Market Overview

Based on a recent historical assessment, the Israel smart textiles for military market recorded spending of approximately USD ~ million, reflecting confirmed defense allocations toward advanced soldier systems, survivability solutions, and wearable battlefield technologies. The market size is driven by continuous modernization of infantry equipment, integration of real-time physiological monitoring, and demand for lightweight multifunctional protection. Strong domestic defense of R&D, rapid prototyping cycles, and close collaboration between the military and technology firms further support sustained procurement of smart fabrics, sensor-embedded garments, and adaptive textile systems.

Based on a recent historical assessment, Israel dominates this market through concentrated activity in Tel Aviv, Haifa, and Beersheba, supported by the country’s dense defense innovation ecosystem. Tel Aviv leads due to its role as the primary hub for defense startups, electronics, and wearable technology development. Haifa benefits from proximity to major defense manufacturers and advanced materials research centers. Beersheba’s dominance is driven by military bases, cybersecurity expertise, and defense technology incubators, enabling rapid testing, integration, and deployment of smart military textile solutions.

Market Segmentation

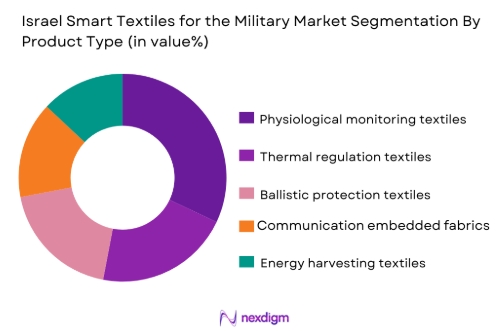

By Product Type

Israel Smart Textiles for Military market is segmented by product type into physiological monitoring textiles, thermal regulation textiles, ballistic protection textiles, communication embedded fabrics, and energy harvesting textiles. Recently, physiological monitoring textiles have had a dominant market share due to operational demand for real health data, fatigue assessment, and injury prevention during prolonged deployments. These textiles integrate biosensors that transmit heart rate, hydration, and stress indicators to command systems, improving decision making. Israeli defense forces prioritize soldier performance optimization, driving consistent procurement. Domestic firms possess strong expertise in medical sensors, enabling reliable military grade solutions. Continuous field validation strengthens user trust. Integration of compatibility with existing uniforms further supports dominance. Research funding alignment accelerates upgrades. Export potential reinforces production scale. These factors collectively sustain leadership of this sub segment across operational units.

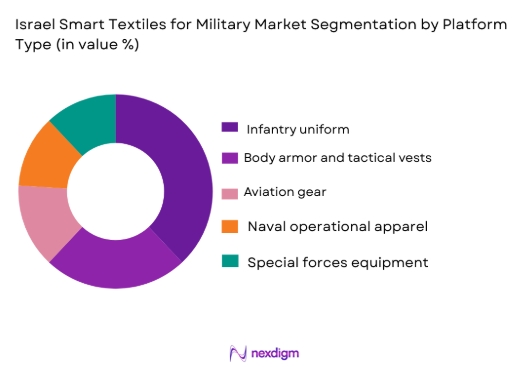

By Platform Type

Israel Smart Textiles for Military market is segmented by platform type into infantry uniforms, body armor and tactical vests, aviation gear, naval operational apparel, and special forces equipment. Recently, infantry uniforms had a dominant market share due to broad deployment across active and reserve forces and continuous upgrade cycles. Infantry units represent the largest operational base, requiring scalable solutions. Smart uniforms enhance endurance, situational awareness, and safety in varied terrains. Standardization across brigades supports volume procurement. Training and combat integration are prioritized. Modular designs allow rapid replacement. Budget allocation favors infantry readiness. Domestic manufacturing ensures supply continuity. These drivers collectively secure dominance for infantry uniform platforms.

Competitive Landscape

The Israel smart textiles for military market are highly consolidated and dominated by domestic defense primes and specialized advanced-material companies with deep ties to the national defense establishment. Long-term procurement contracts, strict defense certification requirements, and high R&D intensity create substantial entry barriers. Major players influence technology standards and integration architecture through close collaboration with the armed forces, while smaller firms typically operate as niche innovators or subsystem suppliers within larger defense programs.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Military Textile Strength |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| DuPont | 1802 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Teijin Aramid | 1972 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Smart Textiles for Military Market Analysis

Growth Drivers

Infantry Soldier Modernization and Survivability Enhancement

Infantry soldier modernization and survivability enhancement is a primary growth driver for the Israel smart textiles for military market, as defense forces prioritize protecting personnel operating in high-risk environments while improving combat effectiveness. Smart textiles enable continuous physiological monitoring, environmental sensing, and adaptive protection, which are critical in modern asymmetric warfare. The Israeli military places strong emphasis on reducing casualties through early detection of injury, heat stress, and fatigue. Embedded sensors within uniforms provide commanders with actionable health and status data in real time. These capabilities support faster medical intervention and improved mission planning. Integration with existing soldier systems enhances situational awareness without increasing cognitive or physical load. Continuous field testing accelerates adoption and refinement. Sustained defense budgets focused on personnel protection further reinforce demand.

Domestic Defense Innovation Ecosystem and Rapid Prototyping

Domestic defense innovation ecosystems and rapid prototyping drive sustained growth by enabling fast development, testing, and deployment of smart military textiles. Israel’s close collaboration between the military, startups, universities, and defense primes shortens innovation cycles. Smart textile solutions can be rapidly adapted based on battlefield feedback. Government-supported defense incubators and funding programs lower development risk. Advanced materials science and electronics expertise support multifunctional textile design. Local manufacturing capabilities ensure supply chain security. Proven export success further incentivizes investment. This ecosystem sustains continuous market expansion.

Market Challenges

High Development Costs and Manufacturing Complexity

High development costs and manufacturing complexity present a major challenge for the Israel smart textiles for military market due to the advanced materials, embedded electronics, and testing requirements involved. Smart military textiles must meet strict durability, reliability, and safety standards under extreme conditions. Integrating sensors and conductive materials into fabrics without compromising comfort increases production complexity. Extensive field trials extend development timelines. Low-volume specialized production limits economies of scale. Certification and qualification processes add cost. Continuous upgrades increase lifecycle expenses. These factors constrain rapid scaling despite strong demand.

Data Security and System Integration Risks

Data security and system integration risks challenge market growth as smart textiles increasingly generate sensitive operational and health data. Secure transmission and storage of data are critical in combat environments. Vulnerabilities could expose troop movements or health status. Ensuring encryption and resilience increases system cost and complexity. Integration with multiple commands and control platforms adds technical risk. Compliance with military cybersecurity protocols slows deployment. User trust and operational acceptance depend on proven security. These challenges require cautious implementation strategies.

Opportunities

Export-Oriented Defense Textile Programs

Export-oriented defense textile programs present significant opportunities as allied nations seek advanced soldier protection solutions proven in operational environments. Israeli smart textiles benefit from combat validation and strong defense reputation. Modular designs enable customization for foreign requirements. Defense export agreements support scaling production. Partnerships with global defense primes expand market access. Technology transfer arrangements increase adoption. Rising global focus on soldier survivability strengthens demand. This creates strong long-term growth potential beyond domestic procurement.

Multifunctional Adaptive Textile Development

Multifunctional adaptive textile development offers opportunities to integrate protection, sensing, communication, and energy management into single garments. Such integration reduces soldier load and improves efficiency. Advances in nanomaterials and flexible electronics enable new cap=abilities. Adaptive camouflage and thermal regulation enhance survivability. Energy-harvesting textiles reduce battery dependence. Israeli R&D strengths support rapid innovation. These advancements position smart textiles as core future soldier systems.

Future Outlook

Over the next five years, the Israel smart textiles for military market is expected to grow steadily, supported by continued infantry modernization, strong defense R&D investment, and export demand. Technological progress will focus on lighter, more durable, and multifunctional textile systems. Regulatory and procurement support will remain favorable due to national security priorities. Demand will increasingly shift toward integrated solutions combining protection, sensing, and data connectivity.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- DuPont

- Teijin Aramid

- 3M Defense Solutions

- Honeywell Advanced Materials

- BAE Systems

- Saab Group

- Textron Systems

- Armor Source

- Point Blank Enterprises

- Polartec

- Kolon Industries

- Protective Textile Technologies

Key Target Audience

- Defense ministries and armed forces

- Government and regulatory bodies

- Investments and venture capitalist firms

- Military equipment procurement agencies

- Defense OEMs and prime contractors

- Advanced materials manufacturers

- Soldier system integrators

- Export-focused defense distributors

Research Methodology

Step 1: Identification of Key Variables

Key variables such as defense spending patterns, soldier modernization programs, material innovation, and operational requirements were identified. Demand drivers and technology adoption indicators were mapped. Market boundaries were clearly defined.

Step 2: Market Analysis and Construction

Data from defense budgets, procurement disclosures, and industry sources were analyzed. Market segmentation was constructed by product type and end user. Cross-validation ensured consistency.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultation with defense technology experts and materials specialists. Assumptions were refined based on operational and regulatory insights.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into structured narratives. Quantitative and qualitative findings were aligned. Final outputs were reviewed for coherence and accuracy.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rapid modernization of infantry soldier systems

Rising demand for real-time health and status monitoring

Increased focus on operational survivability and performance

Government defense technology funding and strategic initiatives

Export demand growth from allied nations - Market Challenges

High R&D and production costs of advanced textiles

Integration complexity with legacy military systems

Cybersecurity and signal integrity risks

Supply chain sensitivity and material sourcing constraints

Regulatory hurdles and export control compliance - Market Opportunities

Development of multifunctional adaptive textile systems

Partnerships with global defense OEMs for co-development

Commercial spin-off applications in protective gear markets - Trends

Adoption of biofeedback-enabled soldier garments

Use of AI for predictive maintenance of wearable systems

Modular smart textile architectures for rapid configuration

Integration of textile systems with C4ISR networks

Focus on lightweight, low-power textile solutions - Government Regulations & Defense Policy

National defense procurement modernization directives

Export control policy frameworks for smart textile technologies

Funding initiatives under strategic defense technology programs - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flexible wearable sensors

Adaptive camouflage and smart concealment fabrics

Integrated health monitoring smart garments

Tactical communication-enabled textile systems

Thermal regulation and energy harvesting textiles - By Platform Type (In Value%)

Wearable soldier systems

Vehicle-integrated textile systems

Base camp and shelter smart textile platforms

Medical and casualty management textile systems

Unmanned systems textile integration platforms - By Fitment Type (In Value%)

New procurement programs

Upgrade and retrofit projects

Field support and logistics fitments

Training and simulation textile systems

Prototype and R&D trial deployments - By End User Segment (In Value%)

Ground forces infantry units

Special operations units

Armored and mechanized divisions

Military medical corps

Defense research and training establishments - By Procurement Channel (In Value%)

Direct government defense procurement

Defense prime contractor integration contracts

Public-private technology partnerships

Foreign military sales and export channels

Technology licensing and service-based procurement - By Material / Technology (in Value%)

Conductive polymers and fibers

Nanotechnology-enhanced smart textiles

Embedded sensor arrays and IoT modules

Phase change materials and thermal regulatory tech

Energy storage and harvesting fabrics

- Cross Comparison Parameters (technology maturity, integration capability, defense certification, production scalability, export footprint, partnership ecosystem, cost competitiveness, innovation pipeline, material sourcing strength, lifecycle support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Textron Systems

Honeywell Advanced Materials

3M Defense and Commercial Solutions

DuPont Performance Materials

Polartec LLC

Point Blank Enterprises

BAE Systems

Gav-Yam Military Textiles

ArmorSource Inc.

Protective Textile Technologies Ltd.

Teijin Aramid

Kolon Industries

- Demand for enhanced situational awareness in infantry units

- Requirements for soldier health monitoring and performance analytics

- Need for adaptive concealment in diverse operational environments

- Integration preferences for interoperable wearable systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035