Market Overview

The Israel Sniper Rifle market, based on a recent historical assessment, was valued at approximately USD ~ million, driven primarily by sustained defense procurement programs, counterterrorism requirements, and continuous modernization of infantry and special operations forces. Demand is reinforced by doctrinal emphasis on precision engagement, reduced collateral damage, and force protection in complex operational environments. Domestic manufacturing strength, close coordination between end users and weapon developers, and steady replacement cycles for aging inventories further support market stability. Procurement is largely government-led, ensuring predictable demand patterns and long-term contractual continuity.

Israel dominates this market due to its concentrated defense industrial base, advanced small-arms engineering capabilities, and persistent national security imperatives. Key activity is centered around cities such as Tel Aviv, Haifa, and Karmiel, where major defense manufacturers, testing facilities, and R&D centers are located. The country’s operational experience in urban and asymmetric warfare drives continuous feedback-driven upgrades. Strong institutional linkages between the military, domestic manufacturers, and regulatory authorities accelerate adoption and sustain leadership without reliance on external suppliers.

Market Segmentation

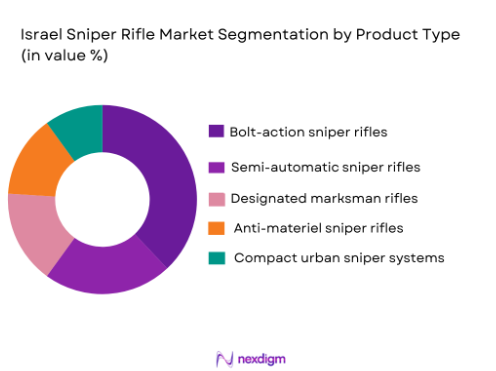

By Product Type

Israel Sniper Rifle market is segmented by product type into bolt-action sniper rifles, semi-automatic sniper rifles, designated marksman rifles, anti-materiel sniper rifles, and compact urban sniper systems. Recently, bolt-action sniper rifles have dominated the market share due to their unmatched accuracy, mechanical reliability, and consistent performance across long-range engagements. These rifles are widely preferred by Israeli armed forces and special operations units for missions requiring first-round hit probability, overwatch, and counter-sniper roles. Their simpler operating mechanism results in lower failure rates under harsh desert and urban combat conditions. Bolt-action systems also support heavier calibers and longer barrels, enhancing ballistic stability. Established training doctrines, long service life, and compatibility with advanced optics and suppressors further reinforce sustained procurement preference across defense and homeland security applications.

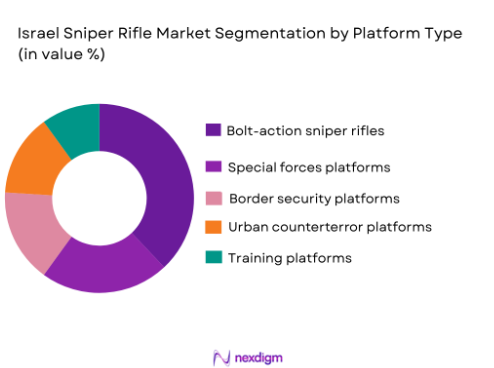

By Platform Type

Israel Sniper Rifle market is segmented by platform type into infantry precision engagement platforms, special forces sniper platforms, border security sniper platforms, urban counterterrorism sniper platforms, and training and evaluation platforms. Infantry precision engagement platforms account for the dominant market share due to their broad deployment across conventional ground forces and continuous integration into infantry modernization programs. These platforms support squad- and platoon-level overwatch, long-range engagement, and force protection missions, making them central to standard military doctrine. Large-scale force structure requirements drive higher unit induction compared to niche platforms. Standardization across infantry units enables cost-efficient procurement, maintenance, and training. Their adaptability across open terrain, semi-urban zones, and border environments further sustains high utilization rates, reinforcing dominance over more specialized sniper deployment platforms.

Competitive Landscape

The Israel Sniper Rifle market is moderately consolidated, with procurement and qualification standards favoring a small set of established domestic defense manufacturers and specialized small-arms firms. Large primes influence integration, soldier modernization linkages, and export compliance, while niche OEMs compete through precision machining, platform customization, and optics compatibility. Public disclosures indicate scale advantages for major defense groups such as Elbit Systems (USD 6.8B revenue) and Rafael Advanced Defense Systems supporting sustained R&D and long-term defense contracting.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Small-Arms Portfolio Strength |

| Israel Weapon Industries | 1933 | Kiryat Gat, Israel | ~ | ~ | ~ | ~ | ~ |

| EMTAN Karmiel | 1977 | Karmiel, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Kiryat Bialik, Israel | ~ | ~ | ~ | ~ | ~ |

| Meprolight | Not consistently disclosed publicly | Israel | ~ | ~ | ~ | ~ | ~ |

Israel Sniper Rifle Market Analysis

Growth Drivers

Precision Engagement Modernization Across Israeli Defense Forces

Precision Engagement Modernization Across Israeli Defense Forces: The continuous modernization of Israeli ground forces is a primary growth driver for the sniper rifle market, as operational doctrines increasingly prioritize accuracy, controlled lethality, and reduced collateral damage in densely populated environments. Israeli defense planners emphasize precision fire as a force multiplier that enhances tactical effectiveness while minimizing unintended consequences, particularly in urban and asymmetric warfare scenarios. This doctrinal shift drives sustained procurement of advanced sniper systems capable of long-range accuracy, environmental resilience, and seamless integration with modern optics and command networks. Regular technology refresh cycles ensure that legacy systems are upgraded or replaced to maintain battlefield superiority. Close collaboration between end users and domestic manufacturers accelerates innovation and customization. Training programs reinforce equipment standardization, further support consistent demand. The focus on soldier survivability and mission effectiveness continues to translate into stable investment.

Operational Experience and Continuous Threat Environment

Operational Experience and Continuous Threat Environment: Israel’s persistent exposure to complex security threats creates an environment where sniper capabilities are not optional but essential, directly stimulating market growth. Real-world operational feedback informs rapid iteration of rifle designs, materials, and ergonomics. Sniper systems are integral to border security, counterterrorism, and force protection missions, ensuring continuous utilization rather than episodic demand. This constant operational relevance justifies recurring budget allocations and expedited procurement decisions. Domestic manufacturers benefit from immediate validation of performance in live environments. The sustained need for readiness and rapid response underpins long-term demand stability.

Market Challenges

High Precision Manufacturing and Lifecycle Cost Burden:

High Precision Manufacturing and Lifecycle Cost Burden. Sniper rifles require exceptionally tight tolerances, premium materials, and extensive testing, all of which elevate production and maintenance costs. These factors place pressure on defense budgets, particularly when systems are procured alongside other high-priority platforms. Lifecycle costs include barrel replacement, optics calibration, and specialized training, which can constrain procurement volumes. Smaller production runs limit economies of scale. Budget trade-offs may delay upgrades despite operational need. This cost intensity remains a structural challenge for the market.

Export Controls and Regulatory Constraints

Export Controls and Regulatory Constraints: Strict national and international export regulations limit the ability of Israeli manufacturers to scale production through foreign sales. Compliance requirements increase administrative burden and extend sales cycles. Market access restrictions reduce revenue diversification opportunities. Dependence on domestic demand heightens sensitivity to defense budget fluctuations. Regulatory complexity also affects technology transfer and collaboration. These constraints collectively challenge long-term expansion.

Opportunities

Development of Modular Multi-Mission Sniper Platforms

Modular sniper systems that support multiple calibers, barrel lengths, and mission configurations present a significant opportunity for the market. Such platforms align with evolving operational needs and reduce total ownership costs for end users. Modular designs enable rapid adaptation to urban, rural, and border environments. This flexibility appeals to both military and security forces. Domestic manufacturers are well positioned to lead this transition. The approach supports future-proof procurement strategies.

Integration with Advanced Digital Fire Control Ecosystems

The integration of sniper rifles with digital fire control, ballistic computation, and networked targeting systems offers strong growth potential. These technologies enhance first-shot accuracy and situational awareness. Alignment with broader digitization of ground forces creates procurement synergies. Manufacturers that offer integrated solutions gain competitive advantage. This opportunity supports higher-value system sales.

Future Outlook

Over the next five years, the Israel Sniper Rifle market is expected to maintain steady growth supported by continuous defense modernization and persistent security requirements. Technological development will focus on modularity, ergonomics, and digital integration. Regulatory support for domestic manufacturing will remain strong. Demand will be driven by replacement cycles, special forces expansion, and evolving operational doctrines emphasizing precision engagement.

Major Players

- Israel Weapon Industries

- EMTAN Karmiel

- IMI Systems

- Rafael Advanced Defense Systems

- Elbit Systems

- Meprolight

- Plasan

- FAB Defense

- Silver Shadow

- Tavor Precision Systems

- Kalashnikov Israel

- Agilite

- SDS Arms Israel

- ZahalPrecision Arms

- Carmel Defense Technologies

Key Target Audience

- Defense Ministries

- Armed forces procurement agencies

- Homeland security agencies

- Police modernization units

- Border security authorities

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense OEMs

Research Methodology

Step 1: Identification of Key Variables

Market scope, system classifications, procurement channels, and end-user demand patterns were identified through defense policy reviews and procurement disclosures.

Step 2: Market Analysis and Construction

Historical procurement data, industry reports, and defense budget allocations were analyzed to construct market size and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert interviews and cross-referencing with defense industry analysts and open-source intelligence.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a structured framework ensuring consistency, accuracy, and relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Defense Modernization Programs

- Growth Drivers

Sustained national security and counterterrorism requirements

Emphasis on precision engagement and force protection

Continuous modernization of infantry and special forces

Strong domestic defense manufacturing ecosystem

Interoperability with advanced optics and targeting systems - Market Challenges

High precision manufacturing and testing costs

Strict export control and compliance regulations

Lengthy procurement and certification timelines

Balancing system weight with durability and accuracy

Dependence on specialized materials and skilled labor - Market Opportunities

Development of modular and multi-mission sniper platforms

Lifecycle upgrade programs for existing rifle inventories

Integration of advanced materials and digital fire-control aids - Trends

Rising adoption of semi-automatic precision rifles

Growing focus on urban and asymmetric warfare scenarios

Enhanced suppressor and signature reduction integration

Improved ergonomics and soldier-centric designs

Compatibility with next-generation optics and sensors - Government Regulations & Defense Policy

National firearms and defense procurement regulations

Export compliance aligned with international arms control regimes

Government support for indigenous defense manufacturing - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Bolt-action sniper rifles

Semi-automatic sniper rifles

Designated marksman rifles

Anti-materiel sniper rifles

Compact urban sniper systems - By Platform Type (In Value%)

Infantry precision engagement platforms

Special forces sniper platforms

Border security sniper platforms

Urban counterterrorism sniper platforms

Training and evaluation platforms - By Fitment Type (In Value%)

Standard shoulder-fired configurations

Modular rail-based configurations

Optics-integrated configurations

Suppressed sniper configurations

Mission-specific customized fitments - By End User Segment (In Value%)

National armed forces

Special operations units

Border and homeland security forces

Police and counterterror units

Training and reserve forces - By Procurement Channel (In Value%)

Direct government procurement

Defense ministry framework contracts

OEM long-term supply agreements

Upgrade and retrofit programs

Emergency and fast-track acquisitions - By Material / Technology (in Value %)

Advanced steel alloy barrel systems

Composite and lightweight stock materials

Precision trigger and fire control systems

Recoil mitigation and stabilization technologies

Integrated optics and targeting compatibility systems

- Market share snapshot of major players

- Cross Comparison Parameters (Accuracy range, System weight, Barrel life, Modularity level, Optics compatibility, Suppressor readiness, Maintenance cycle, Unit cost)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Weapon Industries

Emtan Karmiel

IMI Systems

Rafael Advanced Defense Systems

Elbit Systems Land Division

Meprolight

Plasan Weapon Systems

FAB Defense

Silver Shadow Advanced Security Systems

Tavor Precision Systems

Kalashnikov Israel

Agilite Weapon Solutions

SDS Arms Israel

Zahal Precision Arms

Carmel Defense Technologies

- Military forces prioritizing accuracy, reliability, and environmental resilience

- Special forces emphasizing modularity and mission adaptability

- Border security units focusing on durability and rapid deployment

- Training units seeking cost-effective yet realistic performance systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035