Market Overview

Based on a recent historical assessment, the Israel Small Caliber Ammunition market recorded a total market value of USD ~ billion, reflecting sustained procurement across military, internal security, and training applications. Demand is driven by continuous operational readiness requirements, high live fire training intensity, and routine replenishment of standard NATO caliber ammunition. Strong domestic manufacturing capacity, supported by government contracts, ensures supply continuity, while export orders aligned with allied interoperability standards reinforce production utilization and revenue stability for national defense.

Based on a recent historical assessment, market activity is concentrated in Israel, with Tel Aviv, Haifa, and Be’er Sheva serving as core hubs due to proximity to defense headquarters, manufacturing plants, and testing ranges. These locations benefit from integrated supply chains, skilled labor availability, and secure logistics infrastructure. Israel’s dominance is reinforced by indigenous technology development, close coordination between armed forces and producers, and consistent government procurement cycles supporting uninterrupted production and distribution across domestic and export fulfillment networks nationwide.

Market Segmentation

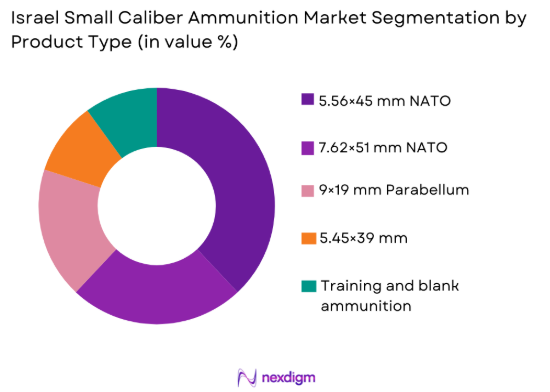

By Product Type

Israel Small Caliber Ammunition Market is segmented by product type into 5.56×45 mm NATO, 7.62×51 mm NATO, 9×19 mm Parabellum, 5.45×39 mm, and training and blank ammunition. Recently, 5.56×45 mm NATO ammunition has a dominant market share due to standardized infantry rifle adoption, sustained operational deployment, and high training consumption across active and reserve forces. The caliber benefits from interoperability requirements, established manufacturing lines, and consistent procurement cycles. Its dominance is reinforced by compatibility with assault rifles, light machine guns, and allied weapon platforms. Continuous replenishment needs, export demand, and logistics efficiency further strengthen its position. Domestic producers prioritize this caliber due to predictable volumes and lower per unit production risk. Stable government contracts and export alignment support recurring demand. The product remains central to readiness doctrines and training doctrines nationwide.

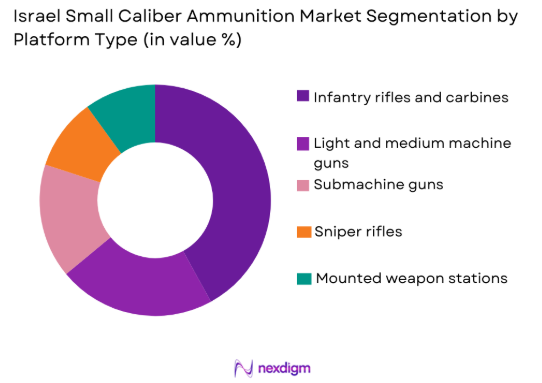

By Platform Type

Israel Small Caliber Ammunition Market is segmented by platform type into infantry rifles and carbines, light and medium machine guns, submachine guns, sniper rifles, and mounted weapon stations. Recently, infantry rifles and carbines have a dominant market share due to widespread deployment across regular forces, reserves, and internal security units. These platforms consume the highest ammunition volumes during routine training and operational readiness cycles. Standard issue rifles drive consistent demand patterns supported by long term procurement frameworks. Platform dominance is reinforced by modernization programs, interoperability needs, and continuous force readiness requirements. Domestic production lines are optimized for rifle ammunition volumes. Export programs aligned with rifle platforms further sustain demand. High utilization rates and replacement cycles ensure sustained consumption across security agencies nationwide.

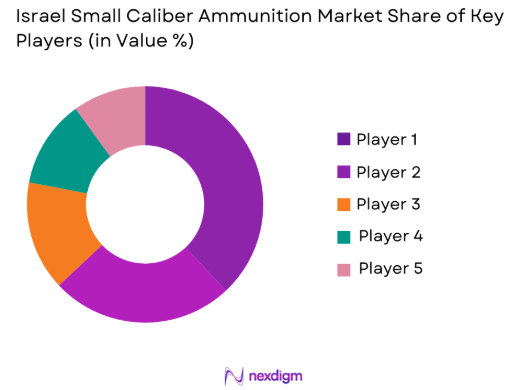

Competitive Landscape

The Israel Small Caliber Ammunition market is moderately consolidated, with a limited number of domestic manufacturers holding long term government contracts and strong relationships with defense and security agencies. Market competition is shaped by technological capability, production reliability, and compliance with strict military standards rather than price alone. Major players benefit from vertically integrated operations, allowing control over design, testing, and large-scale manufacturing. Export credibility, alignment with allied standards, and consistent fulfillment during high demand periods strengthen the position of leading companies, while smaller participants operate in niche or specialized ammunition segments.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Weapon Industries | 1933 | Ramat HaSharon, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat HaSharon, Israel | ~ | ~ | ~ | ~ | ~ |

| Emsan Israel | 1975 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Small Caliber Ammunition Market Analysis

Growth Drivers

Operational Readiness and Continuous Force Mobilization Requirements

Operational readiness and continuous force mobilization requirements are a primary growth driver for the Israel Small Caliber Ammunition market, as national defense doctrine emphasizes permanent preparedness across active duty, reserve forces, and internal security units. The Israel Defense Forces maintain high training intensity levels, which directly translate into sustained ammunition consumption volumes throughout the year. Live fire drills, qualification exercises, and operational simulations require constant replenishment of standard calibers to maintain combat readiness. The integration of reserve forces into routine training cycles further expands baseline demand beyond standing units. Ongoing border security operations and internal threat monitoring create steady ammunition utilization outside scheduled training programs. Ammunition stockpiling policies aimed at strategic resilience also support recurring procurement activity. Domestic manufacturers benefit from predictable order flows aligned with readiness planning frameworks. This driver remains structurally embedded in national defense planning and is not dependent on short term geopolitical fluctuations.

Domestic Manufacturing Strength and Export Interoperability Alignment

Domestic manufacturing strength combined with export interoperability alignment significantly drives growth in the Israel Small Caliber Ammunition market by ensuring reliable supply and international relevance. Israel maintains mature ammunition production infrastructure supported by state linked defense enterprises and long standing industrial know how. Manufacturing lines are optimized for NATO compatible calibers, allowing seamless integration with allied forces and export customers. This alignment enhances production volumes by balancing domestic consumption with foreign orders. Export qualification standards reinforce consistent quality, indirectly strengthening domestic procurement confidence. Localized production reduces supply chain vulnerabilities and shortens delivery cycles for military customers. Technology transfer within domestic industry accelerates efficiency improvements and cost control. Sustained export credibility stabilizes revenues and supports reinvestment into capacity and modernization. This driver anchors long term market resilience and competitive positioning.

Market Challenges

Raw Material Volatility and Propellant Supply Constraints

Raw material volatility and propellant supply constraints represent a significant challenge for the Israel Small Caliber Ammunition market, affecting cost stability and production planning. Ammunition manufacturing relies heavily on metals, chemical compounds, and energetic materials that are exposed to global commodity price fluctuations. Disruptions in international supply chains can directly impact availability of critical inputs. Propellant formulation requires strict quality consistency, limiting alternative sourcing options during shortages. Cost variability complicates long term contract pricing with government customers. Inventory buffering increases working capital requirements for manufacturers. Compliance with safety and storage regulations further restricts procurement flexibility. These factors collectively pressure margins while increasing operational complexity. Managing input volatility remains a persistent structural challenge for the industry.

Stringent Regulatory Compliance and Quality Assurance Requirements

Stringent regulatory compliance and quality assurance requirements pose another major challenge for the Israel Small Caliber Ammunition market due to the sensitive nature of defense products. Ammunition production is subject to rigorous safety, testing, and certification protocols enforced by military authorities. Compliance processes extend production timelines and increase overhead costs. Any deviation from specification can result in batch rejection and financial losses. Export controls and end user certification add administrative burdens for internationally oriented manufacturers. Continuous audits demand dedicated compliance resources. Regulatory evolution requires ongoing process updates and staff training. Smaller manufacturers face higher proportional compliance costs. These constraints limit operational flexibility while raising barriers to rapid scaling.

Opportunities

Advanced Lightweight Ammunition and Material Innovation

Advanced lightweight ammunition and material innovation present a strong opportunity for the Israel Small Caliber Ammunition market as armed forces seek improved soldier mobility and performance. Development of polymer cased and hybrid ammunition can reduce load weight without compromising ballistic effectiveness. Such innovations align with modernization programs focused on endurance and operational efficiency. Domestic R&D capabilities support rapid prototyping and testing cycles. Lightweight solutions can also reduce logistics and transportation costs. Export markets increasingly value advanced materials for next generation infantry systems. Intellectual property development strengthens competitive differentiation. Successful adoption can unlock premium pricing potential. This opportunity aligns technology leadership with evolving operational requirements.

Expansion of Specialized and Precision Ammunition Segments

Expansion of specialized and precision ammunition segments offers another growth opportunity for the Israel Small Caliber Ammunition market as operational environments become more complex. Special forces and internal security units demand ammunition tailored for accuracy, penetration control, and reduced collateral impact. Precision engineered rounds address urban combat and counterterrorism scenarios. Customization capabilities strengthen supplier relationships with elite units. Higher value per unit improves revenue mix. Export demand for specialized ammunition is rising among allied security forces. Advanced testing and analytics enhance product credibility. This opportunity supports margin expansion while leveraging existing manufacturing expertise.

Future Outlook

The Israel Small Caliber Ammunition market is expected to maintain steady growth over the next five years, supported by sustained defense readiness priorities and consistent training intensity. Technological advancements in lightweight materials and precision engineering will shape product development trajectories. Regulatory stability and continued government procurement support will underpin domestic demand. Export opportunities aligned with allied interoperability standards are expected to complement internal consumption. Overall market momentum will remain anchored in operational preparedness and industrial self reliance.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Weapon Industries

- IMI Systems

- Emsan Israel

- Tomer Defense

- Mifram Security

- Silver Shadow

- Meprolight Systems

- Global Ordnance Israel

- NRC Industries

- Givon Ammunition

- UVisionDefense

- Kalashnikov Israel

- TACAM Israel

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense ministries

- Armed forces procurement units

- Internal security agencies

- Homeland security organizations

- Defense manufacturers and suppliers

- Export control authorities

Research Methodology

Step 1: Identification of Key Variables

This step involved identifying demand drivers, supply constraints, pricing dynamics, and regulatory influences affecting the Israel Small Caliber Ammunition market. Both quantitative and qualitative variables were mapped. Emphasis was placed on defense procurement behavior. Market boundaries were clearly defined.

Step 2: Market Analysis and Construction

Data was analyzed to construct a coherent market framework reflecting production, consumption, and trade flows. Supply chain relationships were evaluated. Demand patterns were aligned with operational requirements. Structural market characteristics were validated.

Step 3: Hypothesis Validation and Expert Consultation

Initial assumptions were tested through expert consultations and secondary source validation. Defense industry specialists provided contextual insights. Discrepancies were reconciled through iterative review. Confidence levels were assessed.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a structured narrative ensuring consistency and accuracy. Data points were cross verified. Analytical insights were refined for clarity. The final output reflects validated market intelligence.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Sustained national defense readiness requirements

Continuous infantry modernization programs

High training intensity across active and reserve forces

Domestic manufacturing and R&D capabilities

Export demand aligned with allied standards - Market Challenges

Fluctuating raw material and propellant costs

Stringent safety and quality compliance requirements

Capacity constraints during surge demand

Export control and licensing restrictions

Lifecycle management of legacy calibers - Market Opportunities

Adoption of lightweight and advanced casing technologies

Expansion of precision and special purpose ammunition

Increased co-development with allied defense partners - Trends

Shift toward standardized NATO calibers

Rising focus on accuracy and consistency

Integration of advanced quality control systems

Growth in simulation and training ammunition

Incremental automation of production lines - Government Regulations & Defense Policy

Strict national ammunition safety regulations

Defense export control and end-use monitoring

Support for domestic defense manufacturing

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

5.56×45 mm NATO ammunition

7.62×51 mm NATO ammunition

9×19 mm Parabellum ammunition

5.45×39 mm ammunition

Special purpose training and blank rounds - By Platform Type (In Value%)

Infantry rifles and carbines

Light and medium machine guns

Submachine guns

Sniper rifles

Mounted weapon stations - By Fitment Type (In Value%)

Standard military issue

Special forces customized loads

Training and simulation fitment

Export-specific configurations

Law enforcement fitment - By End User Segment (In Value%)

National armed forces

Border security forces

Internal security and police

Special operations units

Defense training institutions - By Procurement Channel (In Value%)

Direct government contracts

Long-term framework agreements

Emergency and wartime procurement

Defense offset and co-production programs

Foreign military sales support - By Material / Technology (in Value %)

Lead core copper jacket ammunition

Steel core penetrator rounds

Frangible ammunition

Tracer and incendiary rounds

Polymer-cased ammunition

- Market share snapshot of major players

- Cross Comparison Parameters (Caliber range, Production capacity, Technology maturity, Quality certifications, Domestic supply capability, Export footprint, R&D intensity, Cost efficiency, Delivery lead time, Contract flexibility)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Military Industries Systems

Elbit Systems Land

TACAM Israel

UVision Defense

NRC Industries

Emsan Israel

Givon Ammunition

Mifram Security

Tomer Defense

Rafael Advanced Defense Systems

Silver Shadow Advanced Security Systems

IWI US

Global Ordnance Israel

Kalashnikov Israel

Meprolight Ammunition Systems

- Operational readiness requirements drive steady demand

- Training cycles consume significant ammunition volumes

- Special units require customized performance profiles

- Interoperability with allied forces influences specifications

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035