Market Overview

Based on a recent historical assessment, the Israel smart weapons market recorded confirmed spending of approximately USD ~ billion, reflecting active procurement, domestic induction, and export deliveries of precision-guided munitions, autonomous strike systems, and advanced fire-control solutions. The market size is driven by sustained defense modernization, continuous operational deployment requirements, and strong export demand for combat-proven smart weapons. Government-backed R&D funding, rapid integration of AI-enabled guidance, and upgrades to legacy platforms further reinforce demand for precision, low-collateral, and network-enabled weapon systems across multiple operational domains.

Based on a recent historical assessment, Israel dominates this market through concentrated activity in Tel Aviv, Haifa, and Lod, supported by the country’s dense defense manufacturing and R&D ecosystem. Tel Aviv anchors system design, software, and guidance on technology development. Haifa serves as a core production and integration hub due to the presence of major defense primes and naval weapon programs. Lod benefits from proximity to air force bases, testing facilities, and export logistics infrastructure, enabling rapid deployment, validation, and global delivery of smart weapon systems.

Market Segmentation

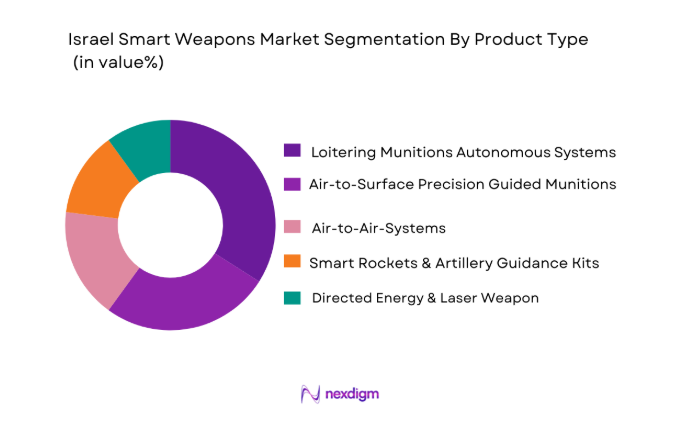

By Product Type

Israel smart weapons market is segmented by weapon type into air-to-surface precision-guided munitions, loitering munitions and autonomous attack systems, air-to-air smart missiles, smart rockets and artillery guidance kits, and directed energy and laser-based weapon systems. Recently, loitering munitions and autonomous attack systems have a dominant market share due to their operational flexibility, extended endurance, and precision strike capability with minimal collateral damage. These systems are highly valued for intelligence-strike convergence, real-time target acquisition, and cost-effective deployment. Strong export demand, battlefield validation, and rapid iteration cycles accelerate adoption. Integration with UAVs and network-centric warfare architectures further strengthens dominance. These factors collectively position loitering munitions as the leading segment.

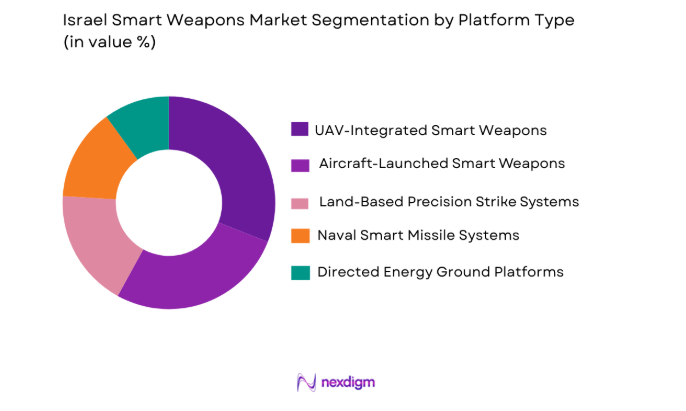

By Platform Type

Israel smart weapons market is segmented by platform type into aircraft-launched smart weapons, unmanned aerial vehicle integrated weapons, land-based precision strike systems, naval smart missile systems, and ground-based directed energy platforms. Recently, UAV-integrated smart weapons dominate the market due to Israel’s advanced unmanned warfare doctrine and extensive operational experience. UAV platforms enable persistent surveillance and precision engagement without pilot risk. Smart weapons integrated with UAVs provide rapid response and scalable strike options. Continuous upgrades and export success drive procurement momentum. Compatibility with multiple payloads enhances flexibility. These attributes collectively reinforce UAV-based platforms as the dominant segment.

Competitive Landscape

The Israel smart weapons market is highly consolidated and dominated by domestic defense primes with vertically integrated capabilities spanning R&D, production, testing, and export. High barriers to entry arise from stringent defense certification, export control compliance, and the need for combat validation. Major players exert strong influence over technology standards, pricing, and integration architectures, while international firms primarily participate through partnerships, co-development programs, or export-oriented collaboration.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Core Smart Weapon Strength |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat Hasharon, Israel | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, US | ~ | ~ | ~ | ~ | ~ |

Israel Smart Weapons Market Analysis

Growth Drivers

Precision Strike and Autonomous Warfare Requirements

Precision strike and autonomous warfare requirements are a major growth driver for the Israel smart weapons market as contemporary combat environments increasingly demand speed, accuracy, and data-driven engagement. Smart weapons enable precise target identification and engagement in real time, significantly reducing collateral damage and improving mission success rates in densely populated or complex operational theaters. Israel’s security environment places strong emphasis on rapid response, precision engagement, and operational flexibility across air, land, sea, and unmanned domains. Autonomous guidance, loitering capabilities, and adaptive targeting algorithms extend engagement windows and allow operators to strike time-sensitive targets with higher confidence. Integration with ISR, C4ISR, and battlefield management systems enhances situational awareness and speed of decision-making. Continuous operational deployment provides real-world feedback that accelerates system refinement and technological maturity. International customers increasingly seek combat-proven autonomous and precision systems, reinforcing sustained demand and long-term market expansion.

Defense Export Strength and Continuous R&D Investment

Defense export strength and continuous research and development investment significantly drive growth in the Israel smart weapons market by enabling scale, innovation, and sustained industrial momentum. Israeli smart weapons enjoy strong international demand due to their combat-proven performance, technological sophistication, and reliability in diverse operational conditions. Government-backed export frameworks and diplomatic defense cooperation agreements reinforce stable production pipelines and long-term contracts. High R&D intensity supports rapid capability upgrades, including AI-enabled guidance, sensor fusion, and networked engagement features. Collaboration with foreign defense forces and system integrators broadens application scope and operational adaptability. Modular system architecture allows customization for varied mission profiles and customer requirements. Export revenues are consistently reinvested into next-generation technologies, creating a self-reinforcing cycle of innovation, credibility, and market growth.

Market Challenges

Export Controls and Geopolitical Constraints

Export controls and geopolitical constraints pose a significant and structural challenge for the smart weapons market due to increasingly strict regulatory oversight, heightened international scrutiny, and continuously shifting diplomatic alignments. Advanced smart weapons, particularly those incorporating artificial intelligence, autonomy, and networked targeting capabilities, are subject to rigorous export approval mechanisms that involve multiple national authorities and intergovernmental frameworks. These approval processes are often lengthy, complex, and unpredictable, leading to delays in contract execution, postponed deliveries, and deferred revenue realization for manufacturers. Market access varies widely across regions depending on political relationships, security priorities, and compliance with international arms control regimes, which limits scalability even when demand is strong. Adhering to global regulations such as arms trade treaties and technology transfer controls increases administrative burden, legal costs, and internal compliance requirements. Additionally, political risk, public scrutiny, and ethical debates surrounding autonomous and AI-enabled weapons influence export decisions in both supplying and recipient countries. This evolving policy environment creates uncertainty for long-term export contracts, complicates strategic planning, and forces companies to balance innovative ambitions with regulatory and geopolitical realities

High Development Costs and Technology Complexity

High development costs and technology complexity represent a major challenge for the smart weapons market as next-generation systems increasingly combine artificial intelligence, advanced seekers, secure data links, autonomous decision logic, and networked combat integration. Research and development cycles are highly capital intensive, requiring sustained investment over long periods before operational induction. Extensive testing, simulation, live-fire trials, and multi-stage certification processes significantly extend development timelines. Integration of hardware, software, and sensors across multiple platforms increases technical risk and engineering effort. Dependence on specialized electronic components and sensitive supply chains exposes programs to cost volatility and delays. Continuous upgrades are required to counter evolving threats, increasing lifecycle costs and reducing economies of scale. Together, these factors slow scalability and place financial pressure on manufacturers despite strong demand.

Opportunities

AI-Enabled Target Recognition and Networked Weapons

AI-enabled target recognition and networked weapons represent a major opportunity for the Israel Smart Weapons Market by fundamentally enhancing precision, speed, and situational awareness across modern battlefields. Advanced machine learning algorithms enable real-time identification, classification, and prioritization of targets in complex and cluttered environments, significantly improving strike accuracy while reducing collateral damage. These capabilities lower cognitive load on operators by automating decision-support functions and enabling faster engagement cycles. Networked weapons further amplify effectiveness by allowing coordinated, multi-platform operations across air, land, sea, and unmanned systems, supporting integrated multi-domain warfare concepts. Seamless data sharing between sensors, command systems, and shooters enhances mission adaptability and resilience against electronic warfare threats. Growing global demand for autonomous and semi-autonomous combat solutions strengthens export prospects. Israel’s mature AI ecosystem, combat-validated technologies, and strong defense export infrastructure position the country for sustained innovation and long-term leadership.

Directed Energy and Counter-Threat Smart Weapons

Directed energy and counter-threat smart weapons present a significant growth opportunity for the Israel Smart Weapons Market as aerial threats such as missiles, rockets, artillery, and unmanned systems become more numerous, affordable, and technologically advanced. Laser-based and high-energy directed energy systems offer rapid, precise, and cost-efficient interception compared to traditional kinetic interceptors, particularly in high-volume threat scenarios. These systems provide deep magazines, lower per-engagement costs, and reduced logistical burden, making them highly attractive for sustained defense operations. Their integration into existing air and missile defense architecture strengthens layered defense capabilities and enhances response flexibility. Strong government funding, accelerated research programs, and field-testing support technological maturation and deployment readiness. Increasing international demand for counter-drone and short-range air defense solutions further positions directed energy weapons as a critical long-term opportunity.

Future Outlook

Over the next five years, the Israel smart weapons market is expected to grow steadily, supported by sustained defense modernization, strong export demand, and rapid technological advancement. Development will focus on autonomy, AI integration, and network-centric warfare compatibility. Regulatory support for domestic R&D will remain strong. Demand will increasingly favor precision, scalable, and low-collateral smart weapon solutions.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- IMI Systems

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- BAE Systems

- MBDA

- General Dynamics

- Textron Inc.

- L3Harris Technologies

- Boeing Defense

- Thales Group

- Leonardo

Key Target Audience

- Defense ministries and armed forces

- Government and regulatory bodies

- Investments and venture capitalist firms

- Military procurement agencies

- Defense OEMs and prime contractors

- System integrators and platform manufacturers

- Export-focused defense distributors

- Strategic security organizations

Research Methodology

Step 1: Identification of Key Variables

Defense spending, procurement programs, export activity, and technology adoption indicators were identified. Demand and supply variables were mapped. Market boundaries were defined.

Step 2: Market Analysis and Construction

Data from defense budgets, export disclosures, and industry sources were analyzed. Segmentation by weapon and platform was constructed. Cross-validation ensured accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through defense experts and industry specialists. Assumptions were refined based on operational and regulatory insights.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into structured narratives. Quantitative and qualitative findings were aligned. Outputs were reviewed for consistency.

- Executive Summary

- Market Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advanced precision guidance and targeting demand

Expansion of autonomous loitering and smart munitions

Government defense export initiatives and global partnerships

Technology integration with UAV and network-centric warfare

Operational lessons from recent conflicts shaping procurement - Market Challenges

Export restrictions and geopolitical opposition

High R&D and integration costs for next-generation systems

Regulatory and ethical constraints on autonomous weapons

Supply chain sensitivity for critical components

Competition from large global defense firms - Market Opportunities

Export expansion to emerging defense markets

Directed energy smart weapons and laser defense systems

Integration of AI-enabled fire control and guidance solutions - Trends

Growth of guided air-to-surface and anti-ballistic systems

Increased adoption of autonomous targeting and smart seekers

Integration of smart weapons with networked combat systems

Focus on low-collateral damage precision engagements

Defense export record performance influencing procurement - Government Regulations & Defense Policy

National defense export incentive frameworks

Arms control and autonomous weapons policy development

R&D funding directives for cutting-edge military tech - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By Weapon Type (In Value%)

Air-to-air precision missiles

Air-to-surface guided munitions

Autonomous guided rockets and loitering munitions

Directed energy and laser-based weapon systems

Smart small arms and fire-control modules - By Platform Type (In Value%)

Aircraft-launched smart weapons

Naval smart missile systems

Land-based precision strike systems

Unmanned aerial vehicle integrated weapons

Directed energy ground systems - By Fitment Type (In Value%)

New procurement programs

Retrofit and upgrade installations

Field deployment support systems

Training and simulation weapon systems

R&D trials and prototype acquisition - By End User Segment (In Value%)

Air force combat units

Army ground strike units

Naval strike and defense units

Special operations units

Defense research and testing establishments - By Procurement Channel (In Value%)

Direct government defense procurement

Defense prime contractor integration contracts

Foreign military sales and export channels

Public-private defense technology partnerships

Technology licensing and service-based procurement - By Technology / Guidance (in Value%)

GPS/INS guided systems

Electro-optical/infrared (EO/IR) precision seekers

Autonomous target recognition systems

Laser guidance and directed energy systems

Network-enabled weapon control systems

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, guidance systems, export footprint, integration capability, production scale, cost competitiveness, strategic partnerships, certification compliance, autonomous capability, lifecycle support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Rafael Advanced Defense Systems

Elbit Systems

IMI Systems

Lockheed Martin

Raytheon Technologies

Northrop Grumman

BAE Systems

MBDA

General Dynamics

Textron Inc.

L3Harris Technologies

Boeing Defense

Thales Group

Leonardo Spa

- Air force requirements for precision engagement

- Army demands for autonomous strike capability

- Naval integration and multi-domain strike needs

- Special operations emphasis on low-signature smart systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by Weapon Type, 2026-2035

- Future Demand by Platform, 2026-2035