Market Overview

Based on a recent historical assessment, the Israel Small Satellite Market reached a valuation of USD ~ billion, driven by sustained government-backed space programs, defense-oriented satellite deployments, and commercial Earth observation demand. Publicly disclosed procurement budgets from the Israel Space Agency and defense acquisition disclosures indicate consistent funding allocations for nanosatellite, microsatellite, and CubeSat platforms. Demand is further supported by rapid payload miniaturization, indigenous satellite manufacturing capabilities, and growing utilization of space-based intelligence, surveillance, and reconnaissance solutions. Commercial data services, secure communications, and responsive launch requirements continue reinforcing procurement volumes and contract awards.

Based on a recent historical assessment, Tel Aviv and surrounding aerospace clusters dominate activity due to proximity to prime contractors, system integrators, and government agencies. Haifa maintains relevance through electronics, payload development, and defense manufacturing infrastructure. Israel’s dominance stems from its mature defense ecosystem, vertically integrated satellite value chain, and long-standing operational heritage in small satellite missions. International collaborations with the United States and European partners strengthen technology access and launch opportunities. Concentrated R&D investment, skilled workforce availability, and regulatory alignment further reinforce national leadership in small satellite development.

Market Segmentation

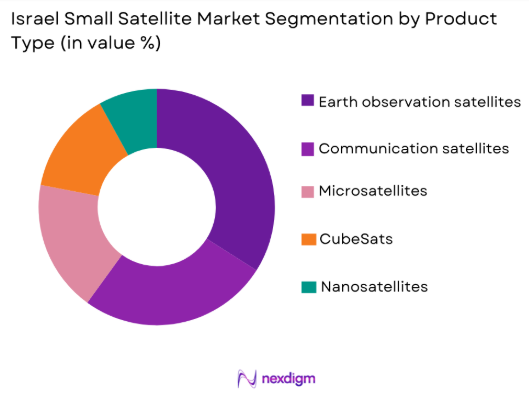

By Product Type

Israel Small Satellite Market is segmented by product type into nanosatellites, microsatellites, CubeSats, Earth observation satellites, and communication satellites. Recently, Earth observation satellites have a dominant market share due to sustained defense surveillance demand, strong intelligence requirements, and expanding commercial imagery applications. Israel’s security environment drives continuous procurement of high-resolution optical and multispectral satellites optimized for rapid deployment. Established domestic manufacturers possess deep expertise in payload integration and mission reliability, increasing buyer confidence. Government-backed programs prioritize ISR-focused platforms, while commercial entities monetize downstream analytics. Export demand for turnkey observation satellites further reinforces dominance.

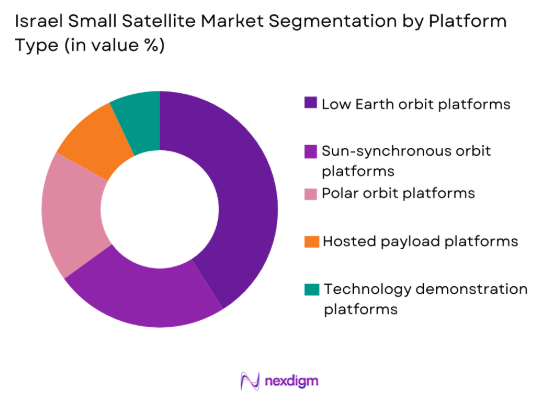

By Platform Type

Israel Small Satellite Market is segmented by platform type into low Earth orbit platforms, sun-synchronous orbit platforms, polar orbit platforms, hosted payload platforms, and technology demonstration platforms. Recently, low Earth orbit platforms have a dominant market share due to optimal balance between coverage, revisit frequency, and launch cost efficiency. Defense and commercial operators favor LEO for ISR, communications, and experimental payloads requiring rapid data access. Israel’s operational experience in LEO missions reduces technical risk and lifecycle costs. Launch availability and compatibility with small satellite constellations further strengthen platform preference.

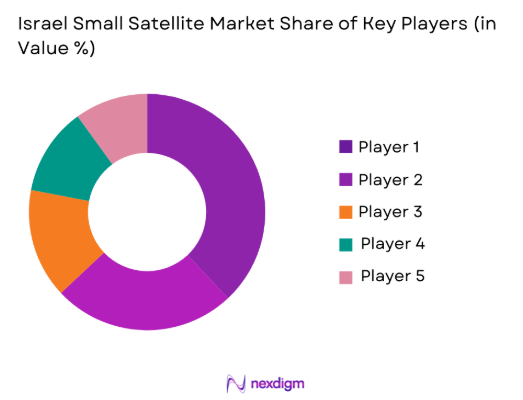

Competitive Landscape

The Israel Small Satellite Market is moderately consolidated, dominated by a small number of vertically integrated defense and aerospace firms with strong government relationships. Major players benefit from long-term contracts, proprietary technologies, and export clearances, creating high entry barriers. Smaller technology firms operate as subsystem suppliers or niche solution providers, often partnering with prime contractors. Strategic collaborations and selective acquisitions continue shaping competitive dynamics.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Space Segment Focus |

| Israel Aerospace Industries | 1953 | Tel Aviv | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa | ~ | ~ | ~ | ~ | ~ |

| ImageSat International | 1997 | Herzliya | ~ | ~ | ~ | ~ | ~ |

| Gilat Satellite Networks | 1987 | Petah Tikva | ~ | ~ | ~ | ~ | ~ |

Israel Small Satellite Market Analysis

Growth Drivers

Defense-Oriented Intelligence, Surveillance, and Reconnaissance Demand

Defense-Oriented Intelligence, Surveillance, and Reconnaissance Demand continues shaping procurement priorities as national security agencies rely heavily on space-based assets for persistent monitoring, border security, and strategic intelligence. Israel’s security doctrine emphasizes independent access to high-resolution imagery and rapid data availability, sustaining continuous satellite replenishment cycles. Small satellites offer faster development timelines, enabling responsive mission planning and adaptation to evolving threats. Government defense budgets allocate dedicated funding lines for satellite reconnaissance programs, ensuring stable long-term demand. Indigenous manufacturing reduces dependence on foreign suppliers, enhancing operational sovereignty. Advanced payload miniaturization allows improved performance within compact platforms. Export opportunities for ISR-capable satellites to allied nations further stimulate production volumes. Continuous mission success reinforces institutional confidence, accelerating follow-on investments.

Commercial Earth Observation Data Monetization Expansion

Commercial Earth Observation Data Monetization Expansion drives growth as analytics, agriculture monitoring, urban planning, and disaster management sectors increasingly rely on satellite-derived insights. Israeli firms leverage strong software and analytics expertise to convert raw imagery into high-value intelligence products. Small satellites enable frequent revisit rates essential for time-sensitive applications. Subscription-based data models generate recurring revenue streams, improving investment attractiveness. Collaboration with global cloud and analytics providers broadens market reach. Competitive launch costs support constellation deployment strategies. Regulatory frameworks encourage commercial participation while safeguarding security interests. This convergence of data demand and technological capability sustains market expansion.

Market Challenges

High Development Costs, Export Controls, and Program Complexity

High Development Costs, Export Controls, and Program Complexity represent a central constraint for the Israel Small Satellite Market as advanced satellite programs require sustained capital investment across design, testing, and qualification stages. Radiation-hardened electronics, secure communication modules, precision optics, and propulsion subsystems significantly increase unit costs, particularly when production volumes remain limited. Strict export control regimes governing satellite technologies restrict market access and prolong approval timelines, limiting commercial scalability and delaying revenue realization. Defense classification requirements impose additional compliance burdens, increasing documentation, security infrastructure, and personnel clearance expenses. Small satellite programs also face complex integration requirements with launch providers and ground systems, further elevating program risk. Talent scarcity in systems engineering and space-grade electronics increases labor costs and extends development cycles. Budgetary rigidity in government procurement frameworks reduces flexibility for rapid iteration. These combined factors constrain margins despite stable demand fundamentals.

Orbital Congestion, Launch Dependency, and Long-Term Sustainability Risks

Orbital Congestion, Launch Dependency, and Long-Term Sustainability Risks increasingly challenge operational planning as low Earth orbit environments become more crowded with satellites and debris. Collision avoidance requirements necessitate additional propulsion, tracking, and maneuvering capabilities, increasing platform mass, cost, and technical complexity. Insurance premiums rise as orbital risk profiles worsen, impacting project economics. Limited access to reliable and affordable launch services introduces scheduling uncertainty and cost volatility, particularly for small satellite operators dependent on rideshare missions. Regulatory scrutiny around debris mitigation and end-of-life disposal imposes stricter compliance standards and monitoring obligations. Failure to secure timely launch windows can delay constellation deployment and revenue generation. International coordination for space traffic management remains fragmented, increasing operational uncertainty. Long-term sustainability concerns may slow approval processes and affect mission viability, requiring proactive mitigation strategies.

Opportunities

Dual-Use Small Satellite Platforms for Defense and Commercial Integration

Dual-Use Small Satellite Platforms for Defense and Commercial Integration represent a substantial opportunity for the Israel Small Satellite Market as stakeholders increasingly prioritize efficiency, flexibility, and return on investment. Designing satellites that can simultaneously serve defense, civil, and commercial missions allows manufacturers to amortize development costs across multiple customers and applications, reducing financial risk. Modular bus architectures and standardized interfaces enable rapid payload swaps, allowing a single platform to support intelligence surveillance, environmental monitoring, maritime awareness, and infrastructure observation missions. Government policies encouraging dual-use innovation accelerate funding approvals and streamline certification processes, reducing time to deployment. Commercial operators benefit from defense-grade reliability, while defense agencies gain access to commercially scalable platforms. Export attractiveness increases as allied nations seek adaptable systems without bespoke redesign. Integration with commercial data analytics and cloud platforms expands downstream revenue opportunities beyond hardware sales. Lifecycle flexibility improves customer retention and supports recurring upgrade contracts. This model aligns strategic security objectives with commercial scalability, making dual-use platforms a core growth lever.

International Collaborative Constellation Development and Shared Space Infrastructure

International Collaborative Constellation Development and Shared Space Infrastructure create a significant opportunity for sustained expansion of the Israel Small Satellite Market as global demand shifts toward networked satellite architectures. Collaborative programs enable cost sharing for satellite manufacturing, launch services, ground infrastructure, and data processing systems, reducing individual capital burdens. Participation in multinational constellations enhances revisit rates, coverage persistence, and data reliability, increasing the commercial value of satellite services. Partnerships with allied governments improve regulatory alignment, export approvals, and access to launch opportunities. Standardized platforms and interoperable payloads simplify joint operations and reduce integration risks. Collaborative research initiatives accelerate innovation in propulsion systems, onboard artificial intelligence, and secure communication links. Long-term political and strategic alignment supports stable cooperation frameworks and recurring procurement cycles. Such collaboration positions Israeli firms within global space ecosystems, strengthens resilience against market volatility, and enables scalable growth through shared infrastructure deployment.

Future Outlook

The Israel Small Satellite Market is expected to maintain steady growth driven by defense modernization, expanding commercial data services, and continuous technological innovation. Advances in onboard processing, propulsion efficiency, and constellation architectures will enhance mission capabilities. Regulatory support for domestic space activities and international cooperation will facilitate deployment. Demand-side factors such as security needs, climate monitoring, and data-driven industries will reinforce procurement momentum over the next five years.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- ImageSat International

- Gilat Satellite Networks

- Orbit Communication Systems

- NSLComm

- SpacePharma

- Maris-Tech

- Accubeat

- Cielo Inertial Solutions

- Spectralink

- Solidus Tech

- AstroScale Israel

- Tomer Ltd

Key Target Audience

- Defense ministries

- Space agencies

- Satellite operators

- Commercial Earth observation firms

- Telecommunication companies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Research Methodology

Step 1: Identification of Key Variables

Key variables included satellite type, payload capability, procurement volume, pricing structures, and regulatory constraints. Secondary data sources were reviewed to establish baseline parameters. Industry standards and defense disclosures informed variable selection. Data relevance and consistency were validated.

Step 2: Market Analysis and Construction

Collected data was organized by segment and application. Market structure was mapped using procurement and deployment patterns. Competitive positioning was assessed through contract analysis. Assumptions were aligned with documented industry behavior.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through consultations with industry professionals. Expert feedback refined assumptions and segment weightings. Contradictions were reconciled through additional source triangulation. Confidence levels were assigned to conclusions.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured narrative. Quantitative and qualitative findings were integrated coherently. Consistency checks ensured alignment across sections. Final output adhered strictly to defined formatting and content rules.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for real-time intelligence and surveillance capabilities

Strong national focus on space-based defense and security programs

Advancements in satellite miniaturization and payload efficiency

Growing commercial demand for Earth observation data services

Increased government funding for indigenous space technologies - Market Challenges

High development and launch costs for advanced small satellites

Limited access to affordable launch opportunities

Stringent regulatory and export control requirements

Space debris and orbital congestion concerns

Dependence on specialized components and skilled workforce - Market Opportunities

Expansion of commercial Earth observation and analytics services

Development of dual-use satellites for defense and civilian missions

International collaboration on small satellite constellations - Trends

Shift toward constellation-based small satellite deployments

Integration of artificial intelligence for onboard processing

Increased use of electric propulsion in small satellites

Growth of rapid manufacturing and agile satellite development cycles

Rising interest in responsive and on-demand launch capabilities - Government Regulations & Defense Policy

Strengthening national space security and sovereignty frameworks

Supportive policies for domestic satellite manufacturing and R&D

Enhanced coordination between defense, civil, and commercial space programs

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Nanosatellites

Microsatellites

CubeSats

Earth observation satellites

Communication satellites - By Platform Type (In Value%)

LEO platforms

MEO platforms

Polar orbit platforms

Sun-synchronous orbit platforms

Hosted payload platforms - By Fitment Type (In Value%)

Standalone satellite systems

Constellation-based systems

Hosted payload integration

Technology demonstration payloads

Mission-specific customized platforms - By End User Segment (In Value%)

Defense and intelligence agencies

Commercial Earth observation operators

Telecommunication service providers

Academic and research institutions

Commercial data analytics companies - By Procurement Channel (In Value%)

Direct government contracts

Prime contractor procurement

Public-private partnership programs

Commercial off-the-shelf procurement

Research grant and institutional funding - By Material / Technology (in Value %)

Advanced composite structures

Miniaturized avionics and electronics

Electric propulsion systems

High-resolution optical payloads

AI-enabled onboard data processing

- Market share snapshot of major players

- Cross Comparison Parameters (Payload capacity, Orbit type capability, Platform scalability, Technology maturity, Manufacturing lead time, Cost efficiency, Government contract exposure, Export capability, R&D intensity, Launch integration readiness)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

ImageSat International

SpacePharma

NSLComm

Gilat Satellite Networks

Cielo Inertial Solutions

Solidus Tech

Accubeat

Spectralink

AstroScale Israel

Orbit Communication Systems

Maris-Tech

Tomer Ltd

- Defense users prioritize secure and resilient ISR capabilities

- Commercial operators focus on data quality and revisit frequency

- Research institutions emphasize cost-effective access to space

- Telecom users seek flexible platforms for niche connectivity needs

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035