterns, and regulatory frameworks were identified through secondary research and defense databases. The emphasis was placed on operational usage and export activity.

Step 2: Market Analysis and Construction

Data was structured by product type, end user, and competitive positioning. Market size validation was conducted using procurement disclosures and trade data.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and defense analysts were consulted to validate assumptions, technology trends, and demand drivers. Feedback loops refined segmentation logic.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a structured framework, ensuring consistency, accuracy, and relevance to strategic decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Sustained strategic defence spending by Israeli government

Persistent regional security threats requiring rapid response capabilities

Modernization programs replacing legacy shoulder-fired systems

Integration of advanced guidance and targeting technologies

Export demand from allied nations seeking battlefield-proven systems - Market Challenges

Export control regulations limiting international sales channels

High research and development costs for next-generation systems

Dependency on imported components for some high-end technologies

Lengthy qualification trials for integration with allied forces

Training intensity requirements limiting rapid fielding - Market Opportunities

Expansion of joint development programs with allied nations

Aftermarket support and lifecycle services for shoulder fired weapon fleets

Upgrades and retrofits to extend operational service life - Trends

Shift toward networked targeting and battlefield management integration

Increased use of lightweight composite materials to enhance soldier mobility

Development of multi-role shoulder-fired munitions

Growing emphasis on simulation and virtual training environments

Adoption of autonomous targeting assistance modules - Government Regulations & Defense Policy

Israel defence export control policies governing shoulder-fired weapon sales

Alignment with international arms control treaties and frameworks

National defence industrial strategies supporting indigenous production - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Man-portable anti-tank guided missiles

Recoilless rifles

Man-portable air-defense systems

Anti-structure munitions

Shoulder-launched multipurpose assault weapons - By Platform Type (In Value%)

Infantry foot soldiers

Special operations units

Border security detachments

Reserve force units

Training and simulation platforms - By Fitment Type (In Value%)

Standard issue shoulder harness

Optics-integrated harness

Night vision compatible fit

Modular accessory ready fit

Lightweight composite fit - By End User Segment (In Value%)

Israeli Defense Forces infantry divisions

Special forces brigades

Border police tactical units

Defense training institutions

Foreign military sales end users - By Procurement Channel (In Value%)

Direct government defence procurement

Intergovernmental defence cooperation agreements

Authorized defence contractors

Offset-based industrial partnerships

Long-term supply and maintenance contracts - By Material / Technology (in Value %)

Composite launch tubes

Advanced guidance electronics

Thermal imaging targeting modules

Lightweight alloy structural systems

Networked fire control integration

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System performance, Export compliance, Technology integration, Production capacity, Aftermarket support, Cost per unit, Training support, Strategic partnerships, Local industrial participation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rafael Advanced Defense Systems

Elbit Systems

Israel Military Industries

IMI Systems Shoulder Fired Division

Aeronautics Defense Systems

Israel Weapon Industries Tactical Solutions

Plasan Composite Structures Tactical Division

Elbit Electro-Optics Targeting Systems

Rafael SPIKE Division

Elbit Guided Missiles and Rockets Group

Elbit Light Weapons Systems

Rafael Defense Export Group

Elbit Soldier Systems Division

Israel Tactical Weapons Consortium

Advanced Infantry Weapons Israel

- Infantry forces prioritize reliability, ease of use, and rapid deployment capabilities

- Special forces emphasize modularity and multi-mission effectiveness

- Border security units require durable systems suitable for varied terrain

- Training institutions focus on simulation-integrated, cost-effective solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035