Market Overview

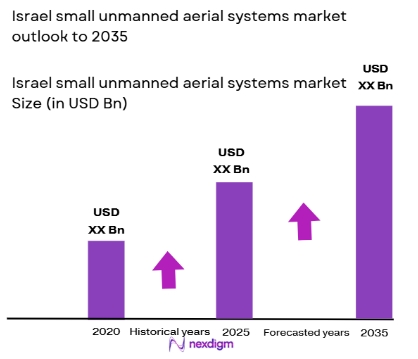

Based on a recent historical assessment, the Israel small unmanned aerial systems market was valued at approximately USD ~ billion, supported by official defense budget disclosures, export filings, and company financial statements from leading domestic manufacturers. Market expansion is driven by sustained defense procurement, continuous operational deployment, and strong export demand for combat-proven systems. Government-backed innovation programs, rapid technology refresh cycles, and high operational tempo across intelligence and surveillance missions further reinforce spending. Domestic production capability and recurring upgrade contracts provide stable revenue visibility across platforms and payload categories.

Based on a recent historical assessment, Tel Aviv, Haifa, and Beersheba remain the dominant hubs due to concentrated defense manufacturing clusters, research institutions, and military command infrastructure. Israel’s national defense ecosystem benefits from close coordination between armed forces, technology firms, and government agencies, enabling rapid testing and deployment. Proximity to operational theaters accelerates feedback-driven development. Internationally, sustained demand from allied countries seeking field-validated systems reinforces Israel’s leadership position, supported by established export channels and long-term defense cooperation frameworks.

Market Segmentation

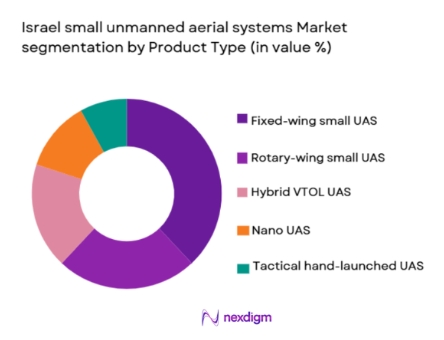

By Product Type:

Israel small unmanned aerial systems market is segmented by product type into fixed-wing small UAS, rotary-wing small UAS, hybrid VTOL UAS, nano UAS, and tactical hand-launched UAS. Recently, fixed-wing small unmanned aerial systems have held a dominant market share due to extended endurance, broader operational range, and suitability for intelligence, surveillance, and reconnaissance missions. These platforms are preferred for border monitoring, maritime patrol, and long-duration overland operations where persistent coverage is required. Strong domestic manufacturing expertise, proven battlefield performance, and continuous payload upgrades support adoption. Fixed-wing systems also integrate advanced sensors and secure communications, aligning with network-centric warfare requirements. Their cost efficiency over long missions and compatibility with existing command infrastructure further reinforce demand across defense and homeland security users.

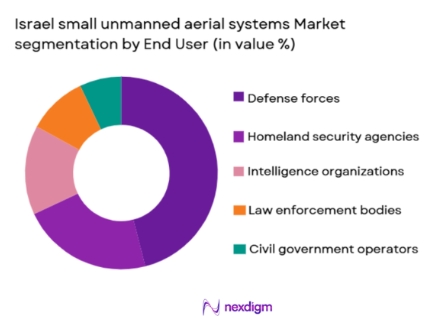

By End User:

Israel small unmanned aerial systems market is segmented by end user into defense forces, homeland security agencies, intelligence organizations, law enforcement bodies, and civil government operators. Recently, defense forces have maintained a dominant market share due to continuous operational requirements, high deployment frequency, and prioritized budget allocation. Defense users demand multi-mission platforms capable of operating in contested environments, driving procurement of advanced systems with encrypted communications and electronic warfare resilience. Close collaboration between armed forces and domestic manufacturers accelerates customization and upgrades. Regular training, replacement cycles, and export-linked production runs further elevate procurement volumes within the defense segment.

Competitive Landscape

The Israel small unmanned aerial systems market is moderately consolidated, led by a group of established defense primes and specialized technology firms. Major players benefit from long-standing government relationships, vertically integrated capabilities, and extensive export experience. Continuous mergers, partnerships, and technology acquisitions strengthen portfolio breadth and global reach, while smaller innovators focus on niche capabilities such as autonomy, sensors, and propulsion.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Group | 1997 | Yavne, Israel | ~ | ~ | ~ | ~ | ~ |

| BlueBird Aero Systems | 2002 | Herzliya, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Small Unmanned Aerial Systems Market Analysis

Growth Drivers

Rising demand for persistent intelligence, surveillance, and reconnaissance capabilities:

Rising demand for persistent intelligence, surveillance, and reconnaissance capabilities underpins sustained procurement of Israel small unmanned aerial systems as defense forces prioritize real-time situational awareness across land and maritime domains. Continuous operational deployments necessitate reliable platforms capable of long endurance and rapid data dissemination. Advances in sensor miniaturization enhance mission effectiveness without increasing platform size. Integrated command systems allow seamless data fusion, improving decision-making speed. Export customers increasingly seek proven ISR solutions validated in active operational environments. Government funding supports accelerated development cycles, ensuring technological relevance. High mission frequency drives replacement and upgrade demand. Interoperability with allied systems further expands adoption. Persistent ISR needs across borders and critical infrastructure protection maintain steady procurement momentum.

Technological leadership in autonomy, sensors, and communications:

Technological leadership in autonomy, sensors, and communications drives competitive differentiation for Israel small unmanned aerial systems across global markets. Artificial intelligence-enabled navigation reduces operator workload and enhances mission resilience. Advanced electro-optical and infrared payloads improve detection accuracy in complex environments. Secure communication links ensure survivability against electronic interference. Continuous software upgrades extend platform lifecycle value. Collaboration between military users and developers accelerates field testing and refinement. Export customers value modular architectures enabling customization. Strong intellectual property portfolios protect innovation advantages. Sustained investment in research ensures long-term technology leadership.

Market Challenges

Electronic warfare and counter-UAS threats:

Electronic warfare and counter-UAS threats present a significant challenge for Israel small unmanned aerial systems as adversaries invest in jamming, spoofing, and interception capabilities. Maintaining secure communications increases system complexity and cost. Continuous upgrades are required to counter evolving threats. Operational environments demand redundancy and resilience, impacting payload capacity. Export customers require assurance against sophisticated countermeasures. Regulatory constraints may limit deployment of certain counter-countermeasure technologies. Training requirements for operators intensify as systems become more complex. Lifecycle costs rise with frequent hardware and software refreshes. Balancing survivability with affordability remains challenging.

Airspace integration and regulatory constraints:

Airspace integration and regulatory constraints affect operational flexibility for Israel small unmanned aerial systems, particularly in mixed civilian-military environments. Coordination with civil aviation authorities imposes procedural limitations. Restricted airspace access can delay training and testing activities. Export markets apply varying regulatory standards, complicating certification. Compliance requirements increase development timelines. Autonomous operations face heightened scrutiny. Harmonizing military needs with civilian safety remains complex. Infrastructure investments are needed to support safe integration. Regulatory uncertainty can slow commercial adoption.

Opportunities

Expansion of export demand from allied nations:

Expansion of export demand from allied nations offers significant growth opportunities for Israel small unmanned aerial systems as countries modernize surveillance capabilities. Combat-proven platforms attract interest from defense and security agencies. Government-to-government agreements facilitate large-volume contracts. Customization for diverse operational environments enhances appeal. Training and support services generate recurring revenue. Joint development programs strengthen long-term partnerships. Offset agreements encourage local assembly and maintenance. Rising regional security concerns sustain demand. Export diversification reduces reliance on domestic procurement cycles.

Adoption of autonomous and swarm-enabled operations:

Adoption of autonomous and swarm-enabled operations creates new opportunities for Israel small unmanned aerial systems by enabling coordinated missions and force multiplication. Advances in artificial intelligence support collaborative task execution. Swarm concepts enhance coverage and redundancy. Reduced operator burden lowers manpower costs. Demonstrated effectiveness attracts international customers. Integration with manned platforms expands mission profiles. Regulatory frameworks gradually adapt to autonomy. Investment in enabling technologies accelerates commercialization. Early adoption positions suppliers as global leaders.

Future Outlook

Over the next five years, the Israel small unmanned aerial systems market is expected to expand steadily, supported by sustained defense investment and export demand. Technological advances in autonomy, sensors, and secure communications will drive platform upgrades. Regulatory adaptation will enable broader operational use. Demand-side factors include evolving security threats and increasing reliance on unmanned solutions.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Aeronautics Group

- BlueBird Aero Systems

- UVision Air

- Controp Precision Technologies

- NextVision Stabilized Systems

- Steadicopter

- Xtend

- Heven Drones

- Smart Shooter

- Orbit Communication Systems

- RT LTA Systems

- SightX

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Homeland security departments

- Intelligence agencies

- Law enforcement authorities

- Aerospace and defense manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Core variables included platform types, payload technologies, procurement volumes, and export flows. Data points were identified through official defense disclosures and company reports.

Step 2: Market Analysis and Construction

Collected data were analyzed using bottom-up aggregation, validating volumes and values across domestic and export segments.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert interviews with industry executives and defense analysts, ensuring alignment with operational realities.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into structured market intelligence, ensuring consistency, accuracy, and decision relevance

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Sustained demand for tactical ISR and situational awareness

Operational shift toward unmanned and autonomous systems

Continuous innovation in sensors, autonomy, and miniaturization - Market Challenges

Airspace regulation and operational integration constraints

Electronic warfare and counter unmanned system threats

Endurance, payload, and energy density limitations - Market Opportunities

Expansion of autonomous and AI enabled unmanned systems

Growth in export demand for combat proven platforms

Increasing adoption of swarm and collaborative operations - Trends

Miniaturization of sensors and mission payloads

Rising use of artificial intelligence based analytics

Integration of unmanned systems into network centric operations

Growth of multi mission and modular system designs

Increased focus on resilience against electronic countermeasures - Government Regulations & Defense Policy

Support for indigenous unmanned system development programs

Strengthening of export control and licensing frameworks

Regulatory oversight for unmanned airspace integration - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed wing small unmanned aerial systems

Rotary wing small unmanned aerial systems

Hybrid VTOL unmanned aerial systems

Nano and micro unmanned aerial systems

Tactical hand launched unmanned aerial systems - By Platform Type (In Value%)

Land based launch and recovery platforms

Naval and coastal deployed platforms

Vehicle mounted unmanned aerial system platforms

Backpack portable unmanned aerial systems

Catapult and rail launch platforms - By Fitment Type (In Value%)

New unmanned aerial system procurement

Retrofit and upgrade installations

Mission specific payload integration fitment

Training and simulation fitment systems

Modular configuration and mission fitment - By EndUser Segment (In Value%)

Israeli Defense Forces

Homeland security and border protection agencies

Law enforcement and internal security agencies

Intelligence and surveillance organizations

Civil government and public sector operators - By Procurement Channel (In Value%)

Direct government defense procurement

Defense prime contractor sourcing

System integrator led acquisition programs

Export and international sales programs

Research and development procurement - By Material / Technology (in Value %)

Composite and lightweight airframe materials

Electric and hybrid propulsion technologies

Electro optical and infrared sensor payloads

Autonomous navigation and artificial intelligence software

Secure data link and communication systems

- Cross Comparison Parameters (Endurance, Payload Capacity, Operational Range, Launch and Recovery Method, Autonomy Level, Sensor Integration, Communication Security, Lifecycle Cost, Export Readiness)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Aeronautics Group

BlueBird Aero Systems

UVision Air

Controp Precision Technologies

NextVision Stabilized Systems

Steadicopter

Xtend

Heven Drones

Smart Shooter

Orbit Communication Systems

RT LTA Systems

SightX

- High reliance on small systems for tactical ISR missions

- Preference for rapid deployment and high portability

- Emphasis on survivability in contested environments

- Growing demand for modular and multi mission platforms

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035